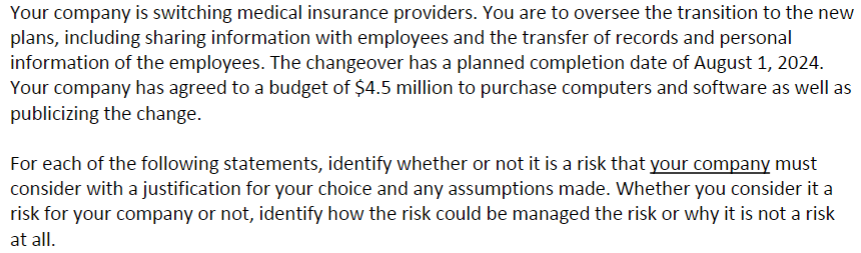

Changing insurance to another state is a common challenge faced by those relocating. Whether you’re moving for work, family, or a fresh start, navigating the complexities of insurance in a new state can be daunting. Insurance requirements, coverage options, and pricing structures vary significantly from state to state, making it essential to understand the process and make informed decisions.

This comprehensive guide will walk you through the steps involved in changing your insurance policies, providing insights into state-specific requirements, factors to consider when choosing a new provider, and potential challenges you might encounter. We’ll also explore the impact of your move on existing policies and offer valuable resources to support your transition.

Understanding the Need for Change

Moving to a new state often requires a comprehensive review of your insurance policies, as they may not be valid or sufficient in your new location. Several factors can necessitate a change in your insurance coverage, and failing to adapt your policies can have significant consequences.

Insurance Coverage May Not Be Valid

When you move to a new state, your existing insurance policies might not be valid. State regulations and requirements for insurance coverage vary widely, and what’s acceptable in one state might not be in another.

- State-Specific Requirements: Each state has its own set of insurance laws, including minimum coverage requirements for auto, homeowners, and health insurance. Your existing policies may not meet these new standards, leaving you vulnerable in case of an accident or claim.

- Non-Transferability of Policies: Some insurance policies are not transferable to other states. This is especially common with policies tied to specific locations, such as homeowners or renters insurance. You might need to obtain a new policy from an insurer licensed in your new state.

Insurance Coverage May Not Be Sufficient

Even if your existing policies are valid in your new state, they may not provide adequate coverage for your specific needs. This is particularly relevant for:

- Auto Insurance: Traffic laws, accident rates, and cost of living can vary significantly between states. Your current auto insurance coverage might not be sufficient to cover the costs associated with an accident in your new state.

- Homeowners or Renters Insurance: The value of your home or belongings, the risk of natural disasters, and the cost of rebuilding or replacing items can differ significantly between states. You may need to increase your coverage limits or add specific endorsements to your policy.

- Health Insurance: The availability and cost of health insurance plans vary significantly between states. Your current plan may not be available in your new state, or it might not cover the same services or providers. You may need to explore different plans or enroll in a state-specific marketplace.

Potential Consequences of Not Changing Insurance

Failing to update your insurance policies after relocating can have serious consequences:

- Denial of Claims: If you file a claim under an invalid or insufficient policy, your insurer may deny it, leaving you responsible for all costs.

- Legal Liability: Driving without proper auto insurance or lacking sufficient coverage for a home-related incident can lead to legal penalties and financial burdens.

- Financial Hardship: Not having adequate insurance can lead to significant out-of-pocket expenses in case of an accident or emergency. You may face difficulties covering medical bills, property damage, or legal fees.

State-Specific Insurance Requirements

Each state in the U.S. has its own unique set of insurance requirements, making it crucial to understand these differences when moving to a new state. Failure to comply with these regulations can result in fines, penalties, and even the suspension of your driver’s license.

Understanding State-Specific Insurance Requirements

It is crucial to be aware of the specific insurance requirements of the state you are moving to, as they can vary significantly. These differences can include the types of coverage mandated, the minimum coverage limits required, and specific requirements like financial responsibility laws.

Comparison of State Insurance Requirements

Here is a table comparing the key differences in insurance requirements across different states:

| State | Coverage Types | Minimum Limits | Specific Requirements |

|---|---|---|---|

| California | Liability, Uninsured/Underinsured Motorist, Property Damage | $15,000 per person/$30,000 per accident (liability), $5,000 (property damage) | Financial Responsibility Law: Requires proof of financial responsibility, such as insurance or a surety bond. |

| Texas | Liability, Uninsured/Underinsured Motorist | $30,000 per person/$60,000 per accident (liability), $25,000 (property damage) | No-Fault Insurance: Requires drivers to use their own insurance for medical expenses, regardless of fault. |

| New York | Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP) | $25,000 per person/$50,000 per accident (liability), $50,000 (property damage) | No-Fault Insurance: Requires drivers to use their own insurance for medical expenses, regardless of fault. |

It is essential to note that these are just examples, and specific requirements may vary within each state.

