A state auto insurance company, like State Auto Insurance, plays a vital role in providing financial protection to individuals and families. This company, with its rich history and extensive product offerings, has established itself as a prominent player in the insurance industry. This article delves into the various aspects of State Auto Insurance, exploring its financial performance, customer service, claims handling, pricing, technology, and competitive landscape. We aim to provide a comprehensive understanding of the company’s operations and its position within the broader insurance market.

State Auto Insurance, founded in 1921, has grown to become a leading provider of insurance products, including auto, home, business, and life insurance. The company prides itself on its commitment to customer satisfaction, offering competitive rates, a wide range of coverage options, and a dedicated customer service team. Throughout its history, State Auto Insurance has consistently demonstrated its financial stability and commitment to its policyholders, ensuring peace of mind and reliable protection in times of need.

State Auto Insurance Overview

State Auto Insurance is a leading provider of insurance products and services, with a rich history spanning over a century. Founded in 1921, the company has a strong reputation for financial stability and customer satisfaction. Headquartered in Columbus, Ohio, State Auto operates in multiple states across the country, offering a wide range of insurance solutions to meet diverse customer needs.

History and Background

State Auto Insurance was established in 1921 as a mutual insurance company, meaning that its policyholders are also its owners. This structure emphasizes a focus on customer interests and long-term financial stability. Over the years, State Auto has grown significantly, expanding its product offerings and geographic reach. The company has weathered economic downturns and industry shifts, demonstrating its resilience and commitment to providing reliable insurance coverage.

