Florida auto insurance state minimums set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In the Sunshine State, understanding your auto insurance requirements is crucial, as Florida operates under a unique “no-fault” system that dictates how accidents are handled. This guide delves into the intricacies of Florida’s auto insurance landscape, exploring the minimum coverage requirements, the “no-fault” system, and the factors that influence insurance costs.

From the legal mandates for auto insurance to the intricacies of filing claims, this comprehensive exploration will equip you with the knowledge necessary to navigate the world of Florida auto insurance. We’ll break down the essential coverage types, discuss the benefits and limitations of the “no-fault” system, and provide practical tips for finding affordable insurance rates.

Florida Auto Insurance Requirements

Driving in Florida legally requires you to have auto insurance. It’s a crucial safety measure that protects you, other drivers, and pedestrians in case of an accident. The state of Florida mandates certain minimum insurance coverages to ensure everyone is financially responsible for the damages they may cause.

Minimum Coverage Requirements

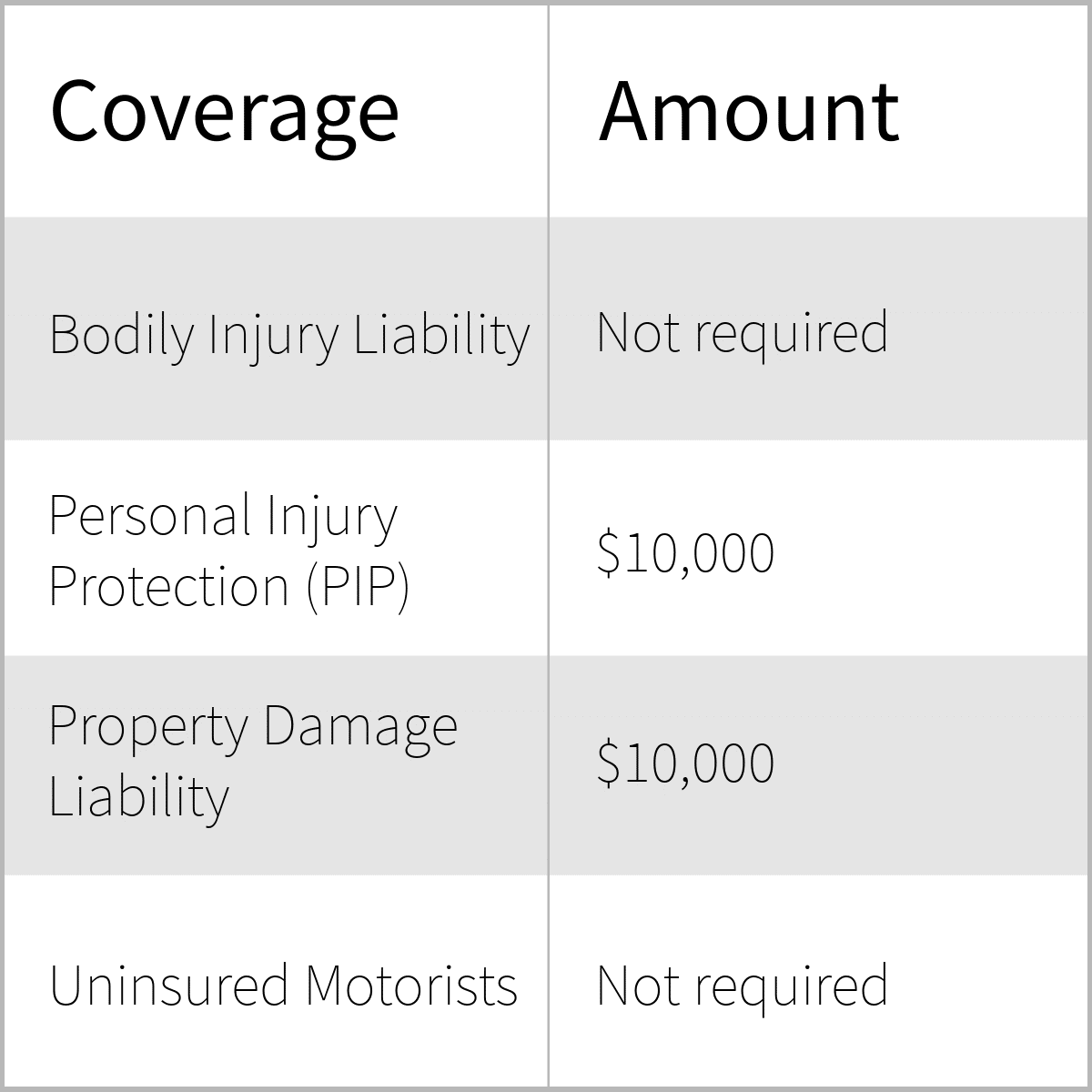

Florida requires drivers to have the following minimum insurance coverages:

- Bodily Injury Liability

- Property Damage Liability

- Personal Injury Protection (PIP)

- Uninsured Motorist Coverage (UM)

Bodily Injury Liability

Bodily injury liability coverage protects you financially if you cause an accident that injures another person. This coverage pays for the medical expenses, lost wages, and pain and suffering of the injured party. Florida requires a minimum of $10,000 per person and $20,000 per accident. This means that if you cause an accident that injures one person, your insurance company will pay up to $10,000 for their injuries. If you injure multiple people, your insurance company will pay up to $20,000 total.

Property Damage Liability

Property damage liability coverage protects you financially if you cause an accident that damages another person’s property. This coverage pays for the repairs or replacement of the damaged property, such as a car, building, or fence. Florida requires a minimum of $10,000 in property damage liability coverage. This means that if you cause an accident that damages another person’s car, your insurance company will pay up to $10,000 for the repairs or replacement of the vehicle.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage is a no-fault insurance coverage that pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. Florida requires a minimum of $10,000 in PIP coverage. This means that if you are injured in an accident, your insurance company will pay up to $10,000 for your medical expenses and lost wages, even if you were at fault for the accident.

