Navigating the world of car insurance in Florida can feel like driving through a maze, especially when it comes to understanding the state’s minimum requirements. Florida Car Insurance State Minimum is a crucial topic for every driver, ensuring you’re protected in case of an accident. This guide will break down the essentials, helping you make informed decisions about your coverage.

Florida’s unique “no-fault” system dictates that drivers are primarily responsible for covering their own injuries and damages after an accident, regardless of who is at fault. This means having adequate Personal Injury Protection (PIP) coverage is essential, as it covers medical expenses, lost wages, and even death benefits. However, there are exceptions to this rule, such as situations where you can sue the other driver for pain and suffering if your injuries meet certain criteria.

Florida’s Minimum Car Insurance Requirements

Driving in Florida requires you to have the minimum amount of car insurance mandated by the state. This ensures that you can cover potential costs in case of an accident. Let’s dive into the specifics of these requirements.

Florida’s Minimum Car Insurance Coverage

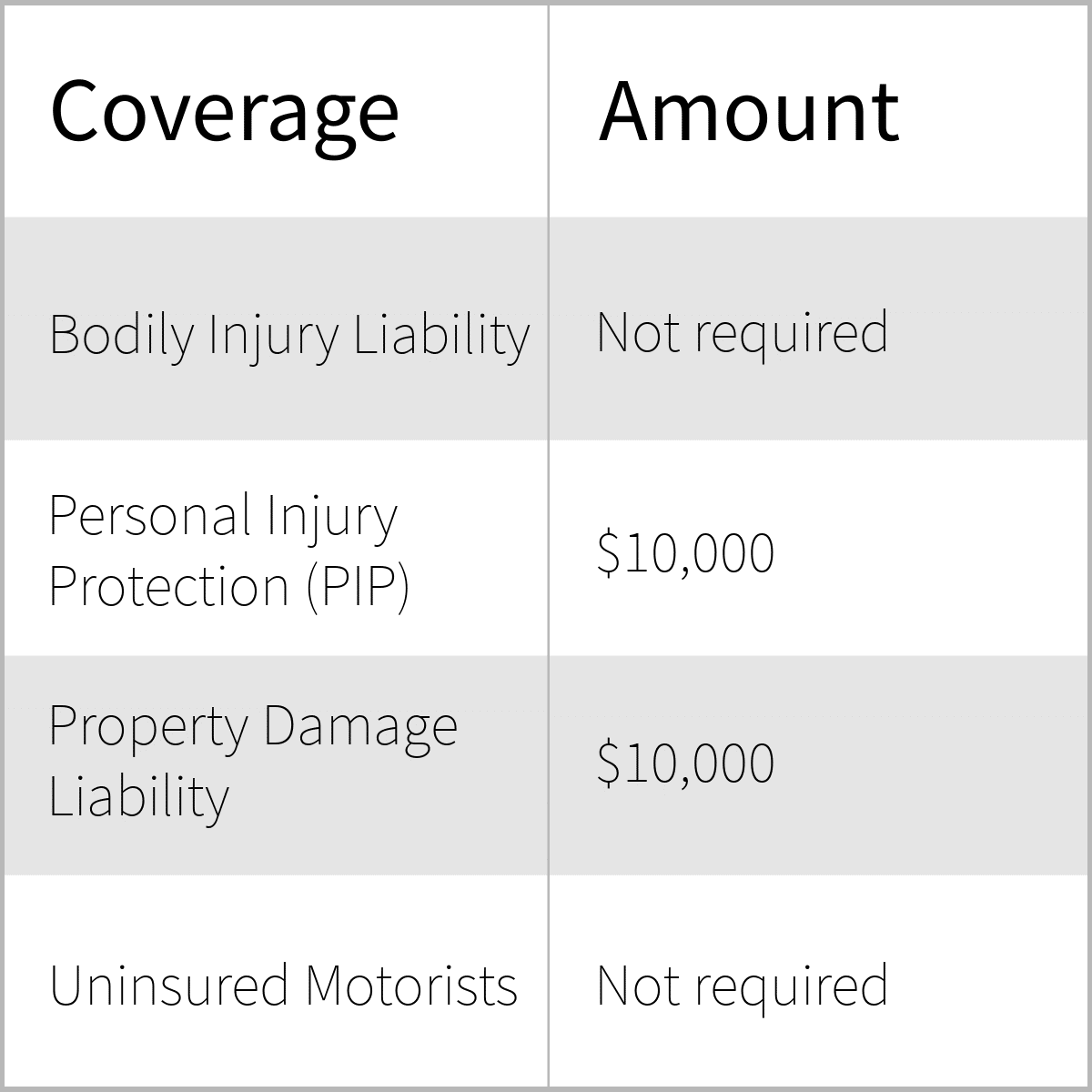

Florida law mandates that all drivers have specific types of car insurance coverage. These coverages are designed to protect you and others in case of an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other party if you cause an accident. The minimum limit is $10,000 per person and $20,000 per accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other party’s vehicle or property if you cause an accident. The minimum limit is $10,000 per accident.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other damages, regardless of who is at fault. It applies to you and your passengers. The minimum limit is $10,000 per person.

