Cheap state minimum insurance can seem like a tempting option, especially for those on a tight budget. However, understanding the risks and limitations of this coverage is crucial. State minimum insurance requirements are designed to provide basic financial protection in the event of an accident, but they often fall short of comprehensive coverage. This guide delves into the pros and cons of cheap minimum insurance, exploring the factors that influence its cost and offering practical tips for finding affordable options that meet your individual needs.

Understanding the intricacies of state minimum insurance is essential for making informed decisions about your auto insurance. By weighing the benefits and drawbacks of different coverage options, you can ensure that you have adequate protection while staying within your budget. This guide provides valuable insights and guidance to help you navigate the complex world of auto insurance.

State Minimum Insurance Requirements

Every state in the United States has its own set of minimum insurance requirements that all drivers must comply with. These requirements are designed to ensure that drivers have adequate financial protection in case they cause an accident, protecting both themselves and others involved.

Purpose and Importance

State minimum insurance requirements serve several crucial purposes. They are designed to:

* Protect victims of accidents: By ensuring that drivers have sufficient insurance coverage, these laws help ensure that victims of accidents have access to financial compensation for their injuries, medical expenses, and property damage.

* Prevent financial hardship: In the event of an accident, drivers without insurance could face significant financial burdens, including legal fees, medical bills, and vehicle repairs. Minimum insurance requirements help mitigate these risks, protecting drivers from potentially devastating financial consequences.

* Maintain a safe driving environment: By encouraging responsible driving practices and providing financial protection for victims, minimum insurance requirements contribute to a safer driving environment for everyone.

Types of Insurance Coverage

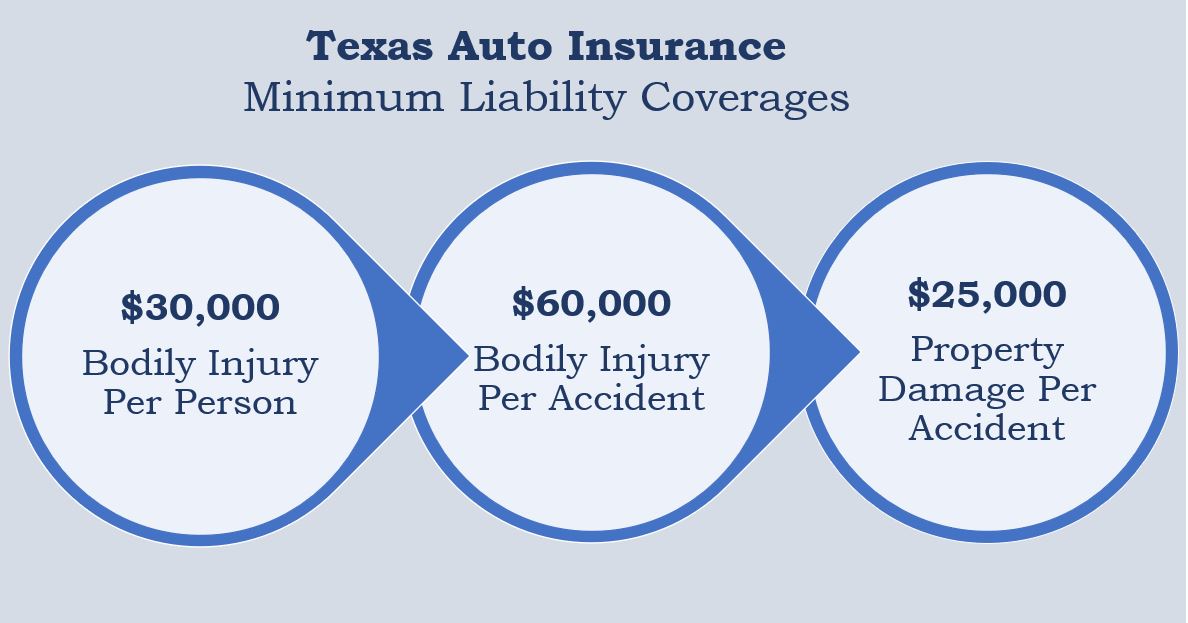

State minimum insurance requirements typically mandate coverage for the following:

* Liability Coverage: This coverage protects drivers from financial responsibility for injuries or damages caused to others in an accident. It is usually divided into two parts:

* Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries sustained by others in an accident.

* Property Damage Liability: Covers damage to another person’s vehicle or property caused by the insured driver.

* Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault.

* Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects the insured driver and passengers in the event of an accident with a driver who is uninsured or underinsured. It covers damages and injuries that the other driver’s insurance may not fully cover.

Consequences of Driving Without Insurance

Driving without the required minimum insurance can result in serious consequences, including:

* Fines and Penalties: Drivers caught operating a vehicle without insurance can face significant fines, which vary by state.

* License Suspension: States may suspend the driver’s license of individuals who fail to maintain the required insurance.

* Vehicle Impoundment: In some cases, vehicles without insurance may be impounded by law enforcement officials.

* Increased Insurance Premiums: Once a driver obtains insurance after driving without it, they may face higher premiums due to their prior lapse in coverage.

