Cheapest home insurance Washington state is a crucial consideration for homeowners seeking financial protection. The Evergreen State presents unique challenges, from earthquake risks to unpredictable weather patterns, that can significantly impact insurance costs. Understanding the factors that influence premiums, exploring available coverage options, and implementing cost-saving strategies are essential steps in securing affordable and comprehensive home insurance.

This guide delves into the intricacies of finding the best home insurance deals in Washington state, equipping you with the knowledge and tools to navigate the process confidently. From identifying key cost-driving factors to leveraging comparison websites, we’ll empower you to make informed decisions and secure the most suitable coverage for your individual needs and budget.

Understanding Washington State Home Insurance

Home insurance in Washington State is crucial for protecting your property and finances against unforeseen events. Understanding the factors that influence costs and the coverage options available is essential for securing the right policy for your needs.

Factors Influencing Home Insurance Costs

Several factors determine the cost of home insurance in Washington State. These include:

- Location: The risk of natural disasters, such as earthquakes, wildfires, and floods, varies across Washington State. Homes in areas with higher risk levels generally have higher insurance premiums.

- Home Value: The higher the value of your home, the more it will cost to rebuild or repair it in case of damage. This directly impacts your insurance premium.

- Home Features: Features like the age of your home, roof type, and building materials can influence the cost of insurance. Newer homes with modern features tend to have lower premiums than older homes with outdated features.

- Safety Features: Homes equipped with security systems, smoke detectors, and fire sprinklers often qualify for discounts on home insurance premiums.

- Credit Score: Your credit score can be a factor in determining your home insurance premium. Insurers may view individuals with lower credit scores as higher risk and charge them higher premiums.

- Claims History: Previous insurance claims can impact your future premiums. A history of frequent claims may lead to higher premiums, while a clean claims history can result in discounts.

- Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums.

- Coverage Limits: The coverage limits on your policy determine the maximum amount your insurer will pay for specific types of damage. Higher coverage limits typically result in higher premiums.

Key Coverage Options

Washington State home insurance policies typically include the following key coverage options:

- Dwelling Coverage: This covers damage to your home’s structure, including the roof, walls, and foundation, due to covered perils like fire, windstorms, and hail.

- Other Structures Coverage: This covers damage to detached structures on your property, such as garages, sheds, and fences.

- Personal Property Coverage: This covers damage to your belongings, such as furniture, electronics, clothing, and jewelry, due to covered perils.

- Liability Coverage: This protects you financially if someone is injured on your property or you are held liable for damage to someone else’s property.

- Additional Living Expenses (ALE): This coverage helps pay for temporary housing and other living expenses if your home becomes uninhabitable due to a covered peril.

Common Perils Covered

Home insurance policies in Washington State typically cover a range of common perils, including:

- Fire: This covers damage to your home and belongings caused by fire, including smoke and water damage from firefighting efforts.

- Windstorms: This covers damage to your home and belongings caused by strong winds, including damage from flying debris.

- Hail: This covers damage to your home and belongings caused by hailstorms.

- Lightning: This covers damage to your home and belongings caused by lightning strikes.

- Theft: This covers loss or damage to your belongings due to theft or burglary.

- Vandalism: This covers damage to your home and belongings caused by vandalism.

Finding Affordable Home Insurance in Washington State

Finding affordable home insurance in Washington State is crucial for protecting your biggest investment. With the right approach, you can find a policy that provides adequate coverage without breaking the bank.

Factors Affecting Home Insurance Costs

Several factors contribute to the price of home insurance in Washington State. Understanding these factors can help you make informed decisions and potentially save money.

- Location: Your home’s location plays a significant role in determining insurance costs. Areas prone to natural disasters like earthquakes, wildfires, or floods generally have higher premiums. Washington State is known for its seismic activity, particularly in the Puget Sound region, which can significantly impact insurance costs.

- Home Value: The value of your home directly impacts the cost of insurance. A higher home value generally translates to higher premiums because the insurance company has more to cover in case of damage or loss.

- Coverage Options: The type and amount of coverage you choose can significantly affect your premium. Choosing higher coverage limits or adding optional coverage like flood or earthquake insurance will increase your premium.

