Florida State Minimum Insurance Limits sets the stage for understanding your legal obligations as a driver in the Sunshine State. These limits are not just numbers on a piece of paper; they represent the minimum financial responsibility you must carry to protect yourself and others in case of an accident. This article delves into the specifics of these requirements, breaking down the different types of coverage, the potential consequences of not meeting them, and how to navigate the system.

From understanding the basics of liability coverage to exploring the factors that can influence your insurance needs, we’ll cover all the essential aspects of Florida’s minimum insurance requirements. This information empowers you to make informed decisions about your insurance coverage and ensure you’re adequately protected on the road.

Understanding Florida’s Minimum Insurance Requirements

Driving in Florida requires you to have the minimum amount of insurance coverage mandated by law. This is crucial for protecting yourself and others in case of an accident. Understanding these requirements can help you avoid hefty fines and legal consequences.

Types of Insurance Coverage

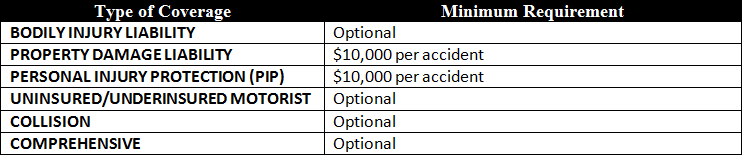

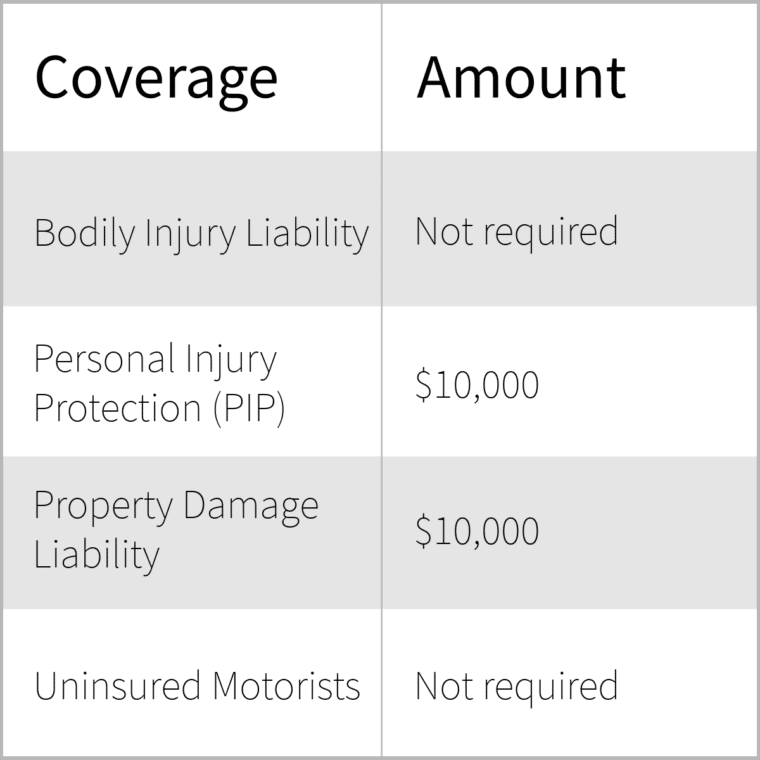

Florida law requires drivers to have at least three types of insurance coverage:

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of who caused the accident. Florida requires a minimum of $10,000 in PIP coverage.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s vehicle or property if you cause an accident. Florida requires a minimum of $10,000 in PDL coverage.

- Bodily Injury Liability (BIL): This coverage pays for medical expenses and lost wages for other drivers and passengers if you cause an accident. Florida requires a minimum of $10,000 per person and $20,000 per accident in BIL coverage.

Penalties for Driving Without Insurance

Driving without the required minimum insurance in Florida can result in serious consequences, including:

- Fines: You can face a fine of up to $500 for driving without insurance.

- License Suspension: Your driver’s license can be suspended for up to three years if you are caught driving without insurance.

