Full coverage car insurance cost State Farm can be a significant expense, but it offers peace of mind knowing you’re protected in case of an accident. This comprehensive guide explores the factors that influence State Farm’s full coverage car insurance pricing, helping you understand what to expect and how to potentially lower your costs.

From understanding the key components of full coverage to comparing State Farm’s rates with other providers, we’ll delve into the intricacies of this essential insurance type. We’ll also examine how factors like your vehicle, driving history, and location can impact your premiums. Whether you’re a new driver or a seasoned motorist, understanding the nuances of full coverage car insurance is crucial for making informed decisions.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a common term used to describe a comprehensive insurance policy that protects you from a wide range of risks associated with owning and operating a vehicle. This type of policy is designed to provide financial protection in case of accidents, theft, vandalism, or other incidents that may damage your car or cause injury to others.

Key Components of Full Coverage Car Insurance

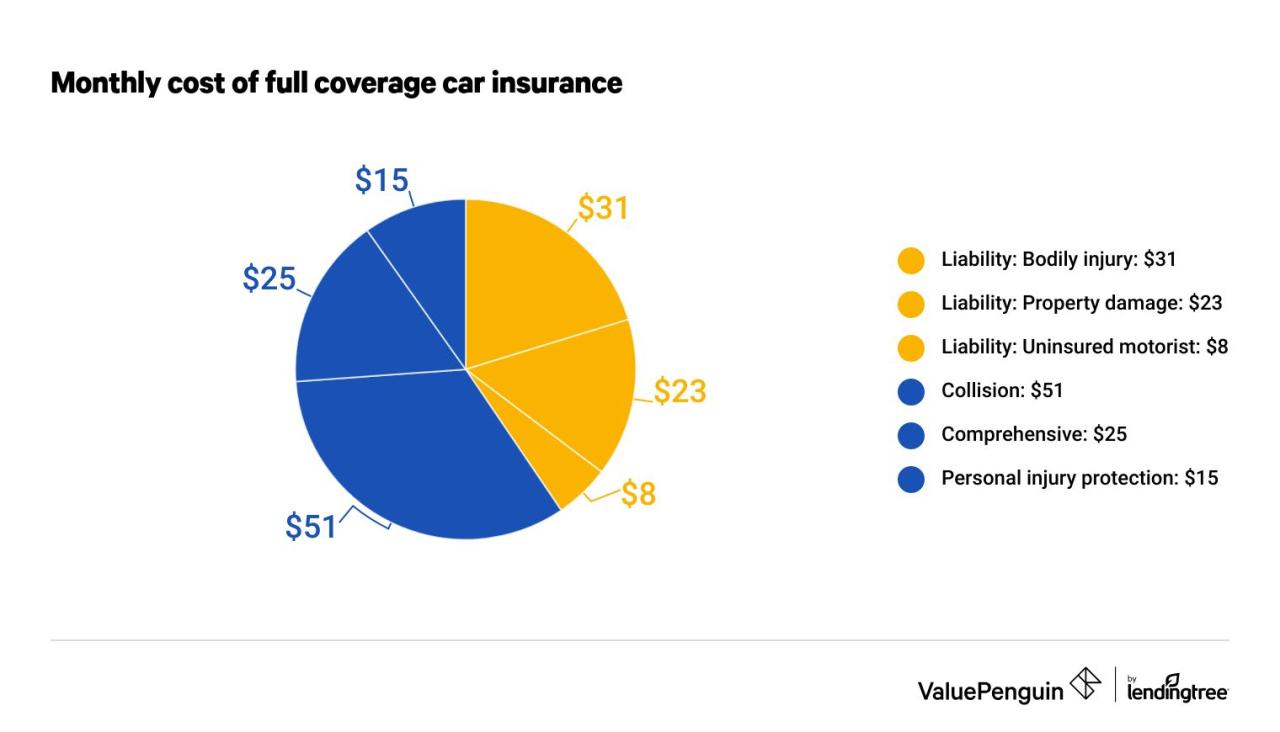

Full coverage car insurance typically includes several key components:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to others. It covers medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by a driver who does not have adequate insurance or is uninsured.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. It is often required in certain states.

