Florida State Insurance Company stands as a beacon of stability in the Sunshine State’s dynamic insurance market. Established with a commitment to protecting Floridians, the company has grown into a leading provider of essential insurance solutions. From its humble beginnings, Florida State Insurance Company has steadily built a reputation for reliability, innovation, and a genuine dedication to customer satisfaction.

The company’s mission centers on providing comprehensive insurance coverage tailored to the unique needs of Florida residents and businesses. This dedication to customer-centric solutions is reflected in their diverse product offerings, including homeowners, auto, business, and life insurance. Each product is carefully crafted to address the specific risks and challenges faced by Floridians, ensuring peace of mind and financial security.

Company Overview

Florida State Insurance Company is a leading provider of insurance solutions in the state of Florida, with a long history of serving the community. Founded in [Year], the company has grown steadily to become a trusted name in the insurance industry.

Company Mission and Core Values

Florida State Insurance Company is committed to providing its customers with exceptional insurance coverage and service. The company’s mission is to protect individuals and businesses from unexpected risks while upholding the highest ethical standards.

- Customer Focus: Florida State Insurance Company prioritizes the needs and satisfaction of its customers. This commitment is reflected in its responsive customer service, personalized insurance solutions, and ongoing support.

- Integrity: The company operates with honesty and transparency in all its dealings, building trust with its customers, partners, and employees.

- Innovation: Florida State Insurance Company is constantly seeking ways to improve its products and services, leveraging technology and industry best practices to provide innovative insurance solutions.

- Financial Stability: The company maintains a strong financial position, ensuring its ability to meet its obligations to policyholders and provide long-term stability.

Company Size and Scope of Operations

Florida State Insurance Company is a significant player in the Florida insurance market. It operates across various segments, including:

- Personal Lines: The company offers a comprehensive range of insurance products for individuals, including homeowners, auto, renters, and life insurance.

- Commercial Lines: Florida State Insurance Company provides customized insurance solutions for businesses of all sizes, covering property, liability, workers’ compensation, and more.

The company has a vast network of agents and brokers across the state, ensuring convenient access to its services. It also maintains a dedicated team of professionals who provide expert advice and support to its customers.

Products and Services

Florida State Insurance Company offers a comprehensive suite of insurance products designed to meet the diverse needs of our customers. Our products are tailored to provide financial protection against a wide range of risks, ensuring peace of mind and financial security.

Personal Insurance, Florida state insurance company

Our personal insurance products are designed to safeguard individuals and families against unexpected events.

- Homeowners Insurance: This policy protects your home and belongings against various perils such as fire, theft, and natural disasters. Key features include coverage for dwelling, personal property, liability, and additional living expenses. The target audience includes homeowners, both primary and secondary residences.

- Auto Insurance: This policy covers damages to your vehicle and liability claims arising from accidents. It also offers optional coverages like collision, comprehensive, and uninsured/underinsured motorist protection. The target audience includes car owners and drivers.

- Renters Insurance: This policy provides coverage for personal belongings and liability in the event of damage or loss within a rented property. It also includes protection against legal expenses arising from accidents. The target audience includes renters and tenants.

- Life Insurance: This policy provides financial protection for your loved ones in the event of your death. It can be used to cover funeral expenses, outstanding debts, and ongoing living expenses. There are various types of life insurance policies available, including term life, whole life, and universal life. The target audience includes individuals with dependents, those with outstanding debts, and those who want to ensure their loved ones’ financial security.

- Health Insurance: This policy provides coverage for medical expenses, including hospitalization, surgery, and prescription drugs. It can be purchased individually or through an employer. The target audience includes individuals and families seeking health insurance coverage.

Commercial Insurance

Our commercial insurance products are designed to protect businesses of all sizes from various risks.

- Business Owners Policy (BOP): This policy combines property and liability coverage for businesses, offering protection against property damage, business interruption, and legal claims. It is a comprehensive solution for small businesses. The target audience includes small business owners.

- Commercial Property Insurance: This policy protects businesses against damage to their buildings, equipment, and inventory. It covers various perils such as fire, theft, and natural disasters. The target audience includes businesses with physical assets.

- Commercial Liability Insurance: This policy protects businesses against legal claims arising from accidents or injuries on their premises or due to their products or services. It provides coverage for medical expenses, legal fees, and settlements. The target audience includes businesses with potential liability risks.

- Workers’ Compensation Insurance: This policy provides coverage for employees injured or sickened while on the job. It covers medical expenses, lost wages, and rehabilitation costs. The target audience includes employers with employees.

Specialized Insurance

Florida State Insurance Company also offers a range of specialized insurance products to meet specific needs.

- Flood Insurance: This policy provides coverage for damages caused by flooding, a risk prevalent in coastal areas. It is a separate policy from homeowners insurance. The target audience includes homeowners in flood-prone areas.

