Georgia State Minimum Insurance Requirements are essential for all drivers in the state, ensuring financial protection in case of an accident. These requirements are designed to safeguard drivers and passengers from the potentially devastating financial consequences of a car accident. By mandating specific types of coverage, Georgia aims to minimize the burden on individuals and the state’s resources while promoting responsible driving practices.

Understanding these requirements is crucial for every driver in Georgia, as non-compliance can lead to severe penalties, including fines, license suspension, and even jail time. This comprehensive guide will explore the various aspects of Georgia’s minimum insurance requirements, providing valuable insights into the different types of coverage, their purpose, and the legal implications of not having the required insurance.

Overview of Georgia State Minimum Insurance Requirements

In Georgia, like many other states, drivers are legally obligated to carry a minimum amount of insurance coverage. This requirement ensures that drivers have financial protection in case of an accident, protecting both themselves and other drivers.

Purpose and Significance

The purpose of Georgia’s minimum insurance requirements is to protect drivers and the state from the financial burden of accidents. These requirements serve as a safety net, ensuring that drivers have access to funds to cover medical expenses, property damage, and other losses resulting from accidents.

Consequences of Driving Without Insurance

Driving without the required minimum insurance in Georgia can have severe consequences, including:

- Fines and Penalties: Drivers caught driving without insurance face substantial fines and penalties.

- License Suspension: The state can suspend your driver’s license if you fail to maintain the required insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Jail Time: In some cases, driving without insurance can even lead to jail time, particularly if you’re involved in an accident.

Types of Required Coverage

Georgia law mandates that all drivers carry specific types of insurance to protect themselves and others in the event of an accident. These coverages ensure financial responsibility and help cover costs associated with injuries, property damage, and other liabilities.

Types of Required Coverage

| Coverage Type | Description | Minimum Required Amount |

|---|---|---|

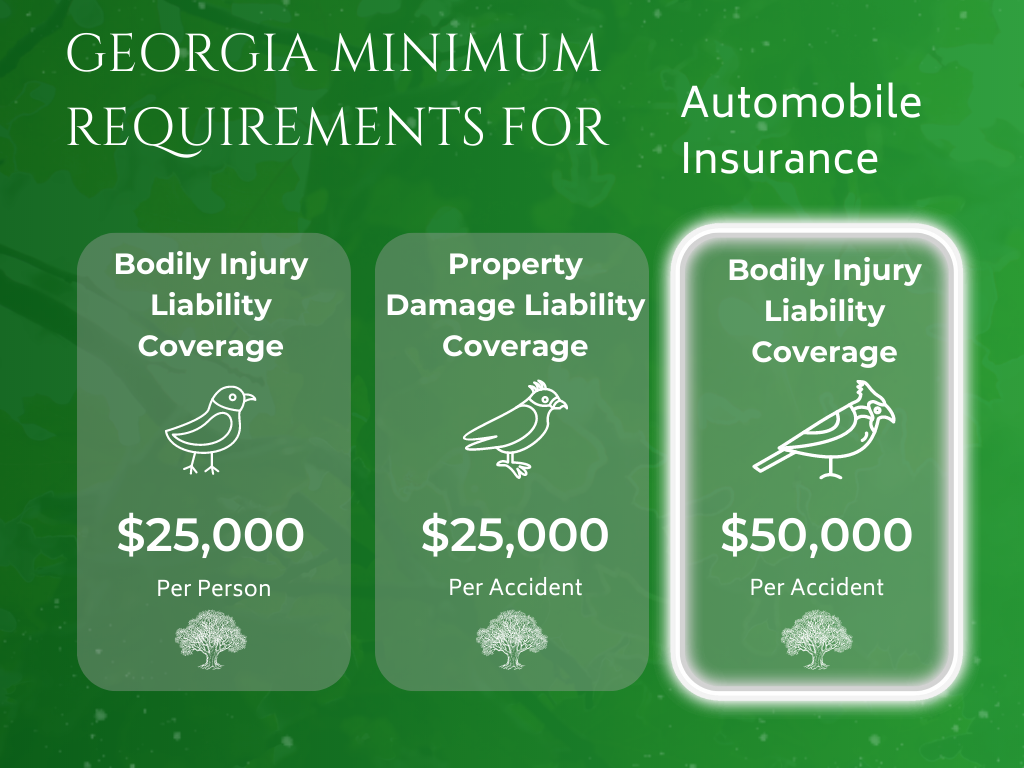

| Liability Coverage | This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers the other driver’s medical expenses, lost wages, and property damage. | $25,000 per person/$50,000 per accident for bodily injury liability and $25,000 for property damage liability. |

| Personal Injury Protection (PIP) | This coverage pays for your medical expenses, lost wages, and other related costs regardless of who is at fault in an accident. It also covers passengers in your vehicle. | $2,500 |

| Uninsured Motorist Coverage (UM) | This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and property damage. | $25,000 per person/$50,000 per accident for bodily injury liability and $25,000 for property damage liability. |

