Cheapest state for insurance, a phrase that sparks curiosity and a desire for savings. The cost of insurance can vary drastically across the United States, influenced by a complex interplay of factors. From state-specific regulations and demographics to the competitive landscape of insurance providers, understanding these elements is crucial for finding the most affordable coverage. This exploration delves into the factors shaping insurance premiums and provides insights for making informed decisions.

Understanding the factors that contribute to insurance costs can empower individuals to make informed decisions. By analyzing state-specific regulations, cost of living, demographics, and market dynamics, you can gain a deeper understanding of how these elements influence premiums. Armed with this knowledge, you can navigate the insurance landscape with greater confidence and secure the most favorable coverage for your needs.

Factors Influencing Insurance Costs

Insurance premiums are not uniform across the United States. Several factors contribute to the cost of insurance, leading to variations in premiums from state to state.

Factors Influencing Insurance Costs

The cost of insurance is influenced by a variety of factors, which can vary significantly from state to state. These factors impact the premiums charged for different types of insurance, including auto, home, and health insurance.

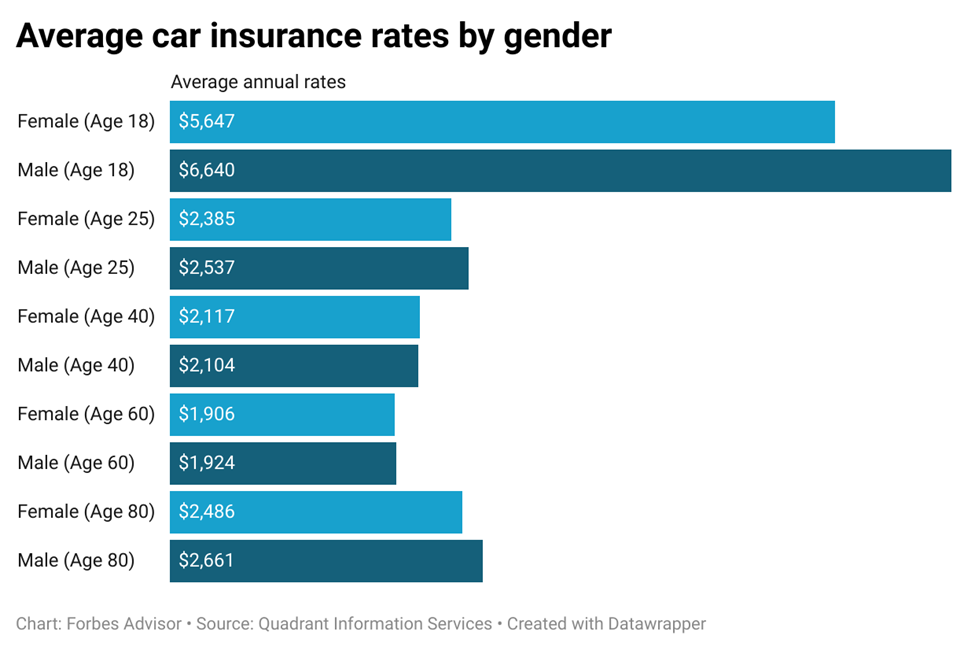

- Demographics: Factors like age, gender, marital status, and credit score can influence insurance premiums. For instance, younger drivers often pay higher auto insurance premiums due to their higher risk profile.

- Driving History: A clean driving record with no accidents or violations generally translates to lower auto insurance premiums.

- Vehicle Type: The make, model, and year of your vehicle play a role in auto insurance premiums. Luxury or high-performance cars often have higher premiums due to their higher repair costs.

