Can you use out of state car insurance – Can you use out-of-state car insurance? It’s a question many drivers ask, especially those who frequently travel across state lines. The answer, as with most things related to insurance, isn’t always straightforward. State regulations and insurance laws vary widely, so it’s essential to understand the nuances before making any decisions.

The concept of “reciprocity” plays a significant role in determining whether you can use out-of-state car insurance. Reciprocity essentially means that two states agree to recognize each other’s insurance requirements. However, not all states have reciprocal agreements, and even when they do, there might be specific exceptions or limitations.

Understanding State Regulations

Car insurance regulations vary significantly across the United States. Each state has its own set of laws governing minimum coverage requirements, insurance rates, and other aspects of car insurance. This means that the rules you must follow when driving in your home state may not apply when you travel to another state.

Reciprocity in Car Insurance

Reciprocity in car insurance refers to an agreement between states that allows drivers from one state to be covered by their home state’s insurance policy while driving in another state. This agreement is often based on the principle of “common law” reciprocity, where states recognize the validity of each other’s insurance laws. However, it’s important to note that reciprocity is not always guaranteed, and some states may have exceptions or limitations.

For example, if you have car insurance in California and drive to Nevada, your California insurance policy will generally be valid in Nevada due to reciprocity. However, there may be specific circumstances where this doesn’t apply, such as if you are driving a commercial vehicle or if you are involved in an accident that triggers certain state-specific coverage requirements.

Specific State Requirements for Out-of-State Drivers

Some states have specific requirements for drivers who are not residents. For instance, some states may require out-of-state drivers to purchase additional insurance coverage, such as uninsured motorist coverage, or to register their vehicle in the state.

For example, in Florida, out-of-state drivers are required to have at least the minimum liability coverage required by Florida law, even if their home state has lower minimum coverage requirements. Additionally, Florida requires out-of-state drivers to provide proof of financial responsibility, which can be done through a valid insurance policy or by posting a bond.

Benefits of Using Out-of-State Insurance

Choosing an insurance policy from a different state might seem unusual, but it can offer significant advantages, particularly in situations where standard in-state options fall short. Let’s explore some potential benefits of using out-of-state insurance.

Lower Premiums

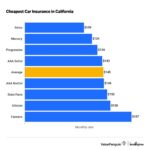

The cost of car insurance can vary significantly between states. This variation is influenced by factors such as traffic density, accident rates, and the cost of healthcare in each state. If you live in a state with high insurance premiums, you might find that policies from other states are more affordable. For example, someone living in a state with high accident rates could potentially find a cheaper policy in a state with lower accident rates.

More Coverage Options, Can you use out of state car insurance

States have different minimum coverage requirements for car insurance. Some states might require more comprehensive coverage than others. If you need more extensive coverage than your home state requires, you might find a better option in another state. For instance, if you own a classic car, you might find a policy with better coverage for antique vehicles in a different state.

Specialized Coverage

Some insurance companies specialize in specific types of coverage, such as coverage for classic cars, motorcycles, or high-value vehicles. If you need specialized coverage that isn’t readily available in your state, you might be able to find a suitable policy from an out-of-state insurer.

Comparison of Coverage and Costs

Here is a table comparing typical coverage options and costs between different states:

| State | Minimum Liability Coverage | Average Annual Premium |

|—|—|—|

| California | $15,000 per person/$30,000 per accident | $1,800 |

| Texas | $30,000 per person/$60,000 per accident | $1,200 |

| New York | $25,000 per person/$50,000 per accident | $2,000 |

| Florida | $10,000 per person/$20,000 per accident | $1,000 |

Note: These are just estimates and actual premiums can vary depending on individual factors such as driving history, age, and vehicle type.

Potential Drawbacks of Using Out-of-State Insurance: Can You Use Out Of State Car Insurance

While using out-of-state insurance can offer certain advantages, it’s crucial to consider the potential drawbacks before making a decision. These drawbacks can significantly impact your experience, particularly when dealing with claims and disputes.

Claims Processing and Coverage Disputes

The process of filing and resolving claims can become more complex when dealing with an out-of-state insurer. This is because insurers often have different procedures and policies for handling claims in different states.

- Delayed Processing: Out-of-state insurers may take longer to process claims, as they may need to coordinate with local adjusters or investigators. This delay can be frustrating, especially if you need immediate assistance after an accident.

- Coverage Disputes: Disputes regarding coverage can arise more frequently when dealing with out-of-state insurers. This can happen if the insurer interprets the policy differently than you do, or if there are differences in state regulations regarding coverage.

- Limited Access to Local Services: You may have limited access to local services, such as roadside assistance or emergency medical care, if your insurer is based out of state.

Cost Comparisons

While out-of-state insurance may seem cheaper initially, it’s important to consider the long-term costs.

- Hidden Fees and Surcharges: Out-of-state insurers may have hidden fees or surcharges that you are not aware of, which can increase your overall costs.