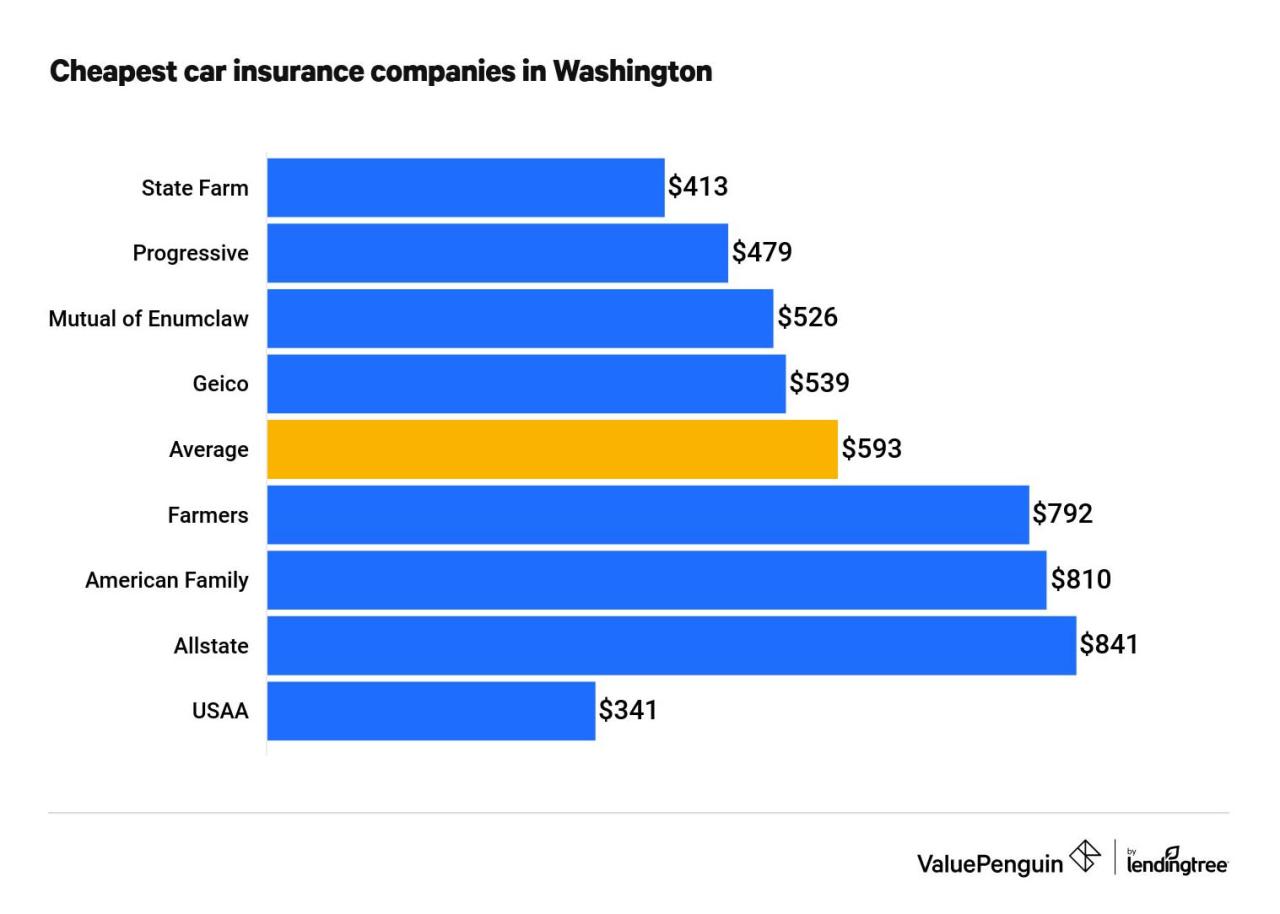

Comparing Home Insurance Quotes, Cheapest home insurance washington state

Comparing quotes from multiple insurance providers is essential for finding the best deal. This process involves several steps:

- Gather Information: Before contacting insurance companies, gather information about your home, including its value, square footage, construction materials, and any safety features. This information will help you provide accurate details when obtaining quotes.

- Contact Multiple Providers: Get quotes from at least three to five different insurance companies. You can contact them directly through their websites or by phone.

- Compare Quotes Carefully: Once you receive quotes, carefully compare the coverage offered, deductibles, and premiums. Pay attention to any additional fees or charges.

- Ask Questions: Don’t hesitate to ask questions to clarify any details or coverage limitations. You want to ensure you understand the policy and its implications before making a decision.

Benefits of Using a Home Insurance Comparison Website

Home insurance comparison websites can be a valuable tool in your search for affordable coverage. These websites allow you to enter your information once and receive quotes from multiple insurance companies simultaneously.

- Convenience: Comparison websites save you time and effort by eliminating the need to contact each insurer individually. You can compare quotes from multiple providers in one place.