Uninsured Motorist Coverage (UM)

Uninsured motorist coverage (UM) protects you financially if you are injured in an accident caused by an uninsured or hit-and-run driver. This coverage pays for your medical expenses, lost wages, and pain and suffering. Florida requires a minimum of $10,000 per person and $20,000 per accident in UM coverage. This means that if you are injured in an accident caused by an uninsured driver, your insurance company will pay up to $10,000 for your injuries. If multiple people are injured, your insurance company will pay up to $20,000 total.

Understanding Florida’s No-Fault System

Florida’s auto insurance system is based on a “no-fault” concept, meaning that drivers involved in accidents are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident.

This system is designed to streamline the claims process and reduce litigation, but it also has certain limitations and implications for drivers.

Personal Injury Protection (PIP)

PIP coverage is a mandatory component of Florida’s no-fault system. It provides coverage for medical expenses and lost wages for the policyholder and passengers in their vehicle, regardless of fault.

The amount of PIP coverage required in Florida is $10,000 per person. This means that your PIP coverage will pay up to $10,000 for your medical bills and lost wages, regardless of the severity of the accident or who caused it.

Limitations of Florida’s No-Fault System

While the no-fault system aims to simplify claims, it has some limitations:

- Limited Coverage: PIP coverage only covers medical expenses and lost wages. It does not cover other damages, such as property damage or pain and suffering.

- Threshold for Pursuing Claims: To pursue a claim against another driver for damages beyond PIP coverage, drivers must meet a “threshold” of injury. This threshold can be met if the injury results in:

- Death

- Significant and permanent impairment

- Permanent scarring or disfigurement

- Loss of a body member

- Potential for Higher Premiums: Because PIP coverage is mandatory, insurers may factor this into their premium calculations, potentially leading to higher premiums for drivers.

Benefits of Florida’s No-Fault System

Despite its limitations, Florida’s no-fault system also offers some benefits:

- Faster Claims Processing: By focusing on covering the policyholder’s own expenses, the no-fault system can streamline the claims process and lead to faster payments.

- Reduced Litigation: The no-fault system aims to reduce litigation by limiting the number of claims that go to court. This can save time and money for both drivers and insurers.

