Cheap auto insurance state minimum coverage might seem like a good way to save money, but is it really worth the risk? While it can be tempting to choose the most affordable option, understanding the limitations of state minimum insurance is crucial. This coverage only meets the bare minimum legal requirements, leaving you vulnerable to significant financial burdens in the event of an accident.

This guide delves into the intricacies of state minimum auto insurance, exploring the potential downsides and highlighting the importance of considering additional coverage options. We’ll examine factors that influence the cost of insurance, provide tips for finding affordable options, and equip you with the knowledge to make informed decisions about your auto insurance needs.

Understanding State Minimum Auto Insurance Requirements

Every state in the U.S. mandates that drivers carry a minimum amount of auto insurance to protect themselves and others on the road. These requirements are designed to ensure that drivers can financially cover the costs of accidents they may cause.

State Minimum Auto Insurance Coverage

State minimum auto insurance requirements typically include three main types of coverage:

- Liability Coverage: This coverage protects you if you cause an accident that injures someone or damages their property. It covers the other driver’s medical expenses, lost wages, and property damage up to the policy limits.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident. It is often required in “no-fault” states.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses.

State Minimums Vary

State minimum insurance requirements vary significantly across the country. For example, the minimum liability coverage required in Florida is $10,000 per person and $20,000 per accident, while in Pennsylvania, the minimum is $15,000 per person and $30,000 per accident.

The Risks of Driving with Only State Minimum Coverage: Cheap Auto Insurance State Minimum

While state minimum auto insurance may seem like a cost-effective option, it’s crucial to understand the potential risks associated with carrying only this limited coverage. In the event of an accident, you could face significant financial consequences and legal ramifications.

Potential Financial Consequences, Cheap auto insurance state minimum

State minimum insurance coverage is designed to meet the bare minimum legal requirements, often leaving you financially vulnerable in the event of a serious accident. The following are examples of expenses that may not be fully covered by state minimum insurance:

- Medical Expenses: State minimum insurance typically has low limits for medical payments coverage, which can leave you responsible for exceeding costs if your injuries are severe.

- Lost Wages: If you’re unable to work due to injuries, your state minimum insurance may not cover lost wages, leaving you without income during your recovery.

- Property Damage: State minimum liability coverage may not be sufficient to cover the full cost of repairs or replacement for the other driver’s vehicle or property if you are at fault.

- Other Expenses: Additional expenses such as towing, rental car, and legal fees may not be covered by state minimum insurance, leaving you responsible for these costs.

Legal Ramifications of Inadequate Coverage

Driving with only state minimum insurance can expose you to significant legal risks. If you are found liable for an accident that results in substantial damages, you could be sued for the difference between the damages and your insurance coverage. This could lead to:

- Personal Liability: If your insurance coverage is insufficient to cover the damages, you could be held personally liable for the remaining amount, potentially leading to the seizure of your assets or a lien on your property.

- Financial Ruin: In severe cases, the financial burden of an accident could lead to bankruptcy, impacting your credit rating and future financial prospects.

- Legal Battles: A lawsuit can be lengthy and expensive, requiring you to hire an attorney and defend yourself in court, even if you were not at fault for the accident.

Factors Influencing the Cost of Cheap Auto Insurance

While state minimum car insurance is the most affordable option, several factors can significantly impact your premium, even within the minimum coverage requirements. Understanding these factors can help you find the best deals and make informed decisions about your coverage.