- Objectivity: These websites present quotes from different providers side-by-side, allowing you to make an objective comparison based on price, coverage, and other factors.

- Potential Savings: By comparing quotes, you can identify potential savings and choose a policy that best suits your needs and budget.

Tips for Saving on Home Insurance Costs

Saving money on your home insurance in Washington State can be achieved through strategic planning and understanding your policy options. By implementing these tips, you can potentially lower your premiums and ensure you have adequate coverage.

Impact of Increasing Your Deductible

Raising your deductible is a common strategy for reducing your home insurance premiums. A higher deductible means you’ll pay more out of pocket if you need to file a claim, but it can significantly lower your monthly premiums. It’s important to choose a deductible you can comfortably afford in case of an unexpected event.

For example, increasing your deductible from $500 to $1,000 could result in a 10-15% reduction in your annual premium.

Bundling Home and Auto Insurance Policies

Insurance companies often offer discounts for bundling your home and auto insurance policies. By combining your policies with the same provider, you can potentially save a significant amount of money on your premiums.

In some cases, bundling can save you up to 20% on your total insurance costs.

Other Tips for Reducing Home Insurance Costs

- Improve Your Home’s Security: Installing security systems, smoke detectors, and fire sprinklers can demonstrate to insurers that your home is less prone to risks. This can lead to discounts on your premiums.

- Maintain Your Home Regularly: Regularly inspecting and maintaining your roof, plumbing, and electrical systems can prevent costly repairs and demonstrate to insurers that your home is well-maintained. This can result in lower premiums.

- Shop Around for Quotes: Compare quotes from multiple insurance providers to find the best rates and coverage options. Don’t be afraid to negotiate with insurers to secure the most favorable terms.

- Consider Discounts: Inquire about available discounts, such as those for good driving records, homeownership, or being a member of certain organizations. These discounts can significantly reduce your premiums.

- Review Your Coverage Regularly: Periodically review your policy to ensure you have adequate coverage for your current needs. You may be able to adjust your coverage levels or remove unnecessary items to save on premiums.

Key Considerations for Choosing a Home Insurance Provider

Choosing the right home insurance provider in Washington state can be a daunting task. You need to consider various factors, including coverage options, pricing, customer service, and financial stability. Understanding these aspects will help you make an informed decision and secure the best insurance for your needs.

Comparing Services Offered by Different Providers

It’s essential to compare the services offered by different home insurance providers in Washington state to find the best fit for your needs. While many providers offer standard coverage, they may differ in specific features and benefits. Some providers may offer specialized coverage options, such as earthquake insurance, which is crucial in areas prone to seismic activity. Others may provide additional perks like discounts for home security systems or energy-efficient upgrades.

Local vs. National Insurance Companies

Deciding between a local or national insurance company is another crucial consideration. Both options have their advantages and disadvantages, which are summarized in the table below.

| Feature | Local Insurance Company | National Insurance Company |

|—|—|—|

| Pros | Strong community ties, personalized service, potentially lower premiums | Wide coverage network, greater financial stability, more options for discounts |

| Cons | Limited coverage area, fewer options for discounts, potentially higher premiums | Less personalized service, may not be as familiar with local risks |

Checking Financial Stability and Customer Satisfaction Ratings

Before committing to a home insurance provider, it’s vital to evaluate their financial stability and customer satisfaction ratings.

A financially stable company is more likely to be able to pay claims in the event of a disaster or other covered incident.

You can check a provider’s financial strength by looking at their ratings from independent agencies like AM Best, Standard & Poor’s, and Moody’s. These agencies assess a company’s financial health based on factors such as its reserves, claims-paying ability, and overall financial performance.

Similarly, customer satisfaction ratings can provide insights into a provider’s reputation and service quality. You can find these ratings from organizations like J.D. Power, Consumer Reports, and the Better Business Bureau.

Understanding Home Insurance Policy Exclusions

While home insurance policies provide crucial protection against various perils, it’s essential to understand that they also come with limitations. Exclusions are specific events or circumstances that are not covered under your policy. These exclusions are designed to protect insurance companies from potentially high-risk or unpredictable situations.

Common Exclusions in Washington State Home Insurance Policies

Understanding common exclusions is vital to ensure you have the right coverage for your needs. Many standard home insurance policies in Washington state exclude coverage for:

- Earthquakes: Earthquakes are a significant risk in Washington state, and most standard policies do not cover earthquake damage. Separate earthquake insurance is usually required to protect your home from this peril.

- Flooding: Similar to earthquakes, flood damage is generally not covered by standard home insurance policies. You’ll need a separate flood insurance policy to protect your property from flood risks.

