Florida State Minimum Auto Insurance Requirements sets the stage for understanding the legal framework that governs car insurance in the Sunshine State. This guide provides a comprehensive overview of the essential coverage types, minimum financial responsibility limits, and potential consequences for failing to meet these requirements. We’ll explore the importance of each coverage type and how they protect you in various real-life scenarios.

Understanding these requirements is crucial for every Florida driver. Whether you’re a seasoned motorist or a new resident, this information will help you navigate the insurance landscape, make informed decisions, and ensure you’re adequately protected on the road.

Florida’s Minimum Auto Insurance Requirements

Driving in Florida requires you to have the minimum auto insurance coverage mandated by the state. This ensures that you can financially cover damages or injuries caused to others in case of an accident. Understanding these requirements is crucial to avoid hefty penalties and legal consequences.

Florida’s Legal Framework for Minimum Auto Insurance Requirements

Florida’s minimum auto insurance requirements are rooted in the state’s “no-fault” insurance system. This system, established by the Florida Motor Vehicle No-Fault Law (also known as the Florida Personal Injury Protection Act), aims to streamline the process of handling accidents and ensure that drivers have access to essential medical coverage.

Types of Coverage Mandated by Florida Law

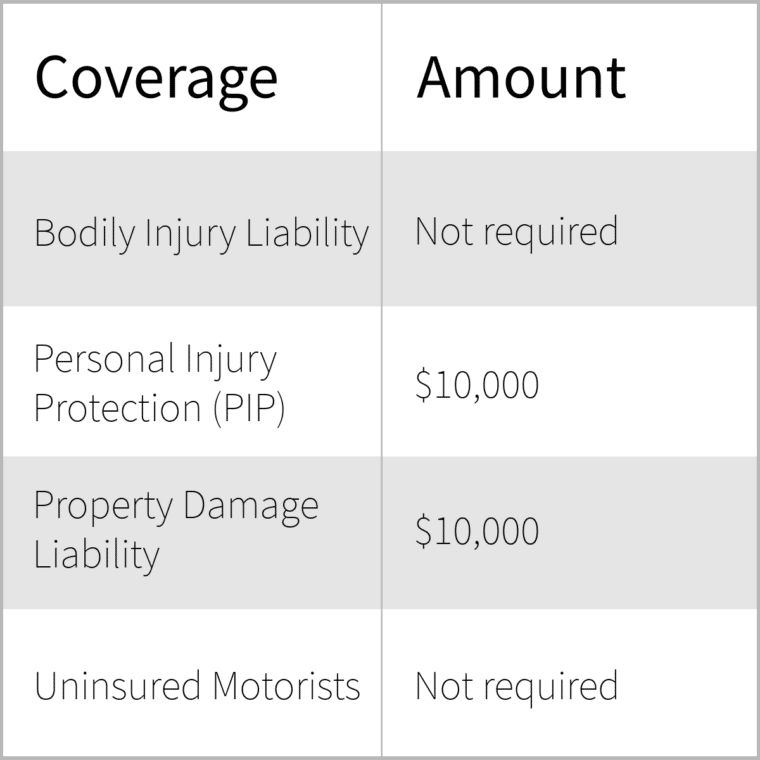

Florida law requires drivers to carry two primary types of auto insurance coverage:

- Personal Injury Protection (PIP): This coverage covers medical expenses, lost wages, and other related costs for injuries sustained by the insured driver and passengers in their vehicle, regardless of who caused the accident. It’s important to note that PIP coverage is capped at $10,000 per person, per accident.

- Property Damage Liability (PDL): This coverage protects the insured driver against financial losses resulting from damage they cause to another person’s property, including their vehicle. This coverage is mandatory in Florida and covers damages to the other driver’s vehicle and other property.

