Can i have out of state insurance – Can I have out-of-state insurance? It’s a question many people ask, especially when moving or spending extended time in a different state. The answer isn’t always straightforward and depends on several factors, including the type of insurance, state regulations, and your individual circumstances. Understanding the nuances of out-of-state insurance is crucial for ensuring you have adequate coverage and avoid potential legal issues.

This guide explores the complexities of out-of-state insurance, covering eligibility, requirements, application processes, coverage benefits, cost considerations, and legal implications. We’ll also provide tips for choosing the right out-of-state insurance policy to meet your needs.

Understanding Out-of-State Insurance

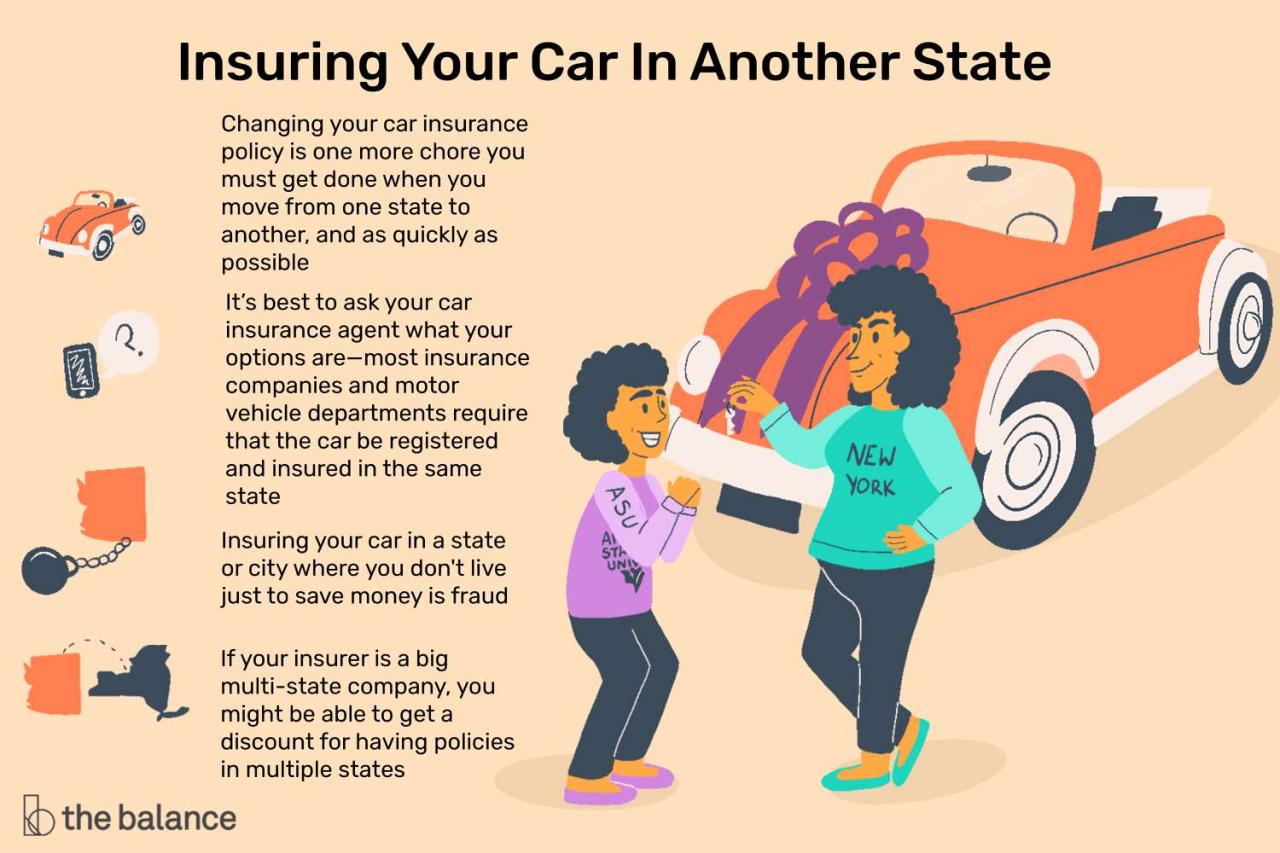

Out-of-state insurance refers to insurance policies purchased in a state different from the one where the insured individual or entity resides. It can be a necessity for people who frequently travel or relocate to different states, or for businesses operating across state lines. Understanding the implications of out-of-state insurance is crucial for making informed decisions about your coverage.

Differences Between In-State and Out-of-State Insurance Policies

The differences between in-state and out-of-state insurance policies primarily stem from the varying regulations and laws governing insurance in different states. This can lead to discrepancies in coverage, premiums, and the availability of certain types of insurance.

- Coverage: Some insurance policies may offer different levels of coverage depending on the state where they are purchased. For instance, a car insurance policy purchased in one state might not provide the same level of liability coverage as a policy purchased in another state.

- Premiums: Insurance premiums can vary significantly from state to state due to factors like the cost of living, accident rates, and the density of the insured population.

- Availability of Coverage: Certain types of insurance, such as workers’ compensation, may not be available in all states, or the requirements for obtaining coverage may differ.

Situations Where Out-of-State Insurance Might Be Necessary

Out-of-state insurance can be essential in various situations:

- Frequent Travelers: Individuals who travel frequently to different states might need out-of-state insurance to ensure they have adequate coverage while away from their home state.

- Relocating to a New State: When relocating to a new state, it’s essential to obtain insurance from a provider licensed in that state to ensure your coverage meets local requirements.

