Do car insurance rates vary by state? Absolutely! The cost of insuring your vehicle can fluctuate significantly depending on where you live, and understanding the reasons behind these variations is crucial for making informed decisions about your coverage.

A complex interplay of factors determines your car insurance premium, ranging from state-specific regulations and risk profiles to individual driving history and vehicle type. This article delves into the intricate world of car insurance rates, exploring how state-specific factors, regulations, and insurance company practices shape the costs you face.

Factors Influencing Car Insurance Rates

Car insurance rates are determined by a complex interplay of factors, each contributing to the overall risk assessment of an individual driver. Insurance companies meticulously analyze these factors to calculate premiums that accurately reflect the likelihood of an insured driver filing a claim.

Driver Demographics

Driver demographics play a significant role in determining insurance rates. This category encompasses factors like age, gender, and driving history, which are considered strong indicators of risk.

- Age: Younger drivers, particularly those under 25, tend to have higher insurance rates due to their inexperience and higher likelihood of accidents. Conversely, older drivers, with their accumulated experience and more cautious driving habits, often enjoy lower premiums.

- Gender: Historically, men have been statistically associated with higher risk profiles, resulting in slightly higher premiums compared to women. This disparity, however, is gradually diminishing as driving habits become more similar across genders.

- Driving History: Drivers with a clean driving record, devoid of accidents, speeding tickets, or other violations, are considered low-risk and are rewarded with lower premiums. Conversely, drivers with a history of accidents or violations face higher rates due to their increased likelihood of future claims.

Vehicle Characteristics

The type of vehicle you drive is another crucial factor in determining insurance rates. This category encompasses aspects like vehicle make, model, year, and safety features.

- Make and Model: Certain vehicle models are known for their safety features, reliability, and performance, which influence their insurance rates. Vehicles with a history of safety and fewer claims generally attract lower premiums. Conversely, models known for their high repair costs or frequent accidents often lead to higher rates.

- Year: Newer vehicles typically have more advanced safety features and are generally considered safer, potentially leading to lower premiums. Older vehicles, with outdated safety technology and a higher risk of mechanical issues, often come with higher rates.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and stability control are generally considered safer and attract lower insurance rates.

Location and Driving Habits

The location where you reside and your driving habits also play a significant role in determining insurance rates.

- Location: Areas with higher crime rates, traffic congestion, or a higher frequency of accidents often lead to higher insurance rates. Conversely, areas with lower crime rates and less traffic congestion may result in lower premiums.

- Driving Habits: Drivers who commute long distances or frequently drive in high-risk areas, such as urban centers or during rush hour, are considered higher risk and may face higher premiums. Conversely, drivers with shorter commutes and fewer miles driven often enjoy lower rates.

Coverage Options

The specific coverage options you choose for your car insurance policy also affect your premium.

- Deductible: A higher deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, generally results in lower premiums. Conversely, a lower deductible, while offering more coverage, often leads to higher rates.

- Coverage Limits: Higher coverage limits, which determine the maximum amount your insurance company will pay for a claim, often lead to higher premiums. Conversely, lower coverage limits, while offering less protection, may result in lower rates.

State-Specific Regulations and Laws

State regulations play a crucial role in shaping car insurance rates. These regulations vary significantly from state to state, leading to differences in the cost of insurance. Understanding how state laws affect insurance premiums can help consumers make informed decisions about their coverage.

Mandatory Coverage Requirements

State laws require drivers to carry specific types of car insurance, known as mandatory coverage. These requirements vary by state and directly influence the cost of insurance. For example, some states require only liability coverage, while others mandate comprehensive and collision coverage as well.

Here are some examples of how mandatory coverage requirements can affect premiums:

- Higher Coverage Requirements: States with stricter mandatory coverage requirements, such as those requiring comprehensive and collision coverage, generally have higher average insurance premiums. This is because drivers are required to purchase more coverage, which increases the cost of their policies.

- No-Fault Insurance: Some states have no-fault insurance laws, which require drivers to file claims with their own insurance company, regardless of who is at fault in an accident. These states typically have higher premiums than states with traditional fault-based systems.