Differences Between Full Coverage and Other Insurance Types

Full coverage insurance provides more comprehensive protection than other types of car insurance, such as liability-only insurance.

- Liability-only insurance only covers damages to other people and their property if you are at fault in an accident. It does not cover damage to your own vehicle or your own injuries.

- Full coverage insurance, on the other hand, covers damage to your vehicle, your injuries, and the injuries and property damage of others involved in an accident.

Benefits of Having Full Coverage Car Insurance

Having full coverage car insurance offers several benefits:

- Financial protection in case of accidents: Full coverage insurance provides financial protection in case of an accident, regardless of who is at fault. This can help you pay for repairs or replacement of your vehicle, medical expenses, and other related costs.

- Peace of mind: Knowing that you are financially protected in case of an accident can give you peace of mind and allow you to focus on recovering from the event.

- Meeting loan requirements: Many lenders require borrowers to have full coverage insurance on vehicles that are financed.

- Protection against theft and other incidents: Full coverage insurance provides protection against theft, vandalism, fire, and other incidents that may damage your vehicle.

State Farm’s Full Coverage Car Insurance

State Farm is one of the largest and most well-known insurance providers in the United States. It offers a comprehensive range of insurance products, including full coverage car insurance. State Farm’s approach to full coverage car insurance is designed to provide policyholders with peace of mind and financial protection in the event of an accident.

State Farm’s Full Coverage Car Insurance Features

State Farm’s full coverage car insurance includes several unique features and benefits.

- Drive Safe & Save: This program offers discounts to drivers who maintain a safe driving record. It utilizes telematics technology to monitor driving habits and provide personalized feedback.

- Accident Forgiveness: This feature allows policyholders to avoid an increase in their premiums after their first at-fault accident. This can be particularly beneficial for drivers who have a clean driving history.

- Ride Sharing Coverage: State Farm offers coverage for drivers who use ride-sharing services like Uber or Lyft. This coverage can help protect drivers from liability claims while they are working.

Factors Affecting State Farm’s Full Coverage Car Insurance Pricing

State Farm’s pricing for full coverage car insurance is influenced by several factors, including:

- Vehicle Year, Make, and Model: Newer, more expensive vehicles generally have higher insurance premiums due to their replacement cost.

- Driver’s Age and Driving History: Younger drivers and those with a history of accidents or traffic violations typically pay higher premiums. This is because they are statistically more likely to be involved in accidents.

- Location: Insurance premiums can vary based on the location where the vehicle is insured. Areas with higher crime rates or more traffic congestion may have higher premiums.

- Coverage Limits: The amount of coverage selected for liability, collision, and comprehensive coverage will affect the premium. Higher coverage limits generally result in higher premiums.

- Deductible: The deductible is the amount a policyholder pays out-of-pocket before insurance coverage kicks in. A higher deductible usually results in a lower premium.

Factors Affecting Full Coverage Car Insurance Costs

The price of full coverage car insurance is influenced by a variety of factors, all of which contribute to the overall risk assessment conducted by insurance companies. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

Vehicle Type and Model

The type and model of your vehicle play a significant role in determining your insurance costs. This is because insurance companies consider factors such as the vehicle’s safety features, repair costs, and likelihood of theft.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and may result in lower insurance premiums. For example, a car with a five-star safety rating from the National Highway Traffic Safety Administration (NHTSA) might have lower insurance rates compared to a car with a lower safety rating.

- Repair Costs: Vehicles with expensive parts or complex repair processes tend to have higher insurance premiums. Luxury cars, sports cars, and vehicles with specialized components are often more costly to repair in case of an accident.

- Theft Risk: Certain vehicle models are more prone to theft than others. Vehicles with high resale value or those in high-theft areas may have higher insurance premiums due to the increased risk of theft.

Driver Demographics

Your age, driving history, and location are key factors that insurance companies use to assess your risk and determine your insurance rates.

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher insurance premiums for young drivers. As drivers gain experience and age, their premiums tend to decrease.