- Businesses Operating in Multiple States: Businesses operating in multiple states often need to obtain insurance policies in each state where they conduct business to comply with local regulations.

- Military Personnel: Military personnel are often stationed in different states, requiring them to obtain out-of-state insurance to meet their coverage needs.

Eligibility and Requirements

Generally, obtaining out-of-state insurance depends on your residency status and the specific insurance type you’re seeking. States have varying rules, and your eligibility may be affected by factors such as your employment, property location, and the purpose of your insurance.

While some states allow out-of-state insurance, it’s important to be aware of potential limitations and restrictions that might apply. These can include differences in coverage, premium rates, and even the availability of specific insurance types.

Requirements for Out-of-State Insurance

The requirements for obtaining out-of-state insurance can vary significantly depending on the state and the type of insurance you’re seeking. However, some common requirements include:

- Proof of residency: You’ll usually need to provide documentation to verify your current address, such as a driver’s license, utility bills, or bank statements.

- Driving record: For auto insurance, you’ll need to provide your driving history, including any accidents or violations.

- Vehicle information: For auto insurance, you’ll need to provide details about your vehicle, such as the make, model, year, and VIN.

- Credit history: In some states, your credit history may be used to determine your insurance rates.

- Proof of insurance: You’ll need to provide proof of current insurance coverage, if applicable.

Limitations and Restrictions

There may be limitations or restrictions on the coverage you can obtain with out-of-state insurance. These can include:

- Coverage exclusions: Some policies may exclude certain types of coverage, such as natural disasters that are common in the state where you’re insured.

- Higher premiums: Out-of-state insurance policies may have higher premiums due to factors such as risk assessments and regulatory differences.

- Limited access to services: You may have limited access to repair shops, medical providers, or other services in the state where you’re insured.

- Claims processing: Claims processing may be more complex and time-consuming if you’re insured in a different state.

Obtaining Out-of-State Insurance

Securing out-of-state insurance can be a straightforward process, but it requires careful planning and understanding of the specific requirements. This section will guide you through the steps involved in applying for out-of-state insurance and provide insights into the application processes of various insurance companies.

