Cotton state homeowners insurance is a crucial aspect of safeguarding your home and financial well-being in regions known for their agricultural practices. These states often face unique challenges, including weather patterns, economic conditions, and agricultural risks, which can significantly impact homeowners insurance premiums and coverage options.

This guide explores the complexities of the cotton state homeowners insurance market, providing insights into key features, risk mitigation strategies, and navigating the claims process. By understanding the specific factors that influence insurance in these areas, homeowners can make informed decisions to protect their properties and ensure adequate coverage.

Understanding the Cotton State Homeowners Insurance Market

Homeowners insurance in states known for cotton production faces unique challenges and risks. The combination of agricultural practices, weather patterns, and economic conditions creates a distinct market dynamic that influences insurance premiums and coverage options.

Factors Influencing the Cotton State Homeowners Insurance Market

Cotton production significantly impacts the homeowners insurance market in these states. Here’s a breakdown of the key factors:

- Agricultural Practices: Cotton farming involves extensive use of pesticides and fertilizers, which can pose environmental risks and potentially lead to property damage. This can increase insurance premiums due to potential liability claims.

- Weather Patterns: Cotton states are prone to severe weather events like tornadoes, hurricanes, hailstorms, and droughts. These events can cause significant property damage, leading to higher insurance premiums and potential coverage limitations.

- Economic Conditions: Cotton prices fluctuate significantly, impacting the financial stability of farmers. This economic volatility can influence homeowners insurance premiums, as insurers consider the overall economic health of the region.

Risks and Challenges Faced by Homeowners

Homeowners in cotton states face specific risks and challenges that influence their insurance needs. These include:

- Agricultural Runoff: Runoff from cotton fields can contaminate water sources, potentially leading to property damage and health issues. This risk can increase insurance premiums and necessitate specific coverage options.

- Pest Infestations: Cotton fields are susceptible to various pests, some of which can migrate to residential areas. This can lead to property damage and potential health risks, requiring specialized insurance coverage.

- Wildfires: Dry conditions in cotton-producing regions can increase the risk of wildfires, posing a significant threat to homes and property. Homeowners insurance premiums often reflect this heightened risk.

Impact on Insurance Premiums and Coverage Options

The unique factors and risks associated with cotton production significantly impact homeowners insurance premiums and coverage options in these states.

- Higher Premiums: The increased risk of property damage due to weather events, agricultural practices, and pest infestations typically results in higher insurance premiums for homeowners in cotton states.

- Limited Coverage Options: Insurers may offer limited coverage options for specific risks, such as agricultural runoff or pest infestations, due to the inherent challenges in assessing and managing these risks.

- Specialized Coverage: Some insurance companies offer specialized coverage for risks specific to cotton-producing regions, such as agricultural runoff liability or wildfire protection. These specialized policies may come at a higher premium but offer tailored protection for specific risks.

Key Features of Cotton State Homeowners Insurance Policies

Homeowners insurance in cotton-producing states typically covers a range of perils and risks that are unique to the region, such as agricultural structures and potential crop damage. Understanding the key features and coverage options available can help homeowners in these states make informed decisions about their insurance needs.

Standard Coverage Components, Cotton state homeowners insurance

Standard homeowners insurance policies in cotton-producing states generally include coverage for the following:

- Dwelling Coverage: This protects the physical structure of the home, including the attached structures, against damage from covered perils such as fire, windstorm, hail, and theft. The amount of coverage is typically based on the replacement cost of the home.

- Other Structures Coverage: This covers detached structures on the property, such as garages, sheds, and fences, against damage from covered perils. The coverage amount is usually a percentage of the dwelling coverage.

- Personal Property Coverage: This protects the homeowner’s belongings inside the home, such as furniture, clothing, electronics, and personal items, against damage from covered perils. The coverage amount is typically a percentage of the dwelling coverage.

- Liability Coverage: This protects the homeowner from financial losses resulting from accidents or injuries that occur on their property, such as a visitor slipping and falling. The coverage amount is typically expressed in thousands of dollars.

- Medical Payments Coverage: This provides coverage for medical expenses incurred by guests who are injured on the homeowner’s property, regardless of fault.

- Loss of Use Coverage: This provides coverage for additional living expenses incurred by the homeowner if they are unable to live in their home due to a covered loss. For example, if a fire damages the home, this coverage would help pay for temporary housing, food, and other essential expenses.

Endorsements and Riders

Homeowners in cotton-producing states may consider purchasing specific endorsements or riders to address unique risks associated with their property and lifestyle. These endorsements can provide additional coverage for:

- Agricultural Structures: This endorsement covers damage to agricultural structures, such as barns, sheds, and silos, against covered perils. This coverage is essential for homeowners who rely on these structures for their livelihood.