Situations Requiring Claims Against Another Driver

In certain situations, drivers may need to pursue a claim against the other driver for damages beyond their PIP coverage:

- When the Other Driver is at Fault: If the other driver is clearly at fault for the accident, and the injured driver meets the threshold for pursuing a claim, they can file a claim for damages exceeding their PIP coverage.

- When the Other Driver is Uninsured or Underinsured: If the other driver is uninsured or underinsured, the injured driver may be able to file a claim against their own uninsured/underinsured motorist (UM/UIM) coverage.

- When the Other Driver’s Liability Coverage is Insufficient: If the other driver’s liability coverage is insufficient to cover the injured driver’s damages, the injured driver may be able to file a claim against their own UM/UIM coverage.

Factors Affecting Florida Auto Insurance Costs

Your driving record, age, and where you live all play a role in how much you pay for car insurance in Florida. These factors, along with the type of vehicle you drive and how often you use it, can significantly impact your insurance premiums.

Driving History

Your driving history is a major factor in determining your insurance rates. A clean driving record with no accidents or violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will increase your insurance costs. Insurance companies consider your driving history a strong indicator of your risk as a driver.

Age

Insurance companies generally consider younger drivers to be higher risk, as they have less experience behind the wheel. This is why young drivers often pay higher premiums. However, as drivers age and gain more experience, their premiums tend to decrease.

Location

The location where you live can significantly impact your auto insurance rates. Areas with higher crime rates, traffic congestion, or a greater number of accidents tend to have higher insurance premiums. Insurance companies use this data to assess the likelihood of you being involved in an accident and adjust your rates accordingly.

Vehicle Type

The type of vehicle you drive also influences your insurance costs. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and increased risk of accidents.

Usage Patterns

How you use your vehicle also plays a role in determining your insurance rates. If you drive your car frequently for work or long commutes, your insurance premiums may be higher than someone who only drives occasionally for errands.

Credit History

In Florida, insurance companies can use your credit history to determine your insurance rates. This is because studies have shown a correlation between credit history and insurance claims. Drivers with good credit scores tend to be more responsible and less likely to file claims, leading to lower premiums.

Options for Additional Coverage

While Florida’s minimum auto insurance requirements cover basic liability, they don’t provide complete protection in every situation. You might consider purchasing additional coverage to enhance your financial security and peace of mind.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional but can be crucial if your car is financed or leased, as lenders often require it.

- Benefits: Collision coverage ensures you can repair or replace your vehicle after an accident, minimizing financial burdens. It also helps maintain your vehicle’s value.

- Costs: The cost of collision coverage depends on factors such as your vehicle’s value, your driving record, and the deductible you choose.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. This coverage is also optional and is particularly helpful for newer or high-value vehicles.

- Benefits: Comprehensive coverage provides financial protection against a wide range of risks, ensuring you can repair or replace your vehicle if it’s damaged by events beyond your control.

- Costs: The cost of comprehensive coverage depends on factors such as your vehicle’s value, your driving record, and the deductible you choose.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you’re involved in an accident with a driver who has no insurance or insufficient coverage to cover your losses.

This coverage is particularly important in Florida, as it is a no-fault state, and uninsured motorists are a concern.

- Benefits: UM/UIM coverage ensures you can receive compensation for medical expenses, lost wages, and property damage even if the other driver is uninsured or underinsured.

- Costs: The cost of UM/UIM coverage is relatively low, but the potential benefits can be significant.

Situations Where Additional Coverage Might Be Beneficial

- Financed or Leased Vehicles: Lenders often require collision coverage for financed or leased vehicles, ensuring they can recover their investment if your vehicle is damaged.

- High-Value Vehicles: Comprehensive coverage is particularly valuable for newer or high-value vehicles, as it protects against damage from events other than collisions.

- High-Risk Areas: If you live in an area with a high rate of uninsured drivers, UM/UIM coverage is essential.

- Frequent Drivers: If you drive frequently or commute long distances, collision and comprehensive coverage can provide additional peace of mind.

Finding Affordable Auto Insurance in Florida

Finding affordable auto insurance in Florida can be challenging, especially with the state’s unique insurance landscape. However, with some strategic planning and research, you can secure a policy that fits your budget without compromising essential coverage.