- Driving History: Your driving record, including any accidents, traffic violations, or DUI convictions, significantly impacts your insurance rates. A clean driving record with no incidents will generally result in lower premiums. Conversely, a history of accidents or violations will likely lead to higher premiums.

- Location: The location where you live and drive influences your insurance rates. Areas with high traffic density, higher crime rates, or more severe weather conditions tend to have higher insurance premiums due to the increased risk of accidents and claims.

Coverage Limits and Deductibles

The amount of coverage you choose and your deductible also influence your insurance premiums.

- Coverage Limits: Coverage limits refer to the maximum amount your insurance company will pay for specific types of losses, such as liability, collision, or comprehensive coverage. Higher coverage limits generally result in higher premiums, as you are insured for more significant financial protection.

- Deductibles: Your deductible is the amount you agree to pay out-of-pocket in case of an accident or claim. A higher deductible generally results in lower premiums, as you are taking on more financial responsibility in case of an incident. Conversely, a lower deductible will lead to higher premiums, as you are transferring more risk to the insurance company.

Obtaining a Quote from State Farm

Getting a quote for full coverage car insurance from State Farm is a straightforward process. You can choose to obtain a quote online, over the phone, or in person at a local State Farm agent’s office. Each method has its own advantages and considerations, allowing you to select the option that best suits your preferences and circumstances.

Methods for Obtaining a Quote

The most common ways to get a quote from State Farm are:

- Online: This is the most convenient option, allowing you to get a quote anytime, anywhere. You can access State Farm’s website and enter your information into their online quote tool. The online process is typically quick and easy, and you can usually receive an instant quote.

- Phone: If you prefer to speak with a representative, you can call State Farm’s customer service line. A representative will ask you for your information and provide you with a quote. This option allows you to ask questions and get personalized advice.

- In Person: You can also visit a local State Farm agent’s office to obtain a quote. This allows you to meet with an agent face-to-face, discuss your specific needs, and get personalized recommendations.

Information Required for a Quote

Regardless of the method you choose, State Farm will need certain information to generate a quote. This information typically includes:

- Your Personal Information: Your name, address, date of birth, and contact information.

- Vehicle Information: The year, make, model, and VIN of your vehicle.

- Driving History: Your driving record, including any accidents or violations.

- Coverage Preferences: The type of coverage you desire, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Other Factors: Your driving habits, your location, and any other relevant information that may affect your insurance premium.

Examples of Information Required, Full coverage car insurance cost state farm

Here are some examples of information you may be asked to provide:

- Driving History: Number of years driving, any accidents or tickets in the past 3-5 years, and any other relevant driving information.

- Vehicle Information: Whether your vehicle is used for personal or business purposes, the number of miles you drive annually, and any modifications made to the vehicle.

- Coverage Preferences: The specific coverage limits you desire for liability, collision, and comprehensive coverage, and whether you want uninsured motorist coverage.

- Other Factors: Your age, gender, credit score, and whether you have any safety features installed in your vehicle.

Comparison with Other Insurance Providers

Choosing the right car insurance provider can be a daunting task, as numerous companies offer various coverage options and prices. To make an informed decision, comparing State Farm’s full coverage car insurance costs with other major providers is crucial. This comparison will help you understand the pros and cons of choosing State Farm over competitors and identify factors that might influence your decision.

