Certificate of liability insurance state farm – Certificate of liability insurance from State Farm is a vital document that demonstrates financial protection against potential risks. This certificate verifies that an individual or business has purchased adequate liability insurance coverage, offering reassurance to clients, partners, and stakeholders. It plays a crucial role in safeguarding businesses from financial repercussions stemming from lawsuits, accidents, or incidents involving third parties.

Understanding the intricacies of certificate of liability insurance from State Farm empowers individuals and businesses to navigate legal and financial landscapes confidently. This guide explores the purpose, components, and significance of this essential insurance document, offering insights into its role in risk management and business operations.

Understanding Certificate of Liability Insurance

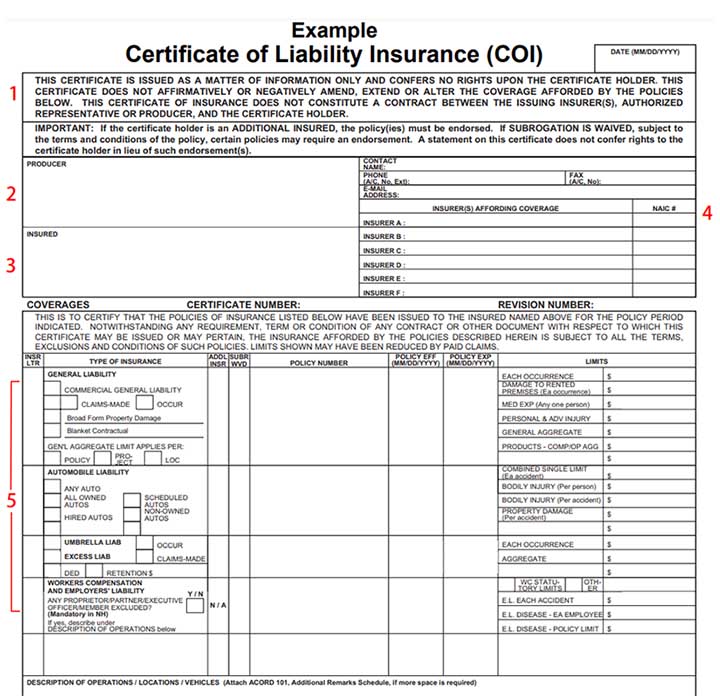

A Certificate of Liability Insurance, often shortened to “Certificate of Insurance” or “COI,” is a crucial document that verifies the existence and coverage details of a liability insurance policy. It serves as proof that an individual or entity has the required insurance coverage to protect against potential financial losses arising from specific risks.

Purpose of a Certificate of Liability Insurance

The primary purpose of a Certificate of Liability Insurance is to provide assurance to third parties that the insured party is financially responsible for any damages or injuries they might cause. This assurance is essential in various situations, particularly when contractual agreements or legal requirements necessitate proof of insurance coverage.

Key Elements Typically Included in a Certificate of Liability Insurance

- Policyholder Information: The name and address of the individual or entity holding the insurance policy.

- Insurance Company Information: The name and contact information of the insurance company issuing the policy.

- Policy Number: A unique identifier for the specific insurance policy.

- Coverage Details: Information about the types of liability coverage provided, including limits of liability, deductibles, and exclusions.

- Effective Dates: The start and end dates of the insurance policy’s coverage period.

- Named Insured: The specific individuals or entities covered under the policy.

- Additional Insured: Any third parties specifically listed as being covered by the policy.

- Certificate Holder: The party requesting the certificate, who may be a client, contractor, or other stakeholder.

Situations Where a Certificate of Liability Insurance Is Required

A Certificate of Liability Insurance is often required in the following situations:

- Commercial Leases: Landlords may require tenants to provide proof of liability insurance to protect themselves from potential claims related to tenant activities.

- Construction Projects: General contractors often require subcontractors to provide certificates of liability insurance to ensure financial protection against accidents or injuries on the job site.

- Event Planning: Event organizers may need to provide certificates of liability insurance to venues, vendors, and other parties involved to demonstrate financial responsibility for potential incidents.

- Professional Services: Professionals such as lawyers, doctors, and engineers may be required to provide certificates of liability insurance to their clients as proof of financial protection against malpractice claims.

- Government Contracts: Government agencies often require contractors to provide certificates of liability insurance as a condition of awarding contracts.

State Farm’s Role in Liability Insurance

State Farm is a major player in the insurance industry, offering a comprehensive range of liability insurance policies to individuals and businesses. Their commitment to providing reliable coverage and excellent customer service has made them a trusted name in the insurance world.

Types of Liability Insurance Policies Offered by State Farm

State Farm offers a variety of liability insurance policies tailored to different needs and situations. These policies provide financial protection against claims arising from accidents or incidents that cause bodily injury, property damage, or other forms of harm.