Liability Coverage

Liability coverage is essential for protecting yourself financially in case you cause an accident. It covers the other driver’s medical expenses, lost wages, and property damage.

For example, if you cause an accident that results in another driver sustaining $30,000 in medical expenses and $10,000 in property damage, your liability coverage would pay for these costs up to the limits of your policy.

Personal Injury Protection (PIP)

PIP coverage is designed to protect you and your passengers in the event of an accident, regardless of who is at fault. It covers your medical expenses, lost wages, and other related costs.

For instance, if you are injured in an accident and require medical treatment, PIP coverage would help pay for your medical bills, even if you were at fault for the accident.

Uninsured Motorist Coverage (UM)

UM coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It covers your medical expenses, lost wages, and property damage.

For example, if you are involved in an accident with a hit-and-run driver, UM coverage would help cover your medical expenses and property damage.

Liability Coverage

Liability coverage is a crucial component of Georgia’s minimum insurance requirements, offering vital protection for drivers in the event of an accident. It safeguards drivers from substantial financial responsibility by covering the costs of injuries and damages caused to others.

Types of Liability Coverage

Liability coverage in Georgia comprises two distinct categories: bodily injury liability and property damage liability. Both are essential for drivers to meet the state’s minimum insurance requirements.

Bodily Injury Liability Coverage

This coverage protects drivers from financial responsibility for injuries sustained by others in an accident they cause. It covers medical expenses, lost wages, and other related costs incurred by the injured party.

Property Damage Liability Coverage

This coverage safeguards drivers from financial responsibility for damages caused to another person’s property in an accident they cause. This includes repairs or replacement costs for vehicles, structures, or other property involved in the accident.

Hypothetical Accident Scenario

Imagine a scenario where a driver, covered by Georgia’s minimum insurance requirements, is involved in an accident that results in injuries to another driver and damages to their vehicle.

The driver’s liability coverage would come into play, covering the medical expenses, lost wages, and other related costs incurred by the injured driver. Additionally, the coverage would cover the repair or replacement costs for the damaged vehicle.

This scenario demonstrates how liability coverage provides crucial financial protection for drivers in the event of an accident, ensuring they are not held responsible for significant financial burdens.

Personal Injury Protection (PIP)

In Georgia, Personal Injury Protection (PIP) coverage is a vital part of your car insurance policy. It provides financial protection for medical expenses and lost wages in the event of an accident, regardless of who is at fault. This means that even if you are responsible for the accident, your PIP coverage will still help you recover from your injuries.

PIP Coverage: A Closer Look

PIP coverage helps you pay for medical expenses and lost wages following a car accident. It covers you and your passengers, regardless of who caused the accident. This coverage is crucial because it can help you avoid the complexities and potential delays of pursuing a claim through the other driver’s insurance company.

Understanding How PIP Coverage Works

- Medical Expenses: PIP coverage helps pay for medical bills incurred due to an accident. This includes expenses such as doctor visits, hospital stays, surgery, and physical therapy.

- Lost Wages: If you are unable to work due to injuries sustained in an accident, PIP coverage can help replace some of your lost income. This benefit is designed to help you maintain financial stability while recovering.

- Benefits Limit: PIP coverage has a maximum amount it will pay out, usually expressed as a dollar amount or a percentage of your medical expenses. You should carefully review your policy to understand your PIP coverage limits.

Examples of When PIP Coverage Applies

Here are some examples of situations where PIP coverage would be helpful:

- You are driving and are involved in an accident caused by another driver. Even though you were not at fault, you may still suffer injuries. PIP coverage will help you pay for your medical bills and lost wages, regardless of who caused the accident.

- You are a passenger in a car that is involved in an accident. PIP coverage will help you pay for your medical bills and lost wages, regardless of whether you were the driver or a passenger.