The Process of Changing Insurance

Switching your insurance policies after a move can seem daunting, but it’s a necessary step to ensure you’re covered in your new state. Understanding the process and following a structured approach can make the transition smoother.

Steps to Change Your Insurance

The process of changing insurance after a move typically involves these steps:

- Notify Your Current Insurers: Inform your current insurance providers about your move and the effective date of your change. This is crucial for maintaining continuity of coverage and ensuring you don’t face any gaps in your protection.

- Research New Insurance Providers: Once you’ve settled into your new state, research insurance companies that operate in your area. Compare their coverage options, pricing, and customer reviews to find the best fit for your needs.

- Obtain Quotes and Compare Policies: Contact multiple insurance providers to obtain quotes for the policies you require. Compare the coverage, deductibles, and premiums to identify the most competitive offer.

- Choose a New Insurance Provider: Select the insurance company that offers the most comprehensive coverage at a reasonable price. Ensure you understand the terms and conditions of the policy before committing.

- Cancel Existing Policies: Once you’ve secured new insurance policies, contact your old providers to cancel your existing ones. Remember to confirm the cancellation date and any outstanding payments.

- Update Your Information: Inform your new insurance provider about any changes to your contact information, vehicle details, or other relevant factors. This ensures they have accurate information for your policy.

- Receive Your New Policy Documents: You will receive your new insurance policy documents from your chosen provider. Review them carefully to ensure they meet your needs and understand the coverage details.

Checklist for Changing Insurance

Here’s a checklist to help you stay organized during the insurance change process:

- Gather all relevant insurance policy documents (car, home, health, etc.)

- Contact your current insurers to inform them about your move and request cancellation dates

- Research insurance companies in your new state and compare their coverage options and pricing

- Obtain quotes from multiple providers and compare the policies side-by-side

- Choose a new insurance provider that meets your needs and budget

- Cancel your existing policies with your old providers and confirm cancellation dates

- Update your contact information with your new insurance provider

- Review your new policy documents and ensure you understand the coverage details

Factors to Consider When Choosing New Insurance

Moving to a new state often necessitates a change in insurance policies. With a new location comes a new set of insurance requirements and a fresh opportunity to evaluate your coverage needs. This transition presents a chance to ensure your insurance aligns with your current circumstances and provides adequate protection.

Coverage Options

The first step in selecting new insurance is understanding the available coverage options. Each state has its own unique requirements, and insurance companies offer various policies to meet these needs. It’s crucial to identify the essential coverages for your situation.

- Auto Insurance: Your state’s minimum liability coverage requirements are a starting point, but consider additional options like collision, comprehensive, uninsured/underinsured motorist coverage, and medical payments coverage. These can provide greater financial protection in case of an accident.

- Homeowners or Renters Insurance: This protects your property against damage from fire, theft, natural disasters, and other covered perils. The level of coverage you need will depend on the value of your belongings and the risks in your new location.

- Health Insurance: The Affordable Care Act (ACA) mandates health insurance coverage. However, the availability of plans and their costs can vary significantly based on your location and the insurer. Explore different plan options and compare their coverage and premiums.

- Life Insurance: If you have dependents, life insurance provides financial security for them in case of your death. Consider the type of policy (term or permanent) and the coverage amount that aligns with your financial needs.

Pricing

Insurance premiums can fluctuate based on a multitude of factors, including your location, driving history, credit score, and coverage options.

- Get Multiple Quotes: Comparing quotes from different insurers is essential to find the best value for your coverage. Online comparison websites can streamline this process.

- Consider Discounts: Many insurers offer discounts for safe driving, bundling multiple policies, or having safety features in your home.

- Negotiate: Don’t hesitate to negotiate with insurers, especially if you have a good driving record or have been a loyal customer.

Customer Service

A good insurance company should offer responsive and reliable customer service.

- Read Reviews: Online reviews and ratings can provide insights into a company’s customer service track record.

- Contact Customer Support: Reach out to the insurer’s customer service department with a question or concern. This interaction can help you assess their responsiveness and helpfulness.

Financial Stability

The financial stability of an insurance company is crucial.

- Check Ratings: Independent rating agencies like A.M. Best, Moody’s, and Standard & Poor’s assign financial strength ratings to insurers. A higher rating indicates a company’s ability to meet its obligations to policyholders.

- Consider Company Size: Larger insurance companies generally have more financial resources to handle claims and potential financial setbacks.