- Umbrella Insurance: This policy provides additional liability coverage beyond the limits of other policies, offering extra protection against significant claims. The target audience includes individuals and businesses with high-value assets or potential for significant liability.

Customer Experience

At Florida State Insurance, we prioritize delivering an exceptional customer experience. We believe that our customers deserve to be treated with respect and understanding, and we strive to make every interaction with our company as seamless and positive as possible.

Customer Service Channels and Processes

We understand that customers have different preferences when it comes to communication. To cater to diverse needs, we offer a variety of customer service channels:

- Phone Support: Our dedicated customer service representatives are available 24/7 to answer questions, address concerns, and provide assistance. Our phone lines are equipped with advanced technology to ensure quick and efficient call routing, minimizing hold times.

- Online Chat: For real-time support, customers can access our online chat feature directly from our website. Our chat agents are trained to handle a wide range of inquiries and provide prompt resolutions.

- Email: Customers can contact us via email for non-urgent inquiries or to request information. Our email response time is typically within 24 hours, ensuring timely and comprehensive responses.

- Mobile App: Our user-friendly mobile app allows customers to manage their policies, submit claims, and access account information anytime, anywhere. The app also includes a built-in messaging feature for convenient communication with our customer support team.

- Social Media: We actively engage with our customers on various social media platforms, responding to inquiries and providing updates on our services. This platform also serves as a valuable channel for gathering customer feedback and addressing concerns in a timely manner.

Customer Satisfaction and Retention

Our commitment to customer satisfaction goes beyond providing excellent service. We actively seek feedback from our customers to continuously improve our products and services. This feedback is incorporated into our decision-making processes, ensuring that we are constantly evolving to meet the changing needs of our customers.

- Customer Surveys: We regularly conduct customer surveys to gauge satisfaction levels and identify areas for improvement. These surveys are designed to gather valuable insights from our customers, allowing us to understand their experiences and address any concerns they may have.

- Focus Groups: We organize focus groups with select customers to gain deeper insights into their needs and preferences. This allows us to engage in direct conversations with our customers, fostering a collaborative approach to improving our offerings.

- Customer Loyalty Programs: We offer various customer loyalty programs to reward our long-standing customers and encourage repeat business. These programs provide exclusive benefits and discounts, demonstrating our appreciation for their continued trust and support.

Positive Customer Experiences

Our commitment to customer satisfaction has resulted in numerous positive customer experiences. Here are a few examples:

“I was recently involved in a car accident, and the claims process was incredibly smooth and efficient. The representative I spoke with was very helpful and kept me informed throughout the entire process. I highly recommend Florida State Insurance.” – John S.

“I’ve been a customer of Florida State Insurance for over 10 years, and I’ve always been impressed with their customer service. They are always responsive, helpful, and go above and beyond to ensure my satisfaction. I wouldn’t hesitate to recommend them to anyone.” – Sarah M.

Financial Performance: Florida State Insurance Company

Florida State Insurance Company has consistently demonstrated strong financial performance, driven by a combination of factors including a robust business model, strategic investments, and a focus on customer satisfaction. The company’s financial health is a testament to its commitment to responsible financial management and its ability to navigate the complexities of the insurance industry.

Key Financial Metrics

Florida State Insurance Company’s financial performance is reflected in several key metrics.

- Revenue: The company has experienced steady revenue growth in recent years, driven by a combination of factors, including increased market share and expansion into new product lines.

- Profitability: Florida State Insurance Company has consistently maintained a strong profit margin, demonstrating its ability to generate significant returns on its investments.

- Market Share: The company has steadily increased its market share in the Florida insurance market, reflecting its strong brand reputation and competitive pricing strategies.

Financial Stability

Florida State Insurance Company’s financial stability is evident in its strong capital position and its ability to meet its financial obligations.

- Capital Adequacy: The company maintains a high level of capital adequacy, exceeding regulatory requirements, ensuring its ability to absorb unexpected losses and meet its financial obligations.

- Debt Management: Florida State Insurance Company has a conservative debt structure, with a low debt-to-equity ratio, reflecting its commitment to financial prudence and long-term stability.

- Solvency Ratios: The company consistently maintains strong solvency ratios, demonstrating its ability to meet its long-term financial obligations and withstand economic downturns.

Recent Trends and Significant Events

Florida State Insurance Company’s financial performance has been influenced by several recent trends and significant events in the insurance industry.

- Increased Competition: The Florida insurance market has become increasingly competitive in recent years, with new entrants and established players vying for market share.

- Natural Disasters: Florida is prone to natural disasters, such as hurricanes, which can significantly impact the insurance industry.

- Regulatory Changes: The insurance industry is subject to evolving regulations, which can impact the financial performance of insurance companies.