Application Process

The application process for out-of-state insurance typically involves the following steps:

- Contact Insurance Companies: Start by contacting insurance companies that offer coverage in the state where you plan to relocate. Research their policies, coverage options, and pricing.

- Gather Required Documents: Prepare the necessary documentation, including your driver’s license, proof of residency, vehicle registration, and insurance history.

- Complete Application: Fill out the insurance application form, providing accurate and complete information about yourself, your vehicle, and your driving history.

- Submit Application: Submit your completed application, along with the required documents, to the insurance company.

- Receive Confirmation: After reviewing your application, the insurance company will notify you of their decision and provide you with a policy confirmation.

Insurance Company Application Processes

Here’s a comparison of the application processes of some popular insurance companies:

| Insurance Company | Application Process | Key Features |

|---|---|---|

| Progressive | Online application, phone call, or through an agent. | Wide coverage options, competitive pricing, 24/7 customer support. |

| Geico | Online application, phone call, or through an agent. | Fast and easy online application process, competitive rates, discounts for multiple policies. |

| State Farm | Online application, phone call, or through an agent. | Extensive network of agents, customizable coverage options, discounts for safe driving. |

| Allstate | Online application, phone call, or through an agent. | Strong financial stability, various discounts, comprehensive coverage options. |

Reputable Insurance Providers

Several reputable insurance providers offer out-of-state coverage. Here are some examples:

- Progressive

- Geico

- State Farm

- Allstate

- USAA (for military members and their families)

- Nationwide

- Liberty Mutual

- Farmers Insurance

Coverage and Benefits

Out-of-state insurance policies offer various types of coverage, much like in-state options. However, there can be subtle differences in the benefits and exclusions, which are crucial to understand before making a decision.

Types of Coverage

Out-of-state insurance policies typically provide coverage for:

- Liability Coverage: This covers damages to other people’s property or injuries caused by you in an accident. It is usually required by law and can include bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

- Collision Coverage: This covers damages to your vehicle if you are involved in an accident, regardless of who is at fault. It helps pay for repairs or replacement costs.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than accidents, such as theft, vandalism, natural disasters, or falling objects. It can also cover the cost of repairs or replacement.

- Medical Payments Coverage: This covers medical expenses for you and your passengers in case of an accident, regardless of who is at fault. It is a separate coverage from health insurance and can help with immediate medical costs.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It can help pay for your medical expenses and vehicle repairs.

- Personal Injury Protection (PIP): This coverage is often required in states with no-fault insurance laws. It covers your medical expenses, lost wages, and other related costs regardless of fault in an accident.

Comparison of Benefits

- Premium Costs: Out-of-state insurance premiums can be higher or lower than in-state options, depending on factors like your driving record, vehicle type, and the state’s insurance regulations. Some states may have lower insurance rates due to lower accident rates or less stringent regulations.

- Coverage Limits: The coverage limits offered by out-of-state insurance policies may differ from in-state options. You should carefully compare the coverage limits for liability, collision, and comprehensive coverage to ensure they meet your needs.

- Deductibles: The deductibles for out-of-state insurance policies can also vary. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums.

- Benefits and Exclusions: Out-of-state insurance policies may have different benefits and exclusions compared to in-state options. For example, some policies may offer rental car reimbursement or roadside assistance, while others may not. It’s essential to read the policy carefully to understand what is covered and what is not.

Potential Gaps in Coverage

- State-Specific Exclusions: Some insurance policies may have exclusions that are specific to the state where the policy is issued. For example, a policy issued in a state with no-fault insurance laws may not cover certain types of damages in a state with fault-based insurance laws.

- Coverage Limitations: Out-of-state insurance policies may have limitations on the coverage they provide, such as a maximum payout for a particular claim or a limit on the number of claims you can file. It’s essential to understand these limitations before purchasing a policy.

- Limited Access to Providers: You may have limited access to healthcare providers or repair shops if you have out-of-state insurance. Some insurance companies may have a limited network of providers in certain states, so it’s crucial to check if your preferred providers are in the network.

