Cheapest state for trucking insurance: Navigating the complex world of trucking insurance can feel like driving through a maze, especially when it comes to finding the most affordable rates. Every state has its own unique set of regulations and factors that influence insurance premiums, making it challenging to determine where you’ll find the best deal. From the type of cargo you haul to your driver’s experience, a multitude of variables play a role in shaping your insurance costs.

This guide delves into the intricacies of trucking insurance across different states, exploring the key factors that impact premiums, comparing state-specific regulations, and offering valuable tips for finding affordable coverage. We’ll also provide a comprehensive cost comparison of trucking insurance premiums across the nation, revealing which states offer the most competitive rates.

Factors Influencing Trucking Insurance Costs

Trucking insurance premiums are influenced by a variety of factors, each playing a significant role in determining the final cost. Understanding these factors can help trucking businesses make informed decisions regarding their insurance coverage and minimize their overall expenses.

Type of Cargo Transported

The type of cargo transported is a major factor influencing insurance costs. High-value cargo, such as pharmaceuticals or electronics, poses a greater risk of loss or damage, leading to higher insurance premiums. Conversely, transporting low-value cargo, like agricultural products, generally results in lower premiums.

Type of Truck

Insurance costs vary significantly based on the type of truck used. Semi-trucks, due to their size and weight, are associated with higher risk and therefore higher premiums compared to smaller trucks like box trucks or flatbed trucks. Box trucks, typically used for local deliveries, generally have lower premiums than semi-trucks. Flatbed trucks, often used for hauling heavy or oversized loads, may face higher premiums depending on the specific cargo and routes traveled.

Driver Experience and Safety Record

Driver experience and safety record are critical factors in determining insurance costs. Inexperienced drivers with a history of accidents or violations are considered higher risk, leading to higher premiums. Conversely, experienced drivers with a clean safety record often qualify for lower premiums.

Geographic Location

Trucking insurance rates are also influenced by geographic location. Areas with higher traffic density, challenging road conditions, or a higher incidence of theft or accidents tend to have higher insurance premiums. Conversely, areas with lower traffic volumes and fewer risks may have lower insurance premiums.

State-Specific Insurance Regulations and Requirements

Trucking insurance requirements vary significantly across states. Each state has its own set of regulations and mandates that affect the cost of insurance for trucking businesses. Understanding these differences can help trucking companies find the most affordable insurance options.

State-Specific Insurance Requirements

The minimum insurance requirements for trucking businesses vary significantly by state. Some states require higher minimum coverage limits than others. For example, in California, the minimum required liability coverage for a commercial truck is $500,000, while in Texas, it is only $300,000. These differences in minimum coverage requirements can have a direct impact on insurance costs, as higher coverage limits generally lead to higher premiums.

State-Specific Mandates and Regulations

In addition to minimum coverage requirements, states also have various mandates and regulations that can impact insurance costs. These regulations can include requirements for:

- Financial responsibility: Some states require trucking businesses to demonstrate financial responsibility through surety bonds, trust funds, or other mechanisms. These requirements can add to the cost of insurance.

- Safety inspections: Some states require trucking businesses to undergo regular safety inspections, which can add to the cost of insurance. States that have stricter safety regulations may have higher insurance premiums.

- Driver qualifications: States have different requirements for driver qualifications, such as minimum age, driving experience, and licensing requirements. These regulations can impact insurance costs, as states with stricter driver qualifications may have lower premiums.

State-Specific Programs and Incentives, Cheapest state for trucking insurance

Some states offer programs or initiatives that can help reduce the cost of trucking insurance. These programs can include:

- Discounts for safety programs: Some states offer discounts for trucking businesses that participate in safety programs, such as driver training programs or safety audits. These programs can help reduce the risk of accidents and therefore lower insurance premiums.

- Tax credits for insurance premiums: Some states offer tax credits for trucking businesses that purchase insurance. These credits can help offset the cost of insurance and make it more affordable.

- State-run insurance pools: Some states have state-run insurance pools that provide insurance to trucking businesses that have difficulty obtaining coverage in the private market. These pools can offer more affordable insurance options for businesses that are considered high-risk.

Impact of State-Specific Laws on Insurance Availability and Affordability

State-specific laws can significantly impact the availability and affordability of trucking insurance. States with stricter regulations and higher minimum coverage requirements may have higher insurance premiums. This can make it more difficult for some trucking businesses to obtain affordable insurance. Conversely, states with more lenient regulations may have lower insurance premiums, making it easier for businesses to find affordable coverage.

“Trucking businesses should carefully consider the insurance requirements and regulations in each state where they operate to ensure they are meeting all legal requirements and finding the most affordable insurance options.”

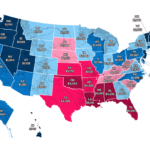

Cost Comparison of Trucking Insurance Across States

Trucking insurance premiums can vary significantly across different states. This variation is influenced by a multitude of factors, including the state’s accident rates, regulatory environment, and the types of trucking operations prevalent in the region. Understanding these cost differences can help trucking businesses choose the state that offers the most affordable insurance rates.

Average Trucking Insurance Premiums by State

This table presents a comparison of average annual trucking insurance premiums across various states, along with key factors influencing cost variation.

| State | Average Annual Premium | Key Factors Influencing Cost Variation |

|---|---|---|

| Texas | $5,000 | High traffic volume, diverse trucking operations, competitive insurance market |

| California | $6,500 | High population density, strict regulations, frequent accidents |

| Florida | $5,500 | High tourism, heavy freight traffic, coastal risks |

| New York | $7,000 | Dense urban environment, high traffic congestion, strict regulations |

| Pennsylvania | $6,000 | Extensive highway network, significant industrial activity, diverse trucking operations |

| Oregon | $4,500 | Relatively low traffic volume, mountainous terrain, limited trucking operations |

The states with the lowest average trucking insurance premiums are generally those with lower traffic density, fewer accidents, and less stringent regulations. For example, Oregon has a relatively low average premium due to its lower population density and less congested roads.