Minimum Financial Responsibility Limits

Florida law specifies the minimum financial responsibility limits for the required coverage:

- PIP: $10,000 per person, per accident

- PDL: $10,000 per accident

Penalties for Driving Without Minimum Required Insurance

Driving without the minimum required auto insurance in Florida is a serious offense. The consequences can be severe, including:

- Fines: Drivers caught operating a vehicle without the required insurance face fines of up to $500.

- License Suspension: The Florida Department of Motor Vehicles (DMV) can suspend the driver’s license for up to three years.

- Vehicle Impoundment: The vehicle may be impounded until the required insurance is obtained.

- Jail Time: In some cases, driving without insurance can lead to jail time.

- Financial Responsibility: If an uninsured driver causes an accident, they are personally liable for all damages and injuries, potentially leading to significant financial burdens.

Coverage Types and Their Importance

In Florida, drivers are required to have specific types of auto insurance coverage to protect themselves and others in case of an accident. These coverages are designed to address different types of financial losses that can arise from an accident. Understanding the purpose and significance of each coverage type is crucial for ensuring adequate protection.

Types of Coverage, Florida state minimum auto insurance requirements

The required coverage types are as follows:

| Coverage Name | Description | Minimum Financial Responsibility Limit |

|---|---|---|

| Bodily Injury Liability | Covers the costs of injuries sustained by others in an accident that you caused. This includes medical expenses, lost wages, and pain and suffering. | $10,000 per person / $20,000 per accident |

| Property Damage Liability | Covers the costs of damage to another person’s property in an accident that you caused. This includes damage to vehicles, buildings, and other structures. | $10,000 per accident |

| Personal Injury Protection (PIP) | Covers your own medical expenses and lost wages, regardless of who caused the accident. This includes medical bills, rehabilitation costs, and lost income. | $10,000 per person |

| Uninsured Motorist Coverage (UM) | Provides coverage for injuries and damages caused by an uninsured or hit-and-run driver. | $10,000 per person / $20,000 per accident |

| Underinsured Motorist Coverage (UIM) | Provides coverage for injuries and damages caused by a driver who has insufficient insurance coverage to fully compensate you for your losses. | $10,000 per person / $20,000 per accident |

Bodily Injury Liability Coverage

This coverage is essential because it protects you from significant financial liability if you cause an accident that results in injuries to others.

For example, if you are involved in an accident and cause injuries to another driver and their passenger, your bodily injury liability coverage would help pay for their medical expenses, lost wages, and pain and suffering. Without this coverage, you could be personally responsible for these costs, which can be substantial, potentially leading to financial ruin.

Property Damage Liability Coverage

This coverage is vital to protect you from the costs of repairing or replacing property damaged in an accident you caused.

Imagine you accidentally back your car into a parked vehicle, causing significant damage. Your property damage liability coverage would help pay for the repairs to the other vehicle, preventing you from having to cover these costs out of pocket.

Personal Injury Protection (PIP) Coverage

This coverage is unique to Florida and is a crucial part of the state’s no-fault insurance system. It covers your own medical expenses and lost wages, regardless of who caused the accident.

For instance, if you are involved in an accident and sustain injuries, even if the other driver is at fault, your PIP coverage will help pay for your medical bills, rehabilitation costs, and lost income. This coverage helps to ensure that you receive the necessary medical care and financial support without having to wait for the outcome of a liability determination.

Uninsured Motorist Coverage (UM)

This coverage is essential because it provides protection when you are involved in an accident with a driver who does not have insurance.

Imagine you are stopped at a red light when another vehicle runs the light and hits you. If the other driver is uninsured, your UM coverage will help pay for your injuries and damages, ensuring that you are not left financially responsible for the costs of the accident.

Underinsured Motorist Coverage (UIM)

This coverage is designed to protect you in situations where the other driver’s insurance coverage is insufficient to cover your losses.

For example, you are involved in an accident with another driver who has $10,000 in liability coverage. Your injuries and damages exceed this amount. Your UIM coverage will step in to cover the difference, ensuring that you are fully compensated for your losses.