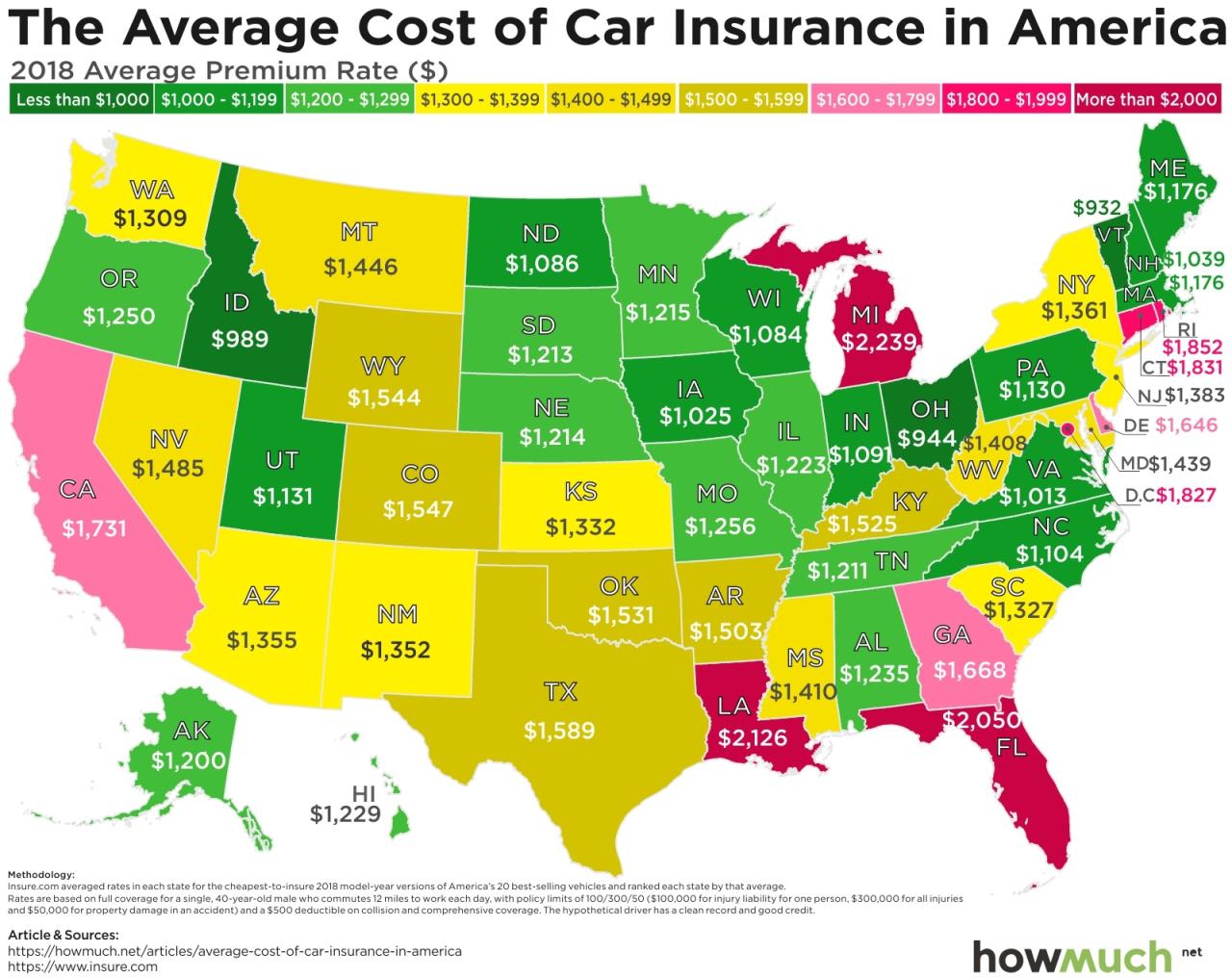

- Location: The state, city, and even neighborhood where you live can significantly impact your insurance costs. Areas with higher crime rates or a greater number of accidents tend to have higher premiums.

- Climate: States with frequent natural disasters like hurricanes or earthquakes may have higher home insurance premiums.

- Competition: The number of insurance companies operating in a state can affect premiums. More competition often leads to lower premiums.

- State Regulations: State laws and regulations can impact insurance costs. Some states have strict regulations that limit the types of coverage offered or the premiums that can be charged.

- Health History: For health insurance, factors like pre-existing conditions, age, and smoking habits can significantly impact premiums.

Impact on Different Insurance Categories

- Auto Insurance: Factors like driving history, vehicle type, and location play a significant role in auto insurance premiums. States with more stringent safety regulations or higher traffic density may have higher premiums.

- Home Insurance: Home insurance premiums are influenced by factors like the value of the home, the location, and the risk of natural disasters. States prone to hurricanes or earthquakes may have higher home insurance premiums.