Cost and Premiums

Understanding the cost of out-of-state insurance is crucial for individuals who plan to relocate or spend an extended period outside their home state. Several factors influence the cost of premiums, and these factors can vary significantly depending on the specific insurance policy and the individual’s circumstances.

Factors Influencing Out-of-State Insurance Premiums

The cost of out-of-state insurance premiums is determined by a complex interplay of various factors. These factors can be categorized into several key areas:

- Individual Factors: Age, driving history, credit score, and health status are all considered by insurers when calculating premiums. For example, younger drivers with a history of accidents or traffic violations are likely to face higher premiums than older drivers with clean driving records.

- Vehicle Factors: The make, model, year, and value of the vehicle can significantly influence insurance premiums. For instance, high-performance sports cars or luxury vehicles tend to have higher insurance costs due to their greater repair expenses and higher risk of theft.

- Location Factors: The state where the insurance is purchased, the specific zip code, and the density of population in the area can all affect premiums. For example, urban areas with high traffic congestion and crime rates may have higher insurance costs compared to rural areas with lower population densities.

- Coverage Factors: The type of insurance coverage selected, such as comprehensive, collision, liability, and uninsured motorist coverage, will directly impact the premium. Choosing a higher level of coverage typically results in higher premiums, while opting for lower coverage limits can reduce costs.

- Insurance Company Factors: Different insurance companies have varying pricing structures and risk assessments, leading to differences in premiums. Some insurers may offer discounts for certain groups, such as good students, members of specific organizations, or drivers who install safety features in their vehicles.

Average Premiums for Out-of-State Insurance Policies

The average cost of out-of-state insurance premiums can vary significantly depending on the type of insurance, the state of residence, and the individual’s circumstances. Here are some general estimates for different types of out-of-state insurance policies:

| Insurance Type | Average Monthly Premium |

|---|---|

| Auto Insurance | $100 – $250 |

| Health Insurance | $300 – $800 |

| Homeowners Insurance | $100 – $300 |

| Renters Insurance | $15 – $50 |

It is important to note that these are just estimates, and actual premiums may vary considerably based on the factors discussed earlier. It is always recommended to obtain quotes from multiple insurers to compare prices and coverage options.

Estimated Cost of Out-of-State Insurance for Various Scenarios

To illustrate how the cost of out-of-state insurance can vary, consider these hypothetical scenarios:

| Scenario | Estimated Monthly Premium |

|---|---|

| A young driver (21 years old) with a clean driving record, living in a suburban area, driving a mid-size sedan, seeking auto insurance with minimum coverage | $150 – $200 |

| A family of four with two drivers (ages 35 and 40), living in a rural area, driving two vehicles (one SUV and one minivan), seeking comprehensive auto insurance | $250 – $350 |

| A homeowner (age 50) with a good credit score, living in a mid-size city, owning a two-story home with a market value of $300,000, seeking homeowners insurance with standard coverage | $150 – $250 |

| A renter (age 25) with a clean credit history, living in a large apartment complex, seeking renters insurance with basic coverage | $20 – $35 |

These scenarios demonstrate how factors like age, location, vehicle type, and coverage level can significantly influence the cost of out-of-state insurance. It is essential to consider these factors when obtaining quotes and making informed decisions about insurance coverage.

Legal Considerations

Obtaining and using out-of-state insurance involves several legal aspects that are crucial to understand. It’s important to be aware of the potential implications of driving with out-of-state insurance in another state, and to navigate any legal complexities related to out-of-state insurance.

State Laws and Regulations

Every state has its own set of laws and regulations governing insurance. When you obtain insurance in one state and drive in another, you need to ensure your policy complies with the laws of the state you’re driving in. For example, some states have minimum liability coverage requirements that may exceed the coverage provided by your out-of-state policy. Failing to meet these minimum requirements could result in fines or penalties.

