Car insurance rates in Washington state can vary widely depending on several factors, including your driving history, age, vehicle type, and location. Understanding these factors is crucial for finding the best insurance policy for your needs and budget.

This comprehensive guide delves into the intricacies of car insurance rates in Washington, exploring key factors, average premiums, available discounts, and tips for choosing the right policy. We’ll also discuss important regulations and resources to help you navigate the insurance landscape in the state.

Factors Influencing Car Insurance Rates in Washington State

Car insurance rates in Washington State are influenced by a variety of factors, which insurance companies use to assess the risk associated with insuring a particular driver. These factors are carefully considered to ensure that premiums reflect the likelihood of accidents and the potential costs associated with them.

Driving History

A driver’s history is a significant factor in determining car insurance rates. Insurance companies analyze past driving behavior to assess the risk of future accidents. This includes:

- Accidents: Drivers with a history of accidents typically pay higher premiums due to the increased likelihood of future accidents. The severity of the accident and the driver’s fault are also considered.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations demonstrate a disregard for traffic laws, indicating a higher risk of accidents. These violations can significantly increase insurance premiums.

- Driving Record: A clean driving record with no accidents or violations is a major factor in securing lower insurance rates.

Age

Age is another crucial factor that affects car insurance rates. Younger drivers, especially those under 25, tend to have higher premiums. This is due to their lack of experience, higher risk-taking behavior, and statistically higher accident rates. As drivers age and gain experience, their rates typically decrease.

- Teen Drivers: Young drivers with limited experience and less mature judgment face the highest insurance premiums.

- Mature Drivers: Drivers over the age of 65 often experience lower premiums, as they have more experience and tend to have fewer accidents.

Vehicle Type

The type of vehicle you drive plays a role in determining your insurance rates.

- Vehicle Value: More expensive vehicles are typically more costly to repair or replace, resulting in higher insurance premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are considered safer and may qualify for lower insurance rates.

- Vehicle Performance: High-performance vehicles, such as sports cars, are often associated with higher accident risks and therefore have higher premiums.

Location

Where you live significantly impacts your car insurance rates.

- Population Density: Areas with higher population density generally have more traffic and a higher risk of accidents, leading to higher premiums.

- Crime Rates: Locations with higher crime rates may see increased insurance premiums due to the higher risk of theft or vandalism.

- Weather Conditions: Regions with harsh weather conditions, such as heavy snow or frequent hailstorms, can contribute to higher insurance premiums due to the increased risk of accidents.

Credit Score

In Washington State, credit score is not a factor in determining car insurance rates.

Note: While credit score is used in some states for insurance pricing, Washington is one of the states that prohibits its use.

Average Car Insurance Rates in Washington State

Car insurance rates in Washington state can vary significantly depending on several factors, including your driving history, vehicle type, location, and coverage options. Understanding the average rates can help you get a better idea of what to expect when shopping for car insurance.

Average Car Insurance Premiums in Washington

The average annual car insurance premium in Washington state is around $1,600. However, this figure can fluctuate based on individual driver profiles. Here’s a breakdown of average rates for different driver categories:

- Good Drivers: Drivers with clean driving records and no accidents or violations typically pay lower premiums, averaging around $1,300 per year.

- High-Risk Drivers: Drivers with a history of accidents, speeding tickets, or DUI convictions can expect to pay significantly higher premiums, often exceeding $2,000 per year.

- Young Drivers: Young drivers, especially those under 25, are generally considered higher risk due to their inexperience. Their average premiums can range from $1,800 to $2,500 per year.

- Senior Drivers: While senior drivers may have more experience, their health conditions or slower reaction times can sometimes lead to higher premiums, averaging around $1,500 per year.

Average Car Insurance Rates by Vehicle Type

The type of vehicle you drive also influences your car insurance premiums.

- Sedans: Sedans are generally considered safer and less expensive to repair than SUVs or trucks, resulting in lower average premiums, typically around $1,400 per year.

- SUVs: SUVs are often larger and heavier than sedans, making them more expensive to repair in case of an accident. Their average premiums are higher, around $1,700 per year.

- Trucks: Trucks are known for their higher towing capacity and off-road capabilities, which can increase their repair costs. Their average premiums are the highest among the three, averaging around $1,900 per year.

Comparison with National Averages

Car insurance rates in Washington state are generally higher than the national average. According to the National Association of Insurance Commissioners (NAIC), the average annual car insurance premium in the United States is around $1,400. This means that drivers in Washington typically pay around $200 more per year for car insurance.