Factors Influencing Insurance Costs: Florida State Minimum Auto Insurance Requirements

Auto insurance premiums in Florida are determined by a complex interplay of factors, each contributing to the overall cost of your policy. Understanding these factors can help you make informed decisions about your insurance coverage and potentially reduce your premiums.

Driver’s Factors

The characteristics of the driver play a significant role in determining insurance costs. Insurance companies consider various factors to assess the risk associated with a particular driver, such as:

- Driving History: A clean driving record with no accidents or violations usually results in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions can significantly increase your insurance costs.

- Age and Experience: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As drivers gain experience and age, their premiums generally decrease.

- Credit Score: While controversial, credit scores are often used by insurance companies to assess risk. A higher credit score generally translates to lower premiums, as it indicates a responsible financial history.

- Driving Habits: Insurance companies may offer discounts for safe driving habits, such as using a telematics device that monitors driving behavior.

Obtaining and Maintaining Insurance

In Florida, obtaining the minimum required auto insurance is a straightforward process that involves finding a suitable insurance provider, providing necessary information, and paying the required premium.

Maintaining continuous coverage is crucial to avoid potential legal and financial repercussions, and understanding the implications of lapses is essential for responsible driving.

The Process of Obtaining Minimum Required Auto Insurance

The process of obtaining minimum required auto insurance in Florida is relatively straightforward. It typically involves the following steps:

- Contacting Insurance Providers: Begin by contacting multiple insurance providers to compare quotes and coverage options. You can use online comparison websites, call insurance companies directly, or consult with an insurance broker.

- Providing Information: Once you’ve chosen a provider, you’ll need to provide them with personal information, including your driver’s license, vehicle registration, and driving history. This information helps them assess your risk and determine your insurance premium.

- Selecting Coverage: Choose the coverage options that meet the minimum requirements for Florida, including Personal Injury Protection (PIP) and Property Damage Liability (PDL).

- Paying Premiums: You’ll need to pay the premium for your chosen coverage. Premiums can be paid monthly, quarterly, or annually, depending on your preference and the provider’s policy.

- Receiving Proof of Insurance: After you’ve paid your premium, your insurance provider will issue you a proof of insurance card, which you must keep in your vehicle at all times.

Tips for Finding Affordable Insurance Options

Finding affordable insurance options that meet Florida’s minimum requirements can be achieved by implementing these strategies:

- Compare Quotes: Obtaining quotes from multiple insurance providers allows you to compare prices and coverage options, ensuring you find the most competitive offer.

- Bundle Policies: Consider bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, to potentially receive discounts.

- Improve Your Driving Record: Maintaining a clean driving record with no accidents or traffic violations can significantly reduce your insurance premium.

- Increase Your Deductible: Choosing a higher deductible can lower your monthly premium, but it also means you’ll pay more out-of-pocket if you need to file a claim.

- Consider Safety Features: Vehicles equipped with safety features like anti-theft devices, airbags, and anti-lock brakes can qualify for discounts.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving and potentially lead to premium reductions.

- Ask About Discounts: Inquire about available discounts for good students, safe drivers, or members of certain organizations.

Maintaining Continuous Coverage

Maintaining continuous insurance coverage is essential for several reasons, including:

- Legal Compliance: Driving without insurance in Florida is illegal and can result in fines, license suspension, and even jail time.

- Financial Protection: Insurance provides financial protection in case of accidents, covering medical expenses, property damage, and legal costs.

- Peace of Mind: Knowing you have insurance coverage can provide peace of mind and reduce stress in the event of an accident.

Consequences of Lapses in Coverage

Lapses in insurance coverage can have significant consequences, including:

- Fines and Penalties: Driving without insurance in Florida is a serious offense that can result in substantial fines and penalties.

- License Suspension: Your driver’s license may be suspended if you’re caught driving without insurance, making it impossible to legally operate a vehicle.

