Arizona Auto Insurance State Minimums: Navigating the complex world of auto insurance in Arizona can be daunting, especially when it comes to understanding the state’s minimum coverage requirements. This guide will equip you with the knowledge to make informed decisions about your auto insurance, ensuring you’re protected on the road.

Arizona law mandates that all drivers carry a minimum level of auto insurance, designed to cover potential financial liabilities arising from accidents. This minimum coverage, often referred to as “state minimums,” includes liability insurance, personal injury protection (PIP), and property damage liability. Understanding these requirements is crucial for staying compliant with the law and safeguarding yourself from financial hardship in the event of an accident.

Arizona Auto Insurance Basics

Driving in Arizona requires you to have auto insurance. This ensures you can cover any financial losses or damages you might cause to yourself, your vehicle, or others in an accident.

Types of Auto Insurance Coverage

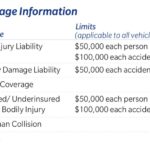

Arizona law mandates certain minimum auto insurance coverage levels, but you can choose additional coverage to enhance your protection.

- Liability Coverage: This protects you against financial losses caused by an accident you’re responsible for. It covers bodily injury and property damage to others.

- Medical Payments Coverage (Med Pay): This covers your medical expenses, regardless of who caused the accident. This applies to you, your passengers, and family members in your car.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This protects you in case you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Collision Coverage: This pays for repairs to your vehicle if it’s damaged in a collision, regardless of who is at fault. This is optional, but it’s often required if you’re financing your car.

- Comprehensive Coverage: This protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, or natural disasters. Like collision coverage, this is optional.

Arizona Department of Transportation’s Role in Auto Insurance Regulation

The Arizona Department of Transportation (ADOT) is responsible for regulating auto insurance in the state. They oversee insurance companies, ensure compliance with state laws, and handle consumer complaints. ADOT’s role is crucial in maintaining fair and accessible auto insurance for all Arizona drivers.

Understanding State Minimums: Arizona Auto Insurance State Minimums

In Arizona, like most states, there are minimum insurance coverage requirements that all drivers must meet. These requirements, known as “state minimums,” are designed to protect you and others in the event of an accident.

Liability Coverage

Liability coverage is the most important type of auto insurance, as it protects you financially if you cause an accident that results in injury or damage to others. Arizona law requires drivers to have a minimum of:

- $25,000 per person for bodily injury liability

- $50,000 per accident for bodily injury liability

- $15,000 per accident for property damage liability

This means that if you cause an accident that results in someone being injured, you are legally obligated to pay up to $25,000 per person and $50,000 per accident for their medical expenses. If you damage someone else’s property, you are responsible for up to $15,000 in repairs or replacement costs.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, covers your own medical expenses and lost wages after an accident, regardless of who was at fault. In Arizona, the minimum PIP coverage requirement is $2,500.

Property Damage Liability

Property damage liability coverage pays for damage you cause to someone else’s vehicle or property in an accident. Arizona’s minimum requirement is $15,000 per accident.

Consequences of Driving Without Adequate Insurance

Driving without the required minimum auto insurance in Arizona can have serious consequences. If you are involved in an accident, you could be held personally liable for all damages, even if you were not at fault. This could include:

- Medical expenses for yourself and other passengers

- Vehicle repair or replacement costs

- Lost wages

- Legal fees

- License suspension

- Fines

- Jail time

In addition, you may be required to pay for the other driver’s insurance premiums, known as “uninsured motorist coverage,” if you do not have adequate coverage.

Key Considerations for Choosing Coverage

Choosing the right auto insurance coverage in Arizona goes beyond just meeting the state minimums. Several factors influence your insurance costs and the level of protection you need. Understanding these factors can help you make informed decisions about your coverage and ensure you have the right protection for your needs.

Factors Influencing Auto Insurance Costs

Several factors contribute to the cost of your auto insurance in Arizona. These include:

- Driving History: Your driving record plays a significant role in determining your insurance premiums. A clean driving history with no accidents or violations will typically result in lower premiums. On the other hand, accidents, speeding tickets, or DUI convictions can significantly increase your rates.

- Vehicle Type: The type of vehicle you drive also impacts your insurance costs. Sports cars, luxury vehicles, and high-performance cars are often more expensive to insure due to their higher repair costs and potential for higher risk. Conversely, smaller, less expensive cars typically have lower insurance premiums.

- Location: Your location in Arizona can influence your insurance costs. Areas with higher crime rates or more traffic congestion may have higher premiums due to the increased risk of accidents or theft. The cost of living and the availability of repair services in your area can also play a role.