Industry Landscape

The Florida insurance industry is a complex and dynamic landscape, characterized by a unique set of challenges and opportunities. Florida’s vulnerability to natural disasters, particularly hurricanes, significantly influences the industry’s operations and financial stability.

Key Trends and Challenges

The Florida insurance industry faces a number of key trends and challenges.

- Rising insurance premiums: Due to increasing reinsurance costs and the frequency of natural disasters, insurance premiums in Florida have been rising steadily in recent years. This trend is particularly concerning for homeowners, who are struggling to afford rising costs.

- Increased litigation: Florida has a reputation for being a “litigation-friendly” state, which has led to an increase in insurance claims and lawsuits. This trend has put pressure on insurers, driving up costs and making it more difficult to predict future losses.

- Hurricane risk: Florida is highly vulnerable to hurricanes, and the frequency and intensity of these storms have been increasing in recent years. This poses a significant risk to insurers, who face the potential for catastrophic losses during hurricane season.

- Climate change: Climate change is expected to exacerbate the risks associated with hurricanes, sea-level rise, and other extreme weather events. This will likely lead to higher insurance premiums and increased uncertainty in the industry.

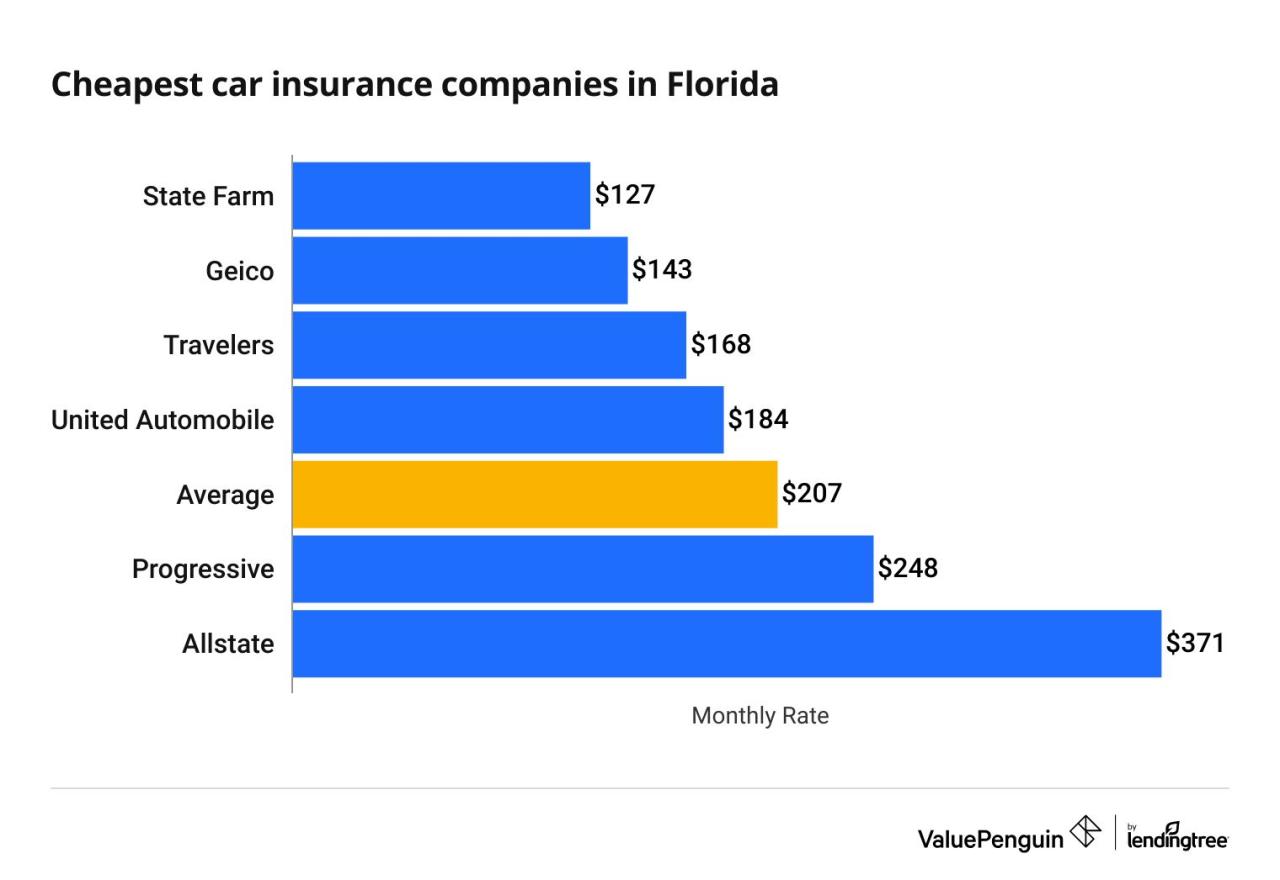

- Competition: The Florida insurance market is highly competitive, with a wide range of insurers offering a variety of products and services. This competition can be beneficial for consumers, but it also puts pressure on insurers to remain competitive and innovative.