- Higher Premiums: When you reinstate your insurance after a lapse, you may face higher premiums due to the increased risk associated with uninsured drivers.

- Limited Financial Protection: If you’re involved in an accident without insurance, you’ll be responsible for all associated costs, potentially leading to significant financial hardship.

Additional Considerations

While Florida’s minimum auto insurance requirements are straightforward, there are several additional factors to consider for a comprehensive understanding of your insurance needs. These include the state’s unique “no-fault” system and the regulatory role of the Florida Highway Safety and Motor Vehicles (FLHSMV).

Florida’s No-Fault Insurance System

Florida operates under a “no-fault” insurance system. This means that, after an accident, each driver is primarily responsible for their own medical expenses and lost wages, regardless of who caused the accident. This system is designed to reduce lawsuits and speed up the claims process.

Implications of Florida’s No-Fault System

- Personal Injury Protection (PIP): All Florida drivers are required to carry PIP coverage, which covers medical expenses and lost wages for the policyholder and their passengers, regardless of fault. The minimum PIP coverage is $10,000.

- Limited Liability Coverage: In a no-fault system, liability coverage is limited to situations where the driver’s injuries exceed the limits of their PIP coverage or when the accident involves a driver without insurance.

- “Threshold” for Lawsuits: In Florida, drivers can only sue for pain and suffering in a car accident if they meet a specific “threshold.” This threshold is typically met if the driver has suffered a “serious injury” as defined by Florida law.

Role of the Florida Highway Safety and Motor Vehicles (FLHSMV)

The FLHSMV is the state agency responsible for regulating insurance companies and ensuring compliance with Florida’s auto insurance laws. They have a crucial role in protecting consumers and ensuring that insurance companies operate fairly.

FLHSMV Responsibilities

- Licensing and Regulation: The FLHSMV licenses and regulates insurance companies operating in Florida, ensuring they meet specific financial and operational standards.

- Consumer Protection: The FLHSMV provides resources and information to consumers regarding their rights and obligations under Florida’s insurance laws.

- Enforcement: The FLHSMV investigates complaints against insurance companies and enforces compliance with state regulations.

Resources and Information

For further clarification or assistance, individuals can consult the following resources:

- Florida Highway Safety and Motor Vehicles (FLHSMV): The FLHSMV website provides comprehensive information on Florida’s auto insurance laws, regulations, and consumer rights.

- Florida Office of Insurance Regulation (OIR): The OIR is responsible for overseeing the insurance industry in Florida and provides information on consumer complaints, insurance company licensing, and other relevant topics.

- Florida Bar: The Florida Bar website provides resources and information on finding legal assistance in matters related to auto insurance and accidents.

Wrap-Up

Navigating Florida’s auto insurance requirements can be a complex process. By understanding the minimum coverage types, financial responsibility limits, and potential penalties, you can make informed decisions that protect yourself and your finances. Remember to review your policy regularly, seek clarification when needed, and ensure you maintain continuous coverage to avoid any legal repercussions. Driving in Florida requires being prepared, and knowing your state’s minimum auto insurance requirements is an essential step in that direction.

Commonly Asked Questions

What happens if I get into an accident without the minimum required insurance?

You could face serious consequences, including fines, license suspension, and even jail time. Additionally, you may be held financially responsible for any damages or injuries caused, potentially leading to significant financial hardship.

Can I choose to have more coverage than the minimum requirements?

Absolutely! While the minimum requirements provide basic protection, opting for more comprehensive coverage can offer greater peace of mind and financial security in case of an accident.

How often do I need to renew my auto insurance policy?

Auto insurance policies in Florida are typically renewed annually. It’s essential to keep your policy active and ensure it meets the minimum requirements at all times.

What resources are available if I need help understanding Florida’s auto insurance requirements?

You can contact the Florida Highway Safety and Motor Vehicles (FLHSMV) directly or consult with an insurance agent or broker. They can provide guidance and answer any questions you may have.