Car insurance in two states can be a complex topic, especially when considering the differences in regulations, rates, and coverage options. This guide will help you navigate the intricacies of car insurance across state lines, providing valuable insights into key considerations, cost comparisons, and essential tips for securing the best coverage.

Understanding the factors that influence car insurance rates in different states is crucial for making informed decisions. This includes exploring the impact of population density, accident rates, cost of living, and state-specific laws and regulations. We will delve into these aspects, shedding light on the nuances of car insurance in two states.

Car Insurance Basics

Car insurance is a crucial financial safety net for vehicle owners, protecting them from significant financial losses in the event of an accident, theft, or other unforeseen circumstances. Understanding the fundamental concepts of car insurance is essential to make informed decisions and secure the appropriate coverage for your needs.

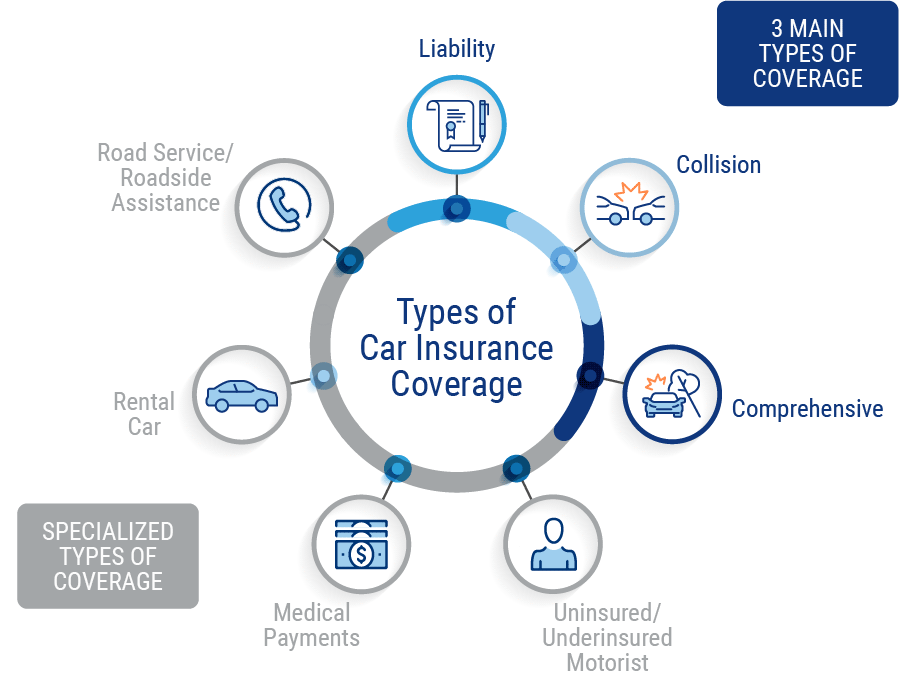

Types of Car Insurance Coverage

Car insurance policies typically include various types of coverage, each designed to address specific risks.

- Liability Coverage: This is the most basic type of car insurance and is generally required by law. Liability coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. It covers the costs of medical expenses, property damage, and legal fees up to the policy limits.

- Collision Coverage: Collision coverage protects you from financial losses if your vehicle is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement of your vehicle, minus the deductible.

- Comprehensive Coverage: Comprehensive coverage protects you from financial losses due to damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or falling objects. It covers the cost of repairs or replacement of your vehicle, minus the deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your losses. It helps cover your medical expenses, lost wages, and property damage.

Deductibles

A deductible is the amount of money you are responsible for paying out of pocket before your insurance company starts covering the remaining costs. The higher your deductible, the lower your premium will be, and vice versa. It’s important to choose a deductible that you can comfortably afford in case of an accident.

Premiums

Car insurance premiums are the monthly or annual payments you make to your insurance company for coverage. Several factors influence your car insurance premium, including:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your premium. A clean driving history typically leads to lower premiums.

- Age: Younger drivers, especially those under 25, tend to have higher premiums due to their higher risk of accidents. As you age, your premiums generally decrease.

- Vehicle Type: The type of vehicle you drive, including its make, model, year, and safety features, can influence your premium. High-performance vehicles or those with a history of theft or accidents may have higher premiums.

- Location: Where you live can impact your premium. Areas with high crime rates, heavy traffic, or frequent accidents generally have higher premiums.

- Credit Score: In some states, insurance companies use your credit score as a factor in determining your premium. This is because individuals with good credit scores tend to be more responsible and less likely to file claims.

Comparing Car Insurance Rates in Two States: Car Insurance In Two States

Car insurance rates can vary significantly from state to state. Understanding the factors that contribute to these differences is crucial for making informed decisions about your car insurance coverage. This section will compare and contrast the average car insurance rates in two states, highlighting the key factors that influence these rates.

