Cheap state required car insurance is essential for responsible drivers, ensuring you meet legal obligations while staying within budget. Each state has its own minimum coverage requirements, dictating the types and amounts of insurance you must carry. Understanding these requirements and the factors that influence your insurance costs is crucial for finding affordable coverage.

This guide explores the intricacies of state-mandated car insurance, from deciphering minimum coverage levels to identifying factors that impact premiums. We’ll also delve into finding affordable options, comparing insurance providers, and discovering tips for saving on your insurance.

Understanding State Required Car Insurance

Driving a car is a privilege, and with that privilege comes responsibility. One of the most crucial responsibilities is carrying adequate car insurance to protect yourself and others on the road. Each state in the United States has its own set of minimum car insurance requirements, which are designed to ensure that drivers can cover the costs of potential accidents.

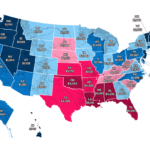

State Minimum Car Insurance Requirements

The minimum car insurance requirements vary significantly from state to state. Some states have more stringent requirements than others, reflecting different priorities and risk profiles.

- Liability Coverage: This coverage is the most common requirement across all states and is essential for protecting you from financial liability if you cause an accident. Liability coverage typically includes:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other driver and passengers involved in an accident that you caused.

- Property Damage Liability: This coverage pays for repairs or replacement costs for the other driver’s vehicle or any other property damaged in an accident that you caused.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages.

- Personal Injury Protection (PIP): Some states require PIP coverage, which pays for your medical expenses and lost wages, regardless of who caused the accident.

Common Car Insurance Coverages

While state minimums provide basic protection, many drivers opt for additional coverage to provide more comprehensive protection.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of who caused the accident.

- Rental Reimbursement Coverage: This coverage provides you with financial assistance to rent a car while your vehicle is being repaired.

Factors Influencing Car Insurance Costs

Your car insurance premium is not a fixed amount. It’s influenced by various factors that insurance companies use to assess your risk as a driver. Understanding these factors can help you understand why your premium is what it is and how you might be able to lower it.

Driving History

Your driving history plays a significant role in determining your car insurance premium. Insurance companies use your driving record to assess your risk of being involved in an accident.

- Accidents: A history of accidents, especially at-fault accidents, will significantly increase your premium. This is because you are considered a higher risk to the insurance company.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations also increase your premium. These violations indicate a higher likelihood of future accidents.

- DUI/DWI: Driving under the influence of alcohol or drugs is a serious offense that carries significant consequences, including a substantial increase in your car insurance premium.

Age

Your age is another important factor that insurance companies consider.

- Younger Drivers: Young drivers, especially those under 25, are generally considered higher risk due to their lack of experience.

- Older Drivers: Older drivers, while generally considered more experienced, may also face higher premiums due to potential health concerns or reduced reaction times.

- Mid-Life Drivers: Drivers in their 30s and 40s are often considered the safest and usually enjoy lower premiums.

Location

Where you live can significantly impact your car insurance rates.

- Urban Areas: Higher population density and increased traffic in urban areas can lead to a greater risk of accidents, resulting in higher premiums.

- Rural Areas: Rural areas often have lower population density and fewer cars on the road, leading to lower accident rates and potentially lower premiums.

- Crime Rates: Areas with high crime rates tend to have higher insurance premiums due to an increased risk of theft or vandalism.

Vehicle Type

The type of vehicle you drive also plays a role in determining your car insurance premium.

- Luxury Vehicles: Luxury cars are often more expensive to repair or replace, leading to higher insurance premiums.

- Sports Cars: Sports cars, known for their high performance, are also considered higher risk and therefore carry higher premiums.

- Safety Features: Vehicles with advanced safety features like anti-lock brakes, airbags, and electronic stability control may qualify for discounts, potentially lowering your premium.

Finding Affordable Car Insurance Options

Finding the right car insurance policy at a price you can afford can feel like a daunting task. But with a little research and smart shopping, you can find a policy that meets your needs without breaking the bank.

Types of Car Insurance Providers

You have several options when it comes to finding car insurance. Understanding the different types of providers can help you narrow your search.

- Major Insurance Companies: These companies, such as State Farm, Geico, and Progressive, offer widespread coverage and often have competitive rates. They are known for their extensive advertising and nationwide presence. However, their rates may not always be the most affordable, and their customer service can sometimes be impersonal.