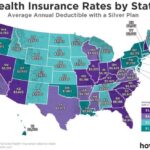

- Health Insurance: Health insurance premiums are affected by factors like age, health history, and the type of coverage chosen. States with a higher cost of living or a larger uninsured population may have higher health insurance premiums.

State-Specific Insurance Regulations

Each state has its own set of insurance regulations that govern how insurance companies operate and how policies are structured. These regulations can significantly impact insurance costs, affecting factors like coverage limits, deductibles, and available discounts.

Impact of State Regulations on Insurance Costs

State regulations can directly influence insurance costs by setting minimum coverage requirements, establishing rules for rate setting, and dictating the types of discounts insurance companies can offer. For example, states with more stringent regulations regarding coverage limits may require higher premiums to ensure sufficient coverage for policyholders.

Examples of State-Specific Regulations and Their Impact

- Minimum Coverage Requirements: States like New York have relatively high minimum liability coverage requirements, leading to potentially higher premiums compared to states with lower minimums, such as Mississippi.

- Rate Setting: Some states, such as California, have stricter rate setting regulations, limiting the factors insurance companies can use to determine premiums, which can potentially lower premiums.

- Discounts: States may regulate the types of discounts insurance companies can offer, such as discounts for safety features or good driving records. States with more lenient regulations might allow for a wider range of discounts, potentially leading to lower premiums.

How Regulations Affect Coverage Limits, Deductibles, and Discounts

- Coverage Limits: States can mandate minimum coverage limits for liability, medical payments, and uninsured motorist coverage. Higher minimums generally translate to higher premiums, as insurance companies need to cover a greater potential financial risk.

- Deductibles: State regulations might influence the range of deductibles offered by insurance companies. For example, some states might have regulations that restrict the maximum deductible amount for certain types of coverage.

- Discounts: State regulations can determine the types of discounts insurance companies can offer. For instance, some states might prohibit discounts based on credit scores, while others might allow them.

