Can you get auto insurance with out of state license – Can you get auto insurance with an out-of-state license? It’s a question that often arises for individuals who relocate or travel frequently. The answer, however, isn’t always straightforward and can vary depending on the state you’re in. State regulations and insurance company policies play a significant role in determining your eligibility for coverage. This article delves into the complexities of obtaining auto insurance with an out-of-state license, providing insights into the requirements, potential challenges, and strategies for securing the coverage you need.

Navigating the world of auto insurance can be challenging, especially when you’re dealing with out-of-state licenses. Understanding the legal framework, insurance company policies, and specific state regulations is crucial. This guide will shed light on the factors that influence insurance rates for drivers with out-of-state licenses, helping you make informed decisions about your coverage. We’ll also provide tips on how to navigate the application process and effectively communicate with insurance agents and companies.

Understanding State Licensing Requirements

Getting auto insurance with an out-of-state license involves navigating the intricate web of state laws and regulations. It’s essential to understand the legal framework that governs both auto insurance and driver’s licenses. This understanding will shed light on the specific requirements you must meet to obtain insurance, regardless of your residency status.

The Role of State Driver’s Licenses in Auto Insurance

States have established a legal framework for driver’s licenses to ensure road safety and hold drivers accountable. Each state has its own licensing requirements and regulations. These licenses serve as proof of a driver’s competency and eligibility to operate a vehicle within the state’s jurisdiction. This legal framework directly impacts auto insurance eligibility.

- Proof of Residency: A driver’s license is often used as proof of residency, which is a key factor in determining insurance rates. Insurance companies use this information to assess risk and calculate premiums based on the driver’s location and the associated risks.

- Driving Record: The driver’s license serves as a record of driving history, including violations, accidents, and suspensions. Insurance companies access this information to determine your driving record and assess the risk associated with insuring you.

- Compliance with State Laws: Driving without a valid driver’s license in the state where you are operating a vehicle is a violation of state law, leading to fines, penalties, and even vehicle impoundment.

State-Specific Rules for Out-of-State Licenses and Auto Insurance

States vary in their rules regarding out-of-state licenses and auto insurance. Some states may require you to obtain a state driver’s license within a specific timeframe after establishing residency. Others may allow you to maintain your out-of-state license for a period but require you to register your vehicle and obtain insurance within the state.

For instance, some states might require you to obtain a state driver’s license within 30 days of establishing residency.

- Temporary Residency: If you are only temporarily residing in a state, you may be able to maintain your out-of-state license and insurance for a limited period.

- Military Personnel: States often have specific provisions for military personnel stationed within their borders. They may have exemptions or alternative requirements for obtaining driver’s licenses and insurance.

- Reciprocity Agreements: Some states have reciprocity agreements with other states, meaning that a driver’s license from one state may be recognized and accepted in another. These agreements can simplify the process of obtaining insurance and driving legally in the new state.

Impact of Out-of-State Licenses on Insurance Coverage

Having an out-of-state driver’s license can potentially impact your auto insurance premiums. Insurance companies often consider various factors when assessing risk, and an out-of-state license can trigger additional scrutiny.

Factors Considered by Insurance Companies

Insurance companies consider various factors when evaluating drivers with out-of-state licenses, including:

- Driving History: Your driving record, including accidents, violations, and claims history, is a primary factor. Insurance companies may access your driving record from the state where your license is issued, even if you’re applying for insurance in a different state.

- State of Residence: The state where you reside is another crucial factor. Insurance companies often use state-specific risk data to calculate premiums. For example, if you live in a state with higher accident rates, your premiums might be higher, even if you have an out-of-state license.

- Length of Residency: The duration of your residency in the current state is also considered. Insurance companies may assess your driving history in your current state if you’ve been living there for a significant period, even if your license is from another state.

- Reason for Out-of-State License: The reason for holding an out-of-state license can also be a factor. If you recently moved and haven’t yet obtained a new license, insurance companies might consider your situation differently compared to someone who has been residing in a state for a long time but still holds an out-of-state license.