Penalties for Driving Without Required Minimum Car Insurance

Driving in Florida without the minimum car insurance coverage can result in severe penalties.

- Fines: You could face a fine of up to $500 for the first offense and up to $1,000 for subsequent offenses.

- License Suspension: Your driver’s license could be suspended for up to three years.

- Vehicle Impoundment: Your vehicle could be impounded until you provide proof of insurance.

- Jail Time: In some cases, you could face jail time for driving without insurance.

It’s crucial to remember that these penalties are just the tip of the iceberg. If you’re involved in an accident without insurance, you could face significant financial hardship and legal consequences.

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, meaning that after a car accident, each driver involved files a claim with their own insurance company, regardless of who caused the accident. This system aims to simplify the claims process and reduce the number of lawsuits.

Personal Injury Protection (PIP) Benefits

Under Florida’s no-fault system, all drivers are required to carry Personal Injury Protection (PIP) coverage. This coverage pays for your medical expenses and lost wages, regardless of who caused the accident.

PIP benefits cover the following:

- Medical expenses: This includes expenses for doctors, hospitals, ambulance services, and other medical treatments.

- Lost wages: This coverage pays for lost income if you are unable to work due to your injuries.

- Death benefits: If you are killed in a car accident, your PIP coverage will pay a death benefit to your beneficiaries.

Limitations and Exceptions to the No-Fault System

The no-fault system in Florida has certain limitations and exceptions. For example, you may be able to sue the other driver in certain situations, such as:

- If your injuries are serious: If your injuries are severe, you may be able to sue the other driver, even if they were not at fault.

- If the other driver was intoxicated or under the influence of drugs: In this case, you may be able to sue the other driver, regardless of the severity of your injuries.

- If the other driver was driving without insurance: You may be able to sue the other driver if they were driving without the required insurance coverage.

It is important to note that even if you are able to sue the other driver, you may still be limited in the amount of damages you can recover. This is because Florida has a law called the “threshold law” that restricts the types of injuries that can be sued for.

Factors Influencing Florida Car Insurance Costs

Florida’s car insurance market is influenced by several factors that determine your premium. These factors are complex and interconnected, ultimately affecting how much you pay for coverage. Understanding these factors can help you make informed decisions about your insurance policy and potentially save money.

Driving History

Your driving history is a major factor in determining your car insurance premium. Insurance companies analyze your driving record to assess your risk of causing accidents. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums.

Age

Age plays a significant role in car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for younger drivers due to their perceived higher risk. However, as drivers gain experience and age, their premiums tend to decrease.

Vehicle Type

The type of vehicle you drive also influences your insurance premium. Luxury cars, sports cars, and high-performance vehicles are often more expensive to repair or replace in case of an accident. Insurance companies reflect this higher cost in their premiums. Additionally, vehicles with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts.

Location

Where you live in Florida can significantly impact your car insurance premium. Areas with higher rates of car accidents and theft tend to have higher insurance premiums. Urban areas with heavy traffic and congested roads often have higher premiums compared to rural areas with lower traffic density.

Florida’s High-Risk Driver Pool

Florida has a large population of high-risk drivers, which contributes to higher insurance premiums. This high-risk driver pool includes individuals with poor driving records, a history of accidents, and uninsured drivers. Insurance companies need to account for this increased risk, leading to higher premiums for all drivers in the state.

Insurance Company Financial Stability and Customer Satisfaction Ratings

When choosing car insurance, it’s essential to consider the financial stability and customer satisfaction ratings of the insurance company. A financially stable company is more likely to be able to pay claims in the event of an accident. Customer satisfaction ratings provide insights into the company’s responsiveness, claims handling process, and overall customer experience. You can research insurance company ratings from independent organizations like AM Best and J.D. Power.

Options for Saving on Florida Car Insurance

Saving money on car insurance is a priority for many Floridians. Fortunately, there are several strategies you can employ to potentially lower your premiums. Understanding your options and taking proactive steps can lead to significant savings over time.

Discounts

Many car insurance companies offer discounts to help policyholders save money. These discounts can be based on various factors, including your driving record, vehicle features, and lifestyle choices.

