At fault insurance states – At-fault insurance states set the stage for a complex legal landscape where drivers found responsible for accidents bear the financial burden. In these states, the concept of “fault” becomes central to determining liability and insurance claims. Understanding the intricacies of at-fault insurance is crucial for drivers, as it directly impacts their premiums, legal obligations, and potential financial repercussions in the event of an accident.

This guide explores the intricacies of at-fault insurance, delving into its legal framework, financial implications, and potential advantages and disadvantages. We will examine the historical context behind the adoption of at-fault insurance systems, analyze the legal procedures involved in determining fault, and discuss the potential impact of emerging technologies on this complex system.

What is At-Fault Insurance?

At-fault insurance is a type of car insurance where the driver who is deemed responsible for a car accident is the one who pays for the damages. This is in contrast to no-fault insurance, where each driver’s own insurance company pays for their own damages, regardless of who caused the accident.

At-Fault Insurance Explained

At-fault insurance is based on the principle of liability. This means that the driver who is found to be at fault for the accident is legally responsible for the damages caused. This can include damages to the other vehicle, injuries to the other driver or passengers, and property damage.

Comparison with No-Fault Insurance

No-fault insurance, also known as personal injury protection (PIP) insurance, operates differently. In no-fault systems, each driver’s own insurance company covers their medical expenses and lost wages, regardless of who caused the accident. The at-fault driver’s insurance company may still be responsible for covering property damage, but the injured party’s insurance company typically covers their own medical expenses.

Real-World Examples, At fault insurance states

Here are some examples of how at-fault insurance works in real-world scenarios:

- If a driver runs a red light and crashes into another car, the driver who ran the red light would be considered at fault. Their insurance company would be responsible for covering the damages to the other car, as well as any injuries to the other driver or passengers.

- If a driver is speeding and loses control of their car, crashing into a parked vehicle, the speeding driver would be considered at fault. Their insurance company would be responsible for covering the damages to the parked vehicle.

States with At-Fault Insurance Laws

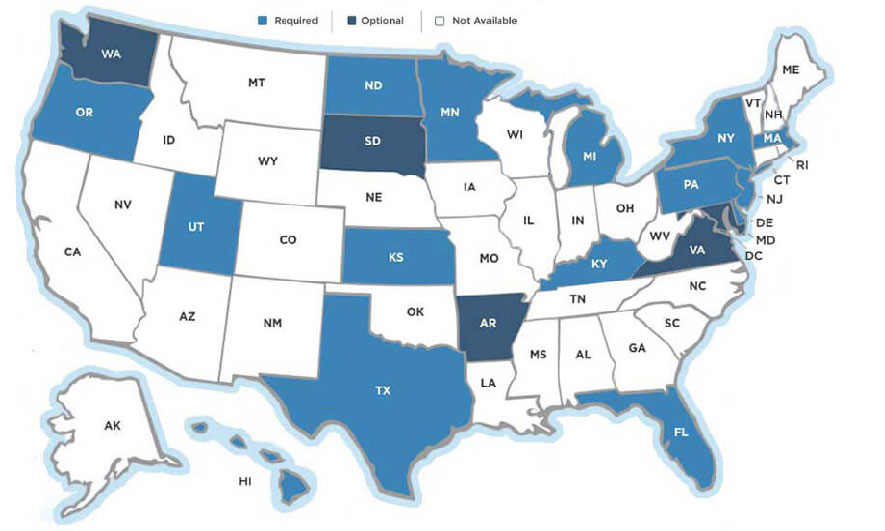

In the United States, the majority of states operate under at-fault insurance systems, which means the driver found responsible for a car accident is typically required to pay for the damages and injuries of the other parties involved. These laws establish a clear framework for determining liability and financial responsibility after a collision.

