Can you insure cars in different states? The answer is a bit more complex than a simple yes or no. Navigating car insurance across state lines involves understanding a variety of factors, from mandatory coverage requirements to the availability of insurance companies and even the impact of state-specific regulations on pricing.

This guide explores the intricacies of car insurance in different states, providing insights into the key considerations for drivers who are relocating or simply curious about how insurance varies across the country. From minimum coverage requirements and rate-determining factors to transferring insurance and understanding state regulations, we’ll delve into the nuances of this often-overlooked aspect of car ownership.

State-Specific Insurance Requirements

Each state in the U.S. has its own set of minimum insurance requirements that drivers must meet. These requirements are designed to protect drivers and other people on the road in case of an accident. Understanding these requirements is crucial for ensuring you have adequate coverage and avoid potential legal consequences.

Minimum Insurance Requirements by State

State-specific insurance requirements vary significantly, impacting the cost of insurance. These requirements are usually defined by the minimum liability coverage a driver must have. This liability coverage covers damages to other people and their property in case of an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to individuals injured in an accident caused by the insured driver. It is typically expressed as a per-person limit and a per-accident limit, such as 25/50, which means $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for damages to another person’s property, such as a car, building, or fence, caused by the insured driver. It is usually expressed as a single limit, such as $25,000.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects the insured driver and passengers in case of an accident with an uninsured or underinsured driver. It covers medical expenses, lost wages, and other damages.

- Collision Coverage: This coverage pays for repairs or replacement of the insured vehicle if it is damaged in an accident, regardless of fault. It is optional in most states.

- Comprehensive Coverage: This coverage pays for repairs or replacement of the insured vehicle if it is damaged due to non-accident events, such as theft, vandalism, or natural disasters. It is also optional in most states.

| State | Bodily Injury Liability | Property Damage Liability | Uninsured/Underinsured Motorist Coverage (UM/UIM) |

|---|---|---|---|

| California | 15,000/30,000 | 5,000 | 15,000/30,000 |

| Florida | 10,000/20,000 | 10,000 | 10,000/20,000 |

| New York | 25,000/50,000 | 10,000 | 25,000/50,000 |

| Texas | 30,000/60,000 | 25,000 | 30,000/60,000 |

Impact of Minimum Insurance Requirements on Cost

Higher minimum insurance requirements generally translate to higher insurance premiums. This is because insurers need to cover the increased risk associated with higher liability limits. For example, a state with a higher minimum liability requirement may have a higher average insurance premium compared to a state with lower requirements.

Factors Affecting Insurance Rates

Car insurance rates are influenced by a complex interplay of factors, encompassing both individual characteristics and broader market dynamics. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Driver Demographics

Driver demographics play a significant role in determining insurance rates. These factors are based on the individual’s personal characteristics and how they correlate with risk.

- Age: Younger drivers, particularly those under 25, tend to have higher insurance rates due to their inexperience and higher risk of accidents. As drivers age and gain experience, their rates generally decrease.

- Gender: Historically, males have had higher insurance rates than females. This difference has narrowed in recent years, but some insurers may still consider gender as a factor in their pricing.

- Marital Status: Married individuals often have lower insurance rates than single individuals. This is attributed to a perceived lower risk associated with married drivers.

- Credit Score: While not directly related to driving ability, credit score can be used by insurers to assess risk. Individuals with lower credit scores may face higher insurance premiums.

Vehicle Type

The type of vehicle you drive is a significant factor in insurance rates. Different vehicles are associated with varying levels of risk and repair costs.

- Make and Model: Some vehicle makes and models are known for their safety features and lower accident rates, which can result in lower insurance premiums. Conversely, vehicles with a history of accidents or high repair costs may have higher rates.

- Vehicle Value: The cost to replace or repair a vehicle is directly related to its value. More expensive vehicles generally have higher insurance rates due to the higher cost of coverage.

- Engine Size and Performance: Vehicles with larger engines and higher performance capabilities are often associated with higher insurance rates. This is due to the potential for higher speeds and more aggressive driving styles.