Factors Influencing Car Insurance Rates

Several factors influence car insurance rates, including:

- Population Density: States with higher population densities tend to have higher car insurance rates. This is because a higher concentration of vehicles increases the likelihood of accidents.

- Accident Rates: States with higher accident rates also tend to have higher car insurance rates. Insurance companies have to pay out more claims in these states, which drives up premiums.

- Cost of Living: The cost of living in a state can also impact car insurance rates. States with a higher cost of living generally have higher car repair costs, which can lead to higher premiums.

- State-Specific Laws and Regulations: Each state has its own set of laws and regulations governing car insurance. These regulations can impact the minimum coverage requirements, the types of insurance available, and the pricing of insurance. For example, states with mandatory no-fault insurance laws may have lower average car insurance rates compared to states with tort-based systems.

Average Car Insurance Rates in Two States

Let’s consider two states, California and Texas, to illustrate the differences in average car insurance rates.

| State | Average Annual Premium | Key Factors |

|---|---|---|

| California | $2,100 | High population density, high accident rates, high cost of living, stringent insurance regulations. |

| Texas | $1,600 | Lower population density, lower accident rates, lower cost of living, less stringent insurance regulations. |

As you can see, California has a significantly higher average annual premium compared to Texas. This difference can be attributed to the factors mentioned above. California’s high population density, high accident rates, and high cost of living contribute to higher car insurance premiums. Additionally, California’s stricter insurance regulations, such as mandatory minimum coverage requirements and a no-fault insurance system, can also impact premiums.

Key Considerations for Choosing Car Insurance

Choosing the right car insurance policy is crucial, as it safeguards you financially in the event of an accident or other covered incidents. However, with various insurance providers and policy options available, it can be overwhelming to navigate the selection process.

The key is to carefully consider your individual needs and circumstances when choosing car insurance. This involves assessing your driving history, the value of your vehicle, and your specific coverage requirements.

Factors to Consider When Choosing Car Insurance

Several factors influence the type and amount of car insurance coverage you need. These factors help determine your insurance premiums and the level of protection you receive.

- Driving History: Your driving record plays a significant role in determining your insurance premiums. A clean driving history with no accidents or traffic violations typically results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums.

- Vehicle Value: The value of your vehicle directly impacts your insurance premiums, particularly for collision and comprehensive coverage. Newer, more expensive vehicles generally require higher premiums due to the cost of repairs or replacement. Older vehicles with lower market value may have lower premiums.

- Coverage Requirements: Each state has minimum liability insurance requirements that all drivers must meet. However, you may choose to purchase additional coverage, such as collision, comprehensive, or uninsured/underinsured motorist coverage, depending on your individual needs and risk tolerance.

- Location: Your location can influence your insurance premiums. Areas with higher crime rates or traffic congestion tend to have higher premiums due to an increased risk of accidents or theft.

- Age and Gender: Younger drivers, particularly those under 25, generally pay higher premiums due to their higher risk of accidents. Gender can also play a role, with some studies suggesting that men tend to have higher premiums than women.

- Credit Score: In some states, insurance companies use credit scores to assess risk and determine premiums. Individuals with good credit scores typically receive lower premiums than those with poor credit scores.

- Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, multiple policy discounts, and membership in certain organizations.

Obtaining Quotes and Comparing Coverage Options

Once you’ve considered the factors mentioned above, it’s crucial to obtain quotes from multiple insurance providers and compare their coverage options and pricing. This allows you to find the best value for your needs.

- Online Quote Tools: Many insurance companies offer online quote tools that allow you to quickly compare rates and coverage options. These tools often provide instant quotes based on your specific information.

- Insurance Brokers: Insurance brokers can provide you with quotes from multiple insurance providers and help you navigate the selection process. They can also offer valuable advice based on your individual needs.

- Direct Comparison Websites: Websites that specialize in comparing insurance quotes can provide you with a side-by-side comparison of rates and coverage options from various providers. These websites can be a helpful resource for finding the best deal.

Car Insurance Discounts and Savings

Saving money on car insurance is a common goal for many drivers. Fortunately, numerous discounts are available to help lower your premiums. By understanding these discounts and taking advantage of them, you can significantly reduce your insurance costs.

Types of Car Insurance Discounts

Car insurance companies offer a wide range of discounts to reward safe driving habits, responsible behavior, and other factors. Some common discounts include:

- Safe Driving Discounts: These discounts reward drivers with a clean driving record, demonstrating their responsible driving behavior. For example, many insurers offer discounts for drivers who have not been involved in accidents or have not received traffic violations for a specific period.