Tips for Finding Competitive Insurance Rates

Here are some valuable tips to help you find competitive insurance rates in Florida:

- Maintain a Good Driving Record: A clean driving record is crucial for lowering your premiums. Avoid traffic violations, accidents, and DUI convictions to maintain a positive history.

- Consider Increasing Your Deductible: A higher deductible typically translates to lower premiums. Carefully assess your financial situation and risk tolerance to determine the right deductible amount for you.

- Shop Around for Quotes: Don’t settle for the first quote you receive. Compare rates from multiple insurance providers to find the best deal. Use online comparison websites or contact insurance agents directly.

- Explore Discounts: Many insurance companies offer discounts for various factors, such as good student records, safe driving courses, multiple policy bundling, and vehicle safety features. Ask about available discounts when getting quotes.

- Review Your Coverage Needs: Ensure you have adequate coverage for your specific needs but avoid unnecessary extras. Consider your driving habits, the value of your vehicle, and your financial situation to determine the right level of coverage.

Resources for Comparing Insurance Quotes

Several online resources can help you compare insurance quotes from different providers. Here are some popular options:

- Insurance Comparison Websites: Websites like Policygenius, The Zebra, and Insurify allow you to enter your information and compare quotes from multiple insurers simultaneously. These websites can save you time and effort in your search.

- Independent Insurance Agents: Independent agents represent multiple insurance companies and can provide personalized quotes based on your specific needs. They can often negotiate better rates on your behalf.

- Insurance Company Websites: You can also obtain quotes directly from insurance company websites. This allows you to explore their specific policies and discounts.

Benefits of Bundling Insurance Policies

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings.

- Combined Discounts: Insurance companies often offer substantial discounts when you bundle multiple policies with them. These discounts can offset the cost of additional coverage and make your overall insurance more affordable.

- Convenience: Managing multiple policies with a single provider simplifies your insurance needs. You have one point of contact for billing, claims, and policy changes.

- Loyalty Rewards: Some insurance companies offer loyalty programs or rewards for bundling multiple policies. These benefits can further reduce your overall insurance costs.

The Importance of Shopping Around for the Best Rates

Finding the best auto insurance rates in Florida requires diligent research and comparison.

- Avoid Assumptions: Don’t assume that your current insurer offers the best rates. Market conditions and your individual needs can change over time.

- Regular Reviews: Review your insurance policies annually to ensure you’re still getting the best rates. Shop around for new quotes to see if you can find a better deal.

- Negotiation Power: By comparing quotes from multiple providers, you have more bargaining power to negotiate better rates with your current insurer. Don’t be afraid to ask for a lower rate if you find a better offer elsewhere.

Navigating Florida’s Insurance Claims Process

After an accident, dealing with your insurance company can feel overwhelming. Understanding the claims process in Florida is crucial for getting the compensation you deserve. This section will guide you through the steps of filing a claim, navigating the no-fault system, and maximizing your chances of a fair settlement.

Filing a Claim with Your Insurance Company

The first step after an accident is to contact your insurance company. They will guide you through the claims process and provide necessary forms.

- Notify your insurer immediately. Most policies have a time limit (typically 24-48 hours) to report an accident. Delaying notification could jeopardize your claim.

- Gather information. This includes the other driver’s insurance information, police report number, and details about the accident, including the location, date, and time.

- Complete the claim form accurately and promptly. Provide all requested information and ensure your contact details are up-to-date.

- Submit any supporting documentation. This may include photos of the damage, medical bills, and witness statements.

Documenting the Accident and Gathering Evidence

Thorough documentation is crucial for a successful claim. It helps establish liability and support your claim for compensation.

- Take photos of the accident scene. Capture the damage to all vehicles involved, any injuries, and road conditions.

- Obtain contact information from witnesses. Their statements can corroborate your account of the accident.

- File a police report. This provides an official record of the accident, which can be invaluable in case of disputes.

- Seek medical attention immediately. Even if you feel fine, it’s essential to get checked by a doctor. Any injuries, even minor ones, should be documented.