Driving History

Your driving history is one of the most significant factors in determining your insurance rates. It reflects your driving habits and past accidents, which can be used to assess your risk.

- Accidents: Any accidents you have been involved in, regardless of fault, will likely increase your insurance rates. The severity of the accident and the number of claims you have filed will also be considered.

- Traffic Violations: Traffic violations, such as speeding tickets or reckless driving citations, can also result in higher insurance premiums.

- Driving Record: A clean driving record with no accidents or violations will typically lead to lower insurance rates.

State-Specific Regulations

State-specific regulations, such as no-fault laws and tort systems, can significantly impact insurance rates.

- No-Fault Laws: In no-fault states, drivers are required to file claims with their own insurance companies, regardless of who is at fault. This system aims to reduce litigation and expedite claims processing. However, it can also lead to higher insurance rates as insurers need to cover more claims.

- Tort Systems: In tort states, drivers can sue other drivers for damages caused by an accident. This system allows for higher payouts to injured parties, but it can also lead to higher insurance rates as insurers need to cover potential lawsuits.

Impact of Factors on Insurance Costs

| Factor | Impact on Insurance Rates | Example |

|---|---|---|

| Age | Younger drivers (under 25) typically have higher rates. | A 20-year-old driver may pay significantly more than a 40-year-old driver with a similar driving record. |

| Gender | Historically, males have had higher rates than females. | In some states, a male driver may pay slightly more than a female driver with the same driving record and vehicle. |

| Marital Status | Married individuals often have lower rates than single individuals. | A married driver may pay less than a single driver with the same driving record and vehicle. |

| Credit Score | Lower credit scores may result in higher rates. | A driver with a poor credit score may pay more than a driver with excellent credit, even if they have the same driving record and vehicle. |

| Vehicle Type | Expensive or high-performance vehicles typically have higher rates. | A luxury sports car may have significantly higher insurance rates than a basic sedan. |

| Driving History | Accidents and violations can increase rates. | A driver with a recent accident may see a substantial increase in their premiums. |

| State-Specific Regulations | No-fault laws can lead to higher rates, while tort systems can result in lower rates. | Insurance rates in a no-fault state may be higher than in a tort state, even for drivers with similar profiles. |

Insurance Company Availability and Coverage Options

Navigating insurance options across state lines can be complex, especially when considering the availability of specific insurance companies and the coverage options they offer. Understanding these factors is crucial for finding the right insurance plan that meets your needs and budget.

Major Insurance Companies and Coverage Offerings

Major insurance companies often operate in multiple states, offering a range of coverage options. However, the specific coverage available can vary depending on the state and the company. Here are some examples of major insurance companies and their common coverage offerings:

- State Farm: Known for its extensive network and diverse coverage options, State Farm is available in all 50 states. It offers standard coverage like liability, collision, comprehensive, and personal injury protection (PIP). Additionally, it provides optional coverage like uninsured/underinsured motorist (UM/UIM), rental car reimbursement, and gap coverage.

- Geico: With a strong presence in many states, Geico offers a variety of coverage options, including liability, collision, comprehensive, PIP, UM/UIM, and rental car reimbursement. However, its availability may vary depending on the specific state.

- Progressive: Progressive is another major insurer operating in multiple states. It offers a wide range of coverage, including liability, collision, comprehensive, PIP, UM/UIM, gap coverage, and roadside assistance.

- Allstate: Allstate is known for its comprehensive coverage options, including liability, collision, comprehensive, PIP, UM/UIM, gap coverage, and accident forgiveness. Its availability may vary depending on the state.

Availability of Specific Insurance Options Across States

The availability of specific insurance options, such as gap coverage and rental car reimbursement, can differ across states. For example, gap coverage, which covers the difference between the actual cash value of a vehicle and the outstanding loan balance, may not be available in all states or may have specific requirements. Similarly, rental car reimbursement, which covers the cost of renting a car while your vehicle is being repaired, may have limitations in certain states.