Explanation of Cost Variations

The cost variations in trucking insurance premiums across states can be attributed to several factors:

* Accident Rates: States with higher accident rates tend to have higher insurance premiums. This is because insurance companies have to pay out more claims in these states, which drives up their costs.

* Regulatory Environment: States with stricter regulations regarding trucking operations often have higher insurance premiums. This is because these regulations can increase the cost of doing business for trucking companies, which is reflected in their insurance rates.

* Type of Trucking Operations: The type of trucking operations prevalent in a state can also influence insurance premiums. For example, states with a high concentration of hazardous materials transportation or long-haul trucking operations may have higher premiums due to the increased risks associated with these activities.

* Competition in the Insurance Market: States with a more competitive insurance market may have lower premiums. This is because insurance companies are competing for customers, which can drive down prices.

* Economic Conditions: The overall economic conditions in a state can also influence insurance premiums. States with strong economies may have lower premiums due to the increased demand for trucking services.

It is important to note that these are just general trends, and individual insurance premiums can vary based on factors such as the specific type of truck, the driver’s experience, and the company’s safety record.

Tips for Finding Affordable Trucking Insurance: Cheapest State For Trucking Insurance

Securing affordable trucking insurance is crucial for the financial well-being of any trucking business. By implementing smart strategies and prioritizing safety, you can significantly reduce your insurance premiums and protect your bottom line.

Maintaining a Clean Driving Record

A clean driving record is paramount in securing affordable trucking insurance. Insurance companies view a history of safe driving as a strong indicator of future driving behavior. A clean driving record demonstrates your commitment to safety, reducing the likelihood of accidents and claims.

Implementing Safety Protocols

Implementing comprehensive safety protocols is essential for reducing insurance costs. By prioritizing safety, you not only minimize the risk of accidents but also demonstrate your commitment to responsible operations. Insurance companies often reward businesses with robust safety programs with lower premiums.

Utilizing Technology and Telematics

Modern technology and telematics can play a significant role in reducing insurance costs. Telematics systems track driving behavior, providing valuable data that can help identify areas for improvement. Insurance companies often offer discounts to businesses that utilize telematics to enhance safety.

Shopping Around and Comparing Quotes

It is essential to shop around and compare quotes from multiple insurance providers. Different insurance companies have varying risk profiles and pricing models. By comparing quotes, you can find the most competitive rates and ensure you are getting the best value for your money.

Considerations for Choosing a Trucking Insurance Provider

Choosing the right trucking insurance provider is crucial for protecting your business and ensuring financial security. A well-informed decision can save you money, provide peace of mind, and help you navigate potential challenges.

Financial Stability and Claims Handling

It is essential to select a trucking insurance provider with a solid financial foundation. A financially stable company is more likely to be able to pay claims when you need them. Consider the following factors:

- A.M. Best Rating: This rating agency evaluates the financial strength and operating performance of insurance companies. Look for providers with high A.M. Best ratings, such as A+ or A.

- Claims Handling Process: Investigate the provider’s claims handling process. How quickly do they respond to claims? What is their reputation for fairness and efficiency? Seek providers with transparent and responsive claims handling practices.

- Financial Reserves: A financially stable provider will have sufficient reserves to cover potential claims. You can inquire about their financial reserves or check for publicly available financial information.

Reputation and Customer Service

The reputation and customer service experience of a trucking insurance provider are critical. A positive reputation indicates a company that is reliable, responsive, and committed to customer satisfaction.

- Industry Reputation: Research the provider’s reputation within the trucking industry. Look for online reviews, industry publications, and testimonials from other truckers.

- Customer Service Availability: Ensure the provider offers readily available customer service channels, such as phone, email, and online chat.

- Response Time: Assess the provider’s response time to inquiries and requests. A prompt and efficient response indicates a company that values its customers.

Coverage Options and Policy Features

Trucking insurance providers offer a range of coverage options and policy features. It is essential to choose a provider that offers the coverage you need at a competitive price.

- Coverage Types: Compare the types of coverage offered by different providers, such as liability, cargo, physical damage, and bobtail coverage.

- Policy Limits: Review the policy limits for each coverage type. Ensure the limits are sufficient to protect your business in the event of an accident or claim.

- Deductibles: Consider the deductibles offered by different providers. Higher deductibles typically result in lower premiums, but you will be responsible for paying a larger portion of any claim.

- Discounts: Inquire about available discounts, such as safe driving records, safety programs, and loss control measures.

Ultimate Conclusion

Ultimately, finding the cheapest state for trucking insurance requires a multi-faceted approach. By understanding the factors that influence premiums, comparing state-specific regulations, and diligently seeking out competitive quotes, trucking businesses can secure affordable coverage that meets their unique needs. This guide provides a solid foundation for making informed decisions, enabling you to navigate the world of trucking insurance with confidence and save money in the process.

Questions Often Asked

What is the average cost of trucking insurance?

The average cost of trucking insurance varies greatly depending on factors like the type of truck, cargo, driver experience, and location. However, it’s generally in the range of $5,000 to $15,000 per year.

What are the most common types of trucking insurance?

Common types include liability insurance, cargo insurance, physical damage insurance, and workers’ compensation insurance. The specific types you need will depend on your business operations.

How can I get a discount on trucking insurance?

Discounts are often available for factors like a clean driving record, safety training, and using telematics devices to track driver behavior.