- You are hit by an uninsured or underinsured driver. In this case, PIP coverage will be essential because you may not be able to recover compensation from the other driver’s insurance company.

Comparing PIP Coverage with Other Health Insurance

While PIP coverage is designed to help you pay for medical expenses and lost wages following a car accident, it is not a substitute for traditional health insurance. Here’s a breakdown of the differences:

- Coverage Scope: PIP coverage specifically covers medical expenses and lost wages related to car accidents. Traditional health insurance covers a broader range of medical expenses, including routine checkups, preventative care, and chronic conditions.

- Benefit Limits: PIP coverage has a specific benefit limit, usually a dollar amount or a percentage of your medical expenses. Traditional health insurance may have higher coverage limits, but deductibles and co-pays can impact your out-of-pocket expenses.

- Premiums: PIP coverage is usually included in your car insurance policy, so its cost is factored into your overall premium. Traditional health insurance premiums are typically separate from car insurance and can vary significantly based on your plan and coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is a crucial addition to your auto insurance policy in Georgia. It safeguards you financially when involved in accidents with drivers who lack sufficient or any liability insurance. This coverage ensures you’re compensated for medical expenses, lost wages, and property damage, regardless of the at-fault driver’s insurance status.

How Uninsured/Underinsured Motorist Coverage Works

UM/UIM coverage steps in when the at-fault driver is uninsured or their insurance limits are insufficient to cover your losses. It functions as a secondary layer of protection, supplementing your own liability coverage and covering the difference. This coverage is designed to compensate you for injuries, medical bills, lost wages, and property damage resulting from an accident caused by an uninsured or underinsured driver.

Examples of Situations Where UM/UIM Coverage Is Beneficial

Here are scenarios where UM/UIM coverage can be invaluable:

- An uninsured driver hits your car, causing significant damage and injuries. Their lack of insurance means you’re responsible for covering your own expenses.

- A driver with minimal liability coverage causes an accident, leaving you with substantial medical bills and lost wages. Their low coverage limits may not fully compensate you for your losses.

- You’re involved in a hit-and-run accident, and the driver responsible cannot be identified or located. This leaves you without any recourse from the at-fault driver’s insurance.

Tips for Ensuring Adequate UM/UIM Coverage, Georgia state minimum insurance requirements

To ensure you have adequate UM/UIM coverage, consider these tips:

- Match your UM/UIM limits to your liability limits: Having the same coverage limits for both liability and UM/UIM ensures you’re protected in various situations.

- Review your policy regularly: As your financial situation changes, your coverage needs may also evolve. Regularly reviewing your policy ensures you have sufficient protection.

- Consider increasing your coverage limits: If you have significant assets or a high income, consider increasing your UM/UIM coverage limits to provide more comprehensive protection.

Exemptions and Exceptions: Georgia State Minimum Insurance Requirements

Georgia’s minimum insurance requirements apply to most vehicles on the road, but there are certain situations and vehicle types that are exempt or have specific exceptions. These exemptions and exceptions are Artikeld in Georgia law, and it’s important to understand them to ensure you are complying with the state’s regulations.

Exemptions and Exceptions

Here are some of the most common exemptions and exceptions to Georgia’s minimum insurance requirements:

| Category | Exemption Criteria | Relevant Details |

|---|---|---|

| Vehicles Not Used on Public Roads | Vehicles primarily used on private property, such as farms or construction sites, are generally exempt from insurance requirements. | These vehicles are typically not considered a risk to the public on public roadways. |

| Antique or Classic Cars | Vehicles classified as antique or classic cars, often with a specific age requirement, may be exempt from certain insurance requirements. | These vehicles may be insured under a specialized policy that covers them for specific events, such as rallies or shows. |

| Vehicles Owned by the Government | Vehicles owned by federal, state, or local governments are generally exempt from minimum insurance requirements. | These vehicles are often covered by self-insurance programs or other forms of government-backed protection. |

| Vehicles Used for Certain Purposes | Vehicles used for specific purposes, such as agricultural or commercial transportation, may have different insurance requirements. | These vehicles may be covered by specific insurance policies that address the unique risks associated with their intended use. |

Consequences of Non-Compliance

Driving without the required minimum insurance in Georgia can lead to significant consequences, impacting your driving privileges, financial stability, and overall well-being. It’s crucial to understand the potential penalties and the enforcement process to avoid these repercussions.