Average Car Insurance Rates in Major Cities

Car insurance rates can vary significantly depending on the city you live in. Here are some examples of average annual premiums in major cities in Washington:

| City | Average Annual Premium |

|---|---|

| Seattle | $1,800 |

| Spokane | $1,500 |

| Tacoma | $1,600 |

| Bellevue | $1,700 |

It’s important to note that these are just average figures and your actual premiums may vary depending on your individual circumstances.

Car Insurance Discounts Available in Washington State

Lowering your car insurance costs is a priority for many drivers. Washington State offers a range of discounts to help you save money on your premiums. Understanding these discounts and how to qualify can significantly impact your overall insurance expenses.

Common Car Insurance Discounts

Car insurance companies in Washington state offer a variety of discounts to policyholders who meet certain criteria. These discounts can significantly reduce your premiums, making car insurance more affordable.

- Safe Driver Discount: This is one of the most common discounts offered by insurance companies. It rewards drivers who have a clean driving record, with no accidents or traffic violations. The discount amount varies based on the driver’s driving history and the insurer’s policy.

- Good Student Discount: This discount is available to students who maintain a high GPA. Insurance companies often offer this discount to recognize students’ responsible behavior and commitment to academics.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount. This discount is typically a percentage off the total premium for all insured vehicles.

- Anti-theft Device Discount: Installing anti-theft devices in your car can deter theft and reduce your insurance costs. Insurance companies often offer discounts for cars equipped with alarms, immobilizers, or GPS tracking systems.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices. Insurance companies may offer discounts to drivers who have successfully completed such courses.

- Loyalty Discount: Some insurance companies reward long-term customers with loyalty discounts. These discounts are often offered after a certain number of years with the same insurer.

- Paperless Billing Discount: Opting for electronic billing instead of paper statements can help insurance companies save on printing and mailing costs. This cost savings is often passed on to customers through a paperless billing discount.

- Bundling Discount: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in a bundled discount. Insurance companies often offer this discount to encourage customers to consolidate their insurance needs with one provider.

Table of Car Insurance Discounts, Car insurance rates in washington state

This table summarizes common car insurance discounts in Washington State, including their eligibility criteria and potential savings.

| Discount Type | Eligibility Criteria | Potential Savings |

|---|---|---|

| Safe Driver Discount | Clean driving record, no accidents or violations | 5-20% |

| Good Student Discount | High GPA, typically 3.0 or higher | 5-15% |

| Multi-Car Discount | Insuring multiple vehicles with the same company | 10-25% |

| Anti-theft Device Discount | Installation of anti-theft devices | 5-10% |

| Defensive Driving Course Discount | Completion of a defensive driving course | 5-10% |

| Loyalty Discount | Long-term customer with the same insurer | 5-10% |

| Paperless Billing Discount | Opting for electronic billing | 2-5% |

| Bundling Discount | Combining car insurance with other policies | 10-20% |

Comparing Discount Availability and Benefits

The availability and benefits of car insurance discounts can vary significantly between insurance companies. It’s important to compare quotes from multiple insurers to find the best deals.

- Safe Driver Discounts: Most insurance companies offer safe driver discounts, but the specific criteria and discount amounts can vary.

- Good Student Discounts: While most insurance companies offer good student discounts, the eligibility requirements, such as the minimum GPA, may differ.

- Multi-Car Discounts: Multi-car discounts are widely available, but the percentage discount can vary depending on the number of vehicles insured and the insurer’s policy.

Unique Discounts in Washington State

Washington State does not have any unique car insurance discounts that are not offered in other states. However, it’s important to check with individual insurance companies for any special promotions or discounts they may offer.

Choosing the Right Car Insurance in Washington State

Finding the right car insurance policy in Washington State can be a daunting task, but it’s essential for protecting yourself financially in case of an accident. By carefully considering your needs, comparing options, and utilizing available discounts, you can secure the best coverage at a reasonable price.

Comparing Different Car Insurance Coverages

Different types of car insurance coverage offer varying levels of protection. Understanding the differences can help you choose the right combination for your situation.

- Liability Coverage: This is the most basic type of car insurance, legally required in Washington State. It covers damages to other people’s property or injuries you cause in an accident. It is usually expressed as a limit, such as 25/50/10, which means $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of who is at fault. This is optional, but it’s often a good idea if you have a newer car or a loan on your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, or natural disasters. It’s optional, but it’s recommended if you have a newer or more expensive car.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It can cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages if you are injured in an accident, regardless of fault. It’s optional, but it can be a valuable addition to your coverage.

