Amica vs State Farm auto insurance – two of the biggest names in the industry. When it comes to protecting your vehicle and your wallet, choosing the right insurer is crucial. Both Amica and State Farm have a long history and a reputation for reliability, but they differ in their coverage options, pricing, and customer service. This comparison will delve into the key factors that can help you make an informed decision.

From comprehensive coverage to discounts and customer satisfaction, we’ll explore the strengths and weaknesses of each company, providing you with a clear understanding of what they offer and how they stack up against each other. Ultimately, the best auto insurance for you will depend on your individual needs and priorities.

Introduction

Amica Mutual Insurance Company and State Farm Mutual Automobile Insurance Company are two of the largest and most reputable auto insurance providers in the United States. Both companies have a long history of providing reliable and affordable coverage to millions of customers.

Comparing Amica and State Farm is crucial for potential customers seeking the best auto insurance option. Choosing the right insurance provider can significantly impact your financial well-being, especially in the event of an accident or other covered incident. By understanding the key differences between these companies, you can make an informed decision that aligns with your specific needs and budget.

Key Differences Between Amica and State Farm, Amica vs state farm auto insurance

Amica and State Farm differ in several aspects, including pricing, coverage options, customer service, and financial strength. Understanding these differences is crucial for determining which company best suits your individual requirements.

- Pricing: Both companies offer competitive rates, but their pricing structures can vary based on factors such as your driving history, vehicle type, and location. Amica is known for its personalized approach to pricing, while State Farm offers various discounts and promotions.

- Coverage Options: Amica and State Farm offer a comprehensive range of auto insurance coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. However, specific coverage details and limits may differ.

- Customer Service: Both companies prioritize customer satisfaction and offer various communication channels, including phone, email, and online portals. Amica is renowned for its personalized and responsive customer service, while State Farm has a vast network of agents nationwide.

- Financial Strength: Amica and State Farm are financially stable companies with strong ratings from independent agencies. Their financial strength provides assurance that they can meet their policy obligations in the event of a significant claim.

Coverage Options and Features

Both Amica and State Farm offer a comprehensive range of auto insurance coverage options to meet the diverse needs of their policyholders. Understanding the key features and optional add-ons can help you determine which insurer aligns best with your specific requirements.

Liability Coverage

Liability coverage protects you financially if you are found at fault in an accident that causes damage to another person’s property or injuries to another person. This coverage is mandatory in most states.

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident.

- Property Damage Liability: Covers repairs or replacement costs for damage to another person’s vehicle or property.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. This coverage is optional but highly recommended if you have a financed or leased vehicle.

- Deductible: You pay a predetermined amount (deductible) before your insurance company covers the remaining costs.

- Coverage Limits: There is usually a limit on the amount your insurance company will pay for repairs or replacement.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, or falling objects. This coverage is optional.

- Deductible: You pay a predetermined amount (deductible) before your insurance company covers the remaining costs.

- Coverage Limits: There is usually a limit on the amount your insurance company will pay for repairs or replacement.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. This coverage is optional but highly recommended.

- Uninsured Motorist Coverage: Covers your medical expenses and property damage if you are hit by an uninsured driver.

- Underinsured Motorist Coverage: Covers the difference between your damages and the other driver’s insurance limits if they are not enough to cover your losses.

Optional Add-ons

Both Amica and State Farm offer a range of optional add-ons to enhance your auto insurance policy. These add-ons provide additional protection and convenience.

- Roadside Assistance: Provides help with flat tires, jump starts, towing, and lockout services.

- Rental Car Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after an accident.

- Accident Forgiveness: Protects your premium from increasing after your first at-fault accident.