Potential Challenges and Complexities

There can be challenges and complexities associated with seeking auto insurance with an out-of-state license:

- Higher Premiums: Insurance companies may consider drivers with out-of-state licenses as higher risks, leading to potentially higher premiums. This is because they may have less information about your driving history in the current state, or they might be concerned about the possibility of you returning to your previous state.

- Limited Coverage Options: Some insurance companies might offer limited coverage options to drivers with out-of-state licenses. This could mean fewer choices in terms of coverage levels, deductibles, and other policy features.

- Difficult to Compare Rates: It can be challenging to compare insurance rates from different companies when you have an out-of-state license. Insurance companies might have different policies and procedures for handling out-of-state drivers, making it difficult to get accurate quotes and compare options.

- Verification and Documentation: You might need to provide additional documentation to verify your residency and driving history. Insurance companies may require proof of your current address, a copy of your out-of-state driver’s license, and a driving record from the state where your license is issued.

Obtaining Auto Insurance with an Out-of-State License

It’s possible to get auto insurance with an out-of-state license, but you’ll need to follow specific steps and be prepared to provide additional information.

Steps to Obtain Auto Insurance with an Out-of-State License

The process for obtaining auto insurance with an out-of-state license is similar to getting it with an in-state license. Here’s a step-by-step guide:

- Gather Your Information: You’ll need to provide your personal details, including your name, address, date of birth, and driver’s license information. You’ll also need information about your vehicle, such as the year, make, model, and VIN.

- Contact Insurance Companies: Reach out to various insurance companies to get quotes. It’s advisable to contact companies that operate in both your current state and the state where you’re licensed.

- Provide Proof of Residency: You may need to provide proof of residency in the state where you’re applying for insurance. This could include a utility bill, lease agreement, or voter registration card.

- Explain Your Situation: Be transparent about your out-of-state license. Explain the reason for the out-of-state license, such as recent relocation, temporary work assignment, or military service.

- Review and Compare Quotes: Carefully review the quotes you receive, considering factors like coverage options, deductibles, and premiums. Choose the policy that best suits your needs and budget.

- Complete the Application: Once you’ve chosen a policy, complete the application process. This typically involves providing your personal and vehicle information, signing a policy agreement, and paying the initial premium.

Essential Documents for the Insurance Application Process

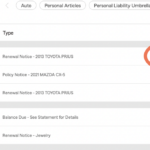

Here’s a table outlining the essential documents you’ll likely need for the insurance application process:

| Document | Description |

|---|---|

| Driver’s License | Your valid out-of-state driver’s license. |

| Vehicle Registration | Your current vehicle registration. |

| Proof of Residency | Documents like utility bills, lease agreements, or voter registration cards. |

| Insurance History | Previous insurance policy details, including coverage information and claim history. |

| Driving Record | A copy of your driving record, which may include information about traffic violations and accidents. |

Strategies for Finding Affordable Insurance Options

Finding affordable insurance options with an out-of-state license can be challenging, but there are strategies you can use:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates.

- Consider Bundling: Bundle your auto insurance with other types of insurance, such as homeowners or renters insurance, to potentially get a discount.

- Increase Your Deductible: A higher deductible can lower your premium, but it means you’ll have to pay more out-of-pocket in case of an accident.

- Maintain a Good Driving Record: A clean driving record can qualify you for discounts.

- Ask About Discounts: Inquire about available discounts, such as those for good students, safe drivers, or membership in certain organizations.

Insurance Requirements for Non-Residents

While obtaining auto insurance with an out-of-state license is possible, it’s crucial to understand the specific requirements for non-residents in each state. These regulations differ from those applicable to residents, and failing to comply can lead to significant penalties.

Non-Resident Insurance Requirements

States typically have distinct insurance requirements for non-residents, ensuring that drivers operating vehicles within their jurisdictions maintain adequate financial responsibility. These requirements often vary based on factors such as the length of stay, purpose of visit, and the type of vehicle being driven.

- Minimum Liability Coverage: Most states require non-residents to carry a minimum level of liability insurance, covering bodily injury and property damage to others in case of an accident. These minimums can vary from state to state, so it’s essential to research the specific requirements of the state you’re visiting. For example, in California, non-residents must carry a minimum of $15,000 per person and $30,000 per accident for bodily injury, and $5,000 for property damage.