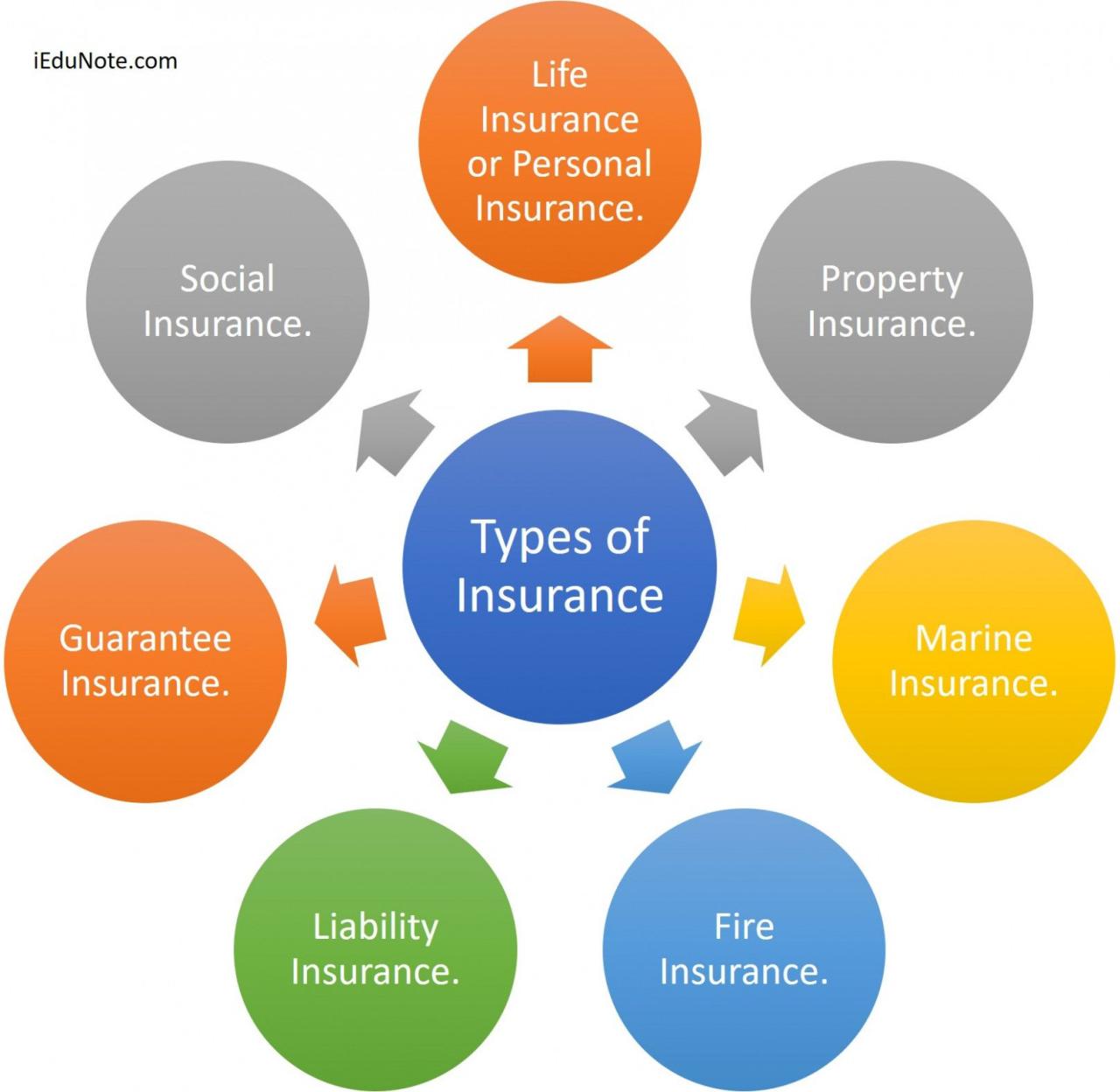

Types of Insurance Products

State Auto Insurance offers a comprehensive suite of insurance products designed to protect individuals, families, and businesses. These products include:

- Auto Insurance: State Auto provides comprehensive auto insurance coverage, including liability, collision, and comprehensive coverage, as well as optional features like roadside assistance and rental car reimbursement.

- Home Insurance: The company offers homeowners insurance policies that protect against damage to homes and personal property due to various perils, including fire, theft, and natural disasters.

- Business Insurance: State Auto provides insurance solutions for businesses of all sizes, including property, liability, workers’ compensation, and commercial auto coverage.

- Life Insurance: The company offers a range of life insurance products, including term life, whole life, and universal life insurance, to help individuals secure their families’ financial future.

- Other Insurance Products: State Auto also provides specialized insurance products, such as motorcycle insurance, recreational vehicle insurance, and umbrella insurance, to meet specific customer needs.

Mission Statement and Core Values

State Auto Insurance’s mission statement is to “provide exceptional insurance products and services that meet the evolving needs of our customers, while maintaining financial strength and integrity.” This mission reflects the company’s commitment to customer satisfaction, financial stability, and ethical business practices.

State Auto’s core values are:

- Customer Focus: The company prioritizes understanding and meeting the needs of its customers.

- Integrity: State Auto operates with honesty and transparency in all its dealings.

- Financial Strength: The company strives to maintain a strong financial position to ensure its long-term viability and ability to fulfill its commitments.

- Innovation: State Auto is committed to adapting to changing market conditions and developing new products and services to meet evolving customer needs.

- Teamwork: The company values collaboration and teamwork among its employees to achieve common goals.

Financial Performance and Stability

State Auto Insurance’s financial performance is crucial for assessing its ability to meet policyholder obligations and maintain a strong market position. The company’s financial stability directly impacts its ability to withstand economic downturns, natural disasters, and other unforeseen events.

Financial Performance

State Auto Insurance has demonstrated consistent profitability over recent years. The company’s strong financial performance can be attributed to several factors, including:

- Effective risk management strategies

- Efficient expense management

- A focus on niche markets

State Auto Insurance’s financial performance is reflected in its key financial ratios, which provide insights into the company’s profitability, liquidity, and solvency.

Key Financial Ratios

State Auto Insurance’s financial ratios are generally in line with industry averages, indicating a healthy financial position.

- Return on Equity (ROE): This ratio measures the company’s profitability relative to its shareholders’ equity. State Auto Insurance’s ROE has consistently been above the industry average, suggesting efficient utilization of capital.