- Crop Insurance: While not typically included in homeowners insurance policies, crop insurance is a separate type of insurance that protects farmers against losses due to adverse weather conditions, pests, and diseases. This coverage is essential for cotton farmers, who are particularly vulnerable to these risks.

- Flood Insurance: In areas prone to flooding, homeowners should consider purchasing flood insurance, as it is not typically included in standard homeowners insurance policies. This coverage is essential for protecting against damage caused by flooding, which can be extensive and costly.

- Personal Injury Liability: This endorsement provides additional liability coverage for injuries caused by the homeowner’s actions or negligence, such as a dog bite or a slip and fall. This coverage is particularly important for homeowners with pets or who frequently have guests on their property.

- Valuable Personal Property Coverage: This endorsement provides increased coverage for valuable personal belongings, such as jewelry, art, and antiques, that exceed the standard coverage limits. This coverage is essential for homeowners who own expensive items that require special protection.

Coverage Options from Different Providers

Insurance providers operating in cotton-producing states offer a variety of homeowners insurance policies with different coverage options and premiums. Homeowners should compare quotes from multiple providers to find the best coverage for their needs at an affordable price.

Key Considerations: When comparing quotes, homeowners should consider the following factors:

- Coverage Limits: The amount of coverage provided for each coverage component, such as dwelling, personal property, and liability.

- Deductibles: The amount the homeowner is responsible for paying out-of-pocket before the insurance company covers the remaining costs of a claim.

- Premiums: The annual cost of the insurance policy, which can vary based on factors such as the home’s value, location, and coverage options selected.

- Discounts: Discounts that may be available for certain features, such as security systems, fire alarms, and sprinkler systems.

- Customer Service: The reputation and responsiveness of the insurance provider’s customer service team.

- Financial Stability: The financial strength and stability of the insurance provider, as this can impact the company’s ability to pay claims.

Risk Assessment and Mitigation Strategies

Protecting your home and belongings from potential risks is crucial in cotton states, where weather patterns and other factors can pose significant challenges. By understanding common risks and implementing effective mitigation strategies, homeowners can significantly reduce their vulnerability and protect their investments.

Common Risks in Cotton States

Homeowners in cotton states face a unique set of risks due to the region’s climate and environment. Understanding these risks is the first step in developing a comprehensive risk management plan.

- Hail Damage: Hailstorms are frequent in cotton states, causing significant damage to roofs, windows, and landscaping. Hail damage can range from minor dents to complete roof replacement.

- Windstorms: Strong winds, tornadoes, and hurricanes are common in cotton states, posing a threat to homes and property. Wind damage can include roof damage, broken windows, and fallen trees.

- Flooding: Heavy rainfall and flash floods are common, particularly during hurricane season. Flooding can cause extensive damage to basements, foundations, and personal belongings.

- Fire: Wildfires are a concern in cotton states, particularly during dry seasons. Fires can spread rapidly, causing damage to homes, structures, and landscapes.

Effective Risk Mitigation Strategies

Homeowners can implement various strategies to mitigate risks and minimize potential losses. These strategies are crucial for protecting their homes and reducing insurance premiums.

- Roof Inspection and Maintenance: Regular roof inspections and maintenance are essential for detecting and addressing potential problems before they escalate. This includes ensuring proper ventilation, sealing any leaks, and replacing damaged shingles.

- Tree Trimming: Trimming trees around your home can prevent damage from falling branches during storms. This includes removing dead or diseased branches and ensuring trees are adequately spaced from structures.

- Storm Shutters: Installing storm shutters or impact-resistant windows can protect your home from wind damage and flying debris during storms. These measures can significantly reduce the impact of hurricanes and other severe weather events.

- Flood Mitigation: Taking steps to mitigate flood risk is essential, especially in areas prone to flooding. This includes installing sump pumps, elevating electrical outlets, and creating a flood-resistant landscape. Homeowners can also consider purchasing flood insurance.

- Fire Prevention: Preventing fires is crucial in cotton states, where wildfires can be a significant risk. This includes maintaining a clear area around your home, removing flammable materials, and ensuring proper operation of smoke detectors.

The Role of Insurance

Insurance plays a vital role in helping homeowners manage and recover from unexpected events. Homeowners insurance policies provide financial protection against covered losses, such as damage from storms, fire, or theft.

- Financial Protection: Insurance policies provide financial protection against covered losses, allowing homeowners to repair or rebuild their homes and replace damaged belongings.