States with At-Fault Insurance Laws

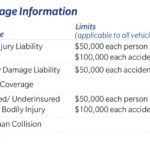

The following table lists the states that currently operate under at-fault insurance systems, along with specific information about their laws:

| State | At-Fault Insurance Laws |

|---|---|

| Alabama | Alabama follows a pure at-fault system. The driver deemed responsible for the accident is liable for all damages, regardless of the degree of fault. |

| Alaska | Alaska has a pure at-fault system. The at-fault driver is liable for all damages caused by the accident. |

| Arizona | Arizona has a pure at-fault system. The at-fault driver is responsible for all damages, including medical expenses, lost wages, and property damage. |

| Arkansas | Arkansas follows a pure at-fault system. The driver found at fault is responsible for all damages caused by the accident. |

| Colorado | Colorado has a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Connecticut | Connecticut follows a modified at-fault system, also known as a “no-fault” system. Drivers are required to carry personal injury protection (PIP) coverage, which covers their own medical expenses regardless of fault. However, if the other driver is found at fault, they can pursue additional damages beyond their PIP coverage. |

| Delaware | Delaware has a pure at-fault system. The at-fault driver is liable for all damages caused by the accident. |

| Florida | Florida follows a no-fault system, but with some at-fault elements. Drivers are required to carry PIP coverage, which covers their own medical expenses. However, if the damages exceed a certain threshold, they can pursue a claim against the at-fault driver. |

| Georgia | Georgia follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Hawaii | Hawaii has a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Idaho | Idaho follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Illinois | Illinois has a modified at-fault system. Drivers are required to carry PIP coverage, which covers their own medical expenses. However, they can pursue a claim against the at-fault driver for additional damages beyond their PIP coverage. |

| Indiana | Indiana follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Iowa | Iowa follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Kansas | Kansas follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Kentucky | Kentucky follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Louisiana | Louisiana follows a pure fault system, but with a unique twist. It uses a “comparative negligence” system, where damages are allocated based on the percentage of fault attributed to each party involved in the accident. |

| Maine | Maine follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Maryland | Maryland follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Massachusetts | Massachusetts follows a no-fault system, but with some at-fault elements. Drivers are required to carry PIP coverage, which covers their own medical expenses. However, they can pursue a claim against the at-fault driver for additional damages beyond their PIP coverage. |

| Michigan | Michigan follows a no-fault system. Drivers are required to carry PIP coverage, which covers their own medical expenses, lost wages, and other related expenses, regardless of fault. However, they can pursue a claim against the at-fault driver for non-economic damages, such as pain and suffering. |

| Minnesota | Minnesota follows a no-fault system, but with some at-fault elements. Drivers are required to carry PIP coverage, which covers their own medical expenses. However, they can pursue a claim against the at-fault driver for additional damages beyond their PIP coverage. |

| Mississippi | Mississippi follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Missouri | Missouri follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Montana | Montana follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Nebraska | Nebraska follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Nevada | Nevada follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| New Hampshire | New Hampshire follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| New Jersey | New Jersey follows a no-fault system. Drivers are required to carry PIP coverage, which covers their own medical expenses, lost wages, and other related expenses, regardless of fault. However, they can pursue a claim against the at-fault driver for non-economic damages, such as pain and suffering, if the injuries meet certain severity thresholds. |

| New Mexico | New Mexico follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| New York | New York follows a no-fault system. Drivers are required to carry PIP coverage, which covers their own medical expenses, lost wages, and other related expenses, regardless of fault. However, they can pursue a claim against the at-fault driver for non-economic damages, such as pain and suffering, if the injuries meet certain severity thresholds. |

| North Carolina | North Carolina follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| North Dakota | North Dakota follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Ohio | Ohio follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Oklahoma | Oklahoma follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Oregon | Oregon follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Pennsylvania | Pennsylvania follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Rhode Island | Rhode Island follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| South Carolina | South Carolina follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| South Dakota | South Dakota follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Tennessee | Tennessee follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Texas | Texas follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Utah | Utah follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Vermont | Vermont follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Virginia | Virginia follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Washington | Washington follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| West Virginia | West Virginia follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Wisconsin | Wisconsin follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

| Wyoming | Wyoming follows a pure at-fault system. The at-fault driver is responsible for all damages caused by the accident. |

Financial Implications of At-Fault Insurance

At-fault insurance, a common system in many US states, has significant financial implications for drivers involved in accidents. Understanding these implications is crucial for drivers to make informed decisions about their insurance coverage and driving habits.