- Combined Ratio: This ratio measures the company’s underwriting profitability. A combined ratio below 100% indicates an underwriting profit, while a ratio above 100% indicates an underwriting loss. State Auto Insurance has maintained a combined ratio below 100% in recent years, indicating profitable underwriting operations.

- Debt-to-Equity Ratio: This ratio measures the company’s financial leverage. State Auto Insurance’s debt-to-equity ratio is moderate, suggesting a balanced approach to financing operations.

Financial Stability

State Auto Insurance’s financial stability is a critical factor for policyholders, as it provides confidence in the company’s ability to meet its obligations. The company’s strong financial performance and robust capital position contribute to its financial stability.

- Capital Adequacy: State Auto Insurance maintains a strong capital position, exceeding regulatory requirements. This capital adequacy provides a buffer against unexpected losses and ensures the company’s ability to meet its obligations.

- Credit Ratings: State Auto Insurance has received positive credit ratings from independent agencies, reflecting its strong financial health and low risk profile. These ratings provide further assurance to policyholders about the company’s financial stability.

State Auto Insurance’s financial stability compares favorably to other insurance providers in the industry. The company’s focus on niche markets, disciplined underwriting practices, and strong capital position contribute to its overall financial resilience.

Customer Service and Reviews

State Auto Insurance’s customer service is a key aspect of its overall performance. It is crucial to understand how customers perceive their interactions with the company and how State Auto responds to feedback. This section will delve into customer reviews, ratings, and the company’s approach to customer service.

Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into the customer experience with State Auto Insurance. These reviews can be found on various platforms, including:

- J.D. Power: J.D. Power is a renowned organization that conducts customer satisfaction surveys in various industries, including insurance. Their ratings can offer a comprehensive view of State Auto’s performance in customer satisfaction.

- Trustpilot: Trustpilot is a platform where customers can share their experiences with companies, providing reviews and ratings. It offers a diverse range of customer perspectives on State Auto’s services.

- Google Reviews: Google Reviews allows customers to leave feedback on businesses, including insurance companies. It provides insights into local customer experiences with State Auto’s branches or agents.

- Yelp: Yelp is a popular platform for reviews and ratings of local businesses, including insurance companies. It offers insights into customer experiences with State Auto’s local presence.

It is important to analyze these reviews and ratings to understand the areas where State Auto excels and where it needs improvement. For example, reviews might highlight positive aspects like responsive customer service, efficient claims processing, or helpful agents. Conversely, negative reviews might point to areas requiring attention, such as long wait times, confusing policies, or unresponsive customer support.

Customer Service Processes and Policies

State Auto Insurance has implemented various customer service processes and policies to enhance the customer experience. These include:

- 24/7 Customer Support: State Auto offers 24/7 customer support through phone, email, and online chat, ensuring that customers can reach out to them anytime they need assistance.

- Online Account Management: State Auto provides an online platform where customers can manage their policies, pay premiums, and access their account information conveniently.

- Claims Reporting Options: Customers can report claims through various channels, including phone, online portal, and mobile app, making the process convenient and accessible.

- Dedicated Claims Representatives: State Auto assigns dedicated claims representatives to handle customer claims, ensuring personalized support and guidance throughout the process.

State Auto also emphasizes continuous improvement in its customer service processes. They regularly analyze customer feedback, conduct surveys, and implement changes to enhance their service delivery. This commitment to customer satisfaction is reflected in their efforts to provide efficient, responsive, and personalized service.

Claims Handling and Process

State Auto Insurance’s claims handling process is designed to be efficient and customer-friendly. They aim to provide a seamless experience for policyholders who need to file a claim. The company emphasizes promptness, transparency, and fair treatment throughout the process.

State Auto Insurance’s Claims Handling Process

State Auto Insurance’s claims handling process involves several steps:

- Reporting the Claim: Policyholders can report a claim online, over the phone, or through a mobile app. This initial step involves providing details about the incident, such as the date, time, and location, along with any relevant information about the damage or injury.