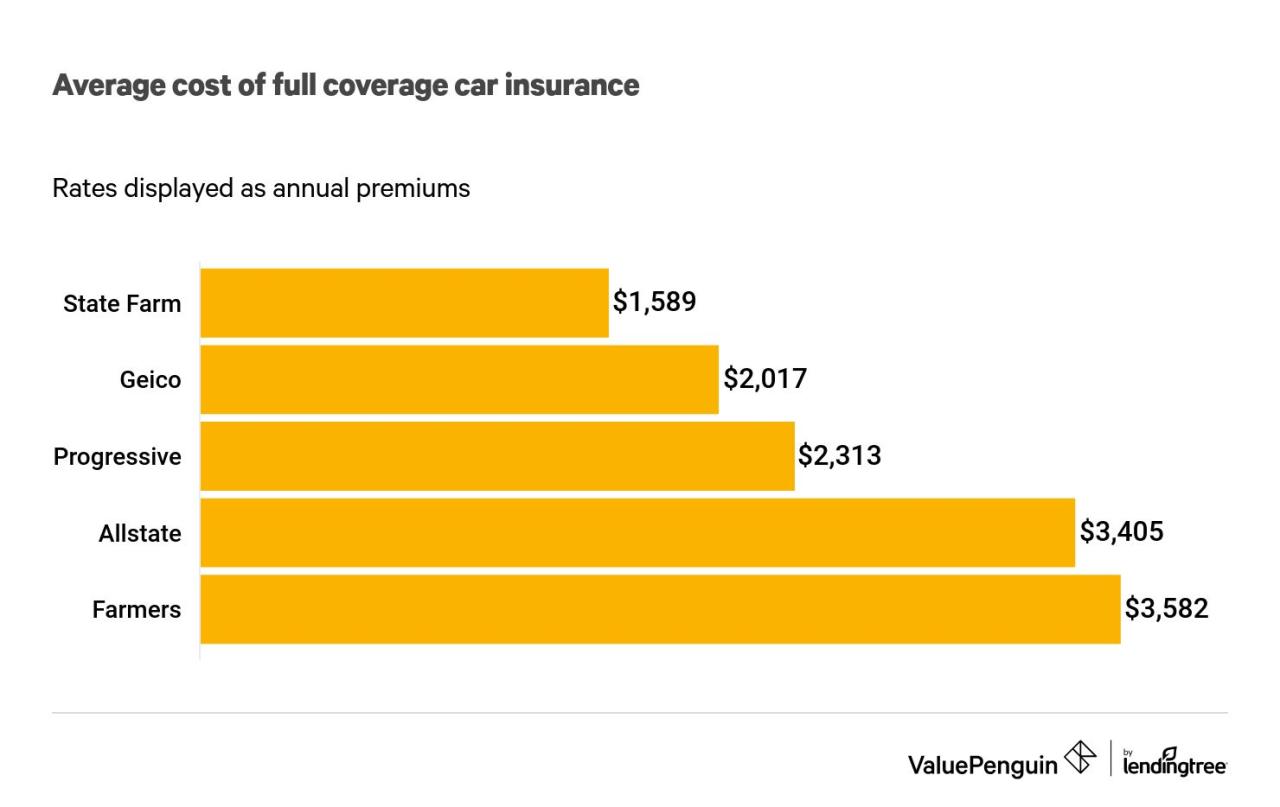

State Farm vs. Other Major Providers

To understand State Farm’s competitive standing, comparing its full coverage car insurance costs with other major providers is essential. It’s important to remember that prices vary based on individual factors like location, driving history, and vehicle type. However, a general comparison can provide valuable insights.

Here’s a comparison of average annual premiums for full coverage car insurance from some major providers:

| Provider | Average Annual Premium |

|---|---|

| State Farm | $1,600 |

| Geico | $1,500 |

| Progressive | $1,450 |

| Allstate | $1,700 |

While these figures are approximate, they illustrate that State Farm’s prices are generally competitive with other major providers. However, it’s crucial to obtain personalized quotes from multiple companies to determine the best option for your specific needs.

Pros and Cons of Choosing State Farm

When choosing a car insurance provider, it’s important to weigh the pros and cons of each option. State Farm offers several advantages, including:

- Strong financial stability: State Farm is a financially sound company with a long history of reliability, offering peace of mind in case of a claim.

- Extensive network of agents: State Farm has a vast network of local agents who can provide personalized service and assistance.

- Wide range of coverage options: State Farm offers various coverage options to meet different needs, including comprehensive and collision coverage, liability coverage, and uninsured/underinsured motorist coverage.

- Discounts: State Farm offers various discounts for safe driving, good student records, and bundling multiple insurance policies.

However, State Farm also has some drawbacks:

- Higher premiums in some areas: State Farm’s premiums can be higher than competitors in certain regions.