Insurance Company Practices and Pricing Models: Do Car Insurance Rates Vary By State

Car insurance rates are not just determined by your driving record and the type of car you drive. Insurance companies use a variety of factors to calculate your premium, and their practices and pricing models play a significant role in the final cost.

Understanding how insurance companies set their rates and the different pricing models they employ can help you make informed decisions when comparing quotes and choosing a policy.

Pricing Models

Insurance companies utilize various pricing models to calculate premiums. These models differ in their complexity and the factors they consider. Here are some of the most common pricing models:

- Territory-based pricing: This model relies on the geographical location of the insured vehicle. Areas with higher accident rates, theft rates, or traffic congestion generally have higher premiums. For example, a driver in a densely populated urban area may pay more than a driver in a rural area with lower accident rates.

- Risk-based pricing: This model considers factors specific to the individual driver, such as their age, driving history, credit score, and driving habits. For instance, a young driver with a history of speeding tickets or accidents will likely pay a higher premium than an older driver with a clean driving record.

- Usage-based insurance (UBI): This model utilizes telematics devices or smartphone apps to track driving behavior. Data such as mileage, speed, braking habits, and time of day driving can influence premium calculations. Drivers with safe driving habits may receive discounts through UBI programs.

- Value-based pricing: This model focuses on the value of the insured vehicle. More expensive cars typically have higher premiums due to higher repair costs and potential for higher claims.

Company-Specific Risk Assessments and Underwriting Practices, Do car insurance rates vary by state

Insurance companies have their own proprietary risk assessment and underwriting practices that influence their pricing models. These practices involve evaluating potential policyholders and determining their likelihood of filing claims.

Here’s how these practices affect premiums:

- Underwriting guidelines: Each insurance company has specific underwriting guidelines that define acceptable risks and how they are assessed. These guidelines can vary significantly between companies, leading to differences in premium calculations. For example, one company might be more lenient with drivers who have minor traffic violations, while another might penalize such violations more heavily.

- Data analysis: Insurance companies use sophisticated data analytics to identify patterns and trends in driving behavior. This data helps them refine their risk assessments and develop more accurate pricing models. For example, companies may analyze claims data to identify areas with higher accident rates or specific demographics with higher risk profiles.

- Claims history: An individual’s claims history is a crucial factor in risk assessment. Drivers with a history of accidents or claims are generally considered higher risk and may face higher premiums. Insurance companies use historical claims data to develop actuarial tables that predict future claims likelihood.

- Credit score: Some insurance companies use credit scores as a proxy for risk assessment, as studies have shown a correlation between credit score and claims history. Drivers with lower credit scores may be considered higher risk and pay higher premiums. This practice is not universal, and some states prohibit the use of credit scores for insurance pricing.