- Acts of War: Home insurance policies typically exclude coverage for damage caused by acts of war or terrorism.

- Neglect or Intentional Acts: Damage resulting from your own negligence or intentional actions, such as failing to maintain your property or deliberately causing damage, is not covered.

- Normal Wear and Tear: Home insurance policies do not cover damage caused by normal wear and tear, such as aging appliances or fading paint.

Situations Where Home Insurance Claims Might Be Denied

It’s important to understand that even if an event is not explicitly excluded from your policy, there are situations where your claim might be denied. Here are some examples:

- Failure to Maintain Your Property: If you fail to maintain your property and it leads to damage, such as a roof leak caused by neglecting to repair a damaged shingle, your claim might be denied.

- Unpermitted Structures: If you have unpermitted additions or structures on your property, and they are damaged, your claim might be denied.

- Misrepresentation of Information: If you provided inaccurate information during the application process, your claim could be denied.

- Failure to File a Claim Promptly: Most policies have time limits for filing claims. If you fail to file a claim within the specified timeframe, your claim might be denied.

Importance of Reviewing Your Home Insurance Policy

Thoroughly reviewing your home insurance policy is crucial to understanding its limitations. By carefully reading the policy documents, you can identify exclusions, understand your coverage limits, and ensure that your policy meets your specific needs. It’s also a good idea to discuss your policy with your insurance agent to clarify any questions or concerns you may have.

Additional Resources for Homeowners

Navigating the world of home insurance can be overwhelming, especially for first-time homeowners. Thankfully, several resources are available to provide guidance and support throughout your journey.

This section will explore valuable resources for homeowners in Washington state, including websites, organizations, and consumer protection agencies. These resources can help you understand your insurance options, find affordable coverage, and navigate the claims process.

Websites and Organizations

- Washington State Office of the Insurance Commissioner (OIC): The OIC is the primary regulator of insurance in Washington state. It provides valuable information about home insurance, consumer rights, and complaint resolution. You can find resources on their website, including publications, FAQs, and a searchable database of licensed insurance companies.