Pricing and Discounts

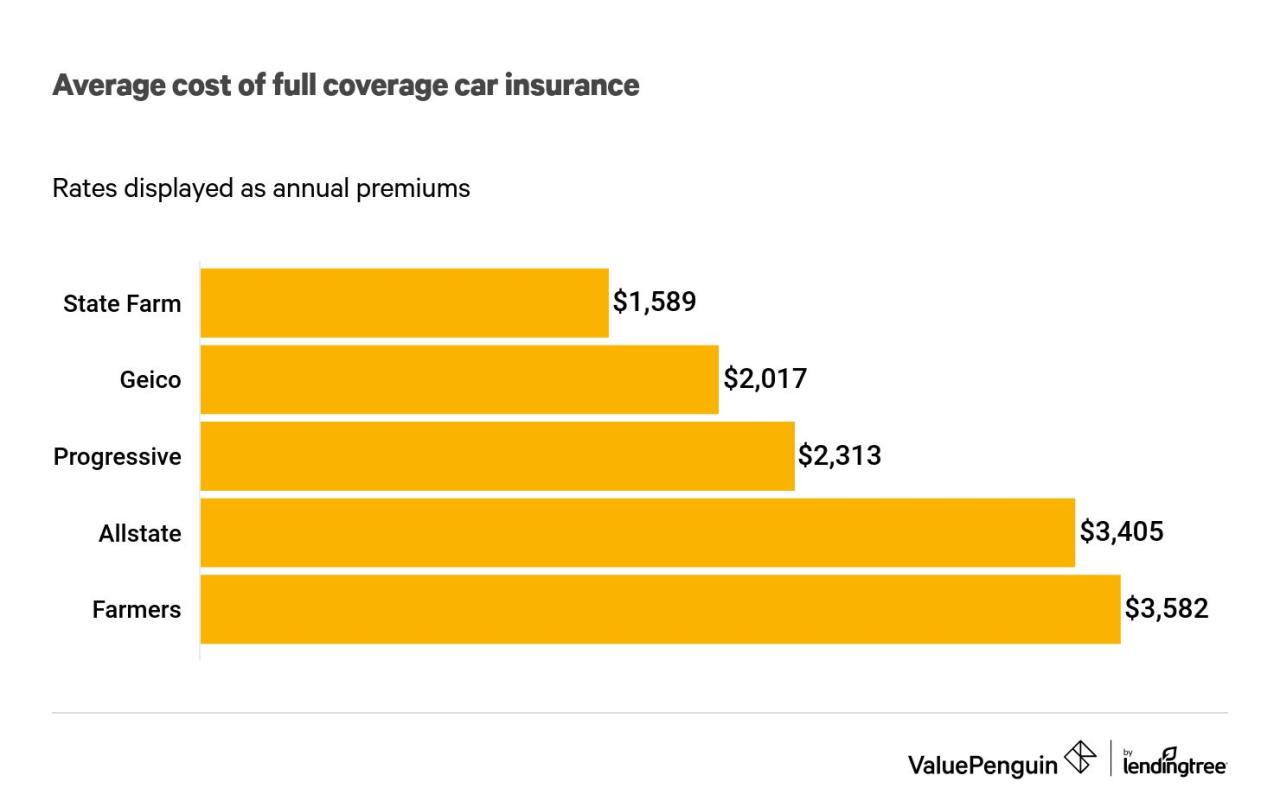

Both Amica and State Farm offer competitive auto insurance rates, but the specific price you pay will depend on several factors, including your driving history, vehicle type, and location. Both companies also offer a variety of discounts to help you save money on your premiums.

Factors Influencing Premium Costs

Your driving history, including your driving record and the number of years you’ve been driving, is a major factor in determining your premium. A clean driving record with no accidents or violations will generally result in lower premiums. Your vehicle type also plays a significant role. Higher-value vehicles, such as luxury cars or sports cars, typically have higher premiums due to their increased repair costs and potential for higher theft risk. Additionally, your location influences your premium because insurance companies consider factors like traffic density, crime rates, and the frequency of accidents in your area.

Discounts Offered by Amica and State Farm

- Safe Driver Discounts: Both Amica and State Farm offer significant discounts for safe drivers. These discounts are usually based on your driving record and the number of years you’ve been accident-free. For instance, Amica offers a discount of up to 25% for drivers who have not had an accident or violation in the past five years. State Farm offers a similar discount structure, with the specific percentage depending on your driving history and the state you reside in.

- Good Student Discounts: Amica and State Farm both reward good students with discounts on their auto insurance premiums. To qualify, you typically need to maintain a certain GPA or be enrolled in a specific academic program. For example, Amica offers a discount of up to 10% for students who maintain a GPA of 3.0 or higher. State Farm’s good student discount is typically between 5% and 15%, depending on your GPA and the state you live in.