- Claim Assessment: Once a claim is reported, State Auto Insurance assigns a claims adjuster to investigate the incident. The adjuster will gather information, including photos and witness statements, to assess the damage and determine the extent of coverage.

- Claim Processing: After the claim is assessed, State Auto Insurance will process the claim and issue a payment. The company offers various payment options, including direct deposit and check.

- Claim Resolution: In some cases, claims may require further investigation or negotiation. State Auto Insurance strives to resolve claims promptly and fairly, working with policyholders to reach a mutually agreeable solution.

Comparison to Competitors

State Auto Insurance’s claims handling process is generally comparable to other major insurance companies. However, some key differentiators include:

- 24/7 Claims Reporting: State Auto Insurance allows policyholders to report claims at any time, day or night, through various channels, including online, phone, and mobile app. This convenience can be crucial in emergency situations.

- Dedicated Claims Adjusters: State Auto Insurance assigns dedicated claims adjusters to each claim, ensuring a consistent point of contact for policyholders throughout the process. This can help streamline communication and reduce confusion.

- Online Claims Portal: State Auto Insurance offers an online claims portal where policyholders can track the status of their claim, submit documents, and communicate with their adjuster. This digital platform provides greater transparency and control over the claims process.

Key Aspects Impacting Customer Satisfaction

Several key aspects of the claims handling process significantly impact customer satisfaction:

- Response Time: Prompt responses to claims are crucial for customer satisfaction. Policyholders expect their claims to be acknowledged and addressed quickly, especially in urgent situations. State Auto Insurance aims to respond to claims within a reasonable timeframe, typically within 24-48 hours.

- Communication: Clear and consistent communication throughout the claims process is essential for building trust and maintaining customer satisfaction. State Auto Insurance strives to keep policyholders informed about the status of their claim and address any questions or concerns promptly.

- Fairness and Transparency: Policyholders expect their claims to be assessed fairly and transparently. State Auto Insurance emphasizes fairness in its claims handling process, ensuring that claims are assessed based on the policy terms and the facts of the incident.

Pricing and Coverage Options

State Auto Insurance offers a range of coverage options and pricing structures to suit different needs and budgets. The company’s pricing is influenced by various factors, and its coverage options compare favorably to other providers.

Factors Influencing Premiums

State Auto Insurance premiums are determined by several factors, including:

- Driving history: Your driving record, including accidents, violations, and driving experience, significantly impacts your premium. A clean driving record typically results in lower premiums.

- Vehicle type: The type of vehicle you drive, its age, make, model, and safety features all play a role in determining your premium. For example, a newer, high-performance car may have a higher premium than an older, basic model.

- Location: Your geographic location influences your premium due to factors like traffic density, accident rates, and weather conditions. Areas with higher crime rates or frequent weather events may have higher premiums.

- Coverage level: The amount of coverage you choose, such as liability limits, comprehensive and collision coverage, and optional add-ons, directly impacts your premium. Higher coverage levels typically result in higher premiums.

- Credit score: In some states, insurance companies may consider your credit score when calculating your premium. A good credit score can lead to lower premiums, while a poor credit score may result in higher premiums.

Comparison of Coverage Options

State Auto Insurance offers a comprehensive range of coverage options, comparable to other major providers. These options include:

- Liability coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. State Auto Insurance offers various liability limits to suit different needs.

- Collision coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional and can be tailored to your specific needs.

- Comprehensive coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, or natural disasters. This coverage is optional and can be tailored to your specific needs.

- Uninsured/underinsured motorist coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. This coverage is important to ensure you’re financially protected in such situations.

- Personal injury protection (PIP): This coverage covers your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault. This coverage is mandatory in some states.

- Medical payments coverage (MedPay): This coverage provides medical expense coverage for you and your passengers, regardless of who is at fault. This coverage is optional and can be tailored to your specific needs.