* Financial Ruin: In the event of an accident, a driver without insurance could be held personally liable for all damages and injuries, potentially leading to significant financial hardship.

Factors Influencing Minimum Insurance Costs

The cost of minimum insurance varies significantly across different states, influenced by a multitude of factors that shape the insurance market. These factors play a crucial role in determining the price individuals pay for essential coverage.

Factors Affecting Minimum Insurance Costs, Cheap state minimum insurance

Several factors contribute to the cost of minimum insurance in a particular state. These factors can be broadly categorized as:

- Population Density: Higher population density often translates to increased traffic congestion and a higher likelihood of accidents. This can lead to higher insurance premiums, as insurers face a greater risk of claims in densely populated areas.

- Accident Rates: States with higher accident rates generally have higher insurance premiums. This is because insurers have to pay out more claims in states with a greater number of accidents, leading to higher costs.

- Cost of Living: States with a higher cost of living tend to have higher insurance premiums. This is because the cost of repairing or replacing vehicles is higher in these areas, leading to higher claim payouts for insurers.

- State Regulations: State regulations can also impact minimum insurance costs. Some states have stricter regulations regarding minimum coverage requirements, which can increase the cost of insurance.

- Competition: The level of competition among insurance companies in a state can also affect insurance costs. A more competitive market generally leads to lower prices, as insurers try to attract customers with lower premiums.

Comparing Minimum Insurance Costs Across States

The cost of minimum insurance can vary significantly across different states. For example, the average cost of minimum car insurance in California is around $700 per year, while the average cost in Texas is around $400 per year. This variation can be attributed to the factors discussed above, such as population density, accident rates, and cost of living.

Impact on Individuals and Families

The cost of minimum insurance can have a significant impact on individuals and families. For those on a tight budget, high insurance premiums can be a financial burden. This can lead to difficult choices, such as choosing between paying for insurance and other essential needs. Additionally, higher insurance premiums can also impact the affordability of owning a car, particularly for lower-income families.

The Pros and Cons of Cheap Minimum Insurance

Choosing the right car insurance is crucial, and understanding the trade-offs involved in opting for minimum coverage is essential. While minimum insurance offers lower premiums, it may leave you financially vulnerable in the event of an accident. This section delves into the advantages and disadvantages of minimum insurance, shedding light on the potential risks associated with inadequate coverage.

Advantages of Minimum Insurance

Minimum insurance offers several advantages, primarily the lower cost. This affordability can be particularly beneficial for individuals with limited budgets.

- Lower Premiums: Minimum insurance policies generally have the lowest premiums compared to comprehensive coverage options. This cost savings can be significant, especially for drivers on a tight budget.

- Financial Flexibility: Opting for minimum insurance can free up more money for other expenses, such as rent, food, or debt repayment. This financial flexibility can be crucial for individuals facing financial constraints.

Disadvantages of Minimum Insurance

While minimum insurance offers lower premiums, it comes with significant drawbacks, primarily limited financial protection.

- Limited Coverage: Minimum insurance policies only cover the bare minimum requirements, leaving you financially responsible for any costs exceeding those limits. This can lead to significant out-of-pocket expenses in the event of an accident.

- Insufficient Protection: Minimum insurance may not cover damages to your own vehicle, medical expenses, or other liabilities arising from an accident. This can leave you financially vulnerable, potentially leading to significant financial hardship.

Risks Associated with Inadequate Coverage

Choosing minimum insurance can expose you to several risks, including:

- Financial Ruin: In the event of a serious accident, minimum insurance may not cover all your expenses, leaving you financially responsible for substantial costs. This can lead to financial ruin, especially if you are involved in a major accident with significant injuries or property damage.

- Legal Liability: Minimum insurance may not cover all legal liabilities arising from an accident. This could result in lawsuits and substantial financial penalties, potentially exceeding your financial capacity.

- Loss of Assets: Inadequate insurance coverage can lead to the loss of your assets, such as your vehicle or home, to cover the costs of an accident. This can have a devastating impact on your financial well-being and future prospects.

Alternatives to Minimum Insurance

While state minimum insurance provides basic financial protection, it often falls short of covering the full cost of accidents and injuries. Consider these alternative insurance options that offer more comprehensive coverage:

Liability Coverage

Liability coverage is a crucial component of car insurance that protects you financially if you are at fault in an accident. While minimum coverage is legally mandated, many drivers opt for higher liability limits to ensure sufficient financial protection in case of a major accident.

- Higher Liability Limits: Increasing your liability limits provides more financial protection for the other driver’s injuries, property damage, and legal expenses. For example, instead of the minimum $25,000 per person/$50,000 per accident, you might choose $100,000/$300,000 or even higher limits.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. It covers your medical expenses, lost wages, and property damage.

Collision and Comprehensive Coverage

Collision and comprehensive coverage protect your vehicle against damage caused by accidents and other incidents. While not required by law, these coverages can be essential for safeguarding your investment.

- Collision Coverage: Pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is particularly beneficial for newer or more expensive vehicles.