Penalties for Driving Without Insurance

The state of Georgia takes insurance compliance seriously. Driving without the required minimum insurance can result in various penalties, including:

- Fines: A first offense can result in a fine of $500, while subsequent offenses can lead to fines of up to $1,000.

- License Suspension: Your driver’s license can be suspended for up to 12 months for driving without insurance.

- Vehicle Impoundment: Your vehicle can be impounded until proof of insurance is provided.

- Court Costs: You may face additional court costs and fees associated with the violation.

Enforcement and Violation Process

Georgia enforces insurance compliance through various methods:

- Police Checks: Law enforcement officers routinely check for proof of insurance during traffic stops.

- Insurance Verification System: The Georgia Department of Motor Vehicles (DMV) has an insurance verification system that allows law enforcement to check insurance status electronically.

- Insurance Company Reporting: Insurance companies are required to report any cancellations or non-renewals of insurance policies to the DMV.

Impact on Driving Privileges and Financial Stability

Driving without insurance can have a significant impact on your driving privileges and financial stability:

- License Suspension: Losing your driver’s license can severely limit your ability to commute, work, and engage in everyday activities.

- Increased Insurance Premiums: If you get insurance after being caught driving without it, you may face higher premiums than you would have otherwise.

- Financial Burden: Fines, court costs, and potential legal fees can create a significant financial burden.

- Responsibility for Accidents: If you are involved in an accident without insurance, you could be held personally liable for all damages, medical bills, and other expenses.

Additional Considerations

While understanding Georgia’s minimum insurance requirements is crucial, there are several additional considerations to ensure you’re adequately protected on the road. These include obtaining the right coverage, choosing a reliable insurance provider, and navigating the complexities of insurance policies.

Obtaining and Maintaining Insurance Coverage

In Georgia, you can obtain car insurance through various channels, including:

- Insurance agents and brokers: These professionals can help you compare different policies and find the best coverage for your needs.

- Insurance companies directly: Many insurance companies offer online quotes and allow you to purchase policies directly through their websites.

- Comparison websites: Online platforms like Insurance.com or Policygenius can help you compare quotes from multiple insurance providers.

To maintain your insurance coverage, you must:

- Pay your premiums on time: Failure to do so could result in policy cancellation.

- Notify your insurer of any changes: This includes changes in your address, vehicle ownership, or driving record.

- Renew your policy before it expires: If your policy lapses, you may face penalties or difficulty obtaining new coverage.

Choosing the Right Insurance Policy and Provider

Selecting the right insurance policy and provider is crucial for getting the best value and coverage for your needs. Here’s how to make an informed decision:

- Assess your individual needs: Consider factors like your driving history, the type of vehicle you own, and your budget.

- Compare quotes from multiple providers: Don’t settle for the first quote you receive. Shop around and compare prices, coverage options, and customer service.

- Read reviews and ratings: Check online reviews and ratings from reputable sources to gauge the reputation and reliability of insurance companies.

- Consider factors beyond price: While price is important, also look at factors like the company’s financial stability, claims handling process, and customer service reputation.

Understanding Insurance Terms and Conditions

Insurance policies can be complex, with a lot of jargon and fine print. To avoid common pitfalls, it’s essential to:

- Read your policy carefully: Don’t just skim through it. Take the time to understand the coverage, exclusions, and limitations.

- Ask questions: If you’re unsure about anything, don’t hesitate to contact your insurance agent or company for clarification.

- Be aware of common pitfalls: Some common pitfalls include failing to disclose important information, neglecting to review your policy regularly, and assuming your insurance covers everything.

Last Word

Navigating the complex world of insurance can be daunting, but understanding Georgia’s minimum insurance requirements is crucial for every driver. By adhering to these regulations, drivers can ensure they are adequately protected in case of an accident, minimizing financial hardship and potential legal complications. Remember, driving without the required insurance can have serious consequences, so prioritize your safety and financial well-being by obtaining and maintaining the necessary coverage.

Question Bank

What are the minimum liability coverage limits required in Georgia?

Georgia requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability and $25,000 for property damage liability.

Do I need to have PIP coverage in Georgia?

While not mandatory, PIP coverage is highly recommended as it provides coverage for medical expenses and lost wages, regardless of fault, for you and your passengers.

What are the penalties for driving without insurance in Georgia?

Driving without the required minimum insurance in Georgia can result in fines, license suspension, and even jail time. Additionally, you may face significant financial consequences if you are involved in an accident without insurance.