- Auto Insurance: State Farm’s auto insurance policies include liability coverage that protects policyholders against financial losses resulting from accidents involving their vehicles. This coverage extends to bodily injury and property damage to others, as well as legal expenses incurred in defending against claims.

- Homeowners Insurance: Homeowners insurance policies issued by State Farm typically include liability coverage that protects homeowners against claims arising from accidents or incidents occurring on their property. This coverage can extend to bodily injury, property damage, and personal liability claims.

- Renters Insurance: Renters insurance policies offered by State Farm provide liability coverage that protects renters against claims arising from accidents or incidents occurring within their rented premises. This coverage can include protection against claims for bodily injury, property damage, and personal liability.

- Business Insurance: State Farm provides various business insurance policies, including general liability insurance, which protects businesses against claims arising from accidents or incidents that occur during the course of their operations. This coverage can include protection against claims for bodily injury, property damage, and advertising injury.

How State Farm Issues Certificates of Liability Insurance, Certificate of liability insurance state farm

A certificate of liability insurance is a formal document that confirms the existence and scope of liability coverage for a specific policyholder. State Farm issues these certificates to policyholders upon request.

Requesting a Certificate of Liability Insurance from State Farm

Requesting a certificate of liability insurance from State Farm is a straightforward process. Policyholders can typically request a certificate online through their State Farm account, by phone, or by contacting their insurance agent.

- Online: Many State Farm policyholders can access their accounts online and request certificates through the website. This option is often the most convenient and efficient method.

- Phone: Policyholders can also request certificates by calling State Farm’s customer service line. They will need to provide their policy information and details about the certificate they require.

- Insurance Agent: Policyholders can contact their State Farm insurance agent directly to request a certificate. Agents are familiar with the process and can assist with any questions or concerns.

Importance of a Certificate of Liability Insurance

A certificate of liability insurance is a crucial document that Artikels the coverage provided by an insurance policy. It serves as proof of financial protection in case of accidents or incidents involving the insured party.

Legal Implications of Not Providing a Valid Certificate of Liability Insurance

In many cases, providing a valid certificate of liability insurance is a legal requirement. Failure to do so can result in serious legal consequences, including:

- Contractual breaches: Many contracts, such as leases, construction agreements, or event contracts, require proof of liability insurance. Failing to provide a valid certificate can lead to contract termination, penalties, or even legal action.

- License revocation: Certain professions, such as contractors, require liability insurance to obtain a license. Not having valid coverage can lead to license suspension or revocation, preventing individuals from conducting business legally.

- Financial penalties: Depending on the jurisdiction and circumstances, individuals or businesses might face fines or other financial penalties for not having the required liability insurance.

- Legal liability: In the event of an accident or incident, not having adequate liability insurance can expose individuals or businesses to significant financial losses, including legal fees, medical expenses, and property damage claims.

Consequences of Insufficient Coverage Compared to Adequate Coverage

Having insufficient coverage can leave individuals or businesses financially vulnerable in the event of an accident or incident. Here’s a comparison:

| Insufficient Coverage | Adequate Coverage |

|---|---|

| Limited financial protection, leaving the insured party responsible for exceeding coverage limits. | Full financial protection, ensuring the insured party is financially shielded from significant losses. |

| Potential for personal assets to be at risk to cover claims. | Protection of personal assets, preventing financial hardship due to claims. |

| Increased financial burden, potentially leading to bankruptcy or financial instability. | Peace of mind, knowing that the insured party is financially protected. |

Potential Financial Risks Associated with Not Having Liability Insurance

Without liability insurance, individuals or businesses face significant financial risks, including:

- Medical expenses: In the event of an accident causing injuries, the insured party could be held liable for medical expenses, potentially amounting to thousands or even millions of dollars.

- Property damage: If an accident causes damage to property, the insured party could be responsible for repair or replacement costs, which can be substantial.

- Legal fees: Defending against lawsuits can be costly, with legal fees quickly adding up. Without insurance, the insured party would be responsible for these expenses.

- Loss of income: Accidents can lead to lost wages and business disruption, impacting the insured party’s financial stability. Liability insurance can help mitigate these losses.

- Reputational damage: Negative publicity surrounding an accident can damage an individual’s or business’s reputation, impacting future opportunities and financial prospects.

Certificate of Liability Insurance and Business Operations

A certificate of liability insurance is an essential tool for businesses of all sizes. It provides financial protection against lawsuits arising from accidents, injuries, or property damage caused by the business or its employees. This certificate demonstrates to clients, partners, and other stakeholders that the business is financially responsible and can cover potential liabilities.

Protection from Lawsuits

A certificate of liability insurance protects businesses from lawsuits by providing financial coverage for legal expenses, settlements, and judgments. For instance, if a customer is injured on business premises due to negligence, the insurance policy would cover the legal fees and any financial compensation awarded to the injured party. This coverage helps businesses avoid significant financial losses and potential bankruptcy resulting from lawsuits.