- Financial Responsibility Proof: States may require non-residents to provide proof of financial responsibility, typically through an insurance card or a certificate of insurance. This proof can be presented during a traffic stop or if involved in an accident.

- Non-Resident Motor Vehicle Insurance: Some states offer specific non-resident motor vehicle insurance policies designed for individuals who live outside the state but frequently drive within it. These policies may provide more comprehensive coverage and flexibility compared to standard non-resident liability insurance.

Comparing Non-Resident and Resident Regulations

While non-residents are generally required to meet the same minimum liability coverage as residents, there are some key differences in regulations:

- Duration of Coverage: Non-resident insurance policies typically have shorter coverage periods, often aligned with the duration of the visit. This can be a factor to consider when choosing a policy, especially for longer stays.

- Vehicle Registration: Non-residents are generally not required to register their vehicles in the state they are visiting, but they may need to obtain temporary registration for longer stays.

- Proof of Residency: Non-residents must provide proof of their primary residence outside the state. This can include a driver’s license, utility bills, or other documentation.

Penalties for Driving Without Proper Insurance

Driving without the required insurance as a non-resident can result in significant penalties and consequences, including:

- Traffic Tickets and Fines: Non-resident drivers caught driving without proper insurance can receive hefty fines, ranging from hundreds to thousands of dollars.

- Vehicle Impoundment: In some states, vehicles driven without insurance can be impounded, leading to additional costs for storage and release.

- License Suspension: Driving without insurance can result in the suspension of your driver’s license, both in the state you are visiting and your home state.

- Legal Liability: If involved in an accident without proper insurance, you could face significant financial liability for damages and injuries, potentially exceeding the limits of your out-of-state policy.

Factors Influencing Insurance Rates

While obtaining auto insurance with an out-of-state license is possible, your premiums might differ from those of in-state residents. Several factors contribute to this variance, impacting your overall insurance costs.

Impact of Driving History

Your driving history plays a crucial role in determining your insurance premiums. Insurance companies assess your past driving record, considering factors such as accidents, traffic violations, and claims history. A clean driving record generally translates to lower premiums, while a history of accidents or violations can lead to higher rates.

For example, a driver with a history of speeding tickets or at-fault accidents might be considered a higher risk by insurance companies, resulting in increased premiums.

Influence of Vehicle Type

The type of vehicle you drive also influences your insurance rates. Insurance companies consider factors such as the vehicle’s make, model, year, and safety features. Vehicles with a history of theft or higher repair costs tend to have higher insurance premiums.

For instance, a luxury sports car might have higher insurance rates than a standard sedan due to its higher value and potential for higher repair costs.

Coverage Options and Their Impact

The type and amount of coverage you choose significantly affect your insurance premiums. Comprehensive and collision coverage provide protection against various risks, but they also come with higher premiums.

Consider the following table illustrating the potential impact of different coverage options on insurance costs:

| Coverage Option | Impact on Premium |

|---|---|

| Comprehensive Coverage | Higher Premium |

| Collision Coverage | Higher Premium |

| Liability Coverage (Minimum Requirements) | Lower Premium |

Opting for higher coverage limits can also increase your premiums. For example, choosing a higher liability coverage limit provides greater financial protection but might result in a higher premium.

Navigating the Insurance Application Process

Applying for auto insurance with an out-of-state license might seem daunting, but it’s a straightforward process with the right approach. Understanding the specific requirements and effectively communicating with insurance companies will help you secure the coverage you need.

Key Information and Questions, Can you get auto insurance with out of state license

Insurance companies gather crucial information to assess your risk and determine your premium. Here’s a breakdown of the key questions and information typically requested:

- Personal Information: Your name, address, date of birth, contact details, and Social Security number.

- Driving History: Your driving record, including any accidents, violations, or suspensions. This information is usually obtained through a motor vehicle report (MVR).

- Vehicle Information: Make, model, year, VIN, and the intended use of the vehicle.

- Coverage Preferences: The types of coverage you require, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Payment Information: Your preferred payment method, including bank account details or credit card information.

- Out-of-State License Details: The state where your license is issued, the license number, and the date of issuance.