- Regional Insurers: These insurers focus on specific geographic areas and may offer lower premiums than national companies, particularly if you live in their service area. They can often provide more personalized customer service due to their smaller size. However, they may not have the same level of brand recognition or the same breadth of coverage as national companies.

- Online Brokers: These companies act as intermediaries, comparing quotes from multiple insurance providers. They can be a convenient way to find the best rates quickly. However, they may not offer the same level of personalized service as traditional insurers. Some popular online brokers include The Zebra, Policygenius, and Insurance.com.

Comparing Quotes from Multiple Insurers

To find the most affordable car insurance, it’s essential to compare quotes from multiple insurers. Here are some strategies to make the process easier:

- Use online comparison tools: Many websites and apps allow you to enter your information once and receive quotes from multiple insurers. This can save you time and effort.

- Contact insurers directly: Don’t rely solely on online quotes. Some insurers may offer better rates if you contact them directly. Be sure to provide accurate information to get the most accurate quote.

- Consider discounts: Many insurers offer discounts for things like good driving records, safety features in your car, and bundling your insurance policies. Be sure to ask about all available discounts.

- Review your policy regularly: Don’t assume your current insurer is still offering you the best rate. Shop around every year or two to make sure you’re getting the most competitive price.

Comparing Features and Pricing of Popular Insurance Providers

| Provider | Average Annual Premium | Features |

|---|---|---|

| State Farm | $1,400 | Drive Safe & Save discount, Drive Safe & Save Usage-Based Insurance, Steer Clear Discount |

| Geico | $1,300 | Defensive Driving Course discount, Multi-Car discount, Good Student discount |

| Progressive | $1,200 | Snapshot Usage-Based Insurance, Good Driver discount, Multi-Policy discount |

Understanding Coverage Options and Their Importance: Cheap State Required Car Insurance

Car insurance offers various coverage options, each designed to protect you and your vehicle in different situations. Understanding these options and their limitations is crucial to ensure you have the right coverage for your needs.

Liability Coverage

Liability coverage is the most basic type of car insurance required by most states. It protects you financially if you cause an accident that results in injury or damage to another person or their property. This coverage typically includes:

- Bodily injury liability: Covers medical expenses, lost wages, and pain and suffering for the other driver and passengers injured in an accident you caused.

- Property damage liability: Covers the cost of repairs or replacement for the other driver’s vehicle or property damaged in an accident you caused.

The minimum liability coverage required by your state may not be enough to cover all potential costs in a serious accident. It is advisable to consider increasing your liability limits to protect yourself from significant financial burdens.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses. It can help cover your medical expenses, lost wages, and property damage if the other driver is at fault.

Uninsured/underinsured motorist coverage is particularly important in areas with a high percentage of uninsured drivers.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is typically optional but is often recommended if you have a financed or leased vehicle.

If you choose to waive collision coverage, you are essentially accepting the risk of paying for repairs or replacement yourself if you are involved in an accident.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional, but it can be beneficial for newer or more expensive vehicles.

Comprehensive coverage typically has a deductible, which is the amount you pay out of pocket before the insurance company covers the remaining costs.

Tips for Saving on Car Insurance

Car insurance is a necessary expense for most vehicle owners. While it’s important to have adequate coverage, you don’t have to overpay for it. Several strategies can help you lower your premiums and keep more money in your pocket.

Increasing Deductibles, Cheap state required car insurance

Raising your deductible can significantly reduce your insurance premiums. Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible means you pay more upfront in case of an accident but pay less in premiums over time.

For example, if you increase your deductible from $500 to $1000, you might see a 10-15% reduction in your premium.

Consider your financial situation and risk tolerance when deciding on a deductible. If you can comfortably cover a higher deductible in case of an accident, it can save you money in the long run.

Maintaining a Good Driving Record

A clean driving record is one of the most significant factors influencing your insurance premiums. Insurance companies view drivers with a history of accidents, violations, or driving under the influence (DUI) as higher risks.

By avoiding accidents, traffic violations, and DUI convictions, you can significantly reduce your insurance premiums.

Bundling Insurance Policies

Many insurance companies offer discounts when you bundle multiple insurance policies, such as car insurance, homeowners insurance, or renters insurance.

By combining your policies with the same insurer, you can often get a discount of 5-15% or more.

This is a simple way to save money on your car insurance premiums.