- Rental car coverage: This coverage provides reimbursement for rental car expenses if your vehicle is damaged and you need a replacement while it’s being repaired.

- Roadside assistance: This coverage provides assistance with services such as towing, flat tire changes, and jump starts.

Coverage Options Summary

Here is a table summarizing the different types of coverage offered by State Auto Insurance:

| Coverage Type | Description | Optional/Mandatory |

|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that injures another person or damages their property. | Mandatory in most states |

| Collision Coverage | Pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. | Optional |

| Comprehensive Coverage | Protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, or natural disasters. | Optional |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. | Optional |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault. | Mandatory in some states |

| Medical Payments Coverage (MedPay) | Provides medical expense coverage for you and your passengers, regardless of who is at fault. | Optional |

| Rental Car Coverage | Provides reimbursement for rental car expenses if your vehicle is damaged and you need a replacement while it’s being repaired. | Optional |

| Roadside Assistance | Provides assistance with services such as towing, flat tire changes, and jump starts. | Optional |

Technology and Innovation

State Auto Insurance has recognized the importance of technology in modernizing its operations and enhancing the customer experience. The company has implemented various technological solutions across its operations, from digital customer portals to data analytics for risk assessment. These initiatives aim to improve efficiency, streamline processes, and provide a more personalized and convenient experience for its policyholders.

Technology Adoption and Innovation

State Auto Insurance has embraced technological advancements to improve its operational efficiency and customer service. Here are some examples:

- Digital Customer Portal: The company offers a user-friendly online portal that allows policyholders to manage their accounts, view policy details, make payments, and file claims conveniently. This digital platform eliminates the need for physical interactions, streamlining processes and providing 24/7 access.

- Data Analytics for Risk Assessment: State Auto Insurance utilizes advanced data analytics to assess risks and develop personalized insurance rates. This data-driven approach allows for more accurate pricing and helps the company identify potential risks more effectively.

- Mobile App: State Auto Insurance offers a mobile app that allows policyholders to access their insurance information, file claims, and contact customer service directly from their smartphones. This app enhances accessibility and convenience for customers on the go.

- Artificial Intelligence (AI) for Claims Processing: The company is exploring the use of AI-powered tools to automate parts of the claims processing workflow, such as initial claim assessment and document verification. This can expedite claim resolution and reduce manual effort.

Industry Comparison

State Auto Insurance’s technology adoption aligns with industry trends, where insurance companies are increasingly leveraging technology to improve efficiency, personalize customer experiences, and gain a competitive advantage.

- Digital Transformation: The insurance industry is undergoing a significant digital transformation, with companies focusing on providing online and mobile-first experiences for their customers. State Auto Insurance’s investments in digital platforms and mobile apps are in line with this trend.

- Data Analytics and AI: Data analytics and AI are becoming increasingly important in insurance, enabling companies to better understand customer behavior, assess risks, and personalize offerings. State Auto Insurance’s use of data analytics and exploration of AI-powered tools reflect this industry trend.

- Customer-Centric Approach: Insurance companies are shifting towards a more customer-centric approach, prioritizing customer satisfaction and convenience. State Auto Insurance’s focus on digital customer portals, mobile apps, and personalized experiences aligns with this trend.

Target Market and Demographics: A State Auto Insurance Company

State Auto Insurance, a regional insurer with a strong presence in the Midwest, targets a specific demographic segment that aligns with its business model and risk appetite. The company’s focus on personal lines insurance, particularly auto insurance, positions it to appeal to individuals and families in its core markets.

The company’s customer base is largely composed of individuals and families residing in the Midwest, primarily in states where State Auto has a significant market share. These customers are often homeowners with stable incomes and a moderate risk profile.

Geographic Distribution

State Auto’s primary geographic focus is the Midwest, where it has established a strong network of agents and a loyal customer base. The company’s core markets include Ohio, Indiana, Illinois, Michigan, and Kentucky. This regional focus allows State Auto to tailor its products and services to the specific needs of these markets, including weather patterns, driving conditions, and local regulations.