- Multi-Policy Discounts: Both companies offer discounts if you bundle your auto insurance with other types of insurance, such as homeowners, renters, or life insurance. Amica’s multi-policy discount can be up to 15%, while State Farm’s discount varies by state and the specific policies you bundle. For example, in some states, you can get a discount of up to 25% for bundling your auto insurance with homeowners or renters insurance.

Customer Service and Claims Process

Navigating the world of insurance can be stressful, especially when you need to file a claim. A smooth and efficient claims process is crucial during a difficult time. Let’s compare Amica and State Farm in terms of customer service and claims handling to see which insurer offers a more positive experience.

Customer Service Experiences

Customer service is a critical factor in evaluating insurance companies. Amica and State Farm both strive to provide excellent customer support, but their approaches and customer feedback differ.

- Amica is known for its personalized service and focus on building long-term relationships with customers. They often assign a dedicated agent to handle your needs, offering a more personal touch.

- State Farm, on the other hand, emphasizes accessibility and convenience. They offer a wide range of channels for contacting customer service, including online, phone, and mobile app.

Ease of Filing Claims

Filing a claim should be straightforward and hassle-free. Both Amica and State Farm offer online claim filing options, but their processes vary in terms of user experience and features.

- Amica’s online claim filing system is generally well-regarded for its intuitive design and comprehensive information.

- State Farm’s online claim filing system is also user-friendly, but some customers have reported experiencing technical glitches or difficulties navigating the platform.

Speed of Claim Processing

The speed of claim processing is a major concern for policyholders. Both Amica and State Farm aim to resolve claims efficiently, but their average processing times can differ.

- Amica is known for its prompt claim processing, often resolving claims within a few days or weeks.

- State Farm’s claim processing times can vary depending on the complexity of the claim and the specific circumstances. Some customers have reported longer processing times than expected.

Customer Satisfaction

Customer satisfaction is a reliable indicator of the overall experience with an insurance company. Independent surveys and customer reviews provide valuable insights into the satisfaction levels of Amica and State Farm policyholders.

- Amica consistently receives high customer satisfaction ratings, often ranking among the top insurers in the industry. Customers praise their responsiveness, communication, and overall claim handling experience.

- State Farm also enjoys generally positive customer feedback, but their ratings are slightly lower than Amica’s. Some customers have expressed concerns about communication and claim processing delays.

Real-World Experiences

Customer testimonials and reviews offer real-world perspectives on the customer service and claims process of Amica and State Farm.

“I was very impressed with Amica’s customer service. My claim was handled quickly and efficiently, and my agent was always available to answer my questions.” – John S.

“State Farm was very helpful when I needed to file a claim. They were quick to respond and kept me informed throughout the process.” – Sarah M.

“I had a frustrating experience with State Farm’s claims process. It took several weeks to get my claim processed, and I had to call multiple times to get updates.” – Michael L.

Financial Stability and Reputation

When choosing an insurance provider, financial stability and reputation are crucial considerations. These factors indicate a company’s ability to fulfill its obligations and provide reliable coverage in the long term. This section will compare the financial strength and reputation of Amica and State Farm, examining their ratings from reputable agencies and highlighting any awards or recognitions they have received.

Financial Strength Ratings

Financial strength ratings are crucial indicators of an insurer’s ability to meet its financial obligations. Reputable agencies like AM Best and Standard & Poor’s assess insurers based on various factors, including their capital adequacy, investment performance, and claims-paying ability.

- Amica Mutual Insurance Company consistently receives high financial strength ratings. AM Best assigns Amica an “A+” (Superior) rating, while Standard & Poor’s gives it an “A+” (Strong). These ratings indicate Amica’s strong financial position and its ability to meet its policyholder obligations.

- State Farm Mutual Automobile Insurance Company also enjoys excellent financial strength ratings. AM Best assigns State Farm an “A+” (Superior) rating, while Standard & Poor’s gives it an “AA” (Very Strong). These ratings reflect State Farm’s strong capital reserves and its proven ability to manage risk effectively.

Awards and Recognition

Beyond financial strength ratings, awards and recognition from independent organizations can provide further insights into an insurer’s performance and customer satisfaction.

- Amica has consistently ranked high in customer satisfaction surveys. For example, J.D. Power has recognized Amica for its excellent customer service in the auto insurance category.