- Vehicle Impoundment: Your vehicle can be impounded until you provide proof of insurance.

- Court Costs: You may have to pay court costs if you are found guilty of driving without insurance.

- Higher Insurance Premiums: If you get into an accident without insurance, you may face significantly higher insurance premiums in the future.

Breakdown of Minimum Insurance Limits

Florida law requires all drivers to carry a minimum amount of liability insurance to protect themselves and others in the event of an accident. These minimum limits are designed to cover the costs of injuries, property damage, and other expenses that may arise from an accident.

Minimum Liability Coverage Limits

The minimum liability coverage limits in Florida are as follows:

| Coverage Type | Minimum Limit |

|---|---|

| Bodily Injury Liability per person | $10,000 |

| Bodily Injury Liability per accident | $20,000 |

| Property Damage Liability | $10,000 |

Understanding Each Coverage Type

- Bodily Injury Liability: This coverage pays for the medical expenses, lost wages, and other damages caused to other people involved in an accident that you caused. The per-person limit refers to the maximum amount your insurance company will pay for injuries to a single person, while the per-accident limit represents the total amount they will pay for all injuries in a single accident.

- Property Damage Liability: This coverage pays for the repairs or replacement of property damage caused by you to another person’s vehicle or property. The limit represents the maximum amount your insurance company will pay for all property damage in a single accident.

Examples of How Limits Affect Accident Claims

- Example 1: If you cause an accident that results in $15,000 in medical bills for the other driver, your $10,000 per-person bodily injury liability coverage will only cover $10,000 of the costs. The other driver will be responsible for the remaining $5,000.

- Example 2: If you cause an accident that injures two people, with one person incurring $12,000 in medical expenses and the other $8,000, your $20,000 per-accident bodily injury liability coverage will be sufficient to cover both claims. However, if the total medical expenses exceed $20,000, you would be personally responsible for the difference.

- Example 3: If you cause an accident that damages another driver’s vehicle, and the repairs cost $12,000, your $10,000 property damage liability coverage will only cover $10,000 of the repair costs. You would be responsible for the remaining $2,000.

Factors Influencing Minimum Insurance Limits

While Florida law mandates minimum insurance limits for all drivers, certain factors can influence the specific requirements for individual drivers. These factors can include the type of vehicle, the number of passengers, and the driver’s age.

Exceptions and Special Circumstances

While the standard minimum insurance limits apply to most drivers, there are exceptions and special circumstances that might alter these requirements. For example, drivers of commercial vehicles or vehicles used for transporting hazardous materials may face higher insurance requirements. Additionally, certain types of vehicles, such as motorcycles or vehicles used for ride-sharing services, may have specific insurance regulations.

Consequences of Exceeding Minimum Limits

In the event of a serious accident, exceeding the minimum insurance limits can have significant consequences. If your insurance coverage is insufficient to cover the damages and injuries caused, you could be held personally liable for the remaining costs. This can include medical expenses, property damage, lost wages, and other related costs. In extreme cases, exceeding the minimum limits can lead to financial ruin or even legal action against you.

Impact of Minimum Insurance Limits on Drivers

Florida’s minimum insurance limits, while legally mandated, can have a significant impact on drivers’ financial responsibility in the event of an accident. Understanding these limits and their implications is crucial for drivers to make informed decisions about their insurance coverage.

Benefits of Carrying Insurance Coverage Exceeding the Minimum Limits, Florida state minimum insurance limits

Carrying insurance coverage exceeding the minimum limits offers drivers several benefits that can mitigate the financial risks associated with accidents.

- Enhanced Financial Protection: Minimum limits may not be sufficient to cover all the costs associated with a serious accident, such as medical expenses, lost wages, property damage, and legal fees. Higher coverage limits provide greater financial protection, reducing the risk of personal financial ruin.

- Peace of Mind: Knowing you have adequate insurance coverage can provide peace of mind, knowing you are protected in case of an accident. This peace of mind can be invaluable in a stressful situation.