Potential Challenges and Solutions: Changing Insurance To Another State

Changing your insurance after moving to a new state can present unique challenges. Navigating the complexities of state-specific regulations, finding the right coverage, and ensuring a smooth transition can be daunting. However, with proper planning and understanding, you can overcome these obstacles and secure the insurance protection you need in your new location.

Potential Challenges

- Coverage Gaps: Your current insurance policy might not cover all the risks in your new state, leaving you vulnerable to financial losses in the event of an accident or unforeseen circumstances.

- State-Specific Requirements: Each state has its own set of insurance regulations, including minimum coverage requirements, policy terms, and exclusions. Failing to comply with these requirements can lead to legal penalties and financial hardship.

- Finding the Right Policy: With a vast array of insurance options available, finding a policy that meets your specific needs and budget can be challenging. You may need to compare multiple providers and policies to find the best fit.

- Transitioning Coverage: Switching from one insurance provider to another can involve complex paperwork, deadlines, and potential disruptions in coverage. It’s crucial to coordinate the transition effectively to avoid gaps in protection.

- Understanding New Laws and Regulations: The insurance landscape varies significantly from state to state. Familiarizing yourself with the laws and regulations in your new state is essential to ensure you have the right coverage and avoid any legal issues.

Strategies for Overcoming Challenges

- Research State-Specific Requirements: Before moving, research the insurance regulations in your new state. This includes minimum coverage requirements for auto, homeowners, and health insurance. Understanding these requirements will help you choose the right policy from the start.

- Compare Quotes and Policies: Obtain quotes from multiple insurance providers in your new state. Compare coverage options, premiums, and policy terms to find the best value. Don’t hesitate to ask for clarification on any terms or conditions you don’t understand.

- Seek Professional Advice: Consider consulting with an insurance broker or agent in your new state. They can provide expert guidance, help you understand your options, and ensure you meet all state requirements.

- Coordinate the Transition: Contact your current insurance provider to inform them of your move and request a policy change. They may be able to help you transition your coverage seamlessly to your new location. If not, they can provide guidance on cancelling your existing policy and finding a new provider.

- Review and Update Coverage: Once you have moved, review your new insurance policy to ensure it meets your current needs. Consider updating your coverage if necessary, especially if your circumstances have changed since your move.

Role of Insurance Brokers and Agents, Changing insurance to another state

Insurance brokers and agents can play a crucial role in helping you navigate the challenges of changing insurance after a move. They can:

- Provide Expert Guidance: Brokers and agents have in-depth knowledge of insurance laws, regulations, and market trends in your new state. They can offer personalized advice and help you understand your options.

- Compare Quotes and Policies: Brokers and agents have access to a wide range of insurance providers and can compare quotes and policies on your behalf. This can save you time and effort in finding the best fit.

- Facilitate the Transition: Brokers and agents can help you coordinate the transition from your old insurance policy to a new one. They can handle paperwork, communicate with providers, and ensure a smooth process.

- Negotiate Coverage and Premiums: Brokers and agents can leverage their expertise to negotiate better coverage and premiums on your behalf. They may be able to secure discounts or special offers that you might not be able to access on your own.

- Provide Ongoing Support: Brokers and agents can provide ongoing support and advice even after you have chosen a new insurance policy. They can help you understand your policy, file claims, and address any questions or concerns you may have.

Impact on Existing Policies

Moving to a new state can significantly impact your existing insurance policies, particularly car insurance, health insurance, and homeowners insurance. The new state’s regulations and laws may differ from your previous state, requiring you to adjust or even cancel your existing policies.

Policy Adjustments and Cancellations

It’s crucial to understand that your current insurance policies may not be valid in your new state. Some policies might require adjustments to comply with the new state’s regulations, while others might need to be canceled altogether.

Car Insurance

Your car insurance policy may need adjustments due to changes in:

* Minimum Coverage Requirements: Each state mandates minimum coverage levels for liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. These requirements can vary significantly between states.

* Driving Laws: Your new state might have different traffic laws, such as stricter penalties for certain violations, which could affect your insurance premiums.

* Vehicle Registration: Your car registration may need to be updated to reflect your new state of residence.

* Driver’s License: You may need to obtain a new driver’s license from your new state.

Health Insurance

Your health insurance coverage might be affected by:

* State-Specific Health Insurance Exchanges: Many states have their own health insurance marketplaces, known as exchanges, where individuals can purchase health insurance plans. You might need to enroll in a new plan through your new state’s exchange.

* Coverage Networks: The network of doctors, hospitals, and healthcare providers covered by your health insurance plan may be different in your new state.

* Pre-existing Conditions: Some states have different regulations regarding coverage for pre-existing conditions, so you might need to review your policy to ensure it aligns with your new state’s laws.