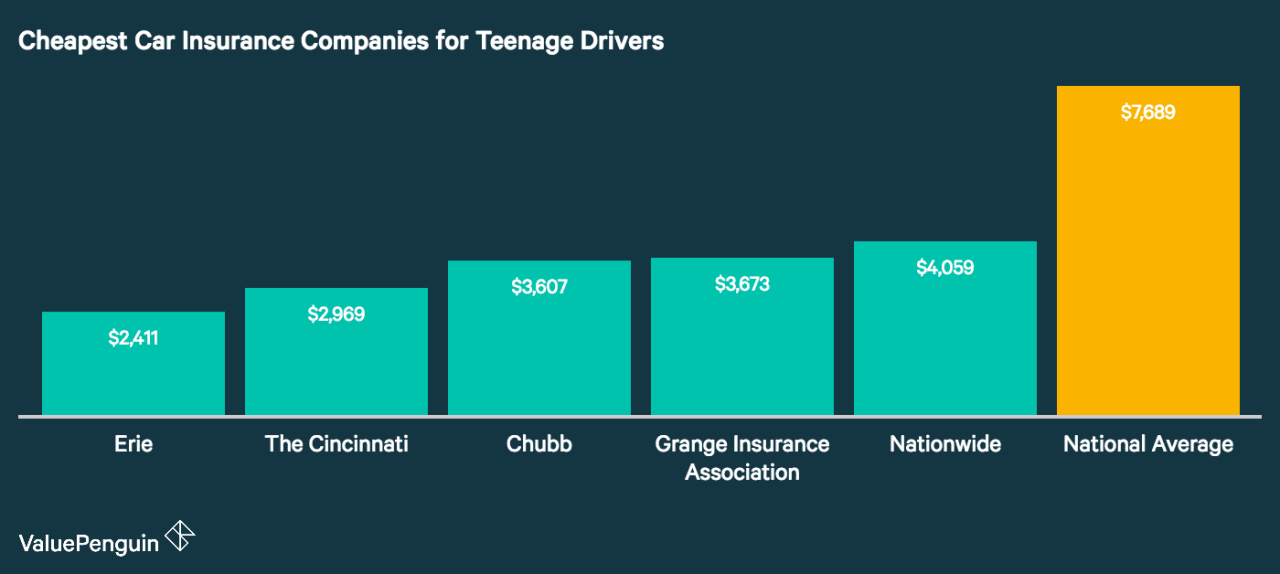

Age and Driving History

Your age and driving history are significant factors in determining your insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Therefore, they often face higher insurance rates.

- Age: Insurance companies typically charge higher premiums for younger drivers due to their higher risk of accidents. As drivers gain experience and age, their premiums tend to decrease.

- Driving History: A clean driving record with no accidents or traffic violations will usually result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your insurance costs.

Vehicle Type and Value

The type and value of your car play a significant role in your insurance premiums.

- Vehicle Type: Sports cars and high-performance vehicles are generally more expensive to insure due to their higher risk of accidents and the cost of repairs. On the other hand, smaller, less expensive vehicles often have lower insurance premiums.

- Vehicle Value: The value of your car is directly related to your insurance premium. More expensive vehicles will cost more to repair or replace, leading to higher insurance costs.

Location and Driving Habits

Where you live and how you drive also impact your insurance premiums.

- Location: Insurance rates vary significantly depending on your location. Areas with higher population density, traffic congestion, and crime rates typically have higher insurance premiums due to a greater risk of accidents.

- Driving Habits: Your driving habits, such as the number of miles you drive annually and your commuting patterns, can affect your insurance premiums. Drivers who commute long distances or frequently drive in congested areas may face higher rates due to an increased risk of accidents.

Credit Score and Insurance History

Your credit score and insurance history can also impact your insurance premiums.

- Credit Score: Many insurance companies use your credit score as a proxy for your overall financial responsibility. A good credit score can lead to lower insurance premiums, while a poor credit score can result in higher rates.

- Insurance History: Your insurance history, including any claims you have filed and your payment record, can also influence your insurance premiums. A history of frequent claims can lead to higher rates.

Exploring Alternatives to State Minimum Coverage

While state minimum auto insurance might seem appealing for its affordability, it often leaves you financially vulnerable in the event of a serious accident. Consider the benefits of exploring additional coverage options beyond the bare minimum.

Benefits of Additional Coverage

- Enhanced Financial Protection: Going beyond state minimums provides greater financial security in the event of an accident. You’ll have more coverage to handle medical bills, property damage, and other expenses, minimizing the impact on your finances.

- Peace of Mind: Knowing you have adequate insurance coverage can offer significant peace of mind. You’ll be less worried about the financial consequences of an accident, allowing you to focus on recovery or other important matters.

- Protection from Uninsured/Underinsured Drivers: Uninsured/underinsured motorist (UM/UIM) coverage is crucial. It protects you if you’re hit by a driver who lacks sufficient insurance or is uninsured entirely.

- Potential Cost Savings: While additional coverage might seem more expensive upfront, it can actually save you money in the long run. In the event of a major accident, comprehensive coverage can help you avoid costly repairs or replacement of your vehicle.