- Peace of Mind: Knowing you have insurance in place can provide peace of mind and reduce stress during difficult times. It ensures you have a safety net to rely on if a covered event occurs.

- Recovery Support: Insurance companies provide support during the recovery process, helping homeowners navigate the complexities of filing claims and accessing resources.

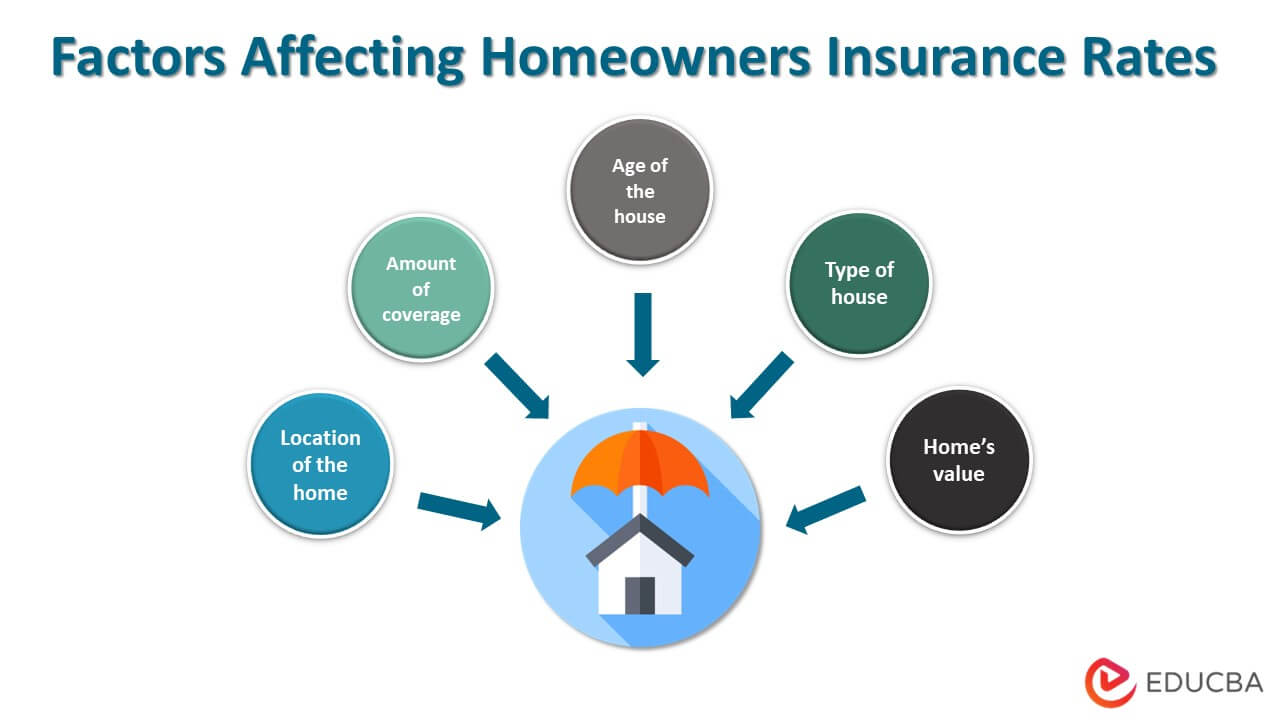

Factors Influencing Homeowners Insurance Premiums

Understanding the factors that influence homeowners insurance premiums in cotton states is crucial for making informed decisions about your coverage and minimizing your costs. Several key factors contribute to the price of your homeowners insurance, each playing a significant role in determining your premium.

Property Value

The value of your home is a primary factor influencing your homeowners insurance premium. The higher the value of your property, the more it costs to rebuild or repair it in case of damage. Insurance companies use various methods to assess property value, including:

- Appraisals: A professional appraiser examines your home and determines its market value.

- Comparative Market Analysis (CMA): This method compares your home to similar properties in your area that have recently sold.

- Reconstruction Cost Estimates: These estimates determine the cost of rebuilding your home from scratch.

The higher your home’s value, the more insurance coverage you need, and consequently, the higher your premium will be.

Location

Your home’s location plays a significant role in determining your insurance premium. Insurance companies consider factors like:

- Natural Disaster Risk: Areas prone to hurricanes, tornadoes, earthquakes, or wildfires have higher insurance premiums due to the increased risk of damage.

- Crime Rates: High crime rates in your neighborhood can increase your insurance premium, as it signifies a higher risk of theft or vandalism.