Homeowners Insurance

Your homeowners insurance policy may require adjustments due to:

* Coverage Limits: The minimum coverage limits for homeowners insurance can vary between states.

* Peril Coverage: The specific perils covered by your homeowners insurance policy may differ based on the risks associated with your new state’s climate and environment.

* Building Codes: Your new state may have different building codes, which could impact the cost of rebuilding your home in case of a covered loss.

Notifying Insurance Providers

It’s essential to inform your insurance providers about your move as soon as possible. This allows them to:

* Assess the Impact: They can review your existing policies and determine if any adjustments are necessary.

* Provide Guidance: They can guide you through the process of updating your policies or finding new coverage options.

* Ensure Continuity: They can help you maintain coverage without any gaps in your insurance.

Resources and Support

Navigating the process of changing insurance after a move can feel overwhelming, but numerous resources are available to provide guidance and support. From government websites to insurance providers and consumer advocacy organizations, there are many avenues to access the information and assistance you need.

Government Websites

Government websites offer valuable information about insurance requirements and regulations. These resources can help you understand your state’s specific rules and ensure you comply with legal obligations.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that serves as a resource for state insurance regulators. Their website provides access to information about insurance regulations, consumer protection, and industry trends. You can find state-specific information on the NAIC website, including contact information for your state’s insurance department. https://www.naic.org/

- State Insurance Departments: Each state has its own insurance department responsible for regulating insurance companies and protecting consumers. Their websites often provide information about insurance requirements, consumer complaints, and licensing. You can find your state’s insurance department website through the NAIC website or by searching online.

Insurance Provider Resources

Insurance providers offer a range of resources to help customers understand their policies and make informed decisions. These resources can be valuable when changing insurance after a move.

- Customer Service Representatives: Insurance companies typically have dedicated customer service representatives who can answer questions about policies, coverage, and the process of changing insurance. You can reach out to your current insurer or a potential new insurer by phone, email, or online chat.

- Website Resources: Many insurance providers have comprehensive websites that provide information about their policies, coverage options, and frequently asked questions. You can often find online tools and calculators to compare quotes, estimate costs, and manage your policy online.

- Brochures and Fact Sheets: Insurance companies often provide brochures and fact sheets that explain their policies and coverage in detail. These resources can be helpful for understanding your policy’s terms and conditions and making informed decisions about your insurance needs.

Consumer Advocacy Organizations

Consumer advocacy organizations play a crucial role in protecting consumers’ rights and providing support in navigating complex situations like changing insurance. These organizations can offer unbiased advice and help resolve disputes with insurance companies.

- National Consumer Law Center (NCLC): The NCLC is a non-profit organization that advocates for consumer rights and provides resources for consumers facing legal challenges. Their website offers information about insurance, consumer protection, and legal rights. https://www.nclc.org/

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of products and services, including insurance. Their website offers information about insurance companies, coverage options, and consumer tips. https://www.consumerreports.org/

Insurance Brokers and Agents

Insurance brokers and agents can provide valuable guidance and support throughout the process of changing insurance. They can help you compare quotes, understand different coverage options, and choose the best insurance plan for your needs.

- Independent Insurance Brokers: Independent brokers represent multiple insurance companies, allowing them to compare quotes and find the best options for their clients. They can provide unbiased advice and help you navigate the insurance market.

- Insurance Agents: Insurance agents typically represent a single insurance company. While they may not have the same breadth of options as independent brokers, they can provide specialized knowledge about their company’s products and services.

Wrap-Up

Relocating and changing your insurance policies can be a stressful process, but with careful planning and understanding, it can be a smooth transition. By following the steps Artikeld in this guide, you can ensure your insurance needs are met in your new state, providing peace of mind and financial protection. Remember to compare quotes, research different providers, and consult with insurance brokers or agents for personalized guidance. With the right approach, you can navigate this change with confidence and ease.

Q&A

What happens to my existing insurance policies when I move to a new state?

Your existing insurance policies may need adjustments or cancellation depending on the type of insurance and the requirements of your new state. For example, your car insurance policy may need to be updated to reflect the new state’s coverage requirements.

Do I need to notify my insurance provider about my move?

Yes, it’s crucial to notify your insurance provider about your move as soon as possible. Failure to do so could result in coverage gaps or policy cancellations.

How can I find insurance brokers or agents in my new state?

You can find insurance brokers or agents in your new state through online directories, recommendations from friends or family, or by contacting your current insurance provider for referrals.

What resources are available to help me understand insurance requirements in my new state?

Your new state’s Department of Insurance website is a valuable resource for information on insurance requirements, coverage options, and consumer protection laws.