Comparison of Coverage Options

| Coverage Type | State Minimum | Comprehensive Plan |

|---|---|---|

| Bodily Injury Liability | $25,000 per person/$50,000 per accident | $100,000 per person/$300,000 per accident |

| Property Damage Liability | $10,000 per accident | $50,000 per accident |

| Collision Coverage | Not Required | Yes (covers damage to your vehicle in an accident) |

| Comprehensive Coverage | Not Required | Yes (covers damage to your vehicle from non-collision events, like theft or vandalism) |

| Uninsured/Underinsured Motorist Coverage | Not Required | Yes (protects you if hit by an uninsured or underinsured driver) |

Understanding Optional Coverages

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault. It’s crucial for newer or more expensive vehicles.

- Comprehensive Coverage: This coverage protects you from damage to your vehicle caused by events other than accidents, such as theft, vandalism, fire, or hail.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage is essential. It pays for your medical expenses and property damage if you’re hit by an uninsured or underinsured driver.

Finding Affordable Auto Insurance Options

Finding affordable auto insurance is crucial, especially when you’re on a tight budget. Fortunately, there are several strategies you can employ to lower your insurance premiums without compromising on essential coverage.

Comparing Quotes from Multiple Insurance Providers

Obtaining quotes from multiple insurance providers is a fundamental step in securing the most affordable coverage. Different insurance companies utilize varying algorithms to calculate premiums, resulting in diverse rates for the same coverage.

- Utilize online comparison websites: Platforms like Policygenius, The Zebra, and Insurance.com allow you to input your information once and receive quotes from multiple insurers simultaneously.

- Contact insurance providers directly: Reach out to individual insurance companies, including regional and national providers, to request personalized quotes.

Exploring Discounts Offered by Insurance Companies

Insurance companies often offer a range of discounts to incentivize policyholders and reduce premiums. These discounts can significantly impact your overall cost.

- Good driving record: Maintaining a clean driving record, free of accidents and traffic violations, often qualifies you for a significant discount.

- Safe driving courses: Completing defensive driving courses can demonstrate your commitment to safe driving practices and potentially lower your premiums.

- Bundling insurance policies: Combining multiple insurance policies, such as auto and homeowners or renters insurance, with the same provider can lead to substantial savings.

- Loyalty discounts: Some insurance companies reward long-term policyholders with discounts for continued loyalty.

- Payment discounts: Opting for annual or semi-annual payments instead of monthly installments can sometimes result in a discount.

- Safety features: Vehicles equipped with advanced safety features, such as anti-theft systems, airbags, and anti-lock brakes, can qualify for discounts.

Investigating Potential Savings through Bundling Insurance Policies

Bundling insurance policies, as mentioned earlier, is a common strategy to secure substantial savings. When you bundle your auto insurance with other policies, such as homeowners, renters, or life insurance, with the same provider, you often qualify for a bundled discount.

- Bundled discounts: These discounts can vary depending on the insurance company and the policies you bundle, but they can often save you 5% to 25% or more on your premiums.

- Convenience and ease: Bundling your policies can simplify your insurance management, providing a single point of contact for all your coverage needs.

Obtaining Insurance Quotes and Comparing Them Effectively

To effectively compare insurance quotes, you need to gather accurate information about your vehicle, driving history, and coverage needs.

- Gather your vehicle information: This includes your vehicle’s make, model, year, and VIN (Vehicle Identification Number).

- Provide your driving history: This includes your driving record, including any accidents or traffic violations.

- Specify your coverage needs: Clearly communicate the level of coverage you require, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Compare quotes side-by-side: Once you have received quotes from multiple insurers, compare them carefully, considering factors such as premium, deductibles, coverage limits, and discounts.

Last Point

Ultimately, choosing the right auto insurance plan involves striking a balance between affordability and adequate protection. While state minimum coverage might seem appealing at first glance, it’s essential to weigh the risks and consider your individual circumstances. By understanding the limitations of minimum coverage and exploring alternative options, you can make an informed decision that safeguards your financial well-being and provides peace of mind on the road.

Detailed FAQs

What happens if I only have state minimum coverage and cause an accident?

If you only have state minimum coverage and cause an accident, you could be held financially responsible for any damages exceeding your coverage limits. This could include medical expenses, property damage, lost wages, and legal fees. You could also face legal consequences, such as fines or even jail time, depending on the severity of the accident.

How do I know what the state minimum insurance requirements are in my area?

You can find information about state minimum insurance requirements on your state’s Department of Motor Vehicles (DMV) website or by contacting your insurance agent.

What are some ways to lower my auto insurance premiums?

There are several ways to lower your auto insurance premiums, including maintaining a good driving record, taking defensive driving courses, bundling your insurance policies, and increasing your deductible.