- Age and Gender: Younger drivers, especially those under 25, generally have higher insurance premiums. This is due to their lack of experience and higher risk-taking behaviors. Similarly, gender can also influence insurance costs, with some insurance companies charging higher rates for young men.

- Credit Score: In Arizona, insurance companies can use your credit score to determine your insurance rates. A good credit score is often associated with responsible behavior and can result in lower premiums. Conversely, a poor credit score may indicate higher risk and could lead to higher insurance rates.

Individual Needs and Risk Factors

It’s crucial to consider your individual needs and risk factors when choosing your auto insurance coverage. Some key factors to consider include:

- Financial Situation: Your financial situation can impact your choice of coverage. If you have limited financial resources, you may want to focus on meeting the state minimums. However, if you have a higher income and can afford it, you may want to consider higher coverage levels to protect yourself financially in case of an accident.

- Driving Habits: Your driving habits can also influence your coverage needs. If you frequently drive in high-traffic areas or have a long commute, you may want to consider higher coverage levels to protect yourself against potential accidents. If you drive infrequently or primarily in low-traffic areas, you may be able to get by with lower coverage.

- Vehicle Value: The value of your vehicle is another important factor. If you have a new or high-value vehicle, you may want to consider comprehensive and collision coverage to protect yourself against damage or theft. If you have an older vehicle with a lower value, you may be able to get by with liability coverage only.

Benefits and Drawbacks of Exceeding State Minimums

Exceeding the state minimums for auto insurance can provide additional protection and peace of mind. However, it’s important to weigh the benefits and drawbacks before making a decision.

- Benefits of Higher Coverage:

- Greater Financial Protection: Higher coverage levels can provide more financial protection in case of an accident. This can help cover your medical expenses, property damage, and lost wages.

- More Options for Repair or Replacement: With higher coverage, you have more options for repairing or replacing your vehicle after an accident. You can choose to repair your vehicle at a reputable shop or replace it with a new vehicle, depending on the damage and your coverage levels.

- Peace of Mind: Knowing that you have adequate coverage can provide peace of mind, especially if you are involved in an accident. You can focus on recovering from the accident without worrying about the financial burden.

- Drawbacks of Higher Coverage:

- Higher Premiums: Higher coverage levels typically come with higher premiums. You’ll need to weigh the cost of additional coverage against the potential benefits.

- Potential for Over-Coverage: If you have an older vehicle with a lower value, you may not need comprehensive and collision coverage. Over-coverage can result in paying for insurance you don’t need.

Navigating the Insurance Process

Getting auto insurance in Arizona is a straightforward process. By understanding the key steps involved, you can obtain the best coverage for your needs and budget.

Obtaining an Auto Insurance Quote

Before you can get a quote, you need to gather some basic information about yourself and your vehicle. This includes your driver’s license number, vehicle identification number (VIN), and information about your driving history. Once you have this information, you can contact insurance companies directly, use online comparison websites, or work with an insurance broker.

- Gather Your Information: Collect your driver’s license number, vehicle identification number (VIN), and details about your driving history, including any accidents or violations. You may also need information about your vehicle’s make, model, year, and mileage.

- Choose a Method: You can obtain quotes directly from insurance companies, utilize online comparison websites like Policygenius or Insurance.com, or work with an insurance broker who can compare quotes from multiple companies on your behalf.

- Provide Information: When contacting an insurance company or using an online platform, provide the required information about yourself and your vehicle. This may include your personal details, driving history, vehicle details, and desired coverage levels.

- Receive and Compare Quotes: Once you’ve provided the necessary information, you’ll receive quotes from different insurance companies. Compare these quotes based on price, coverage options, and the company’s reputation.

- Choose a Policy: After comparing quotes, select the policy that best suits your needs and budget. Consider factors such as coverage limits, deductibles, and the company’s customer service record.

Reputable Insurance Companies in Arizona

Several reputable insurance companies operate in Arizona, offering a range of coverage options and pricing structures. Some of the well-known companies include:

- State Farm: A large, well-established company with a strong presence in Arizona. They offer a variety of insurance products, including auto insurance, and have a reputation for good customer service.

- Geico: Known for its competitive pricing and convenient online services. They offer a range of auto insurance options and have a strong customer base in Arizona.

- Progressive: A leading insurer in Arizona, offering a variety of coverage options and discounts. They are known for their innovative insurance products and personalized customer service.

- Allstate: A major insurance provider in Arizona, offering comprehensive auto insurance coverage and a wide range of discounts. They have a strong reputation for customer satisfaction.

- Farmers: A well-established company with a strong presence in Arizona. They offer a variety of insurance products, including auto insurance, and have a reputation for providing personalized service.

Comparing Quotes and Choosing the Best Policy, Arizona auto insurance state minimums

When comparing quotes, consider factors such as price, coverage options, and the company’s reputation.