Impact on Insurance Premiums

At-fault insurance systems can influence insurance premiums in various ways. Drivers found at fault in accidents typically face higher premiums. This is because insurance companies view at-fault drivers as higher risk, increasing the likelihood of future claims. The increase in premiums can be substantial, depending on the severity of the accident, the driver’s history, and other factors. For example, a driver with a clean driving record who is found at fault in a minor accident might experience a modest premium increase. However, a driver with a history of accidents or violations who is found at fault in a serious accident could face a significant premium hike.

Financial Burden on Drivers Found at Fault

Drivers found at fault in accidents can face a substantial financial burden. This burden can include:

- Higher insurance premiums: As mentioned earlier, being found at fault can lead to increased insurance premiums for a considerable period, potentially impacting their financial stability.

- Deductibles: Even with insurance coverage, drivers found at fault are typically responsible for paying their deductibles, which can be a significant expense, especially in serious accidents.

- Out-of-pocket expenses: Depending on the severity of the accident, drivers found at fault may incur additional out-of-pocket expenses, such as medical bills, repair costs, or lost wages.

- Legal fees: In some cases, accidents involving at-fault drivers may lead to legal disputes, resulting in additional legal fees and costs.

Impact on the Cost of Auto Repairs and Medical Expenses

At-fault insurance can influence the cost of auto repairs and medical expenses in several ways.

- Negotiation power: Drivers found at fault may have less negotiation power with repair shops and medical providers. This is because they are often responsible for the costs, potentially leading to higher bills.

- Limited coverage: Insurance coverage for at-fault drivers may be limited, especially if they have insufficient coverage or if the accident exceeds their policy limits. This can leave them responsible for significant out-of-pocket expenses.

- Increased claim processing: Insurance companies may scrutinize claims more closely when the driver is at fault, potentially delaying the claim processing and increasing the cost of repairs and medical treatment.

Legal Aspects of At-Fault Insurance

Determining fault in an accident is a crucial aspect of at-fault insurance. This involves legal procedures to establish who is responsible for the accident and subsequent damages. Legal concepts like negligence, contributory negligence, and comparative negligence play significant roles in this process.

Determining Fault in Accidents

Understanding how fault is determined in different types of accidents is essential. Here’s a breakdown of the legal considerations involved:

Rear-End Collisions

In rear-end collisions, the driver of the vehicle that strikes the rear of another vehicle is generally considered at fault. However, exceptions exist, such as when the driver in front suddenly brakes without warning or stops in an unsafe location. In such cases, the driver in the rear may argue that the driver in front was negligent.

Intersection Accidents

Intersection accidents often involve multiple vehicles, making it more complex to determine fault. Factors considered include:

- Right of way: Drivers must yield to vehicles with the right of way, and failure to do so can be considered negligence.

- Traffic signals: Running red lights or failing to stop at stop signs is a clear violation of traffic laws and usually indicates negligence.

- Speeding: Exceeding the speed limit or driving too fast for conditions can contribute to an accident and may be considered negligence.

- Failure to yield: Failing to yield to pedestrians or other vehicles when required can be a factor in determining fault.

Hit-and-Run Incidents

Hit-and-run incidents are considered particularly egregious, as the driver involved flees the scene without providing assistance or identifying themselves. In these cases, the driver who left the scene is almost always considered at fault. The absence of the driver makes it challenging to establish the exact circumstances of the accident, but the act of leaving the scene itself is often considered sufficient evidence of negligence.