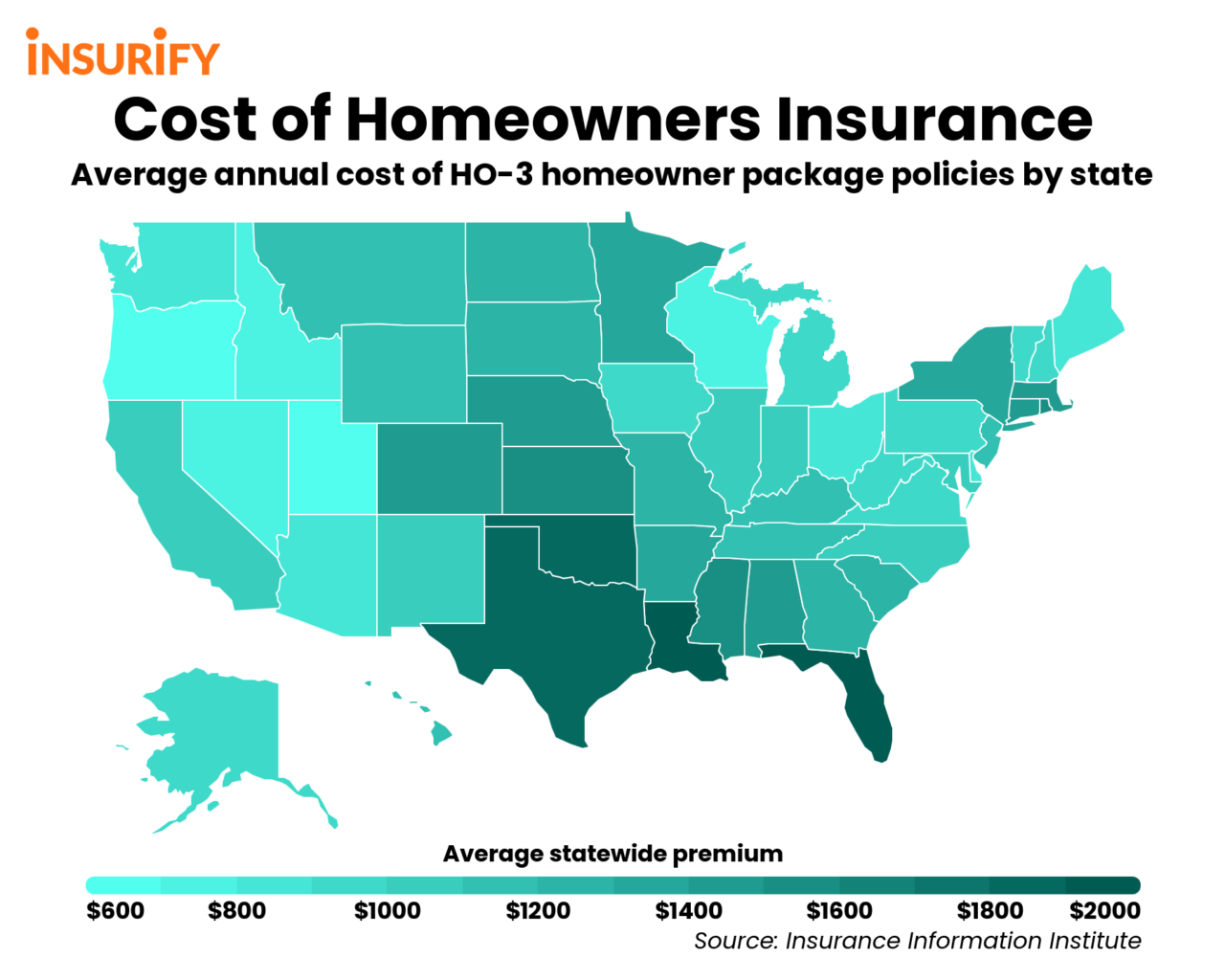

- Insurance Information Institute (III): The III is a non-profit organization that provides information about insurance to consumers and the media. Their website offers comprehensive resources on various insurance topics, including home insurance, risk management, and disaster preparedness.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that works to promote uniformity in state insurance laws and regulations. Their website offers a wealth of information about insurance, including consumer protection tips and resources for filing complaints.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent product testing and consumer advice. Their website offers detailed reviews of home insurance companies, helping consumers make informed decisions about their coverage.

Helpful Resources for Homeowners

| Resource | Description | Contact Information |

|---|---|---|

| Washington State Office of the Insurance Commissioner (OIC) | Regulates insurance in Washington state and provides consumer protection information. | Website: https://www.insurance.wa.gov/ Phone: (800) 562-6900 |

| Washington State Attorney General’s Office | Protects consumer rights and investigates consumer complaints related to insurance. | Website: https://www.atg.wa.gov/ Phone: (360) 753-6200 |

| Better Business Bureau (BBB) | Provides business reviews and consumer protection information. | Website: https://www.bbb.org/ Phone: (800) 815-0444 |

Filing a Home Insurance Claim

- Contact your insurance company: Immediately notify your insurance company about the damage. This is usually done by phone or through their online portal. Provide them with the details of the incident, including the date, time, and location.

- Document the damage: Take photos or videos of the damage to your property. This will help you support your claim and ensure you receive fair compensation.

- Make temporary repairs: If necessary, take steps to protect your property from further damage. This could involve covering holes, boarding up windows, or removing damaged belongings. Keep receipts for these expenses, as you may be reimbursed by your insurance company.

- Cooperate with the insurance adjuster: An insurance adjuster will be assigned to your claim to assess the damage and determine the amount of compensation you are entitled to. Be prepared to provide them with information about your property and the incident.

- Negotiate the settlement: Once the adjuster has completed their assessment, they will present you with a settlement offer. You have the right to negotiate this offer if you believe it is not fair.

Closing Summary

Navigating the world of home insurance in Washington state can be complex, but armed with the right information and strategies, finding affordable and comprehensive coverage is achievable. By understanding the factors that influence premiums, utilizing comparison tools, and implementing cost-saving tips, you can secure a policy that provides peace of mind while aligning with your budget. Remember, a proactive approach to home insurance ensures you’re adequately protected against unforeseen events, safeguarding your most valuable asset.

Questions Often Asked: Cheapest Home Insurance Washington State

What are the main factors that determine home insurance costs in Washington state?

Home insurance premiums in Washington state are influenced by several factors, including your home’s location, age, and value, the coverage you choose, your credit score, and your claims history.

How can I compare home insurance quotes from different providers?

You can compare quotes online using insurance comparison websites, contact individual insurance providers directly, or work with an independent insurance broker.

What are some tips for saving on home insurance premiums?

Consider increasing your deductible, bundling home and auto insurance, making home improvements to reduce risk, and shopping around for the best rates.

What are some common exclusions in home insurance policies in Washington state?

Home insurance policies typically exclude coverage for certain events, such as earthquakes, floods, and acts of war. It’s crucial to review your policy carefully to understand its limitations.