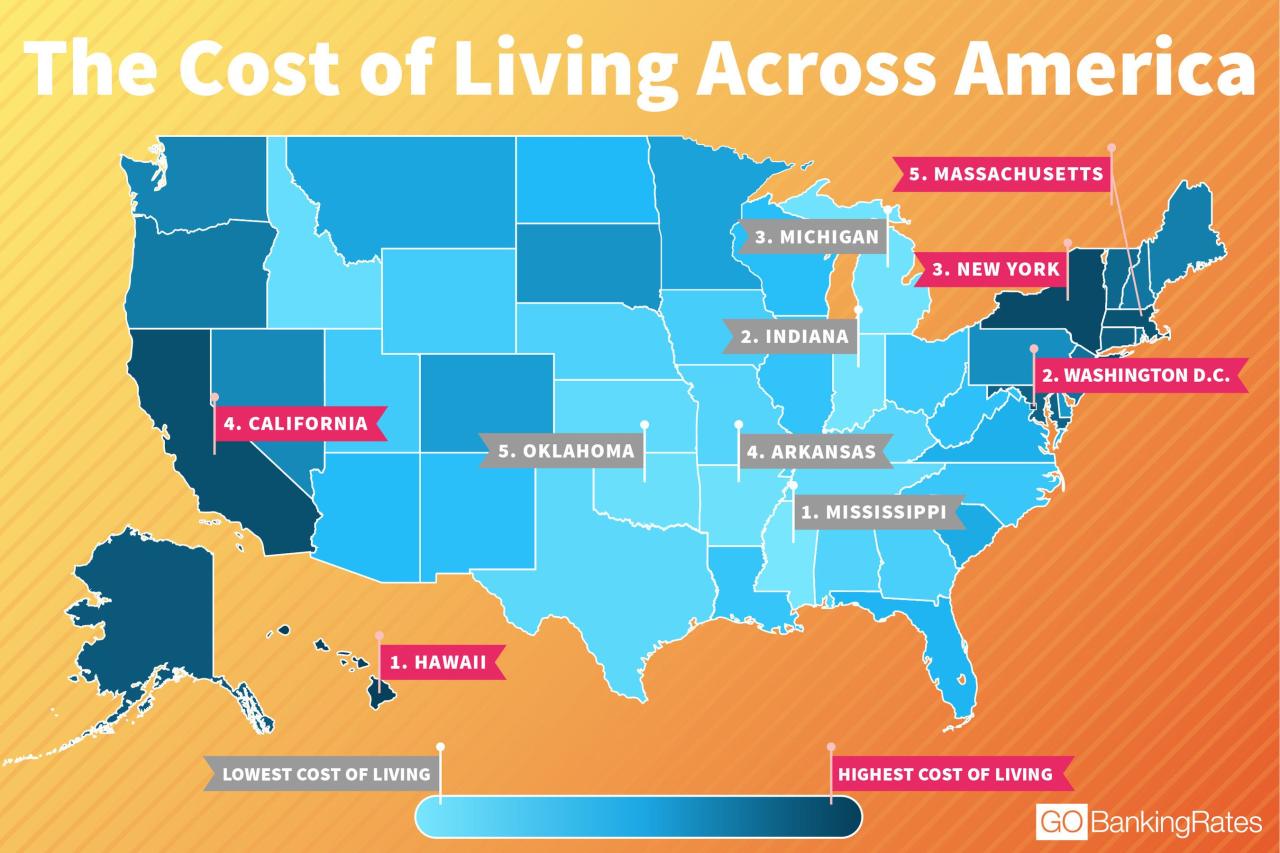

Cost of Living and Demographics

The cost of living in a state plays a significant role in determining insurance premiums. Higher costs of living often correlate with higher insurance rates, as insurers consider the potential for more expensive repairs and medical expenses. Additionally, demographic factors within a state can significantly impact insurance premiums.

Population Density and Crime Rates

Population density and crime rates are closely linked to insurance costs. States with higher population densities often have higher car insurance premiums. This is due to the increased likelihood of accidents in areas with more vehicles on the road. Similarly, states with higher crime rates tend to have higher property insurance premiums as the risk of theft and vandalism is greater.

Average Income and Insurance Costs

Average income levels in a state can also influence insurance premiums. Insurers often use income as a proxy for risk assessment. States with higher average incomes may have higher insurance premiums as residents are more likely to own more expensive vehicles and have greater financial resources to cover potential losses.

Demographics and Insurance Premiums

Demographic factors, such as age, driving history, and health conditions, play a significant role in determining individual insurance premiums.

- Age: Younger drivers are statistically more likely to be involved in accidents, resulting in higher premiums. However, premiums generally decrease as drivers age and gain experience.

- Driving History: Drivers with a history of accidents, speeding tickets, or DUI convictions face higher insurance premiums. Insurers view these factors as indicators of increased risk.

- Health Conditions: In some cases, health conditions can impact insurance premiums. For example, drivers with certain medical conditions may be required to pay higher premiums for health insurance.

Competition and Market Dynamics: Cheapest State For Insurance

Competition in the insurance market is a significant factor influencing premium costs. When numerous insurance providers compete in a state, they often offer lower premiums to attract customers, resulting in more affordable insurance for consumers. Conversely, states with limited competition may experience higher premiums due to reduced pressure on insurers to lower their prices.

Number of Insurance Providers and Pricing

The number of insurance providers in a state can significantly impact pricing. A higher number of insurance providers generally leads to greater competition, which can drive down premiums. For example, states with a robust insurance market, such as California and New York, have a wide range of insurance companies competing for customers, resulting in more competitive pricing. Conversely, states with a limited number of providers may experience higher premiums due to less competition.

Market Dynamics and Insurance Costs

Market dynamics, such as mergers and acquisitions, can significantly affect insurance costs. When insurance companies merge, they may have a greater market share, leading to reduced competition and potentially higher premiums. Conversely, acquisitions can sometimes increase competition if a smaller company is acquired by a larger one, leading to lower premiums.

Mergers and acquisitions can lead to both increased and decreased competition in the insurance market, impacting insurance costs for consumers.

Data and Resources for Comparison

To make informed decisions about where to live based on insurance costs, it’s essential to have access to reliable data and resources. This section will provide you with information on where to find this data and how to interpret it.

Reliable Sources of Insurance Cost Data

Finding accurate and up-to-date insurance cost data can be challenging. However, several reliable sources can provide valuable insights.

- Government Websites: The National Association of Insurance Commissioners (NAIC) is a valuable resource for insurance data, including state-specific premium averages and regulatory information. The NAIC website provides access to data on auto, home, and health insurance premiums, allowing you to compare costs across different states.