Securing Contracts and Partnerships

Many contracts and partnerships require businesses to provide proof of liability insurance. This requirement ensures that both parties are protected from financial risks associated with potential liabilities. For example, a construction company may require a certificate of liability insurance from its subcontractors to ensure that they can cover any damages caused during a project. This practice safeguards the main contractor from potential lawsuits and financial burdens.

Mitigating Risks

Businesses can use certificates of liability insurance to mitigate risks associated with their operations. For instance, a restaurant may purchase liability insurance to cover potential injuries to customers caused by food poisoning or slips and falls. This insurance policy helps the restaurant avoid financial losses and maintain its reputation in the event of an incident.

“A certificate of liability insurance is a vital document that demonstrates a business’s commitment to financial responsibility and risk management.”

Understanding Liability Insurance Coverage: Certificate Of Liability Insurance State Farm

Liability insurance protects individuals and businesses from financial losses arising from claims of negligence or wrongdoing. State Farm offers a variety of liability insurance policies to meet diverse needs, providing coverage for various potential risks.

Types of Liability Insurance Coverage Offered by State Farm

State Farm offers several types of liability insurance, each tailored to specific situations and risks. Here is a table outlining the different types of liability insurance coverage offered by State Farm:

| Type of Liability Insurance | Description |

|---|---|

| General Liability Insurance | Protects businesses against claims of negligence or property damage caused by their operations. |

| Professional Liability Insurance (Errors and Omissions) | Covers professionals, such as doctors, lawyers, and accountants, against claims of negligence or errors in their services. |

| Product Liability Insurance | Protects manufacturers and sellers against claims arising from defective products. |

| Auto Liability Insurance | Covers individuals and businesses for damages caused by their vehicles in accidents. |

| Umbrella Liability Insurance | Provides additional coverage beyond the limits of other liability policies, offering broader protection. |

Coverage Limits and Premiums for Liability Insurance Policies

The coverage limits and premiums associated with liability insurance policies vary depending on factors such as the type of policy, the insured’s risk profile, and the coverage amount. Here is a table comparing the coverage limits and premiums for various liability insurance policies:

| Type of Liability Insurance | Coverage Limit | Premium |

|---|---|---|

| General Liability Insurance | $1 million per occurrence, $2 million aggregate | $500-$2,000 per year |

| Professional Liability Insurance | $1 million per claim, $3 million aggregate | $1,000-$5,000 per year |

| Product Liability Insurance | $1 million per occurrence, $2 million aggregate | $1,500-$5,000 per year |

| Auto Liability Insurance | $25,000 per person, $50,000 per accident | $500-$1,500 per year |

| Umbrella Liability Insurance | $1 million-$10 million | $500-$2,000 per year |

General Liability Insurance vs. Professional Liability Insurance

General liability insurance and professional liability insurance are distinct types of coverage, each addressing specific risks. General liability insurance provides protection against claims of negligence or property damage arising from a business’s operations. For example, a restaurant might need general liability insurance to cover claims from a customer who slips and falls due to a wet floor.

Professional liability insurance, also known as errors and omissions (E&O) insurance, specifically covers professionals against claims of negligence or errors in their services. For instance, a lawyer might need professional liability insurance to cover claims from a client who alleges that the lawyer made a mistake during their representation.

The key difference between general liability insurance and professional liability insurance lies in the nature of the risks covered. General liability insurance covers broader risks associated with business operations, while professional liability insurance focuses on risks related to professional services.

Factors Influencing Certificate of Liability Insurance Costs

The cost of liability insurance premiums is influenced by various factors, each contributing to the overall risk assessment and premium calculation. Understanding these factors can help businesses make informed decisions regarding their insurance needs and minimize costs.

Factors Influencing Premium Costs

The premium for liability insurance is influenced by a combination of factors that assess the risk associated with the insured entity. Here are some key factors:

- Industry and Business Type: Certain industries are inherently riskier than others, leading to higher premiums. For example, construction companies face higher risks compared to office-based businesses. The specific type of business within an industry also plays a role. For instance, a construction company specializing in high-rise buildings may have a higher premium compared to one focusing on residential projects.

- Location: Geographic location significantly impacts premiums due to factors such as crime rates, natural disaster risks, and traffic congestion. Areas with higher crime rates or more frequent natural disasters typically have higher insurance premiums.

- Business Size: The size of a business, measured by factors like revenue, number of employees, and assets, influences premium costs. Larger businesses with more employees and assets generally face higher premiums due to increased potential liability exposure.

- Claims History: A business’s past claims history is a critical factor in determining premiums. Businesses with a history of frequent or high-value claims are likely to face higher premiums as they are considered higher risk.