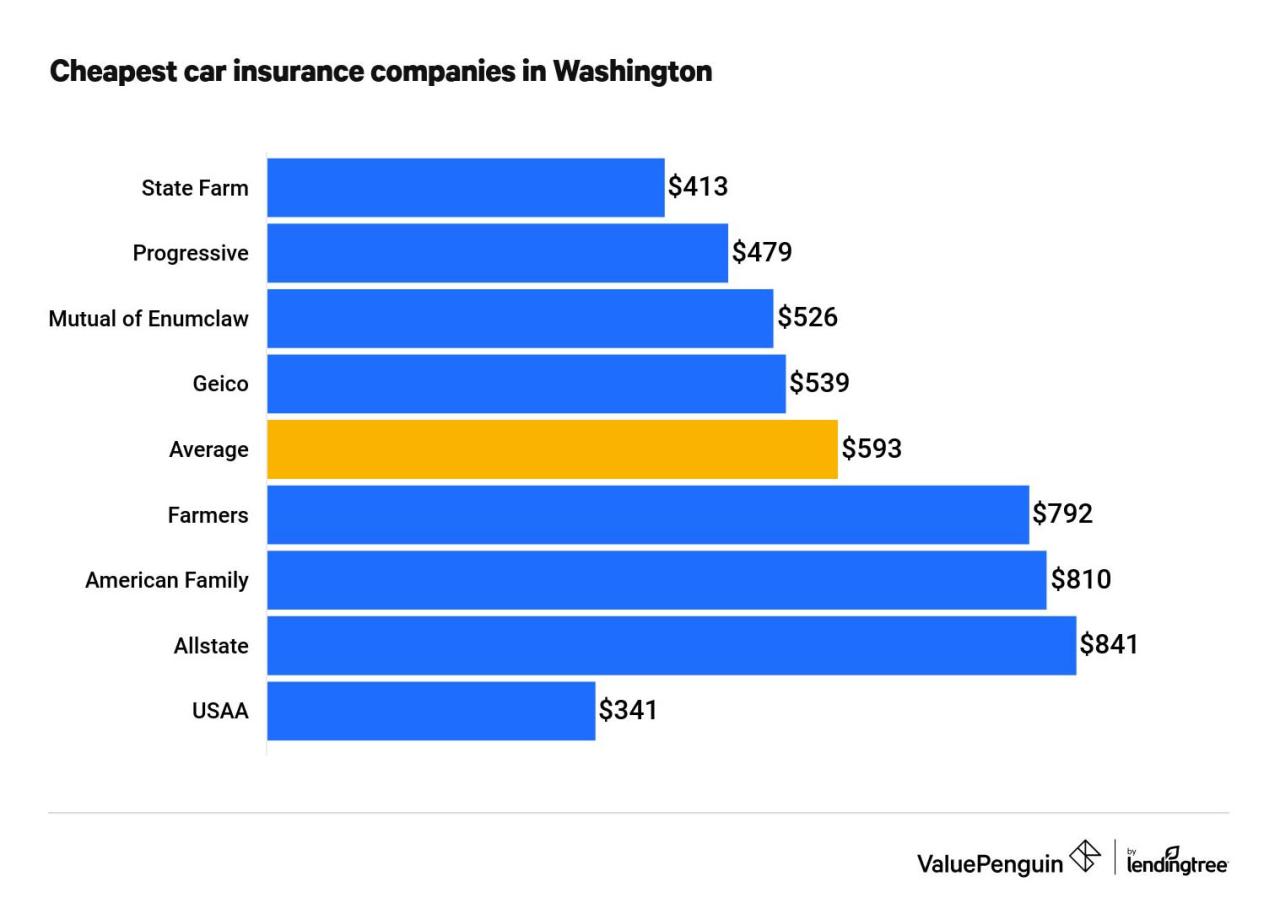

Comparing Car Insurance Providers in Washington

Choosing the right car insurance provider is crucial for getting the best value for your money.

| Provider | Pros | Cons |

|---|---|---|

| Geico | Competitive rates, wide range of discounts, convenient online tools. | Limited customer service options, may not have the best coverage options for all drivers. |

| State Farm | Strong reputation, extensive agent network, good customer service. | Rates may be higher than some competitors, limited online options. |

| Progressive | Innovative features, personalized coverage options, strong online presence. | Customer service can be inconsistent, rates may vary significantly depending on your profile. |

| USAA | Excellent customer service, competitive rates for military members and their families. | Only available to military members and their families. |

| Liberty Mutual | Wide range of coverage options, strong customer service, available in all states. | Rates may be higher than some competitors, online tools can be complex. |

Tips for Getting the Best Car Insurance Rates

There are several strategies you can use to secure the best car insurance rates in Washington State.