- Fire Department Rating: The proximity and efficiency of your local fire department influence your premium. Areas with a high fire department rating have lower premiums.

Coverage Level

The amount of coverage you choose for your homeowners insurance directly impacts your premium.

- Dwelling Coverage: This coverage protects your home’s structure from damage. Higher coverage levels mean higher premiums.

- Personal Property Coverage: This coverage protects your belongings inside your home from damage or theft. Choosing a higher coverage limit increases your premium.

- Liability Coverage: This coverage protects you from financial losses if someone is injured on your property. Increasing your liability coverage limit also increases your premium.

Risk Factors

Several risk factors can influence your homeowners insurance premium, including:

- Age of Your Home: Older homes often have outdated wiring, plumbing, and roofing, which can increase the risk of damage. This can lead to higher premiums.

- Home Maintenance: Regularly maintaining your home, including roof inspections and plumbing checks, can reduce the risk of damage and potentially lower your premium.

- Security Features: Installing security features like alarm systems, fire extinguishers, and smoke detectors can reduce your premium. These features indicate a lower risk of damage or theft.

- Claims History: Filing multiple claims in the past can increase your premium, as it signals a higher risk of future claims.

Average Premiums

According to the National Association of Insurance Commissioners (NAIC), the average annual homeowners insurance premium in the United States was $1,533 in 2022. However, premiums vary significantly by state and region.

- Cotton States: The average homeowners insurance premium in cotton states, including Alabama, Arkansas, Georgia, Louisiana, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, and Texas, is generally higher than the national average due to the increased risk of natural disasters like hurricanes, tornadoes, and floods.

Reducing Your Premiums

Several measures can help you reduce your homeowners insurance premiums:

- Shop Around for Quotes: Comparing quotes from multiple insurance companies can help you find the best rates.

- Increase Your Deductible: A higher deductible means you pay more out of pocket for a claim, but it can significantly reduce your premium.

- Improve Your Home’s Security: Installing security features like alarm systems, smoke detectors, and fire extinguishers can lower your premium.

- Maintain Your Home Regularly: Regularly maintaining your home, including roof inspections and plumbing checks, can reduce the risk of damage and potentially lower your premium.

- Bundle Your Policies: Combining your homeowners insurance with other policies, such as auto insurance, can result in discounts.

Navigating the Insurance Claims Process

In the unfortunate event of damage to your property, understanding the homeowners insurance claims process is crucial. This section will guide you through the steps involved in filing a claim, emphasizing the importance of communication and documentation.

Filing a Claim

Filing a claim is the first step in seeking compensation for covered damages. The process usually involves the following steps:

- Report the Event: Contact your insurance company immediately after the incident occurs. Inform them of the details, including the date, time, and nature of the event. You may be required to provide a brief description of the damage and any potential injuries.

- Gather Documentation: Documenting the damage is essential for supporting your claim. Take detailed photos and videos of the affected areas, capturing the extent of the damage. If possible, obtain statements from witnesses who may have observed the event.

- Submit a Claim Form: Your insurance company will provide a claim form that you need to complete and submit. Be thorough and accurate in providing all the required information. Include details about the damage, the cause of the event, and any relevant documentation.

- Schedule an Inspection: The insurance company will schedule an inspection of the damaged property. Cooperate with the inspector and allow them to access the affected areas. Be prepared to answer questions about the incident and the extent of the damage.

- Negotiate a Settlement: After the inspection, the insurance company will assess the damage and determine the amount of coverage. You may need to negotiate with the company to ensure a fair settlement that covers all the necessary repairs or replacements.

Understanding Your Rights and Responsibilities

It is important to understand your rights and responsibilities as a homeowner during the claims process. You have the right to:

- Prompt and fair handling of your claim.

- Access to all relevant documentation and information related to your claim.

- Representation by an attorney if you believe your rights are being violated.

On the other hand, you are responsible for:

- Cooperating with the insurance company during the claims process.

- Providing accurate and complete information about the event and the damage.

- Following the insurance company’s guidelines and procedures for filing a claim.

Tips for Navigating the Claims Process

Navigating the claims process can be stressful, but following these tips can help ensure a smooth and effective experience:

- Keep Detailed Records: Maintain a record of all communications with the insurance company, including dates, times, and the names of individuals you spoke with. This documentation will be valuable if any disputes arise.

- Understand Your Policy: Thoroughly review your homeowners insurance policy to understand your coverage limits, deductibles, and any exclusions. This will help you anticipate potential issues and ensure you are aware of your rights and responsibilities.

- Be Prepared for Delays: The claims process can take time, so be patient and persistent. Keep in touch with your insurance company to ensure your claim is progressing as expected.