Key Legal Concepts

Understanding the key legal concepts is crucial for comprehending how fault is determined:

Negligence

Negligence is the failure to exercise reasonable care, resulting in harm to another person. In car accidents, negligence often involves actions like speeding, driving under the influence, or failing to obey traffic laws.

Contributory Negligence

Contributory negligence occurs when the injured party’s own negligence contributes to the accident. In some jurisdictions, if the injured party is found to be even partially at fault, they may be barred from recovering any damages.

Comparative Negligence

Comparative negligence is a legal doctrine that allows for the apportionment of fault between the parties involved in an accident. Instead of completely barring recovery, the injured party’s damages are reduced by the percentage of their own negligence.

“For example, if a driver is found to be 20% at fault for an accident, and the other driver is found to be 80% at fault, the injured party may be able to recover 80% of their damages.”

Advantages and Disadvantages of At-Fault Insurance: At Fault Insurance States

At-fault insurance systems, prevalent in many US states, present both benefits and drawbacks. Understanding these aspects is crucial for drivers and policymakers alike. This section will delve into the advantages and disadvantages of at-fault insurance, highlighting its impact on driving behavior, fairness, and overall cost.

Incentivizing Safe Driving Practices

At-fault insurance systems inherently encourage drivers to practice safe driving habits. This is because the financial burden of an accident falls on the party deemed at fault. Drivers are more likely to exercise caution, knowing that reckless behavior could lead to significant financial consequences.

- Increased Awareness: Drivers are more conscious of their actions behind the wheel, as they are directly responsible for the financial repercussions of their mistakes. This heightened awareness translates into more cautious driving, potentially reducing accidents.

- Financial Disincentive: The risk of bearing the financial burden of an accident, including repair costs, medical expenses, and potential legal fees, serves as a strong disincentive for risky driving behaviors.

- Potential for Lower Premiums: Safe drivers with a clean record may benefit from lower insurance premiums in at-fault systems. This acts as a reward for responsible driving behavior, further encouraging safety.

Potential for Unfair Outcomes or Disputes

While at-fault insurance systems aim for fairness, there are inherent challenges that can lead to disputes and potentially unfair outcomes. The determination of fault in an accident can be subjective, leading to disagreements between parties involved.

- Subjective Fault Determination: Determining fault in accidents can be complex and subjective, especially in multi-vehicle collisions or situations where multiple factors contribute to the accident. This subjectivity can lead to disputes and disagreements, particularly when the parties involved have different interpretations of events.

- Disputes Over Liability: When multiple parties are involved, disputes over liability can arise. This can lead to drawn-out legal battles, increasing costs and stress for all parties involved. For instance, if two drivers collide, but both claim the other was at fault, the legal process to determine liability can be lengthy and costly.

- Potential for Bias: There is a potential for bias in the determination of fault, especially if one party has more resources or influence than the other. This can lead to unfair outcomes, where the party with less influence bears the brunt of the financial burden despite not being fully responsible.

Advantages and Disadvantages of At-Fault Insurance

| Advantages | Disadvantages |

|---|---|

| Incentivizes safe driving practices by making drivers financially responsible for their actions. | Can lead to unfair outcomes if fault determination is subjective or biased. |

| Potentially lower insurance premiums for safe drivers. | Can result in disputes and legal battles over liability, increasing costs and stress. |

| Clearer allocation of responsibility in accidents. | May encourage “fault-finding” behavior, where drivers focus on blaming others rather than preventing accidents. |

The Future of At-Fault Insurance

The landscape of auto insurance is constantly evolving, influenced by changing societal norms, technological advancements, and legal developments. As a result, at-fault insurance systems, while prevalent in many states, are facing potential changes and trends that could reshape the industry in the years to come.

