Best auto insurance rates Washington state? It’s a question on the minds of many drivers, especially those navigating the unique landscape of Washington’s insurance market. This state boasts a diverse range of insurance providers, each with its own set of policies and pricing structures. Understanding the factors that influence rates and how to leverage them to your advantage can be the key to securing the best possible coverage at a price that fits your budget.

This guide delves into the intricacies of Washington state auto insurance, covering everything from mandatory coverages to the key factors that determine your premiums. We’ll explore strategies for finding the best rates, maximizing discounts, and understanding your consumer rights. Whether you’re a seasoned driver or just starting out, this comprehensive resource will equip you with the knowledge to make informed decisions about your auto insurance.

Understanding Washington State Auto Insurance

Washington state has its own set of auto insurance laws and regulations, which differ from other states. Understanding these regulations can help you choose the right coverage and ensure you meet all legal requirements.

Mandatory Coverages in Washington State

Washington state requires all drivers to carry certain types of auto insurance, known as mandatory coverages. These coverages are designed to protect you and others in case of an accident.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It covers the other party’s medical expenses, lost wages, and property damage. In Washington, the minimum liability coverage required is $25,000 per person, $50,000 per accident for bodily injury, and $10,000 for property damage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance. It covers your medical expenses, lost wages, and property damage. In Washington, you are required to carry UM/UIM coverage equal to your liability limits, which means you are required to carry at least $25,000 per person, $50,000 per accident for bodily injury, and $10,000 for property damage.

Types of Auto Insurance in Washington

In addition to the mandatory coverages, there are other types of auto insurance available in Washington that can provide additional protection.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault. It also covers the cost of replacing your vehicle if it is totaled.

- Comprehensive Coverage: This coverage pays for repairs to your vehicle if it is damaged by something other than a collision, such as theft, vandalism, fire, or hail.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault, if you are injured in an accident.

- Rental Reimbursement: This coverage pays for a rental car if your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance if your vehicle breaks down, such as towing, flat tire changes, and jump starts.

Factors Influencing Auto Insurance Rates

Several factors influence the cost of auto insurance in Washington state, reflecting the insurer’s assessment of risk. Understanding these factors can help you make informed decisions that potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your insurance rates. A clean driving record with no accidents or violations typically translates to lower premiums. However, any incidents, such as speeding tickets, DUI convictions, or accidents, can significantly increase your rates. The severity of the violation and the frequency of incidents influence the impact on your premiums. For example, a minor traffic violation might result in a slight rate increase, while a DUI conviction could lead to a substantial premium hike.

Vehicle Type

The type of vehicle you drive also influences your insurance rates. Higher-performance vehicles with powerful engines or expensive luxury cars are generally associated with higher insurance premiums. This is because they are more expensive to repair or replace and are often targeted by thieves. Conversely, older, less expensive vehicles tend to have lower premiums. The vehicle’s safety features also impact rates. Vehicles equipped with advanced safety technologies like anti-lock brakes, airbags, and electronic stability control are often eligible for discounts.