Taking Defensive Driving Courses

Defensive driving courses teach you safe driving techniques and strategies to avoid accidents. Insurance companies often offer discounts to drivers who complete these courses, recognizing the reduced risk associated with safer driving habits.

Completing a defensive driving course can lower your premiums by 5-10% or more, depending on the insurer.

These courses can also help you become a safer driver, potentially saving you from accidents and costly repairs.

Taking Advantage of Discounts

Insurance companies offer various discounts to lower your premiums. These discounts vary by insurer, so it’s essential to shop around and compare quotes. Here are some common discounts:

- Good Student Discount: Students with good grades often qualify for a discount. This reflects the lower risk associated with responsible students.

- Safe Driver Discount: Drivers with a clean driving record and no accidents or violations for a specified period may qualify for a discount.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you may receive a discount.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can lower your premiums.

- Loyalty Discount: Insurers may offer discounts to long-term customers who have been with them for a certain period.

Navigating the Insurance Claims Process

Filing a car insurance claim can be a stressful experience, but understanding the process and taking the right steps can make it smoother. It’s important to act quickly and accurately to ensure your claim is processed efficiently and you receive the compensation you deserve.

Understanding the Claims Process

The claims process typically involves several steps, starting with reporting the accident to your insurance company. Here’s a general overview:

- Report the Accident: Immediately contact your insurance company to report the accident. They will provide you with instructions on how to proceed, including any necessary documentation or forms.

- Gather Information: Collect as much information as possible about the accident, including the date, time, location, and details of the other parties involved. Exchange contact and insurance information with the other drivers and any witnesses.

- File a Claim: Complete and submit the necessary claim forms to your insurance company. Be sure to provide all the required information accurately and thoroughly.

- Investigate the Claim: Your insurance company will investigate the claim to determine the cause of the accident and the extent of the damages. This may involve reviewing police reports, medical records, and other evidence.

- Negotiate a Settlement: Once the investigation is complete, your insurance company will assess the claim and offer a settlement. You have the right to negotiate the settlement amount if you believe it is too low.

- Receive Payment: If you accept the settlement offer, your insurance company will issue payment for your covered losses. This may include repairs to your vehicle, medical expenses, or other damages.

Documenting an Accident and Gathering Evidence

Proper documentation is crucial for a smooth claims process. Here are some essential tips for documenting an accident:

- Take Photos and Videos: Document the scene of the accident by taking clear photos and videos of the damage to your vehicle, the other vehicles involved, and any surrounding area that might be relevant.

- Record Witness Information: Get the names, addresses, and phone numbers of any witnesses to the accident.

- Obtain a Police Report: If the accident involves injuries or significant damage, contact the police and obtain a copy of the accident report.

- Keep a Detailed Account: Write down a detailed account of the accident, including the date, time, location, weather conditions, and a description of the events leading up to the accident.

Handling the Claims Process

Here’s a step-by-step guide for handling the claims process effectively:

- Report the Accident Promptly: Contact your insurance company as soon as possible after the accident to report it. This helps ensure that your claim is processed efficiently.

- Be Cooperative: Provide your insurance company with all the information they need to process your claim. Be honest and truthful in your interactions with them.

- Understand Your Policy: Review your insurance policy to understand your coverage limits and any exclusions. This will help you understand what you are entitled to.

- Keep Track of Communication: Document all communication with your insurance company, including dates, times, and the content of conversations.

- Seek Legal Advice: If you are dissatisfied with the settlement offer or have any questions about your rights, consider consulting with an attorney.

Last Word

Navigating the world of car insurance can feel overwhelming, but understanding state requirements, exploring coverage options, and utilizing strategies for finding affordable premiums can make the process smoother. Remember, every driver has unique needs, so take the time to compare quotes, explore different providers, and find the best fit for your situation. By being informed and proactive, you can secure the necessary coverage while keeping your insurance costs manageable.

Detailed FAQs

How do I know what minimum coverage is required in my state?

You can find this information on your state’s Department of Motor Vehicles (DMV) website or by contacting your insurance agent.

What are some common car insurance coverages?

Common coverages include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP).

Can I get discounts on my car insurance?

Yes, many insurance companies offer discounts for things like good driving records, bundling policies, safety features, and completing defensive driving courses.

What happens if I get into an accident and don’t have enough insurance?

You could be held personally liable for damages exceeding your coverage limits, potentially leading to significant financial hardship.