Transition to No-Fault Systems

The possibility of transitioning to no-fault insurance systems in states currently using at-fault insurance is a topic of ongoing debate. No-fault insurance, where drivers are compensated by their own insurance company regardless of who is at fault, has been adopted in some states and has its proponents and critics.

The potential benefits of transitioning to a no-fault system include:

- Reduced litigation: No-fault systems often streamline the claims process, reducing the need for lawsuits and associated legal costs.

- Faster claim resolution: Drivers can typically receive compensation more quickly under a no-fault system.

- Potential for lower insurance premiums: The reduced litigation and administrative costs associated with no-fault insurance could potentially translate to lower premiums for drivers.

However, there are also potential drawbacks to consider:

- Higher premiums for some drivers: Drivers with a history of accidents or risky driving behaviors may see higher premiums under a no-fault system, as they are no longer shielded from the full cost of their accidents.

- Limited compensation for serious injuries: No-fault systems often have limits on the amount of compensation available for serious injuries, which may not be sufficient to cover all expenses.

- Potential for abuse: Some drivers may be tempted to file fraudulent claims under a no-fault system.

The decision of whether or not to transition to a no-fault system is complex and involves weighing the potential benefits and drawbacks. Factors such as the state’s legal and political climate, the availability of resources for accident victims, and the potential impact on insurance premiums all play a role.

Impact of Emerging Technologies

The emergence of autonomous vehicles (AVs) is poised to have a significant impact on the at-fault insurance system. AVs, with their advanced sensing and decision-making capabilities, have the potential to dramatically reduce accidents caused by human error.

This shift raises questions about liability and insurance in the context of AVs:

- Who is liable in an accident involving an AV: The manufacturer, the software developer, the owner, or a combination of these parties?

- How will insurance premiums be determined for AVs: Will they be lower due to reduced accident risk, or will other factors, such as data privacy concerns, influence premiums?

- Will traditional at-fault insurance systems be adequate for AVs: Or will new insurance models be required to address the unique risks associated with autonomous driving?

As AVs become more prevalent, insurance companies and regulators are working to develop new insurance models that account for the specific characteristics of autonomous driving. These models may involve:

- Usage-based insurance: Premiums based on the actual driving behavior of the AV, rather than the driver’s history.

- Data-driven risk assessment: Utilizing data from AV sensors and algorithms to assess risk and set premiums.

- Shared liability models: Distributing liability among the various parties involved in the development and operation of AVs.

The impact of AVs on at-fault insurance systems is still evolving, but it is clear that the industry will need to adapt to the changing landscape of road safety and liability.

End of Discussion

Navigating the world of at-fault insurance requires a thorough understanding of its intricacies. This guide has provided insights into the legal framework, financial implications, and potential advantages and disadvantages of this system. As technology continues to evolve, it is crucial to stay informed about potential changes and trends in at-fault insurance laws. By understanding the complexities of this system, drivers can make informed decisions about their insurance coverage and navigate the legal landscape with confidence.

General Inquiries

How do at-fault insurance states determine fault in an accident?

At-fault insurance states typically use a system of negligence to determine fault. This involves examining the actions of all parties involved in the accident and determining who was at fault for causing the accident. Evidence, such as witness statements, police reports, and accident reconstruction reports, can be used to establish fault.

What are the potential financial burdens for drivers found at fault in an accident?

Drivers found at fault in an accident may be responsible for paying for damages to other vehicles, medical expenses for injured parties, and their own vehicle repairs. Additionally, their insurance premiums may increase due to the accident, and they may face legal penalties.

What are the benefits of at-fault insurance?

At-fault insurance systems are designed to incentivize safe driving practices by holding drivers accountable for their actions. They also provide a clear framework for determining liability in accidents, which can simplify the claims process.

What are the disadvantages of at-fault insurance?

At-fault insurance systems can lead to disputes over fault, particularly in cases where multiple parties are involved or the circumstances of the accident are unclear. They can also result in higher insurance premiums for drivers who have been found at fault in the past.