Age and Income

State Auto’s customer base skews towards individuals and families in the middle-age bracket, with a household income that is generally above the national average. The company’s products and services are designed to appeal to this demographic segment, which typically values financial stability, risk management, and personalized customer service.

Lifestyle and Values

State Auto’s target market is comprised of individuals and families who prioritize stability and security. These customers are often homeowners, have established careers, and are focused on protecting their assets and families. State Auto’s focus on providing reliable insurance coverage, combined with its commitment to personalized customer service, resonates with this value system.

Tailoring Products and Services

State Auto’s products and services are designed to meet the specific needs of its target market. For example, the company offers a wide range of coverage options, including comprehensive and collision coverage, as well as optional add-ons such as roadside assistance and rental car reimbursement. State Auto also provides discounts for good drivers, multiple policyholders, and safe driving practices, further tailoring its offerings to its customer base.

Competitive Landscape

The insurance industry is fiercely competitive, with numerous players vying for market share. State Auto Insurance faces competition from both national giants and regional insurers, each offering a unique set of products and services. Understanding the competitive landscape is crucial for State Auto to identify its strengths and weaknesses, pinpoint opportunities for differentiation, and formulate effective strategies for growth.

Key Competitors

The insurance industry is fragmented, with various companies offering a diverse range of products and services. State Auto’s key competitors include:

- National Insurance Companies: These companies, such as Allstate, Geico, Progressive, and Liberty Mutual, have significant market share, vast resources, and extensive advertising budgets. They often leverage technology and data analytics to offer competitive pricing and personalized experiences.

- Regional Insurance Companies: These companies, such as Nationwide, Erie Insurance, and Farmers Insurance, focus on specific geographic areas, allowing them to build strong local relationships and cater to regional needs. They may offer more personalized service and competitive pricing in their target markets.

- Direct Writers: These companies, such as Geico and Progressive, sell insurance directly to customers through online channels and call centers, eliminating the need for agents. This allows them to offer lower prices and a streamlined customer experience.

- Independent Agents: These agents work with multiple insurance companies, providing customers with a wider range of options and personalized advice. They may offer more comprehensive coverage and customized solutions, but may not be as cost-effective as direct writers.

Strengths and Weaknesses

State Auto Insurance has a number of strengths that differentiate it from its competitors. These include:

- Strong Financial Performance: State Auto has a history of financial stability and profitability, providing customers with confidence in its ability to meet their insurance needs.

- Focus on Customer Service: State Auto emphasizes personalized service and customer satisfaction, building strong relationships with its policyholders.

- Regional Expertise: State Auto’s focus on the Midwest region allows it to understand local needs and provide tailored insurance solutions.

- Independent Agent Network: State Auto leverages a network of independent agents, providing customers with access to local expertise and personalized advice.

However, State Auto also faces some challenges compared to its competitors. These include:

- Smaller Market Share: Compared to national insurance giants, State Auto has a smaller market share, limiting its ability to leverage economies of scale.

- Limited Digital Presence: State Auto’s digital capabilities lag behind some of its competitors, particularly in terms of online quoting and policy management.

- Potential for Increased Competition: The insurance industry is constantly evolving, with new entrants and technological advancements posing a challenge to traditional players.

Differentiation Strategies

State Auto Insurance differentiates itself in a competitive market through a combination of strategies:

- Focus on Customer Relationships: State Auto prioritizes building strong relationships with its customers, offering personalized service and support.

- Regional Expertise: State Auto leverages its deep understanding of the Midwest region to provide tailored insurance solutions.

- Independent Agent Network: State Auto’s network of independent agents provides customers with local expertise and personalized advice.

- Financial Stability: State Auto’s strong financial performance provides customers with confidence in its ability to meet their insurance needs.

- Innovation and Technology: State Auto is investing in technology and innovation to improve its customer experience and stay competitive.