- Safety Measures and Risk Management Practices: Businesses that implement strong safety measures and proactive risk management practices are often rewarded with lower premiums. These practices demonstrate a commitment to minimizing liability exposure and reducing the likelihood of claims.

- Coverage Limits and Deductibles: The level of coverage chosen and the deductible amount selected can significantly impact premiums. Higher coverage limits, which provide greater financial protection in case of a claim, typically lead to higher premiums. Similarly, lower deductibles, which require the insurer to pay a larger portion of the claim, also result in higher premiums.

Relationship Between Coverage Level and Cost

The level of coverage chosen directly influences the cost of liability insurance. Higher coverage limits, offering greater financial protection in case of a claim, generally lead to higher premiums. This is because the insurer assumes a greater financial responsibility for potential losses. Businesses should carefully consider their risk profile and financial capacity when determining the appropriate coverage level to balance protection and affordability.

Influence of Industry, Location, and Business Size

- Industry: As mentioned earlier, different industries have varying risk profiles. Industries with higher inherent risks, such as construction or manufacturing, typically face higher premiums compared to industries with lower risks, such as retail or services. For example, a construction company is more likely to face claims related to accidents or injuries on construction sites, leading to higher premiums.

- Location: The geographic location of a business can significantly impact its liability insurance premiums. Areas with higher crime rates, more frequent natural disasters, or heavy traffic congestion typically have higher premiums. For instance, a business located in a high-crime area may face a higher risk of theft or vandalism, leading to increased premiums.

- Business Size: Larger businesses with more employees and assets generally face higher premiums due to increased potential liability exposure. The greater number of employees and assets increases the potential for accidents, injuries, or property damage, leading to higher premiums.

Certificate of Liability Insurance and Risk Management

A certificate of liability insurance is a vital tool for effective risk management, ensuring businesses are adequately protected against potential financial losses arising from accidents, injuries, or property damage. By obtaining a certificate, businesses demonstrate their commitment to responsible practices and mitigate potential risks associated with their operations.

The Role of Risk Assessment in Determining Liability Insurance Coverage

Risk assessment is crucial in determining the appropriate level of liability insurance coverage. Businesses should conduct a thorough analysis of their operations, identifying potential hazards and the likelihood of incidents occurring. This assessment helps determine the amount of coverage needed to adequately address potential financial liabilities.

A comprehensive risk assessment helps businesses identify potential liabilities, enabling them to secure the right amount of liability insurance coverage, thereby minimizing financial risks.

- Identifying potential hazards: Businesses should identify potential hazards in their operations, such as slips, trips, and falls, product defects, or environmental damage. This analysis helps determine the potential for accidents and injuries.

- Assessing the likelihood of incidents: By analyzing historical data and industry trends, businesses can estimate the likelihood of incidents occurring. This helps prioritize risk mitigation strategies and determine the level of insurance coverage needed.

- Determining the potential financial impact: Businesses should estimate the potential financial impact of incidents, considering factors such as medical expenses, legal fees, and property damage. This helps determine the amount of insurance coverage needed to adequately address potential liabilities.

Utilizing Certificates of Liability Insurance to Proactively Manage Potential Risks

Businesses can utilize certificates of liability insurance to proactively manage potential risks. By demonstrating their commitment to risk mitigation, businesses can build trust with clients, partners, and stakeholders.

- Meeting contractual requirements: Many contracts require businesses to provide proof of liability insurance coverage. Obtaining a certificate ensures compliance with these contractual obligations, protecting the business from potential legal disputes.

- Protecting business assets: Liability insurance coverage protects business assets, such as property, equipment, and financial resources, from financial losses resulting from accidents or incidents.

- Maintaining business operations: In the event of an accident or incident, liability insurance coverage helps businesses maintain their operations, minimizing disruptions and ensuring continuity.

- Enhancing business reputation: By demonstrating a commitment to risk management and obtaining appropriate insurance coverage, businesses can enhance their reputation and build trust with clients and stakeholders.

Closing Notes

In conclusion, a certificate of liability insurance from State Farm serves as a cornerstone of risk management, providing peace of mind for individuals and businesses alike. It demonstrates financial responsibility, protects against legal liabilities, and fosters trust in professional relationships. By understanding the intricacies of certificate of liability insurance, individuals and businesses can navigate the complexities of potential risks with greater confidence and security.

FAQ Summary

How long is a certificate of liability insurance valid for?

The validity period of a certificate of liability insurance varies depending on the policy terms. It’s typically tied to the policy’s renewal date.

What happens if I don’t have a certificate of liability insurance?

Failing to provide a valid certificate of liability insurance can lead to legal consequences, contract breaches, and financial losses.

Can I get a certificate of liability insurance online?

State Farm offers online tools and resources for requesting certificates of liability insurance.

What are the different types of liability insurance offered by State Farm?

State Farm offers various types of liability insurance, including general liability, professional liability, and product liability.