- Good Student Discounts: Insurers often offer discounts to students who maintain a certain grade point average (GPA) or are enrolled in a college or university. This discount recognizes students’ responsible behavior and academic achievements.

- Multi-Car Discounts: If you insure multiple vehicles with the same insurance company, you may qualify for a multi-car discount. This discount recognizes that insuring multiple vehicles with the same company reduces administrative costs and risk for the insurer.

- Anti-theft Device Discounts: Installing anti-theft devices in your car, such as alarms, immobilizers, or tracking systems, can reduce your insurance premiums. These devices deter theft and make it easier to recover a stolen vehicle, lowering the risk for the insurer.

- Defensive Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving practices and qualify you for a discount. These courses teach drivers defensive driving techniques and strategies for avoiding accidents.

- Loyalty Discounts: Insurance companies often reward long-term customers with loyalty discounts. These discounts acknowledge your continued business and incentivize you to stay with the same insurer.

- Bundling Discounts: Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often result in significant savings. This is because insurers offer discounts for combining multiple policies, as it reduces administrative costs and simplifies the claims process.

Qualifying for Discounts

To qualify for car insurance discounts, you need to meet specific criteria set by the insurer. These criteria vary depending on the discount and the insurance company. For example, to qualify for a good student discount, you might need to maintain a GPA of 3.0 or higher. To qualify for a safe driving discount, you might need to have a clean driving record for a certain period, such as three years without accidents or violations.

Maximizing Savings

To maximize your car insurance savings, consider the following tips:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates. Use online comparison tools or contact insurers directly to get quotes.

- Review Your Policy Regularly: Make sure your policy is up-to-date and reflects your current driving needs. Consider increasing your deductible to lower your premiums. However, ensure you can afford to pay the higher deductible in case of an accident.

- Ask About Available Discounts: Contact your insurance company to inquire about all available discounts and how to qualify for them.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations, as these can increase your premiums.

- Consider Bundling Policies: If you have homeowners or renters insurance, consider bundling it with your car insurance to take advantage of potential discounts.

“By taking advantage of available discounts and shopping around for the best rates, you can significantly reduce your car insurance costs.”

Filing a Car Insurance Claim

After an accident, filing a car insurance claim is a crucial step to ensure you receive the necessary coverage and financial assistance for repairs, medical expenses, and other related costs. Understanding the process and knowing what to do can make the experience smoother and less stressful.

Steps Involved in Filing a Car Insurance Claim

Following a car accident, it is important to take immediate steps to protect yourself and your vehicle. This includes contacting the authorities, seeking medical attention if necessary, and documenting the accident. The following steps Artikel the process of filing a car insurance claim:

- Contact Your Insurance Company: As soon as possible after the accident, contact your insurance company to report the incident. Provide them with the necessary details, including the date, time, and location of the accident, as well as the other parties involved. This initial contact initiates the claims process.

- File a Claim: Your insurance company will provide you with instructions on how to file a claim. This may involve completing a claim form online or over the phone, depending on your insurer’s procedures. Be sure to provide accurate and complete information to avoid delays or complications.

- Provide Documentation: Your insurance company will likely request supporting documentation to process your claim. This may include:

- A copy of your driver’s license

- Your vehicle registration

- Police report (if applicable)

- Photos and videos of the accident scene and damaged vehicles

- Medical bills and other related expenses

- Cooperate with the Insurance Company: It is important to cooperate fully with your insurance company throughout the claims process. This includes responding to requests for information promptly and providing any additional documentation they may require.

- Negotiate a Settlement: Once your insurance company has reviewed your claim, they will determine the amount of coverage you are eligible for. You may have the opportunity to negotiate the settlement amount, especially if you believe the initial offer is too low. Be prepared to discuss your needs and provide supporting documentation to justify your request.

Documenting the Accident

Documenting the accident thoroughly is crucial for a smooth claims process. It provides evidence to support your claim and helps to prevent disputes with the insurance company. The following tips can help you document the accident effectively:

- Take Photos and Videos: Capture images of the accident scene, including the damage to your vehicle and any other involved vehicles. Take photos from different angles to provide a comprehensive view of the situation. Consider using your smartphone to record a video of the scene, especially if there are any witnesses present.

- Gather Witness Information: If there are any witnesses to the accident, obtain their contact information, including their names, phone numbers, and addresses. Witnesses can provide valuable firsthand accounts of the event, which can be helpful in supporting your claim.

- Get a Police Report: If the accident involves injuries or significant property damage, contact the police and file a report. The police report provides an official record of the incident, which can be used as evidence in your claim.

Communicating with the Insurance Company

Clear and concise communication with your insurance company is essential for a successful claims process. Here are some tips for effective communication:

- Be Polite and Professional: Even if you are frustrated or upset, maintain a respectful tone in your interactions with the insurance company. This can help to ensure that you are treated fairly and that your claim is processed efficiently.