Industry Trends and Future Outlook

The insurance industry is constantly evolving, driven by technological advancements, changing consumer preferences, and economic fluctuations. State Auto Insurance, like other players in the market, faces a dynamic landscape with both opportunities and challenges.

Trends and Challenges

The insurance industry is facing several significant trends and challenges, including:

- Increased Competition: The insurance market is becoming increasingly competitive, with the emergence of new players and the growth of existing ones. This competition is driven by factors such as technological advancements, changing consumer preferences, and the rise of online insurance platforms.

- Rising Claims Costs: The cost of claims is increasing due to factors such as inflation, rising healthcare costs, and more frequent and severe weather events. This puts pressure on insurance companies to manage their expenses effectively.

- Cybersecurity Threats: The increasing reliance on technology has exposed insurance companies to cybersecurity threats, such as data breaches and ransomware attacks. These threats can lead to significant financial losses and reputational damage.

- Changing Consumer Expectations: Consumers are becoming more demanding, expecting personalized experiences, faster response times, and seamless digital interactions. This puts pressure on insurance companies to adapt their products and services to meet these expectations.

Opportunities for State Auto Insurance

Despite the challenges, the insurance industry also presents several opportunities for State Auto Insurance. These opportunities include:

- Technological Innovation: The use of artificial intelligence (AI), machine learning (ML), and big data analytics can help insurance companies improve their efficiency, personalize their products and services, and reduce their costs. State Auto Insurance can leverage these technologies to gain a competitive advantage.

- Growth in Emerging Markets: The insurance market in emerging markets is growing rapidly, offering significant opportunities for expansion. State Auto Insurance can explore opportunities in these markets by tailoring its products and services to meet the specific needs of these consumers.

- Focus on Customer Experience: By prioritizing customer experience, State Auto Insurance can differentiate itself from competitors and build strong customer loyalty. This can be achieved through personalized communication, streamlined claims processes, and responsive customer support.

Navigating Future Industry Changes, A state auto insurance company

State Auto Insurance can navigate the future industry changes by adopting the following strategies:

- Embrace Technological Advancements: Investing in technologies such as AI, ML, and big data analytics can help the company improve its efficiency, personalize its products and services, and enhance its customer experience.

- Expand into Emerging Markets: Exploring opportunities in emerging markets can help the company grow its customer base and diversify its revenue streams.

- Focus on Customer Centricity: Prioritizing customer experience by providing personalized communication, streamlined claims processes, and responsive customer support can help the company build strong customer loyalty and differentiate itself from competitors.

- Manage Risk Effectively: Implementing robust risk management strategies can help the company mitigate the impact of potential threats such as rising claims costs and cybersecurity threats.

Closure

State Auto Insurance stands as a reputable and reliable insurance provider, offering a comprehensive suite of products and services tailored to meet the diverse needs of its customers. The company’s commitment to financial stability, customer satisfaction, and innovative technology positions it as a strong contender in the competitive insurance market. As the industry continues to evolve, State Auto Insurance is well-equipped to adapt and thrive, providing its policyholders with the protection and peace of mind they deserve.

Essential Questionnaire

What is State Auto Insurance’s claim settlement process?

State Auto Insurance offers a streamlined claim settlement process that aims to provide a smooth and efficient experience for its policyholders. Customers can file claims online, over the phone, or in person. The company’s claims adjusters are dedicated to promptly investigating claims, providing clear communication throughout the process, and ensuring fair and timely settlements.

Does State Auto Insurance offer discounts on premiums?

Yes, State Auto Insurance offers a variety of discounts on premiums to eligible policyholders. These discounts may include safe driving discounts, good student discounts, multi-policy discounts, and more. To learn about the specific discounts available in your area, you can contact a State Auto Insurance agent or visit their website.

How can I get a quote for auto insurance from State Auto Insurance?

You can obtain a free quote for auto insurance from State Auto Insurance online, over the phone, or by visiting a local agent. To get a quote online, simply provide your basic information and vehicle details. State Auto Insurance will then provide you with a personalized quote based on your specific needs and risk factors.