Comparison to Competitors

Florida State Insurance Company competes with a number of major insurers in the Florida market. While specific market share data is not readily available, Florida State Insurance Company aims to differentiate itself through its focus on customer service, its comprehensive product offerings, and its commitment to providing competitive rates.

Future Outlook

Florida State Insurance Company is well-positioned to capitalize on growth opportunities in the Florida insurance market. The company’s strong financial performance, customer-centric approach, and commitment to innovation will enable it to navigate industry challenges and thrive in a rapidly evolving market.

Growth Opportunities

Florida State Insurance Company has several potential growth opportunities.

- Expanding Product Offerings: The company can expand its product offerings to cater to the diverse needs of Florida residents. This includes developing new insurance products for emerging risks, such as cyberattacks and climate change. For example, Florida State Insurance Company could introduce specialized insurance policies for homeowners in coastal areas vulnerable to hurricanes or for businesses facing increasing cyber threats.

- Leveraging Technology: The company can leverage technology to enhance its operations and improve customer experience. This includes adopting artificial intelligence (AI) for claims processing, using data analytics for risk assessment, and developing mobile apps for policy management. For instance, Florida State Insurance Company can utilize AI-powered chatbots to provide instant customer support or use data analytics to identify potential fraud risks in claims.

- Strategic Partnerships: The company can forge strategic partnerships with other businesses to expand its reach and offer bundled services. This could involve collaborations with financial institutions, real estate agencies, or home improvement companies. For example, Florida State Insurance Company could partner with a mortgage lender to offer bundled insurance and mortgage products, providing customers with a more comprehensive financial solution.

- Market Expansion: The company can consider expanding its operations beyond Florida, targeting other states with similar risk profiles or growth potential. For example, Florida State Insurance Company could explore opportunities in coastal regions of other southeastern states, leveraging its expertise in hurricane risk management.

Addressing Industry Challenges

The Florida insurance market faces several challenges, including increasing hurricane frequency and severity, rising litigation costs, and regulatory changes. Florida State Insurance Company has strategies to address these challenges.

- Risk Management: The company can strengthen its risk management practices to mitigate the impact of hurricanes. This includes adopting advanced modeling techniques to assess hurricane risk, investing in property hardening measures, and developing reinsurance strategies to transfer risk. For example, Florida State Insurance Company can use sophisticated climate models to predict hurricane intensity and track potential storm paths, allowing them to better prepare and respond to future events.

- Cost Control: The company can focus on cost control measures to manage rising litigation costs. This includes implementing fraud detection mechanisms, streamlining claims processes, and collaborating with stakeholders to reduce unnecessary litigation. For example, Florida State Insurance Company can leverage data analytics to identify patterns in fraudulent claims, enabling them to proactively prevent such incidents.

- Adapting to Regulations: The company can proactively adapt to evolving regulatory requirements. This includes staying informed about changes in insurance laws, maintaining compliance with regulatory standards, and engaging in industry dialogue to shape future regulations. For example, Florida State Insurance Company can actively participate in industry associations and work with regulators to advocate for policies that promote a healthy and stable insurance market.

Future Prospects

Florida State Insurance Company is well-positioned to achieve sustained growth and maintain its leadership position in the Florida insurance market. The company’s strong financial performance, customer-centric approach, and commitment to innovation will enable it to navigate industry challenges and capitalize on emerging opportunities.

Conclusion

As Florida State Insurance Company navigates the ever-evolving landscape of the insurance industry, its commitment to innovation and customer focus remains unwavering. The company’s dedication to building strong relationships with its policyholders, coupled with its financial strength and commitment to community involvement, positions it for continued success in the years to come. Florida State Insurance Company is more than just an insurer; it’s a trusted partner, providing Floridians with the security they need to thrive in a dynamic and unpredictable world.

Commonly Asked Questions

What are the key benefits of choosing Florida State Insurance Company?

Florida State Insurance Company offers a range of benefits, including competitive rates, personalized service, a wide selection of coverage options, and a strong commitment to customer satisfaction.

How can I get a quote for insurance from Florida State Insurance Company?

You can easily get a quote online, by phone, or by visiting a local agent. The company offers multiple convenient options to make the process simple and straightforward.

What are the company’s community involvement initiatives?

Florida State Insurance Company is actively involved in various community initiatives, supporting local charities and organizations dedicated to improving the lives of Floridians. These initiatives reflect the company’s commitment to giving back to the communities it serves.