Impact of State-Specific Risk Factors

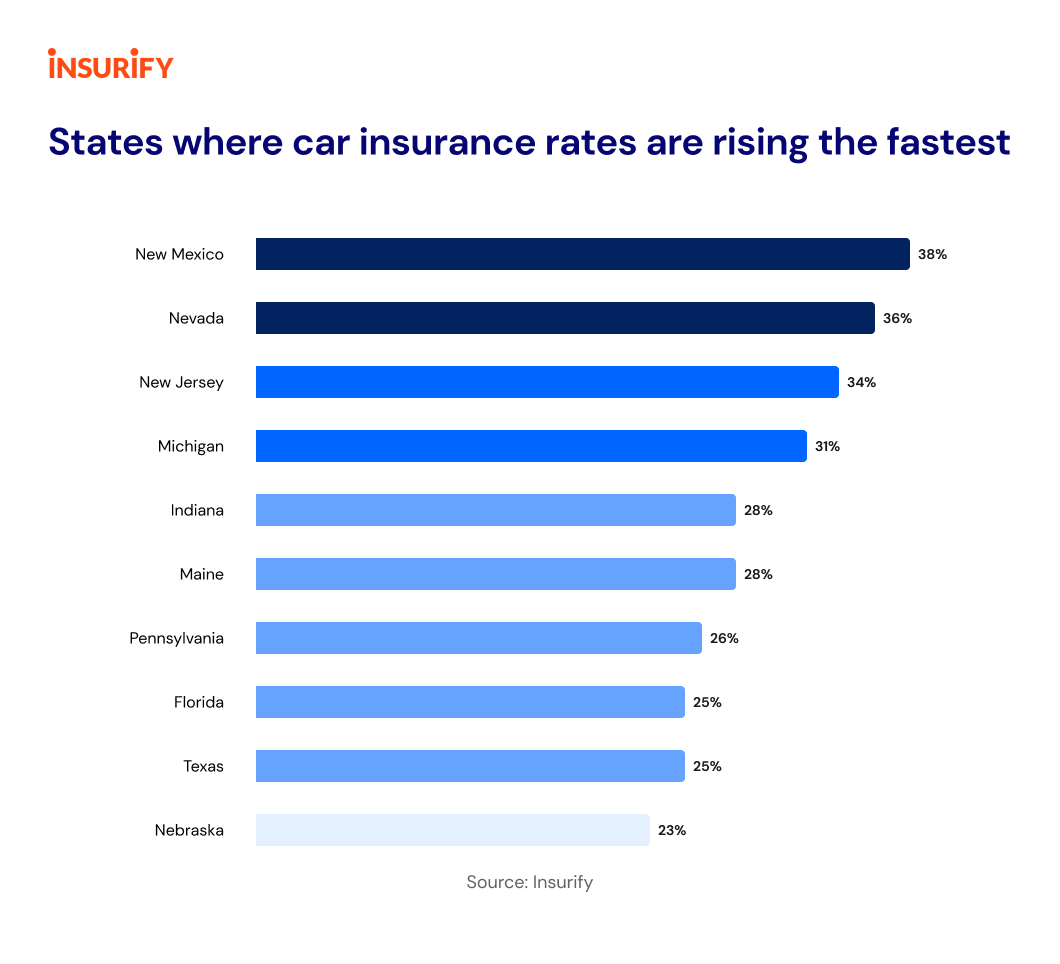

The cost of car insurance is heavily influenced by the risk profile of each state. This means that states with higher accident rates, more traffic congestion, and other factors that contribute to higher risk of accidents tend to have higher car insurance premiums.

State-Specific Risk Factors and Their Impact on Rates

States with higher accident rates, traffic congestion, and crime rates tend to have higher car insurance premiums. This is because insurance companies have to pay out more claims in these states, which ultimately leads to higher costs for policyholders.

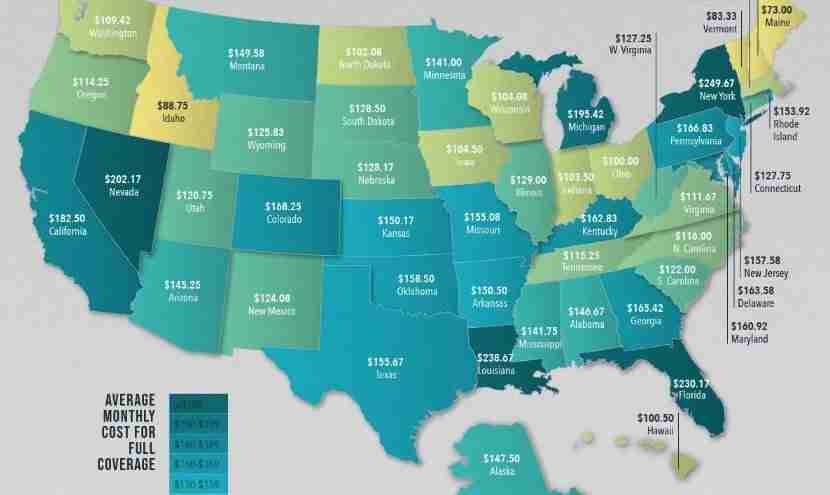

- Accident Rates: States with high accident rates are more likely to have higher car insurance premiums. For example, states like Florida and Texas have high accident rates, which is reflected in their higher average car insurance premiums.

- Traffic Congestion: Traffic congestion increases the risk of accidents, leading to higher insurance premiums. States with major metropolitan areas and heavy traffic tend to have higher premiums than those with less congestion. For instance, California and New York have some of the highest levels of traffic congestion in the United States, which contributes to their higher car insurance premiums.

- Crime Rates: States with high crime rates are more likely to experience car theft and vandalism, which can lead to higher insurance premiums. For example, states like California and Louisiana have high crime rates, which is reflected in their higher average car insurance premiums.