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, typically those who have not been involved in accidents or received traffic violations.

- Safe Driver Discount: This discount is similar to the good driver discount but may be offered by companies that use telematics devices to track driving behavior. These devices monitor factors like speed, braking, and acceleration, rewarding safe driving practices.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount.

- Multi-Policy Discount: You can often save money by bundling your car insurance with other policies, such as homeowners or renters insurance.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or GPS tracking systems, can reduce your premium.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and potentially lower your premiums.

- Student Discount: Good students with high GPAs may qualify for discounts.

Bundling Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often result in significant savings. By combining policies, you can benefit from multi-policy discounts and streamline your insurance needs with a single provider.

Shopping for Competitive Rates

It’s essential to compare quotes from multiple car insurance companies to ensure you’re getting the best rates. Don’t be afraid to switch providers if you find a better deal. Here are some tips for finding competitive rates:

- Use online comparison tools: Many websites allow you to enter your information and compare quotes from various companies simultaneously.

- Contact insurance agents: An insurance agent can help you compare quotes from different companies and provide personalized advice.

- Negotiate: Don’t be afraid to negotiate with insurance companies. Explain your driving record and any relevant factors that might influence your rates.

Improving Your Driving Record, Florida car insurance state minimum

Your driving record plays a significant role in determining your car insurance premiums. By taking steps to improve your driving record, you can potentially lower your premiums.

- Avoid traffic violations: Every traffic violation, from speeding tickets to parking violations, can negatively impact your premiums.

- Drive safely and defensively: Defensive driving techniques can help you avoid accidents and maintain a clean driving record.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and potentially lower your premiums.

Comparing Car Insurance Providers in Florida

When choosing a car insurance provider in Florida, it’s essential to consider factors beyond just price. Here are some key aspects to evaluate:

- Financial Stability: Choose a company with a strong financial history and a high rating from independent agencies like A.M. Best.

- Customer Service: Look for a company with a reputation for excellent customer service and responsiveness.

- Claims Process: Consider how easy it is to file a claim and the company’s track record in handling claims efficiently.

- Coverage Options: Ensure the company offers the coverage options you need, such as comprehensive, collision, and liability coverage.

Additional Considerations for Florida Car Insurance: Florida Car Insurance State Minimum

While Florida’s minimum car insurance requirements are a good starting point, they may not offer adequate protection in all situations. To ensure comprehensive coverage and peace of mind, it’s essential to consider additional factors beyond the state minimums.

Uninsured/Underinsured Motorist Coverage

Florida has a high number of uninsured drivers, making uninsured/underinsured motorist (UM/UIM) coverage crucial. UM/UIM coverage protects you in case you’re involved in an accident with a driver who lacks adequate insurance or is uninsured altogether. This coverage helps pay for your medical expenses, lost wages, and property damage.

Supplemental Coverage Options

Beyond the minimum requirements, you might want to consider supplemental coverage options like collision and comprehensive insurance. Collision coverage protects your vehicle against damage caused by an accident, regardless of fault. Comprehensive coverage provides protection against damage caused by events like theft, vandalism, or natural disasters.

Filing a Car Insurance Claim in Florida

To file a car insurance claim in Florida, you’ll need to contact your insurance company as soon as possible after an accident. Provide them with the following information:

- Your policy details

- The date, time, and location of the accident

- The names and contact information of all parties involved

- A description of the accident and the damages incurred

- Any available evidence, such as photographs or witness statements

Your insurance company will then review your claim and determine the next steps.

Wrap-Up

Understanding Florida’s car insurance laws is crucial for protecting yourself financially in case of an accident. While the state minimum requirements provide basic coverage, it’s essential to assess your individual needs and consider additional options like collision and comprehensive insurance. Remember, shopping around for competitive rates and taking advantage of discounts can help you find the best coverage at the most affordable price. Stay informed, drive safely, and ensure you have the protection you need on the road.

FAQ Section

What happens if I get into an accident and don’t have the required minimum car insurance?

You could face serious consequences, including fines, license suspension, and even jail time. Additionally, you’ll be responsible for covering all costs related to the accident, including medical bills, property damage, and legal fees.

How much does Florida car insurance typically cost?

The cost of car insurance in Florida varies significantly depending on factors such as your driving history, age, vehicle type, location, and the amount of coverage you choose. It’s essential to compare quotes from multiple insurance companies to find the best rates.

What are some tips for lowering my car insurance premiums?

You can potentially save money by maintaining a good driving record, taking advantage of discounts (like safe driver, good student, or multi-car), bundling your policies, and comparing rates from different insurance providers.