- Keep Detailed Records: Maintain a detailed record of all communication with your insurance company, including the date, time, and content of each conversation. This documentation can be helpful if you need to refer back to previous interactions.

- Ask Questions: Don’t hesitate to ask questions if you are unsure about any aspect of the claims process. It is better to clarify any doubts than to make assumptions that could lead to problems later on.

- Follow Up Regularly: Follow up with your insurance company regularly to check on the status of your claim. This can help to prevent delays and ensure that your claim is moving forward as expected.

Navigating the Claims Process

The claims process can be complex and time-consuming. Here are some tips to help you navigate it effectively:

- Understand Your Policy: Review your insurance policy carefully to understand your coverage limits and any applicable deductibles. This knowledge will help you to manage your expectations and avoid surprises during the claims process.

- Be Patient: The claims process can take time, especially if the accident involves significant damage or injuries. Be patient and avoid pressuring your insurance company to expedite the process.

- Seek Legal Advice: If you are having difficulty with your insurance company or if you believe that your claim is being handled unfairly, consider seeking legal advice from a qualified attorney. An attorney can help you to understand your rights and options and can represent you in negotiations with the insurance company.

Resources and Additional Information

This section provides valuable resources and information to help you navigate the world of car insurance and make informed decisions. Whether you’re seeking additional guidance, need to contact relevant authorities, or want to know how to resolve disputes, the information provided below can be helpful.

Reputable Websites and Organizations, Car insurance in two states

These websites and organizations offer comprehensive information about car insurance, helping you understand your options and make informed decisions.

- National Association of Insurance Commissioners (NAIC): This organization serves as a resource for consumers and regulators, providing information about insurance regulations, consumer protection, and industry trends. You can find state-specific information on their website, including contact details for your state’s insurance department.

- Insurance Information Institute (III): The III is a non-profit organization that provides educational materials and resources about insurance, including car insurance. Their website offers information on various topics, such as how to choose the right coverage, understanding your policy, and filing a claim.

- Consumer Reports: This organization conducts independent testing and research on various products and services, including car insurance. Their website provides car insurance ratings and recommendations based on their analysis of coverage, customer satisfaction, and claims handling.

- J.D. Power: This company conducts customer satisfaction surveys and provides ratings for various industries, including car insurance. Their website offers information on car insurance companies based on customer satisfaction, claims handling, and overall performance.

State Insurance Departments and Consumer Protection Agencies

Your state’s insurance department is responsible for regulating insurance companies and protecting consumers. Contact your state’s insurance department if you have questions about your car insurance policy, experience issues with your insurance company, or need to file a complaint.

- [State Name] Department of Insurance: [Contact information]

- [State Name] Consumer Protection Agency: [Contact information]

Resolving Disputes with Insurance Companies

While most insurance companies strive to provide fair and prompt service, you may encounter situations where you need to resolve a dispute. Here are some steps you can take to advocate for fair treatment:

- Review your policy: Understand your policy’s terms and conditions, including coverage limits, deductibles, and exclusions.

- Document everything: Keep a detailed record of all communications with your insurance company, including dates, times, and summaries of conversations.

- Contact your insurance company: If you have a dispute, try to resolve it directly with your insurance company. Explain your concerns and provide supporting documentation.

- File a complaint: If you’re unable to resolve the dispute with your insurance company, file a complaint with your state’s insurance department or consumer protection agency.

- Consider mediation: Mediation can help you reach a mutually agreeable resolution with your insurance company. Your state’s insurance department or consumer protection agency may offer mediation services.

- Seek legal advice: If you believe your insurance company has acted unfairly or in bad faith, you may need to consult with an attorney.

Ultimate Conclusion

Navigating car insurance across state lines can be a daunting task, but with careful planning and a comprehensive understanding of your options, you can find the best coverage to suit your needs and budget. By considering factors like driving history, vehicle value, coverage requirements, and available discounts, you can make informed choices and secure affordable protection on the road.

Key Questions Answered

What are the common coverage types offered by car insurance?

Common coverage types include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP). Each type provides specific protection for different scenarios.

How can I compare car insurance rates from different providers?

You can use online comparison websites or contact insurance providers directly to obtain quotes and compare coverage options.

What factors influence car insurance premiums?

Factors that influence premiums include driving history, age, vehicle type, location, credit score, and coverage level.

What are some common car insurance discounts?

Common discounts include safe driving discounts, good student discounts, multi-car discounts, and bundling discounts.

What should I do if I need to file a car insurance claim?

Document the accident, gather witness information, contact your insurance company, and follow their instructions for filing a claim.