- Price: The cost of insurance can vary significantly depending on factors such as your driving history, vehicle type, and coverage limits. Compare quotes from different companies to find the most affordable option.

- Coverage Options: Ensure that the policy you choose provides adequate coverage for your needs. Consider factors such as liability limits, collision and comprehensive coverage, and uninsured motorist coverage.

- Company Reputation: Research the company’s financial stability, customer service record, and claims handling process. Look for companies with a history of fair and prompt claim settlements.

- Discounts: Many insurance companies offer discounts for factors such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. Ask about available discounts to potentially lower your premium.

Understanding Policy Language and Exclusions

Arizona auto insurance policies, like many others, contain a lot of legal jargon. It’s essential to understand the key terms and conditions to ensure you know what’s covered and what’s not. The fine print matters! Understanding the exclusions and limitations of your policy is crucial to avoid surprises when you need to file a claim.

Policy Exclusions and Limitations

Exclusions and limitations define situations where coverage might not apply. These are specific scenarios Artikeld in your policy that are not covered. Here are some common examples of exclusions:

- Driving without a valid license: If you’re driving without a valid driver’s license, your policy might not cover accidents.

- Driving under the influence of alcohol or drugs: This is a serious offense, and your policy might not cover any accidents that occur while you’re intoxicated.

- Using your vehicle for business purposes: If you’re using your vehicle for business activities, you might need additional commercial auto insurance.

- Intentional acts: If you intentionally cause an accident, your policy won’t cover the damages.

- Uninsured or underinsured motorists: This coverage protects you in accidents caused by drivers who lack sufficient insurance. However, there are limits on how much this coverage will pay.

Filing a Claim and Seeking Compensation

If you’re involved in an accident in Arizona, understanding the process for filing an auto insurance claim is crucial. This section Artikels the steps involved, from reporting the incident to receiving compensation.

Reporting an Accident

The first step after an accident is to report it to the authorities. This includes contacting the police if there are injuries, significant property damage, or a dispute about fault. It’s also important to exchange information with the other parties involved, including names, addresses, insurance details, and vehicle information.

After reporting the accident, you should contact your insurance company as soon as possible. This notification is usually required within a specific timeframe, often 24 hours or less. The insurance company will guide you through the claim process and provide necessary documentation.

Documenting Damages and Injuries

It’s essential to document the damages to your vehicle and any injuries you sustained. This includes taking photographs of the accident scene, vehicle damage, and any injuries. If you have witnesses, gather their contact information as well.

You should also seek medical attention immediately if you have any injuries, even if they seem minor. Keep a detailed record of all medical appointments, treatments, and expenses. This documentation will be essential when filing your claim.

Role of Insurance Adjusters

Once you file a claim, your insurance company will assign an insurance adjuster to your case. The adjuster’s role is to investigate the accident, assess the damages, and determine the amount of compensation you are entitled to receive.

The adjuster will likely contact you to gather information about the accident, review your documentation, and potentially inspect your vehicle. They may also request medical records if you have sustained injuries.

Potential Disputes

Disputes can arise during the claims process, especially when determining liability or the amount of compensation. If you disagree with the adjuster’s assessment, you have the right to appeal their decision. This may involve negotiating with the adjuster, seeking legal advice, or filing a lawsuit.

It’s important to be proactive in communicating with your insurance company and the adjuster. Keep detailed records of all interactions, including dates, times, and the content of conversations. This will help you navigate the process effectively and protect your interests.

Final Review

In conclusion, being aware of Arizona’s auto insurance state minimums is essential for every driver. While these minimums provide a basic level of protection, it’s important to consider your individual needs and risk factors when deciding on coverage levels. By carefully reviewing your options and choosing a policy that meets your specific circumstances, you can ensure you’re adequately protected on the road. Remember, driving without sufficient insurance can have serious consequences, including hefty fines and potential license suspension. So, prioritize your safety and financial well-being by making informed decisions about your auto insurance.

General Inquiries

What happens if I get into an accident and don’t have enough insurance?

If you cause an accident and don’t have enough insurance to cover the damages, you could be held personally liable for the costs. This means you could be sued and face significant financial consequences, even if you weren’t at fault for the accident.

How can I find out how much my insurance premiums will be?

You can get an auto insurance quote online or by calling different insurance companies. Be sure to provide accurate information about your driving history, vehicle, and location.

What are some tips for finding the best auto insurance deal?

Shop around and compare quotes from multiple insurance companies. Consider bundling your auto insurance with other types of insurance, such as homeowners or renters insurance. Ask about discounts, such as good driver discounts, safe driving courses, and multi-car discounts.