- Comprehensive Coverage: Covers damage to your vehicle caused by non-collision events such as theft, vandalism, hail, fire, or natural disasters.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, provides medical and wage loss benefits to you and your passengers, regardless of who is at fault in an accident. This coverage can help offset medical expenses and lost income while you recover.

- Medical Expenses: Covers medical bills, including doctor’s visits, hospital stays, and rehabilitation services.

- Lost Wages: Provides compensation for income lost due to injuries sustained in an accident.

Additional Coverages

Beyond the core coverages, consider these optional additions to your insurance policy:

- Rental Car Coverage: Pays for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides assistance for situations like flat tires, jump starts, and towing.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled.

Practical Tips for Finding Affordable Insurance

Finding affordable car insurance doesn’t have to be a daunting task. With a little effort and some strategic planning, you can significantly reduce your premiums and keep your wallet happy.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurance providers is the most effective way to find the best deal. Different insurers use different algorithms to calculate premiums, so you’ll likely find variations in pricing.

- Use online comparison websites: These websites allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves you time and effort.

- Contact insurers directly: While online comparison websites are convenient, it’s also a good idea to contact insurers directly. This gives you the opportunity to discuss your specific needs and ask questions about their policies.

- Consider bundling your insurance: Many insurers offer discounts for bundling multiple types of insurance, such as car and home insurance. This can save you a significant amount of money.

Maintaining a Good Driving Record

A clean driving record is essential for keeping your insurance premiums low.

- Avoid traffic violations: Traffic violations, such as speeding tickets and reckless driving, can significantly increase your insurance premiums.

- Take defensive driving courses: Defensive driving courses can help you improve your driving skills and reduce your risk of accidents. Many insurers offer discounts for completing these courses.

Factors Influencing Insurance Premiums

Several factors beyond your driving record can influence your insurance premiums. Understanding these factors can help you make informed decisions that could save you money.

- Vehicle type: The type of vehicle you drive is a major factor in determining your insurance premium. High-performance vehicles and luxury cars are typically more expensive to insure.

- Vehicle usage: How you use your vehicle also plays a role in your insurance premiums. If you drive your car frequently for long distances, your premiums will likely be higher.

- Location: Your location can also affect your insurance premiums. Insurers consider factors such as the density of population, crime rates, and the number of accidents in your area.

The Importance of Understanding Insurance Coverage: Cheap State Minimum Insurance

Choosing the cheapest minimum insurance may seem like a good way to save money, but it’s crucial to understand that this approach could leave you financially vulnerable in the event of an accident. The terms and conditions of your insurance policy are vital for ensuring adequate protection for your personal and financial well-being.

Understanding Key Concepts

Understanding key concepts in insurance policies is essential to make informed decisions about your coverage.

- Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually means lower premiums, but you’ll have to pay more if you file a claim.

- Coverage Limits: This refers to the maximum amount your insurance company will pay for a covered event. For example, liability coverage limits the amount your insurer will pay for damages to another person’s property or injuries caused by an accident.

- Exclusions: These are specific situations or events that are not covered by your insurance policy. For instance, most policies exclude coverage for intentional acts or damage caused by wear and tear.

How to Ensure Adequate Coverage

- Read the Policy Carefully: Before signing up for any insurance policy, take the time to read through the terms and conditions thoroughly. Pay close attention to the coverage limits, deductibles, and exclusions. If you don’t understand something, ask your insurance agent for clarification.

- Review Your Needs Regularly: Your insurance needs may change over time, especially as your financial situation evolves. Review your coverage periodically to ensure it still meets your current requirements.

- Consider Additional Coverage: Depending on your circumstances, you may want to consider additional coverage beyond the minimum requirements. This could include things like collision and comprehensive coverage, which can protect you from financial losses due to accidents or damage to your vehicle.

- Compare Quotes from Different Insurers: Don’t settle for the first quote you receive. Shop around and compare quotes from multiple insurance companies to find the best value for your needs.

Last Recap

Navigating the world of auto insurance can be daunting, but understanding the nuances of state minimum insurance is a crucial step in ensuring your financial well-being. While cheap minimum insurance might seem appealing, it’s essential to weigh its limitations against the potential risks. By considering your individual needs, exploring alternative options, and following practical tips for finding affordable coverage, you can make informed decisions that provide adequate protection without breaking the bank. Remember, when it comes to insurance, a little extra coverage can go a long way in protecting you and your loved ones in the event of an accident.

Detailed FAQs

What happens if I get into an accident with only state minimum insurance?

If you cause an accident and only have state minimum insurance, your coverage might not be enough to cover the other driver’s damages or injuries. You could be held personally liable for any costs exceeding your coverage limits.

Can I get a discount on my insurance if I have a good driving record?

Yes, many insurance companies offer discounts for drivers with clean driving records. Maintaining a good driving record can significantly lower your insurance premiums.

What is a deductible, and how does it affect my insurance costs?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

What are some common exclusions in insurance policies?

Insurance policies often exclude coverage for certain events, such as intentional acts, driving under the influence, or driving without a valid license. It’s essential to carefully review the exclusions in your policy to understand what is and isn’t covered.