Communicating Effectively

Open and transparent communication is essential when applying for insurance with an out-of-state license. Here are some tips to ensure a smooth process:

- Be Prepared: Gather all the necessary documents before starting the application process, including your driver’s license, vehicle registration, proof of residency, and any previous insurance policies.

- Be Honest: Provide accurate information about your driving history and any relevant details regarding your out-of-state license. Misrepresenting information can lead to policy cancellation or denial.

- Ask Questions: Don’t hesitate to ask questions about the application process, coverage options, or anything that’s unclear. A good insurance agent will be happy to clarify any concerns.

- Be Patient: The application process may take some time, especially if you’re dealing with an out-of-state license. Stay patient and follow up with the insurance company if you have any questions or concerns.

Understanding Your Insurance Policy: Can You Get Auto Insurance With Out Of State License

Your auto insurance policy is a legally binding contract that Artikels the terms and conditions of your coverage. It’s crucial to understand what your policy covers and the limits of your protection, especially if you have an out-of-state license.

Key Components of an Auto Insurance Policy

Your auto insurance policy typically includes several key components:

- Declarations Page: This page summarizes your policy’s essential details, including your name, address, vehicle information, coverage types, and premium amounts.

- Coverages: This section Artikels the specific types of coverage you’ve purchased, such as liability, collision, comprehensive, and personal injury protection (PIP).

- Exclusions: This section specifies situations or events that are not covered by your policy.

- Conditions: This section Artikels your responsibilities as the insured, including reporting accidents, cooperating with investigations, and paying premiums on time.

Coverage Options for Drivers with Out-of-State Licenses

While most coverage options are generally the same for drivers with out-of-state licenses, there are a few specific points to consider:

- Non-Resident Coverage: Some states offer specific insurance policies designed for non-residents, which may have different coverage limits or premiums.

- Reciprocity: In some cases, your home state’s insurance coverage may be recognized in the state where you’re driving, especially if your home state has a reciprocity agreement with the other state.

- State-Specific Requirements: Each state has its own minimum insurance requirements. Ensure your policy meets the minimum requirements of the state where you’re driving, even if you have an out-of-state license.

Importance of Reviewing Your Policy

Before driving with an out-of-state license, carefully review your insurance policy to ensure you understand:

- Coverage Limits: Know the maximum amounts your policy will pay for each type of coverage, such as liability or collision.

- Deductibles: Understand the amount you’ll have to pay out-of-pocket before your insurance kicks in for certain types of claims.

- Exclusions: Be aware of any situations or events that are not covered by your policy, such as driving under the influence or using your vehicle for commercial purposes.

- Claims Process: Familiarize yourself with the process for reporting accidents and filing claims.

Closing Notes

Obtaining auto insurance with an out-of-state license can be a complex process, but it’s not impossible. By understanding the legal framework, state regulations, and insurance company policies, you can increase your chances of securing the coverage you need. Remember to be transparent with your insurance provider about your situation, gather the necessary documents, and compare quotes from multiple insurers to find the best rates. With careful planning and research, you can navigate the complexities of insurance and drive with peace of mind.

General Inquiries

What happens if I get into an accident with an out-of-state license?

If you’re involved in an accident while driving with an out-of-state license, your insurance coverage will be determined by the terms of your policy. It’s crucial to have adequate coverage that meets the minimum requirements of the state where the accident occurred. Failure to comply with state regulations could result in penalties and legal complications.

How long can I drive with an out-of-state license before I need to get a license in the new state?

The timeframe for obtaining a license in your new state varies. It’s recommended to contact your local Department of Motor Vehicles (DMV) to determine the specific requirements and deadlines for license renewal or issuance. Failure to comply with state regulations could result in fines or other penalties.

Can I get insurance with an out-of-state license if I’m a student?

Yes, you can generally get insurance with an out-of-state license if you’re a student. However, you may need to provide additional documentation, such as proof of enrollment and residency, to the insurance company. It’s advisable to contact the insurance company directly to confirm their specific requirements.

What if I have a poor driving record in my home state?

Insurance companies typically consider your driving history when evaluating your insurance premiums. If you have a poor driving record in your home state, it may affect your rates in the new state. It’s important to be transparent with the insurance company about your driving history and provide any relevant documentation.