- Limited Discounts: You may not be eligible for certain discounts offered by in-state insurers, such as discounts for safe driving records or for being a member of a certain organization.

- Higher Premiums in the Long Run: If you have an accident or make a claim, your premiums may increase significantly, especially if your insurer is unfamiliar with your driving history or local conditions.

Factors to Consider When Choosing Out-of-State Insurance

Choosing out-of-state car insurance can be a complex decision. While it might seem like a straightforward choice, there are several factors to consider before making a final decision. This section delves into the crucial aspects you should assess to determine if out-of-state insurance is the right fit for your needs.

Understanding Coverage Limits and Exclusions

Before you choose an out-of-state insurer, it’s essential to understand the coverage limits and exclusions associated with their policies. This involves comparing the coverage provided by the out-of-state insurer with the coverage you currently have or the coverage required by your state’s laws.

- Liability Coverage: This coverage protects you financially if you’re responsible for an accident that causes damage to another person’s property or injuries. Ensure the liability limits offered by the out-of-state insurer meet your state’s minimum requirements and provide adequate protection in case of a significant accident.

- Collision and Comprehensive Coverage: These coverages protect you against damage to your vehicle, whether it’s caused by an accident or other events like theft, vandalism, or natural disasters. Compare the coverage limits and deductibles offered by the out-of-state insurer with your current coverage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you’re involved in an accident with a driver who doesn’t have adequate insurance or no insurance at all. Ensure the out-of-state insurer offers this coverage and that the limits are sufficient to cover potential losses.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers, regardless of who’s at fault in an accident. Compare the coverage limits and deductibles offered by the out-of-state insurer with your current coverage.

Alternatives to Out-of-State Insurance

If you’re a frequent traveler and find yourself driving across state lines often, out-of-state insurance might seem like a good option. However, there are other alternatives that can provide you with the coverage you need without the potential drawbacks of using out-of-state insurance.

Non-Resident Insurance

Non-resident insurance is specifically designed for individuals who live in one state but frequently drive in another. It provides coverage for the state you are driving in, even though your primary residence is elsewhere. This type of insurance can be a more convenient and cost-effective solution compared to out-of-state insurance, as it often comes with lower premiums and less paperwork.

Comparison of Insurance Options for Frequent Travelers

Here’s a comparison of different insurance options for frequent travelers:

- Out-of-State Insurance: This option involves purchasing insurance from a provider in the state you’re driving in, regardless of your primary residence. While it offers coverage in the specific state, it can be expensive and require you to maintain multiple insurance policies.

- Non-Resident Insurance: This option is specifically designed for drivers who frequently travel across state lines. It provides coverage in the state you are driving in, but your primary residence remains in another state. Non-resident insurance is often more affordable and easier to manage than out-of-state insurance.

- Multi-State Coverage: Some insurance providers offer multi-state coverage, which extends your existing policy to cover you in multiple states. This option can be a convenient and cost-effective solution if you frequently travel to a limited number of states.

- Out-of-State Insurance: This option involves purchasing insurance from a provider in the state you’re driving in, regardless of your primary residence. While it offers coverage in the specific state, it can be expensive and require you to maintain multiple insurance policies.

- Non-Resident Insurance: This option is specifically designed for drivers who frequently travel across state lines. It provides coverage in the state you are driving in, but your primary residence remains in another state. Non-resident insurance is often more affordable and easier to manage than out-of-state insurance.

- Multi-State Coverage: Some insurance providers offer multi-state coverage, which extends your existing policy to cover you in multiple states. This option can be a convenient and cost-effective solution if you frequently travel to a limited number of states.

Tip: When choosing an insurance option, consider the frequency of your travel, the states you visit, and the cost of each option.

Wrap-Up

Ultimately, the decision of whether to use out-of-state car insurance depends on your individual circumstances. If you frequently travel across state lines, it’s crucial to weigh the potential benefits and drawbacks carefully. Consider your driving habits, the frequency of your trips, and the specific requirements of the states you’ll be visiting. Remember, it’s always best to consult with an insurance professional to determine the most suitable coverage for your needs.

Answers to Common Questions

What happens if I get into an accident in a state where my insurance isn’t valid?

If you get into an accident in a state where your insurance isn’t valid, you could face serious consequences. You may be held liable for the full cost of damages, and your insurance company might not cover the costs. It’s essential to ensure your insurance is valid in every state you drive in.

Is non-resident insurance a good option for frequent travelers?

Non-resident insurance can be a suitable option for frequent travelers, as it provides coverage in multiple states. However, it’s important to compare different non-resident insurance policies and ensure they meet your specific needs and coverage requirements.

Can I use my out-of-state insurance for a temporary move?

Generally, you can use your out-of-state insurance for a temporary move, but it’s best to check with your insurance company to confirm their policies and any potential restrictions. It’s also advisable to inform the state’s Department of Motor Vehicles about your change of address.