- Driving Habits: States with a higher proportion of young drivers or drivers with a history of reckless driving are more likely to have higher car insurance premiums. For example, states like Texas and Florida have a high proportion of young drivers, which contributes to their higher average car insurance premiums.

Average Car Insurance Rates by State

The following table showcases the average car insurance rates across different states in the United States, as of 2023.

| State | Average Annual Premium |

|---|---|

| Florida | $2,814 |

| Louisiana | $2,561 |

| Texas | $2,427 |

| California | $2,371 |

| New York | $2,184 |

| Michigan | $2,154 |

| New Jersey | $2,123 |

| Pennsylvania | $2,088 |

| Illinois | $2,045 |

| Ohio | $1,982 |

Consumer Considerations and Strategies

Navigating the complexities of car insurance rates across different states can feel overwhelming, but with a strategic approach, you can find the best coverage at the most affordable price. Understanding how your choices impact your premiums and implementing smart strategies can significantly reduce your insurance costs.

Factors Affecting Car Insurance Premiums

Your driving history, credit score, and vehicle type are key factors that insurance companies consider when calculating your premiums. Understanding how these factors influence your rates empowers you to make informed decisions that can lower your costs.

- Driving History: Your driving record is a significant factor in determining your car insurance premiums. A clean driving record with no accidents or traffic violations will result in lower rates. However, if you have a history of accidents, speeding tickets, or DUI convictions, you can expect to pay higher premiums.

- Credit Score: In many states, insurance companies use your credit score as a proxy for your risk assessment. A good credit score generally translates to lower insurance premiums, while a poor credit score can lead to higher rates. This practice is based on the assumption that individuals with good credit are more responsible and less likely to file claims.

- Vehicle Type: The type of vehicle you drive significantly impacts your insurance premiums. Luxury cars, high-performance vehicles, and newer models tend to have higher insurance costs due to their higher repair costs and potential for greater damage. Conversely, older, less expensive vehicles generally have lower insurance rates.

Strategies for Obtaining Discounts and Reducing Costs

Several strategies can help you lower your car insurance premiums and save money in the long run. These include:

- Shop Around: Comparing quotes from multiple insurance companies is crucial to find the best rates. Use online comparison tools or contact insurance agents directly to gather quotes and compare coverage options.

- Bundle Policies: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Increase Deductibles: Raising your deductible, the amount you pay out-of-pocket before your insurance kicks in, can lower your premiums. However, ensure you can afford to pay the higher deductible in case of an accident.

- Improve Your Driving Record: Maintaining a clean driving record is the most effective way to lower your premiums. Avoid speeding tickets, traffic violations, and accidents to ensure you qualify for the lowest rates.

- Consider Safety Features: Vehicles equipped with safety features like anti-theft devices, airbags, and anti-lock brakes can qualify for discounts.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices and potentially earn you a discount.

Closure

Navigating the world of car insurance can be daunting, but by understanding the factors that influence rates and utilizing strategies for comparison and negotiation, you can secure the best possible coverage at a price that fits your budget. Remember to research thoroughly, compare quotes from multiple insurers, and leverage available discounts to minimize your premium. By taking a proactive approach, you can ensure that your car insurance provides the protection you need without breaking the bank.

FAQ Overview

How can I find the cheapest car insurance in my state?

To find the cheapest car insurance in your state, it’s crucial to compare quotes from multiple insurers. Utilize online comparison tools, contact insurance agents directly, and consider factors like your driving history, credit score, and vehicle type to personalize your search.

Do I need to contact each insurance company individually for quotes?

While contacting individual companies can be helpful, online comparison tools can streamline the process. These tools allow you to input your information once and receive quotes from multiple insurers simultaneously, saving you time and effort.

Are there any discounts available for car insurance?

Yes, many insurance companies offer discounts for various factors, including good driving history, safety features in your vehicle, bundling multiple insurance policies, and even completing driver’s education courses.

Can I switch insurance companies if I find a better rate?

Absolutely! You can switch insurance companies at any time. Simply contact your new insurer, provide the necessary information, and they will handle the transfer process. It’s advisable to review your insurance needs periodically and compare quotes to ensure you’re getting the best value.