It’s important to research the specific coverage options available in your state and compare them across different insurance companies.

Impact of Company Availability on Insurance Rates and Coverage Choices

The availability of insurance companies in a particular state can impact insurance rates and coverage choices. When there are fewer insurance companies operating in a specific area, competition may be limited, potentially leading to higher premiums. Conversely, a greater number of insurance companies can increase competition, potentially resulting in lower premiums and a wider range of coverage options.

It’s crucial to compare quotes from multiple insurance companies to ensure you’re getting the best rate and coverage for your needs.

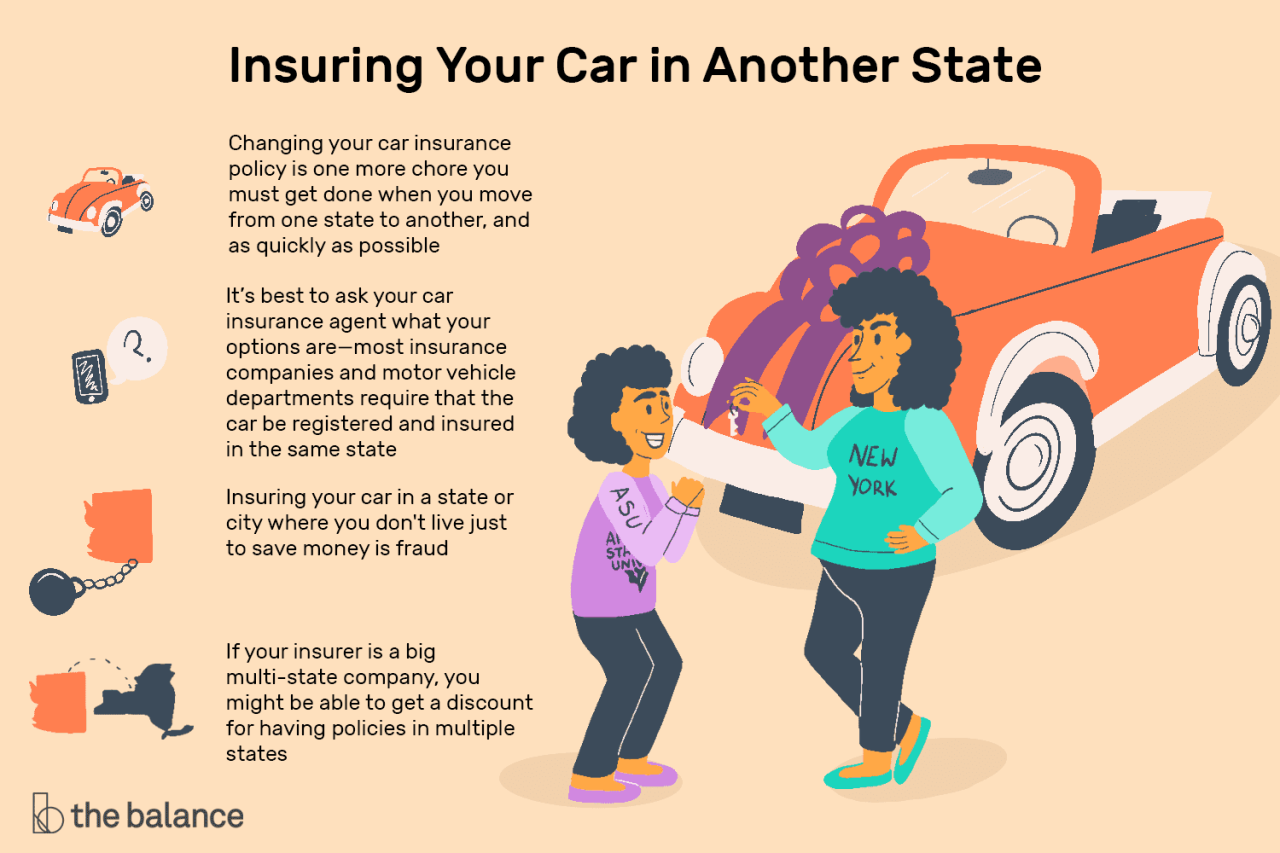

Navigating Insurance Transfers and Changes: Can You Insure Cars In Different States

Moving to a new state often requires adjusting your car insurance policy. This involves transferring your existing coverage to a new insurer or modifying your existing policy to meet the new state’s requirements. Here’s a guide to help you navigate the process smoothly.