- Avoiding Financial Ruin: A single accident can have devastating financial consequences if you only carry minimum limits. Higher coverage limits can help you avoid financial ruin by ensuring you have enough coverage to cover all your liabilities.

Cost Comparison of Minimum and Higher Coverage Options

The cost of insurance varies based on factors such as age, driving history, vehicle type, and location. However, generally, higher coverage limits will cost more than minimum coverage. Here’s a table illustrating a hypothetical example:

| Coverage Type | Liability Coverage | Cost (Monthly) |

|—|—|—|

| Minimum Coverage | $10,000/$20,000/$10,000 | $50 |

| Higher Coverage | $100,000/$300,000/$50,000 | $80 |

*Note: This is a hypothetical example and actual costs may vary.

It’s important to consider the potential financial risks and benefits of each coverage option before making a decision. While higher coverage may cost more, the peace of mind and financial protection it provides can be invaluable.

Resources for Florida Drivers: Florida State Minimum Insurance Limits

Navigating Florida’s insurance requirements can be a bit overwhelming, but there are several resources available to help drivers understand their obligations and find the right coverage. These resources offer valuable information, support, and guidance for all aspects of insurance in Florida.

Obtaining Proof of Insurance

It’s crucial to have proof of insurance readily available when driving in Florida. This document verifies that you have the minimum required coverage and can be presented upon request by law enforcement officers. There are several ways to obtain proof of insurance:

- Insurance Card: This is the most common form of proof of insurance. Your insurance company will provide you with a card containing your policy details, coverage limits, and policy number. Keep this card in your vehicle at all times.

- Digital Proof: Many insurance companies offer digital proof of insurance through their mobile apps or online portals. This allows you to access your insurance information anytime, anywhere.

- Declaration Page: Your insurance policy’s declaration page is a comprehensive document that Artikels all your coverage details, including the policy number, coverage limits, and effective dates. You can print this page or save it digitally for easy access.

Filing a Claim

If you’re involved in an accident, you’ll need to file a claim with your insurance company to initiate the process of getting compensation for damages. Here’s how to file a claim:

- Contact Your Insurance Company: The first step is to contact your insurance company as soon as possible after the accident. Provide them with the necessary information, including the date, time, and location of the accident, as well as details about the other parties involved.

- Gather Evidence: Collect any evidence you can, such as photos of the damage, witness statements, and police reports. This will help support your claim and ensure you receive fair compensation.

- Follow Instructions: Your insurance company will provide you with specific instructions on how to file your claim, including any required forms or documentation. Make sure to follow these instructions carefully and submit all necessary information promptly.

Contact Information

- Florida Department of Motor Vehicles (FLHSMV): (850) 617-2000, https://www.flhsmv.gov/

- Florida Office of Insurance Regulation: (850) 413-3000, https://www.floir.com/

Final Thoughts

Navigating the world of insurance can feel overwhelming, but understanding Florida’s minimum insurance requirements is crucial for every driver. By adhering to these limits and considering the potential benefits of carrying higher coverage, you can protect yourself financially and ensure peace of mind while driving in Florida. Remember, staying informed and proactive is key to navigating the complexities of insurance and ensuring you’re adequately prepared for any unexpected events on the road.

Key Questions Answered

What happens if I get into an accident and don’t have the minimum required insurance?

You could face serious consequences, including fines, license suspension, and even jail time. Additionally, you’ll be responsible for covering the costs of any damages or injuries you cause, which can be financially devastating.

Is it possible to get insurance coverage that exceeds the minimum limits?

Absolutely! While the minimum limits provide basic protection, it’s often advisable to consider higher coverage options for greater peace of mind. This can help you avoid significant out-of-pocket expenses in the event of a serious accident.

Where can I find more information about Florida’s insurance requirements?

The Florida Department of Motor Vehicles (DMV) is a great resource for all things related to driving in Florida. You can visit their website or contact them directly for specific information on insurance requirements and other regulations.