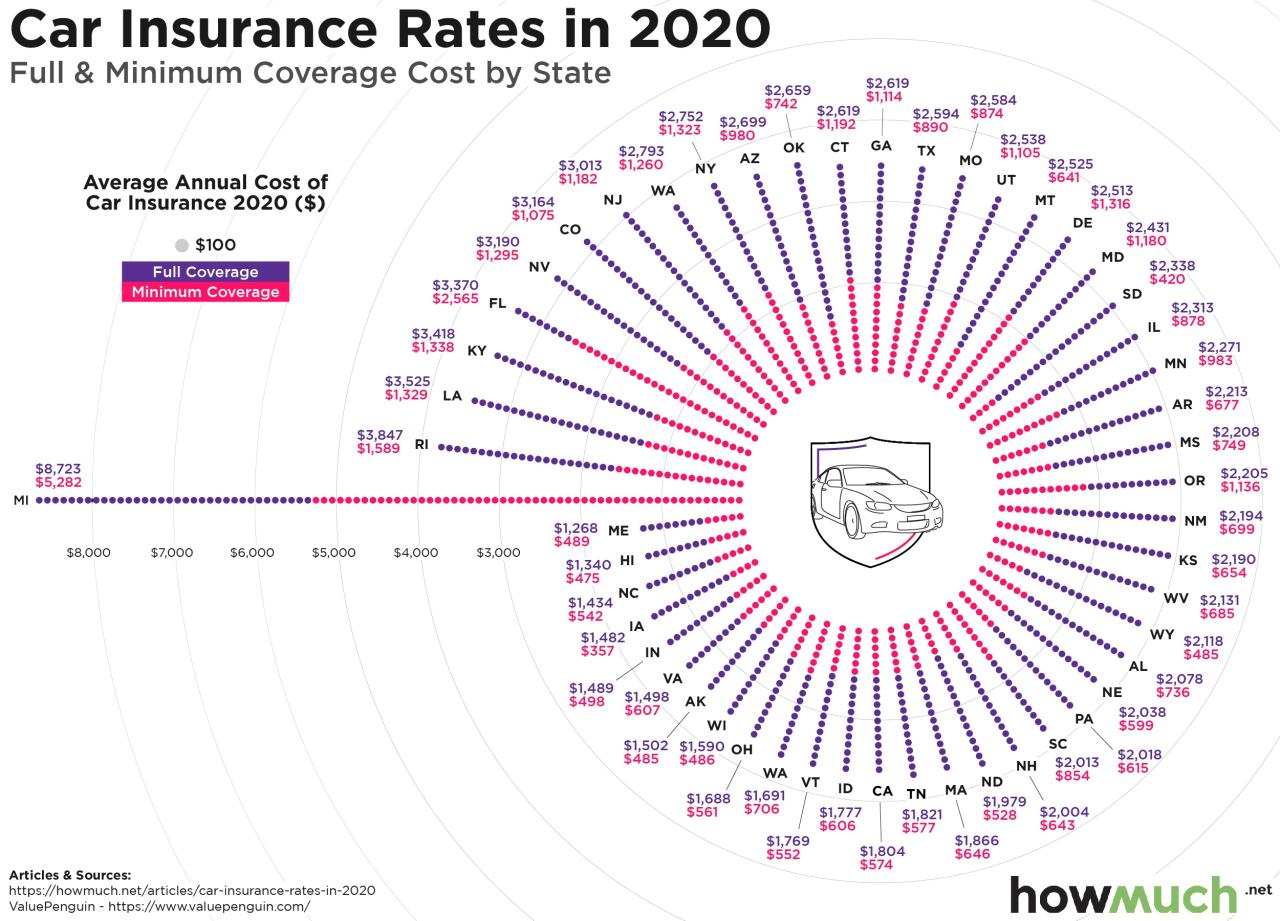

Location

The location where you live significantly impacts your insurance rates. Areas with higher rates of car theft, accidents, or vandalism generally have higher insurance premiums. Urban areas with congested traffic and higher population density often have higher rates compared to rural areas. Insurers consider the frequency of claims and the cost of repairs in specific locations when setting premiums.

Credit Score

In Washington state, insurers can use your credit score to determine your auto insurance rates. The rationale behind this practice is that individuals with good credit history are generally considered to be more responsible and financially stable. Insurers believe that this translates into a lower risk of filing claims. However, this practice is controversial, and some states have prohibited insurers from using credit scores for insurance rate determination.