- State Farm has also received numerous awards and recognitions for its customer service and financial performance. It has consistently ranked among the top insurers in J.D. Power’s customer satisfaction surveys and has been recognized for its commitment to community service.

Target Audience and Niche: Amica Vs State Farm Auto Insurance

Both Amica and State Farm cater to a broad range of customers, but they have specific strengths that appeal to certain segments of the market.

Amica’s Target Audience

Amica’s target audience tends to be older, more affluent, and value strong customer service and financial stability. Their niche lies in providing insurance for those who prioritize personalized attention and a long-standing reputation for financial security.

State Farm’s Target Audience

State Farm, on the other hand, targets a broader range of customers, including families, young adults, and those seeking affordable insurance options. They are known for their widespread availability, diverse coverage options, and extensive agent network.

Niche Focus for Amica

Amica focuses on providing high-quality insurance for customers who value personalized service and a strong financial foundation. This translates to:

* Affluent clientele: Amica’s policies often come with higher premiums, appealing to customers with higher incomes.

* Mature drivers: Amica has a reputation for providing excellent customer service and financial stability, making them a good fit for older drivers who prioritize these factors.

* Luxury car owners: Amica offers specialized coverage options for high-value vehicles, catering to those who own luxury cars.

Niche Focus for State Farm

State Farm’s niche lies in providing affordable insurance with a strong emphasis on convenience and accessibility. This translates to:

* Families: State Farm offers a wide range of family-oriented insurance products, including auto, home, and life insurance.

* Young adults: State Farm’s competitive pricing and comprehensive coverage make them appealing to young adults who are new to insurance.

* Rural communities: State Farm has a strong presence in rural areas, where they provide accessible insurance options.

Conclusion

Choosing the right auto insurance provider is a crucial decision. Amica and State Farm are both reputable companies with strong financial standing and positive customer feedback. However, they cater to different needs and preferences.

Key Differences and Similarities

Amica and State Farm offer a range of coverage options, but their pricing, discounts, and customer service approaches differ. Amica focuses on a more personalized, customer-centric approach with higher-quality service and competitive pricing for certain demographics. State Farm, on the other hand, emphasizes convenience and accessibility, offering a wider range of discounts and a more extensive agent network.

Strengths and Weaknesses

- Amica Strengths:

- Strong financial stability and reputation for excellent customer service.

- Competitive pricing for certain demographics, particularly those with good driving records.

- Personalized approach with dedicated agents and a focus on customer satisfaction.

- Amica Weaknesses:

- Limited agent network compared to State Farm.

- May not be the most affordable option for all drivers.

- State Farm Strengths:

- Extensive agent network and widespread availability.

- Wide range of discounts and competitive pricing for some drivers.

- Convenience and accessibility with online and mobile tools.

- State Farm Weaknesses:

- Customer service can be inconsistent and may not always be as personalized as Amica.

- May not be the best choice for drivers with a history of accidents or violations.

Recommendation

Ultimately, the best choice between Amica and State Farm depends on individual needs and preferences.

Amica is a great option for drivers seeking personalized service, competitive pricing, and a company with a strong reputation for customer satisfaction.

State Farm is a good choice for drivers who prioritize convenience, accessibility, and a wide range of discounts.

Last Word

Choosing between Amica and State Farm auto insurance is a personal decision. Both companies offer solid coverage and competitive pricing, but their strengths lie in different areas. Amica shines with its customer service and financial stability, while State Farm excels in its widespread availability and discounts. By carefully considering your needs, priorities, and budget, you can make the best choice for your specific circumstances.

Q&A

What are the main differences between Amica and State Farm?

Amica is known for its excellent customer service and financial stability, while State Farm offers a wider range of discounts and a more extensive agent network.

Which company offers better coverage options?

Both companies offer a comprehensive range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. However, they may have slight variations in their policy details and add-ons.

How do their pricing structures compare?

Pricing varies based on factors like your driving history, vehicle type, and location. It’s recommended to get quotes from both companies to compare their rates for your specific situation.

Are there any specific situations where one company might be a better choice than the other?

Amica might be a better choice for drivers seeking excellent customer service and financial stability. State Farm might be more suitable for drivers seeking a wider range of discounts and a more extensive agent network.