Transferring Car Insurance When Moving, Can you insure cars in different states

Transferring your car insurance when moving involves notifying your current insurer and potentially switching to a new one. Here’s a step-by-step guide to help you:

- Inform your current insurer about your move: Contact your current insurer as soon as you know your moving date. Provide them with your new address and the date you’ll be moving.

- Obtain a copy of your insurance policy and driving record: Request a copy of your current policy and your driving record from your insurer. These documents will be useful for comparing insurance rates and coverage options with new insurers.

- Research insurance companies in your new state: Use online comparison tools or contact insurance agents to gather quotes from different insurers in your new state.

- Compare insurance rates and coverage options: Compare the quotes from different insurers based on factors like coverage, deductibles, and discounts. Consider your specific needs and budget when making your decision.

- Choose a new insurer and obtain a policy: Once you’ve chosen a new insurer, provide them with the necessary information, including your driving history, vehicle details, and desired coverage.

- Cancel your old policy: Inform your previous insurer that you’re canceling your policy and provide the effective date of cancellation. Make sure to obtain confirmation of cancellation in writing.

Updating Insurance Information

When moving to a new state, it’s essential to update your insurance information to ensure continuous coverage. Here’s a checklist of important documents and procedures:

- Update your address with your insurer: Notify your insurer about your new address as soon as you move. This ensures you receive important communications and policy updates.

- Update your vehicle registration: Register your vehicle in your new state and obtain new license plates. This process usually requires proof of insurance.

- Obtain a new driver’s license: Apply for a new driver’s license in your new state. This will require you to pass a vision test and possibly a driving test.

- Keep your insurance documents readily available: Maintain copies of your insurance policy, registration, and driver’s license for easy access in case of an accident or traffic stop.

Changes in Insurance Coverage

Moving to a new state can impact your insurance coverage. Here are some potential adjustments you may need to make:

- State-specific coverage requirements: Each state has its own minimum insurance requirements. You may need to adjust your coverage to meet the new state’s mandates.

- Insurance rates: Insurance rates can vary significantly from state to state due to factors like traffic density, accident rates, and cost of living.

- Coverage options: The availability of certain coverage options, such as uninsured motorist coverage, may differ from state to state.

- Discounts: Some insurers offer discounts based on factors like safe driving records, good credit scores, and car safety features. These discounts may vary depending on the state.

Understanding State-Specific Insurance Regulations

Each state in the US has its own set of laws and regulations governing car insurance. These regulations ensure consumer protection, prevent fraud, and maintain a stable insurance market.

State Insurance Departments

State insurance departments play a crucial role in regulating and overseeing insurance companies operating within their jurisdictions. They establish and enforce insurance laws, monitor financial solvency of insurance companies, and investigate consumer complaints. These departments have the authority to issue licenses to insurance companies, set minimum coverage requirements, and approve insurance rates.

Key Regulations and Laws

State insurance laws cover various aspects of car insurance, including:

- Minimum Coverage Requirements: Every state mandates minimum liability coverage for bodily injury and property damage. These requirements ensure that drivers are financially responsible for any accidents they cause.

- Insurance Fraud Prevention: State laws address insurance fraud, including false claims, staged accidents, and premium manipulation. These laws aim to protect consumers and maintain the integrity of the insurance market.

- Consumer Protection Guidelines: States have implemented consumer protection measures to safeguard policyholders’ rights and ensure fair treatment. These measures include requirements for clear and understandable insurance policies, complaint resolution procedures, and access to consumer information.

Consumer Resources for Resolving Disputes

State insurance departments provide resources for consumers to resolve insurance disputes and file complaints. These resources include:

- Complaint Filing: Consumers can file complaints with their state insurance department if they believe their insurer has acted unfairly or violated state regulations.