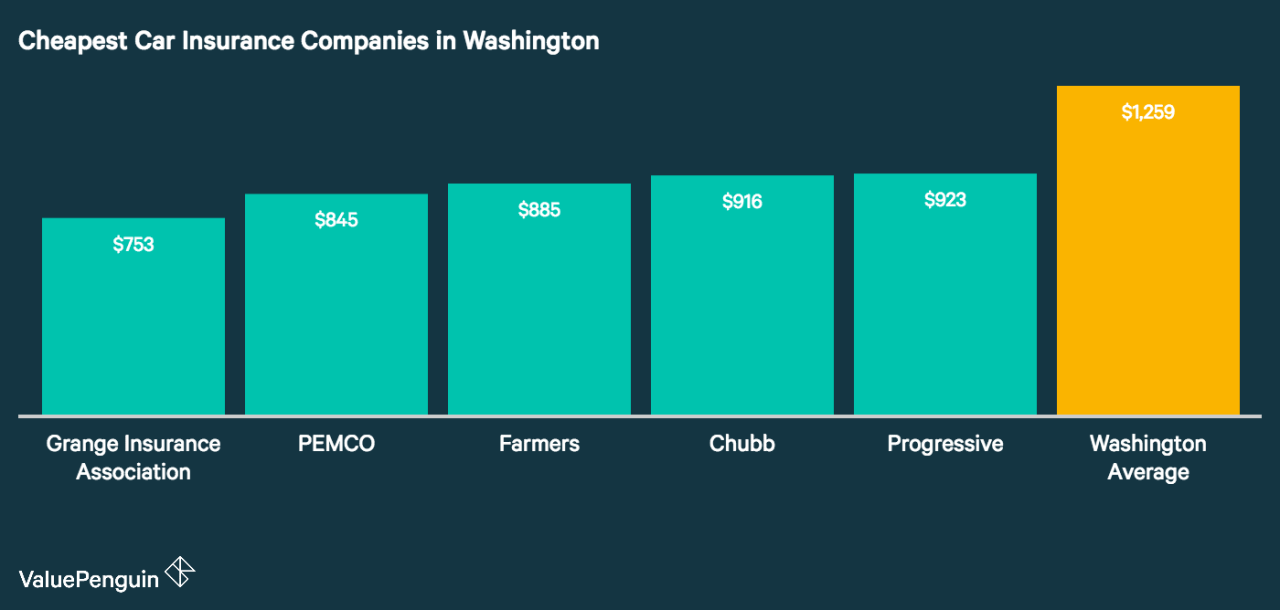

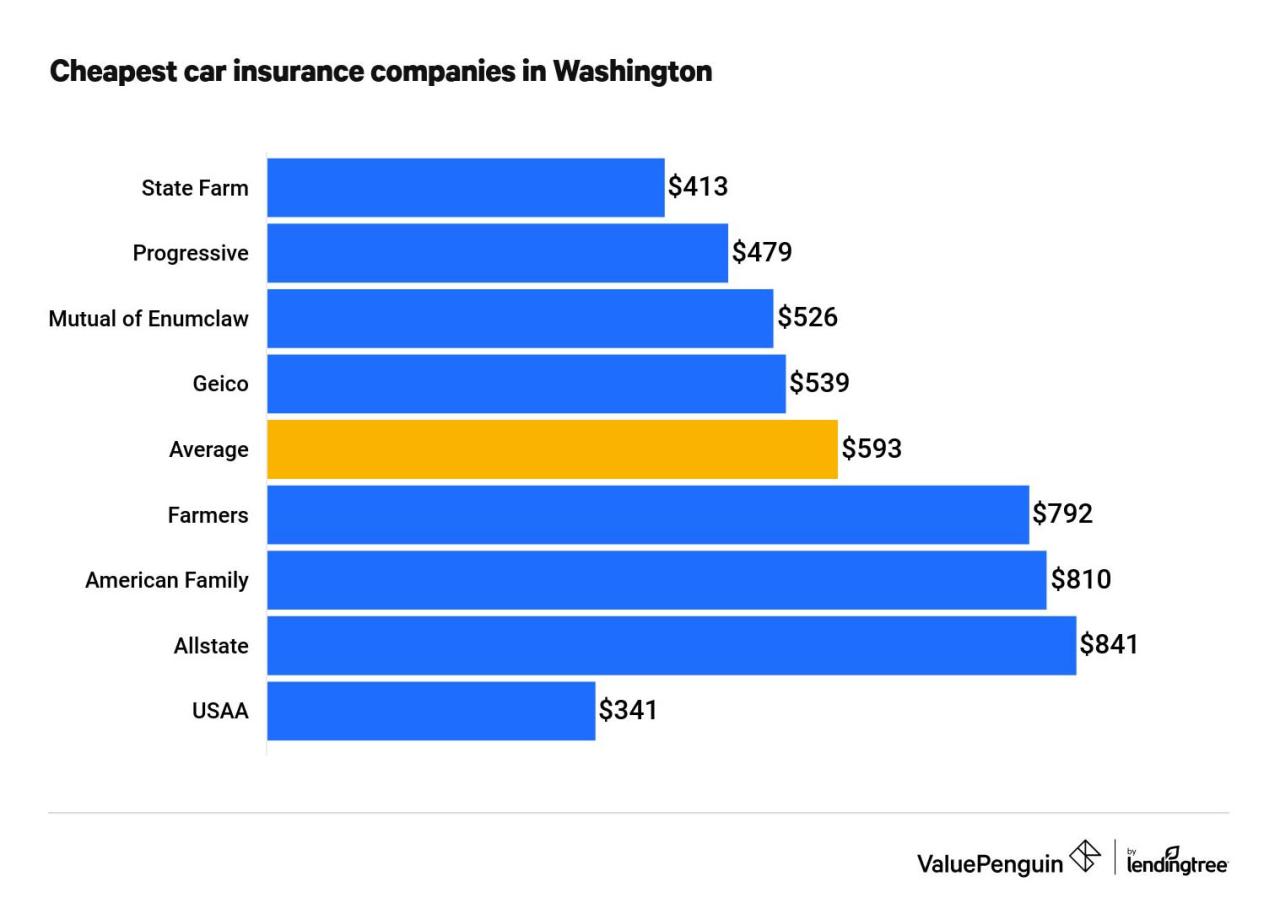

Finding the Best Auto Insurance Rates

Finding the best auto insurance rates in Washington State requires a strategic approach. It’s essential to compare quotes from multiple insurance companies, carefully consider coverage options, and understand the factors that influence premiums. By following these steps, you can secure the most affordable and comprehensive coverage for your needs.

Comparing Quotes

To find the best auto insurance rates, it’s crucial to compare quotes from multiple insurance companies. This allows you to identify the most competitive prices and coverage options available. Here are some tips for comparing quotes effectively:

- Use online comparison websites: Many websites allow you to enter your information once and receive quotes from multiple insurance companies simultaneously. This saves time and effort, making the comparison process more efficient.

- Contact insurance companies directly: While online comparison websites are convenient, contacting insurance companies directly can provide more detailed information and personalized quotes.

- Ask for discounts: Insurance companies offer various discounts, such as safe driving discounts, good student discounts, and multi-policy discounts. Be sure to inquire about these discounts when requesting quotes.

Coverage Limits and Deductibles

Coverage limits and deductibles play a significant role in determining your auto insurance premium. Coverage limits define the maximum amount your insurance company will pay for a specific type of claim. Deductibles represent the amount you pay out of pocket before your insurance coverage kicks in.

- Coverage Limits: Higher coverage limits typically result in higher premiums. It’s essential to choose coverage limits that adequately protect you financially in case of an accident.

- Deductibles: Conversely, higher deductibles generally lead to lower premiums. This is because you agree to pay more out of pocket before your insurance coverage kicks in. Consider your financial situation and risk tolerance when deciding on your deductible.

Negotiating Lower Premiums

While comparing quotes and understanding coverage options are crucial, you can also negotiate lower premiums with insurance companies. Here are some strategies to consider:

- Shop around regularly: Insurance rates can fluctuate over time, so it’s beneficial to shop around for quotes every year or two to ensure you’re getting the best possible rate.

- Bundle policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can lead to discounts.

- Improve your credit score: A good credit score can often lead to lower insurance premiums, as it indicates a lower risk to insurance companies.

Discounts and Savings

Saving money on your auto insurance premiums is a priority for most drivers. Luckily, many discounts are available to help you reduce your costs. Understanding these discounts and how to qualify for them can significantly impact your bottom line.

Common Discounts

Many insurance companies in Washington state offer a variety of discounts to help drivers save money. Some of the most common discounts include:

- Safe Driving Discounts: Insurance companies reward drivers with clean driving records by offering discounts for accident-free periods. The longer you go without an accident, the higher the discount you may qualify for.

- Good Student Discount: Students who maintain good grades often qualify for a discount. This reflects the assumption that good students tend to be more responsible and make safer driving decisions.

- Multi-Car Discount: Insuring multiple vehicles with the same company can result in a discount. This is often referred to as a “multi-policy” or “bundling” discount.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can deter theft and lower your risk, making you eligible for a discount.

- Defensive Driving Course Discount: Completing a defensive driving course demonstrates your commitment to safe driving practices, leading to a potential discount.

- Loyalty Discount: Insurance companies often reward long-term customers with discounts for their continued business.

- Military Discount: Active military personnel or veterans may qualify for special discounts.

Qualifying for Discounts

To qualify for discounts, you typically need to meet specific criteria set by the insurance company. Here’s how to qualify for some common discounts:

- Safe Driving Discounts: This discount is usually granted based on your driving record. You may need to have a certain number of years without accidents or traffic violations.