- Insurance Comparison Platforms: Online insurance comparison platforms like Policygenius, NerdWallet, and Insurance.com allow you to get personalized quotes from multiple insurers in a single location. These platforms typically provide detailed breakdowns of insurance costs based on your specific needs and preferences.

- State Insurance Departments: Each state has an insurance department responsible for regulating the insurance industry within its borders. These departments often publish reports and data on insurance costs, including average premiums and consumer complaints. You can find contact information for your state’s insurance department on the NAIC website.

Comparison of Average Insurance Premiums

The table below provides a general overview of average insurance premiums across different states. Remember that these figures are averages and actual premiums may vary depending on factors such as your age, driving history, credit score, and the specific coverage you choose.

| State | Average Auto Premium | Average Home Premium | Average Health Premium |

|---|---|---|---|

| Idaho | $1,100 | $1,500 | $400 |

| Utah | $1,200 | $1,600 | $450 |

| Maine | $1,300 | $1,700 | $500 |

| Wyoming | $1,400 | $1,800 | $550 |

| Vermont | $1,500 | $1,900 | $600 |

| New Hampshire | $1,600 | $2,000 | $650 |

| Iowa | $1,700 | $2,100 | $700 |

| North Dakota | $1,800 | $2,200 | $750 |

| South Dakota | $1,900 | $2,300 | $800 |

| Montana | $2,000 | $2,400 | $850 |

Note: These figures are estimates and may vary depending on the specific insurance company, coverage, and individual circumstances.

Tips for Finding Affordable Insurance

Finding affordable insurance is crucial for individuals and families, especially in states with higher insurance costs. By implementing smart strategies and taking advantage of available resources, you can significantly reduce your insurance premiums and ensure you have adequate coverage without breaking the bank.

Negotiating Premiums, Cheapest state for insurance

Negotiating insurance premiums can be an effective way to lower your costs. Insurance companies are often willing to work with policyholders to find mutually beneficial solutions.

- Shop Around and Compare Quotes: Get quotes from multiple insurance providers to compare prices and coverage options. This competitive approach allows you to identify the best deals available.

- Bundle Your Policies: Combining multiple insurance policies, such as home, auto, and life insurance, with the same provider often results in significant discounts.

- Consider a Higher Deductible: Opting for a higher deductible can lead to lower premiums. This strategy involves paying more out-of-pocket in the event of a claim but can significantly reduce your monthly insurance costs.

- Ask About Discounts: Many insurance companies offer discounts for various factors, including safe driving records, good credit scores, home security systems, and membership in certain organizations. Be sure to inquire about these discounts and provide any relevant documentation.

- Negotiate After a Claim: If you have a clean driving record or haven’t filed a claim for a significant period, you may be eligible for a premium reduction. Consider negotiating with your insurer after a claim-free period to see if they are willing to adjust your rates.

Utilizing Discounts and Programs

Insurance companies offer various discounts and programs to incentivize policyholders and reward responsible behavior. These programs can help you save money on your insurance premiums.

- Safe Driving Discounts: Many insurance companies offer discounts for drivers with clean driving records and no accidents or violations.

- Good Student Discounts: Students with good grades may be eligible for discounts on their auto insurance. This recognizes their responsible behavior and academic achievements.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices and qualify you for a discount.

- Loyalty Discounts: Long-term policyholders may receive loyalty discounts as a reward for their continued business.

- Group Discounts: Some insurance companies offer discounts to members of certain groups, such as alumni associations, professional organizations, or employee groups.

End of Discussion

Finding the cheapest state for insurance involves a multi-faceted approach. By carefully considering factors such as state-specific regulations, cost of living, demographics, and market competition, you can make informed decisions to secure affordable coverage. Remember, insurance is a crucial aspect of financial planning, and understanding the dynamics that shape its cost is essential for making wise choices.

User Queries

What is the cheapest state for car insurance?

The cheapest state for car insurance varies, but some states consistently rank among the most affordable, such as Idaho, Maine, and North Dakota.

How do I compare insurance quotes from different states?

Utilize online insurance comparison platforms, contact insurance providers directly, and request quotes based on your specific needs and location.

Is it cheaper to get insurance in a rural area?

Generally, insurance premiums tend to be lower in rural areas due to lower population density, fewer accidents, and lower cost of living.