Negotiating a Settlement with Your Insurer

Once your claim is filed, your insurance company will investigate the accident and assess your damages. You may need to negotiate with them to reach a fair settlement.

- Understand your coverage. Review your policy to determine the limits of your coverage and what expenses are covered.

- Be prepared to negotiate. Insurance companies often try to settle claims for less than the actual value. Be prepared to provide supporting documentation and evidence to justify your claim.

- Don’t accept the first offer. Take time to review the offer and consider your options before accepting. If you disagree with the amount, you can counteroffer.

- Consider legal counsel. If you can’t reach a fair settlement with your insurer, an attorney can advocate on your behalf and help you navigate the legal process.

Avoiding Common Mistakes During the Claims Process, Florida auto insurance state minimums

Several common mistakes can jeopardize your claim and reduce your compensation. Here are some tips to avoid them:

- Don’t admit fault. Avoid making statements that could be interpreted as admitting fault for the accident. Stick to the facts and let your insurer handle the investigation.

- Don’t delay in filing your claim. Time limits apply to reporting accidents, and delays could jeopardize your claim.

- Don’t sign anything without understanding it. Carefully review any documents you are asked to sign, and don’t hesitate to ask questions.

- Don’t talk to the other driver’s insurance company without legal representation. Anything you say could be used against you.

Understanding Florida’s Financial Responsibility Laws: Florida Auto Insurance State Minimums

Florida’s financial responsibility laws are designed to ensure that drivers have the financial means to cover the costs of any accidents they may cause. These laws require drivers to have a minimum amount of liability insurance or to demonstrate proof of financial responsibility in another way.

Florida’s financial responsibility laws are designed to protect both drivers and pedestrians from the financial burden of accidents caused by uninsured or underinsured motorists.

Penalties for Driving Without Insurance

Driving without the required minimum auto insurance in Florida is a serious offense. The penalties for driving without insurance can be significant and include:

– Fines: Drivers caught driving without insurance can face fines ranging from $150 to $500, depending on the severity of the offense.

– License Suspension: The Florida Department of Motor Vehicles (DMV) can suspend the driver’s license of anyone caught driving without insurance. The suspension period can range from 30 days to a year, depending on the circumstances.

– Vehicle Impoundment: In some cases, the vehicle of a driver caught driving without insurance may be impounded until proof of insurance is provided.

– Points on Driving Record: Drivers caught driving without insurance may receive points on their driving record, which can increase their insurance premiums in the future.

– Jail Time: In some cases, driving without insurance can even result in jail time.

Florida Department of Motor Vehicles (DMV)

The Florida Department of Motor Vehicles (DMV) is responsible for enforcing the state’s financial responsibility laws. The DMV maintains a database of insured drivers and vehicles. When a driver is involved in an accident, the DMV can check their insurance status and ensure that they have the required coverage.

The DMV also investigates accidents involving uninsured motorists. If a driver is found to be driving without insurance, the DMV can take action against them, including suspending their driver’s license or impounding their vehicle.

Last Recap

Navigating Florida’s auto insurance system can seem complex, but with a clear understanding of your obligations and options, you can make informed decisions that protect you financially and legally. By carefully considering your coverage needs, comparing rates from different insurers, and staying informed about your rights and responsibilities, you can ensure that you’re adequately protected on the road. Remember, understanding Florida’s auto insurance landscape is key to driving with peace of mind.

Key Questions Answered

What happens if I get into an accident and don’t have the required insurance?

Driving without the required insurance in Florida can result in serious consequences, including fines, license suspension, and even jail time. You may also face difficulty registering your vehicle or obtaining insurance in the future.

Can I choose to have more coverage than the state minimums?

Absolutely! While the state minimums provide basic protection, you may want to consider additional coverage, such as collision and comprehensive coverage, for greater peace of mind.

How can I find the best auto insurance rates in Florida?

Shop around! Compare quotes from multiple insurance companies, consider bundling policies, and explore discounts for good driving records, safety features, and other factors.

What should I do if I’m involved in an accident?

Stay calm, exchange information with the other driver(s), call the police if necessary, and contact your insurance company to report the accident.