- Good Student Discount: You will typically need to provide proof of good grades, such as a report card or transcript. The minimum GPA requirement varies by insurer.

- Multi-Car Discount: To qualify, you need to insure multiple vehicles with the same insurance company. The discount may apply to all vehicles or only the additional vehicles.

- Anti-theft Device Discount: You need to install an approved anti-theft device in your vehicle and provide proof of installation to the insurance company.

- Defensive Driving Course Discount: You must complete an approved defensive driving course and provide the certificate of completion to your insurer.

- Loyalty Discount: This discount is typically awarded after a certain period of time as a customer with the insurance company. The specific time frame may vary.

- Military Discount: You will need to provide proof of your military service, such as a military ID card or discharge papers.

Maximizing Savings

Here are some tips to maximize your savings on auto insurance premiums:

- Shop Around: Get quotes from multiple insurance companies to compare rates and discounts.

- Bundle Policies: Consider bundling your auto insurance with other policies, such as home or renter’s insurance. This can lead to significant savings.

- Improve Your Driving Record: Avoid accidents and traffic violations to maintain a clean driving record, which can qualify you for lower premiums.

- Maintain a Good Credit Score: Your credit score can impact your insurance rates in some states. Maintaining a good credit score can potentially lower your premiums.

- Take Advantage of Discounts: Make sure you are taking advantage of all the discounts you qualify for, including those for good student status, safe driving, and anti-theft devices.

- Consider Increasing Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can also lower your premium. Choose a deductible you can comfortably afford.

Resources for Consumers

Navigating the world of auto insurance can feel overwhelming, especially with the diverse range of options and complexities involved. Fortunately, several resources are available to help Washington residents make informed decisions and ensure they’re getting the best coverage at a fair price.

These resources can provide valuable information, assist with resolving insurance disputes, and protect your rights as a consumer.

The Washington State Office of the Insurance Commissioner, Best auto insurance rates washington state

The Washington State Office of the Insurance Commissioner (OIC) plays a crucial role in regulating the insurance industry and protecting consumers’ interests. This office is responsible for:

- Licensing and overseeing insurance companies operating in Washington.

- Enforcing state insurance laws and regulations.

- Investigating consumer complaints and resolving disputes between policyholders and insurers.

- Educating consumers about their rights and responsibilities regarding insurance.

The OIC provides a wealth of information on its website, including:

- Consumer guides and brochures on various insurance topics, including auto insurance.

- A searchable database of licensed insurance companies, allowing consumers to verify the legitimacy of an insurer.

- Information about filing complaints against insurance companies.

- Resources for understanding insurance policies and navigating claims processes.

Consumer Protection Rights Related to Auto Insurance

Washington state law provides consumers with specific rights and protections regarding auto insurance. These rights include:

- The right to receive a clear and concise explanation of your insurance policy, including coverage details, exclusions, and premium calculations.

- The right to be treated fairly and respectfully by insurance companies and their representatives.

- The right to dispute a claim decision if you believe it’s unfair or unreasonable.

- The right to file a complaint with the OIC if you have unresolved issues with your insurance company.

- The right to cancel your policy within a certain period after purchase if you’re not satisfied with the terms.

It’s essential to familiarize yourself with your consumer rights and understand how to exercise them effectively. The OIC’s website provides detailed information on consumer protection laws and regulations related to auto insurance in Washington.

Ending Remarks: Best Auto Insurance Rates Washington State

Navigating the world of auto insurance in Washington can feel like a maze, but with the right information and strategies, you can find the best rates and ensure you’re adequately protected. By understanding the nuances of Washington’s insurance landscape, comparing quotes from different providers, and leveraging available discounts, you can secure a policy that meets your needs and fits your budget. Remember, your safety and financial well-being are paramount, and a well-informed approach to auto insurance is crucial for peace of mind on the road.

User Queries

What are the minimum auto insurance requirements in Washington state?

Washington requires drivers to carry liability coverage, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I get a free auto insurance quote?

Most insurance companies offer online quote tools, allowing you to get a free quote in minutes. You can also contact insurance agents directly for a personalized quote.

What factors affect my auto insurance rates in Washington?

Your driving history, vehicle type, location, credit score, and coverage choices all influence your rates.

Are there any discounts available on auto insurance in Washington?

Yes, many discounts are available, including safe driver discounts, good student discounts, and bundling discounts for multiple policies.