- Mediation and Arbitration: Many state insurance departments offer mediation and arbitration services to help resolve insurance disputes between consumers and insurers.

- Consumer Education Materials: State insurance departments often provide consumer education materials on car insurance, including information on coverage options, policy terms, and rights and responsibilities.

Impact of State Laws on Insurance Practices

State laws and regulations play a significant role in shaping the insurance industry, influencing how insurance companies operate and how consumers access coverage. These regulations affect various aspects of the insurance business, including claims processing, pricing strategies, and customer service.

State Laws and Claims Processing

State laws establish guidelines for how insurance companies must handle claims. These laws typically dictate:

- Timeframes for acknowledging and investigating claims

- Procedures for communicating with policyholders during the claims process

- Requirements for providing claim denials and appeals

- Standards for claim settlements and payments

For example, some states have laws requiring insurance companies to acknowledge a claim within a specific timeframe, such as 15 days, and to investigate the claim within a certain period. This ensures prompt attention to claims and helps prevent delays in processing.

State Laws and Pricing Strategies

State laws also influence insurance pricing. They regulate how insurance companies can calculate premiums, including factors they can consider and those they cannot. Some common regulations include:

- Prohibition of discrimination based on certain factors, such as race, religion, or gender

- Mandates for using specific rating factors, such as driving history and credit score

- Restrictions on the use of certain pricing models

States with stricter regulations on pricing factors may lead to more equitable premiums, but they can also result in higher average insurance costs.

State Laws and Customer Service

State laws establish standards for customer service in the insurance industry. These laws may cover areas such as:

- Requirements for providing clear and understandable policy information

- Procedures for handling complaints and disputes

- Mandates for providing customer service in multiple languages

For instance, some states have laws requiring insurance companies to provide policy summaries in plain language, making it easier for consumers to understand their coverage.

Impact of Differing Regulations

The differences in state insurance regulations can have a significant impact on the availability and affordability of insurance across the country.

- States with more lenient regulations may attract insurance companies seeking lower regulatory burdens and potentially higher profits. However, this can lead to a less competitive market with fewer choices for consumers and potentially higher prices.

- States with stricter regulations may have a more competitive insurance market with more choices for consumers and potentially lower prices. However, these regulations can also lead to higher administrative costs for insurance companies, which may be passed on to consumers in the form of higher premiums.

Insurance Landscape in States with Lenient vs. Strict Regulations

States with more lenient regulations often have a wider range of insurance companies operating within their borders, offering a variety of coverage options. However, consumers in these states may face higher premiums and fewer consumer protections.

On the other hand, states with stricter regulations often have fewer insurance companies operating within their borders, but consumers in these states may benefit from lower premiums and stronger consumer protections.

Conclusion

Ultimately, navigating car insurance in different states requires a blend of research, planning, and communication. By understanding the unique requirements and factors at play, drivers can make informed decisions to ensure they have adequate coverage and protection, no matter where they choose to drive.

FAQ Explained

What happens to my insurance if I move to a new state?

Generally, your current insurance policy will remain valid for a grace period (often 30-60 days) after you move. You’ll need to contact your insurer to update your address and obtain new coverage that complies with the new state’s requirements.

Can I use my current insurer in my new state?

Not all insurance companies operate in every state. Check if your current insurer offers coverage in your new location. If not, you’ll need to find a new insurer.

How can I compare insurance rates in different states?

Online insurance comparison websites allow you to input your information and compare quotes from various insurers in different states. You can also contact insurers directly to get personalized quotes.

What if I’m only driving in a different state temporarily?

If you’re only driving in another state for a short period, you may be covered under your current policy. However, it’s essential to confirm with your insurer if you have adequate coverage for the specific state and duration of your trip.

How do I file a claim if I have an accident in a different state?

Contact your insurer immediately to report the accident and follow their instructions for filing a claim. Your insurer will handle the process, even if the accident occurs in a different state.