Reciprocity Agreements

Reciprocity agreements are arrangements between states that recognize the validity of insurance policies issued in other participating states. These agreements can simplify the process of obtaining out-of-state insurance and ensure your policy is recognized in the state you’re driving in. However, it’s important to note that not all states have reciprocity agreements with every other state.

Potential Implications of Driving with Out-of-State Insurance, Can i have out of state insurance

Driving with out-of-state insurance in another state can have several potential implications. If you’re involved in an accident, the other party’s insurance company may try to argue that your out-of-state policy is not valid or does not provide sufficient coverage. Additionally, if you’re found to be at fault for the accident, you may face legal action from the other party, even if your out-of-state insurance covers the damages. It’s crucial to understand the specific laws and regulations of the state you’re driving in and to ensure your out-of-state policy meets the minimum requirements.

Tips for Choosing Out-of-State Insurance: Can I Have Out Of State Insurance

Navigating the world of out-of-state insurance can feel overwhelming, but with a strategic approach, you can find the best coverage for your needs. This section provides practical tips and a checklist to guide you through the selection process.

Comparing Out-of-State Insurance Providers

When choosing an out-of-state insurance provider, it’s crucial to compare different options to find the best fit. Here’s a checklist of factors to consider:

- Coverage Options: Compare the types of coverage offered by different providers. Ensure they meet your specific requirements, including liability limits, comprehensive and collision coverage, and optional add-ons like roadside assistance or rental car reimbursement.

- Premiums and Discounts: Request quotes from multiple providers to compare premiums and identify potential discounts. Factors like your driving history, vehicle type, and location can significantly impact pricing. Consider discounts for safe driving, multiple policies, or affiliations with certain organizations.

- Customer Service and Claims Process: Research the provider’s reputation for customer service and claims handling. Check online reviews and ratings to gauge their responsiveness and efficiency in resolving issues.

- Financial Stability: Evaluate the provider’s financial strength. Look for ratings from independent agencies like AM Best or Standard & Poor’s to ensure they have a solid track record and are financially sound.

Researching and Evaluating Out-of-State Insurance Options

Thorough research is essential for making informed decisions. Here’s a breakdown of effective research strategies:

- Online Research: Start by using online comparison tools to gather quotes from multiple providers. These tools can help you quickly compare coverage options, premiums, and discounts. Consider websites like Insurance.com, The Zebra, or NerdWallet.

- Direct Provider Websites: Visit the websites of insurance companies that interest you. Explore their coverage details, customer testimonials, and claims handling procedures.

- Contacting Providers Directly: Don’t hesitate to contact providers directly to ask questions and request personalized quotes. This allows you to clarify specific details and get a better understanding of their policies.

- Seeking Recommendations: Ask friends, family, or colleagues for recommendations on out-of-state insurance providers they’ve had positive experiences with. Their insights can provide valuable perspectives.

Last Point

Navigating the world of out-of-state insurance can be confusing, but it’s essential to understand the intricacies involved. By researching your options, carefully considering your needs, and adhering to state regulations, you can ensure you have the appropriate coverage wherever you go. Remember, the key is to be proactive, informed, and prepared. Don’t hesitate to reach out to an insurance professional for personalized advice and guidance tailored to your specific situation.

Questions and Answers

Is out-of-state insurance always recognized?

Not necessarily. Some states have reciprocity agreements, while others may require additional coverage or specific endorsements. It’s best to check with the state’s Department of Motor Vehicles or insurance regulator.

What if I need to file a claim in another state?

Your out-of-state insurer should handle claims regardless of where you are. However, there may be specific procedures or requirements depending on the state where the claim occurs.

Can I get out-of-state insurance for a short trip?

In most cases, your existing in-state insurance should provide sufficient coverage for temporary travel. However, if you’re planning an extended stay, it’s best to explore out-of-state options.