- Limited online options: While State Farm offers online quotes and account management, its online services may be less extensive than some competitors.

Factors Influencing Consumer Decision

Ultimately, the decision of choosing a car insurance provider depends on individual preferences and priorities. Several factors can influence a consumer’s decision, including:

- Price: Cost is often a primary concern, and consumers generally seek the most affordable option while maintaining adequate coverage.

- Coverage options: The specific coverage options offered by a provider are crucial, ensuring adequate protection for your vehicle and financial interests.

- Customer service: The quality of customer service is essential, especially during claims processing, ensuring a smooth and efficient experience.

- Brand reputation: A provider’s reputation for reliability and financial stability can influence consumer trust and confidence.

Additional Considerations

While the cost of full coverage car insurance is a crucial factor, understanding the details of your policy and exploring cost-saving options can significantly impact your overall financial well-being. This section delves into key considerations that can help you make informed decisions about your insurance coverage.

Policy Terms and Conditions

It’s essential to carefully review your policy’s terms and conditions to ensure you fully comprehend the coverage provided and any exclusions. This includes understanding:

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, but you’ll have to pay more in the event of a claim.

- Coverage Limits: These define the maximum amount your insurance company will pay for specific types of losses, such as bodily injury or property damage.

- Exclusions: Certain situations or events may not be covered by your policy. It’s crucial to understand these exclusions to avoid unexpected financial burdens.

Discounts and Cost-Saving Options

State Farm offers a range of discounts that can significantly reduce your premium. These discounts are often based on factors such as:

- Safe Driving: Maintaining a clean driving record with no accidents or traffic violations can earn you discounts.

- Good Student: Students with good grades may qualify for discounts, reflecting their responsible nature.

- Multiple Policies: Bundling your car insurance with other policies like homeowners or renters insurance can lead to substantial savings.

- Safety Features: Vehicles equipped with anti-theft devices or advanced safety features like airbags and anti-lock brakes may qualify for discounts.

- Payment Options: Paying your premium annually or semi-annually may offer a lower rate compared to monthly payments.

Lowering Full Coverage Insurance Costs

Several strategies can help you potentially lower your full coverage insurance costs:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. Websites and apps can help you easily compare different options.

- Improve Your Credit Score: In some states, insurers use credit scores as a factor in determining premiums. Improving your credit score can potentially lead to lower rates.

- Increase Your Deductible: As mentioned earlier, increasing your deductible can lower your premium. However, ensure you can afford to pay the higher deductible if you need to file a claim.

- Consider a Less Expensive Vehicle: Certain car models are known to have higher insurance premiums due to their value, repair costs, or safety ratings. Choosing a less expensive vehicle could lead to lower insurance costs.

- Drive Safely: Maintaining a clean driving record and avoiding accidents or traffic violations can significantly reduce your premium over time.

Last Point: Full Coverage Car Insurance Cost State Farm

Navigating the world of car insurance can feel overwhelming, but understanding the intricacies of full coverage and exploring your options with State Farm can empower you to make the right choices for your needs. By carefully considering factors like your driving habits, vehicle type, and desired coverage levels, you can find the best balance between affordability and comprehensive protection. Remember, a little research can go a long way in securing the right insurance coverage at a price that fits your budget.

FAQ Guide

How does State Farm determine my full coverage car insurance cost?

State Farm considers various factors, including your driving history, vehicle type, location, and coverage limits. They use a complex algorithm to assess your risk and calculate your premium.

What discounts can I qualify for with State Farm’s full coverage car insurance?

State Farm offers a variety of discounts, such as good driver discounts, safe driver discounts, multi-policy discounts, and more. Check with your local State Farm agent to see what discounts you may be eligible for.

What is the difference between liability-only and full coverage car insurance?

Liability-only insurance covers damage you cause to others in an accident. Full coverage adds additional protection for your vehicle, including collision and comprehensive coverage.

How can I lower my full coverage car insurance cost?

Consider increasing your deductible, improving your driving record, and exploring discounts offered by State Farm. You can also compare quotes from other insurance providers.