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. Use online comparison tools or contact insurance agents directly.

- Bundle Your Policies: If you have multiple insurance policies, such as homeowners or renters insurance, consider bundling them with your car insurance. Many insurers offer discounts for bundling policies.

- Improve Your Driving Record: A clean driving record is essential for getting lower car insurance rates. Avoid traffic violations and accidents to keep your premiums low.

- Take a Defensive Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount on your car insurance.

- Consider a Higher Deductible: Choosing a higher deductible can lower your monthly premium. However, make sure you can afford to pay the deductible if you need to file a claim.

- Ask About Discounts: Many insurers offer discounts for various factors, such as good student discounts, safe driver discounts, and multi-car discounts. Ask your insurer about all available discounts.

Car Insurance Regulations in Washington State: Car Insurance Rates In Washington State

Washington state has a comprehensive set of car insurance regulations designed to protect drivers and ensure financial responsibility. Understanding these regulations is crucial for all drivers in the state.

Minimum Liability Coverage Requirements

Washington state mandates that all drivers carry a minimum amount of liability insurance to cover potential damages caused to others in an accident. This requirement is in place to ensure that victims of accidents have access to compensation for their injuries and property damage. The minimum liability coverage requirements in Washington are as follows:

- Bodily Injury Liability: $25,000 per person/$50,000 per accident. This coverage pays for medical expenses, lost wages, and other damages incurred by the injured party.

- Property Damage Liability: $10,000 per accident. This coverage pays for damages to the other driver’s vehicle or property.

It’s important to note that these are minimum requirements. Drivers may choose to purchase higher coverage limits to provide greater protection in case of a serious accident.

Unique Car Insurance Laws in Washington

Washington state has several unique car insurance laws and regulations, including:

- Financial Responsibility Law: This law requires drivers to prove they have financial responsibility to cover potential damages. This can be done by providing proof of insurance, a surety bond, or a deposit of cash or securities.

- No-Fault Insurance: Washington state has a no-fault insurance system, meaning that drivers are required to file claims with their own insurance company, regardless of who was at fault in an accident. This system aims to expedite the claims process and reduce litigation.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage is mandatory in Washington state. It protects drivers in case they are involved in an accident with an uninsured or underinsured driver. It provides coverage for medical expenses, lost wages, and other damages.

- PIP Coverage: Personal Injury Protection (PIP) coverage is optional in Washington state but highly recommended. It covers medical expenses, lost wages, and other damages incurred by the insured driver and passengers, regardless of fault. This coverage is particularly important for drivers who are at risk of high medical bills or who have limited health insurance.

Washington State Office of the Insurance Commissioner

The Washington State Office of the Insurance Commissioner (OIC) is responsible for regulating the insurance industry in the state and protecting consumers. The OIC performs several important functions, including:

- Licensing and Supervising Insurance Companies: The OIC ensures that insurance companies operating in Washington state meet specific financial and operational standards.

- Enforcing Insurance Laws and Regulations: The OIC investigates and resolves complaints against insurance companies and enforces insurance laws and regulations.

- Providing Consumer Education and Resources: The OIC provides information and resources to consumers about insurance products, their rights, and how to resolve insurance disputes.

Epilogue

Navigating the world of car insurance in Washington can be daunting, but with careful planning and informed decision-making, you can secure the right coverage at a reasonable price. By understanding the factors that influence rates, exploring available discounts, and comparing different providers, you can find the best car insurance policy to meet your specific needs and budget.

Question Bank

How often are car insurance rates reviewed in Washington?

Car insurance rates in Washington are typically reviewed annually by insurance companies, though they can be adjusted more frequently based on factors like driving history changes or changes in the cost of repairs.

What are the consequences of driving without car insurance in Washington?

Driving without car insurance in Washington is illegal and can result in hefty fines, license suspension, and even vehicle impoundment. It’s crucial to maintain valid car insurance coverage at all times.

Can I get car insurance quotes online in Washington?

Yes, many insurance companies in Washington offer online car insurance quotes. This allows you to compare rates from different providers conveniently and quickly.