- Consider Professional Assistance: If you feel overwhelmed or unsure about any aspect of the claims process, consider seeking assistance from a public adjuster or an attorney. These professionals can help you navigate the complexities of insurance claims and ensure your rights are protected.

Resources and Support for Homeowners

Navigating the complexities of homeowners insurance can be challenging, especially in regions prone to natural disasters. Fortunately, numerous resources are available to provide guidance, support, and assistance to homeowners in Cotton States. This section explores these resources, including government agencies, industry organizations, and community support groups.

Government Agencies

Government agencies play a crucial role in disaster preparedness, recovery, and financial assistance.

- Federal Emergency Management Agency (FEMA): FEMA offers a wide range of resources, including disaster preparedness information, financial assistance programs, and temporary housing assistance. Their website provides comprehensive information on disaster recovery, including how to apply for assistance, navigate the claims process, and access resources.

- National Flood Insurance Program (NFIP): The NFIP provides flood insurance to homeowners in participating communities. It is essential to note that standard homeowners insurance policies generally do not cover flood damage.

- Department of Housing and Urban Development (HUD): HUD offers various programs to assist homeowners with housing-related issues, including disaster recovery assistance, homeownership counseling, and financial assistance for home repairs.

- State and Local Government Agencies: Many states and local governments have dedicated agencies or programs to assist homeowners with disaster preparedness, recovery, and insurance-related matters. For example, the Texas Department of Insurance offers resources and information on homeowners insurance, including guidance on filing claims and resolving disputes.

Insurance Industry Organizations

The insurance industry provides various resources and support to homeowners, including consumer information, educational materials, and assistance with resolving insurance disputes.

- Insurance Information Institute (III): The III is a non-profit organization that provides consumer information and educational resources on insurance topics. Their website offers articles, FAQs, and tools to help homeowners understand insurance policies and navigate the claims process.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents insurance commissioners from all 50 states, the District of Columbia, and five U.S. territories. Their website provides information on insurance regulations, consumer protection, and resources for resolving insurance disputes.

- State Insurance Departments: Each state has an insurance department responsible for regulating the insurance industry and protecting consumers. These departments offer resources and information on homeowners insurance, including complaint resolution services.

Community Support Groups

Community organizations and support groups can provide valuable assistance to homeowners, particularly during disaster recovery.

- American Red Cross: The Red Cross provides disaster relief, including emergency shelter, food, and other essential supplies. They also offer support services to help individuals and families recover from disasters.

- Salvation Army: The Salvation Army provides disaster relief services, including emergency shelter, food, and clothing. They also offer emotional and spiritual support to individuals and families affected by disasters.

- Local Churches and Community Centers: Many churches and community centers offer support services to homeowners in need, including food banks, clothing banks, and financial assistance.

Accessing and Utilizing Resources

Accessing and utilizing these resources effectively is crucial for homeowners facing insurance challenges. Here are some tips:

- Keep Records: Maintain accurate records of your insurance policy, including coverage details, premium payments, and claims history.

- Contact Your Insurance Agent: If you have questions or concerns about your policy, contact your insurance agent or company representative.

- Utilize Online Resources: Many government agencies and industry organizations have comprehensive websites that provide information, resources, and tools.

- Seek Legal Advice: If you encounter difficulties with your insurance company or believe your claim has been unfairly denied, consider seeking legal advice from an experienced insurance attorney.

Last Recap

Navigating the cotton state homeowners insurance landscape requires a proactive approach. By understanding the unique risks and challenges faced in these regions, homeowners can effectively manage their insurance needs. This guide has provided insights into key features, risk mitigation strategies, and navigating the claims process, empowering homeowners to make informed decisions and secure adequate protection for their valuable investments. Remember to consult with reputable insurance providers and utilize available resources to ensure your property is properly insured and your financial interests are safeguarded.

Questions and Answers

What are the common risks faced by homeowners in cotton states?

Homeowners in cotton states face risks such as hail damage, windstorms, flooding, fire, and agricultural-related hazards. These risks can result in significant property damage and financial losses.

How can I reduce my homeowners insurance premiums in a cotton state?

You can potentially reduce your premiums by implementing risk mitigation strategies, such as installing storm shutters, upgrading your roof, and maintaining your property. Additionally, consider bundling your homeowners insurance with other policies, such as auto insurance.

What are some resources available to homeowners in cotton states?

Resources include government agencies, insurance industry organizations, and community support groups. These organizations can provide disaster preparedness guidance, financial assistance, and legal advice.