What states is Tesla insurance available sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Tesla Insurance, the innovative insurance program designed specifically for Tesla vehicle owners, has been expanding its reach across the United States, offering a unique blend of technology and affordability. This exploration delves into the current availability of Tesla Insurance, its eligibility criteria, and the benefits it provides to Tesla drivers.

The expansion of Tesla Insurance has been a gradual process, with the company strategically choosing states based on a variety of factors, including market demand, regulatory environment, and operational considerations. This expansion has been met with both enthusiasm and skepticism, as consumers weigh the potential advantages of a dedicated insurance program against the established players in the insurance market. The journey of Tesla Insurance, from its initial launch to its ongoing expansion, is a compelling tale of innovation, competition, and the evolution of the automotive insurance landscape.

Tesla Insurance Availability

Tesla Insurance, a product of Tesla’s foray into the insurance market, is currently available in a growing number of states across the US. Tesla Insurance leverages the company’s advanced technology and data to provide personalized rates and features, offering an alternative to traditional insurance providers.

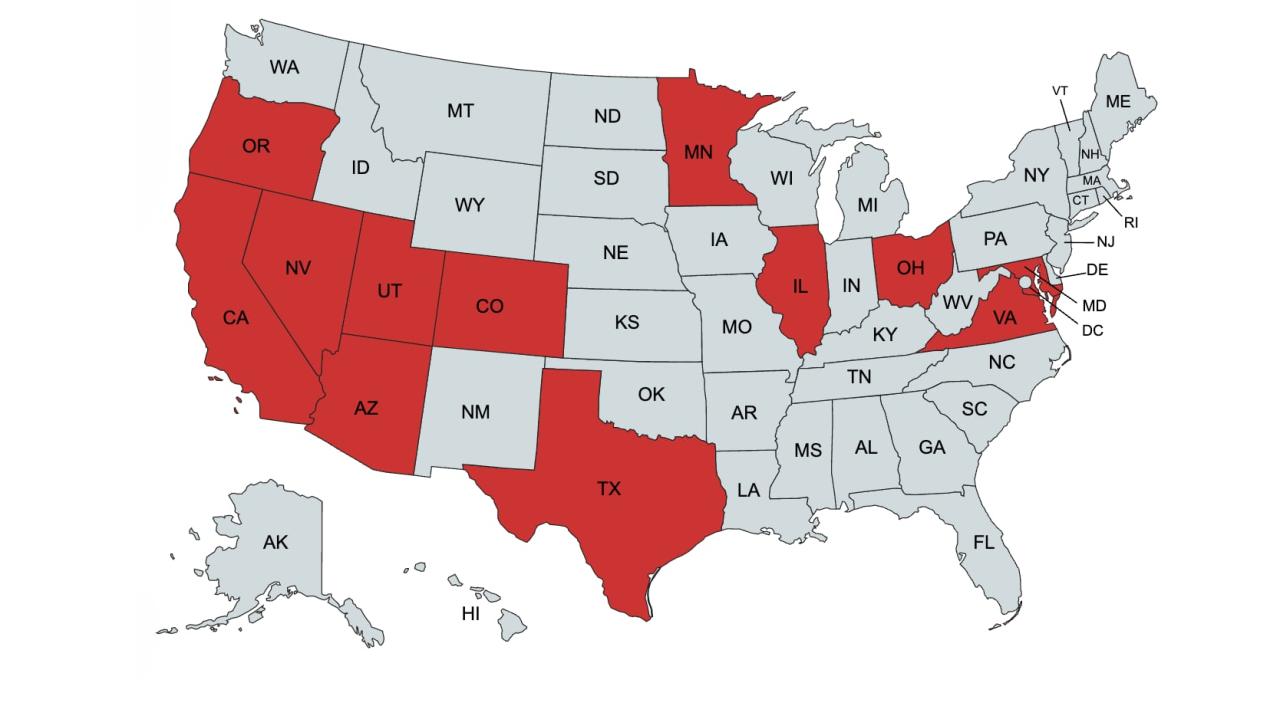

Current States with Tesla Insurance Availability

Tesla Insurance is currently available in the following states:

- Arizona

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- Wisconsin

Historical Timeline of Tesla Insurance Expansion

Tesla Insurance has expanded its reach across the United States in a phased manner, gradually increasing its footprint over time.

- 2021: Tesla Insurance launched in California, its first state of operation.

- 2022: The company expanded its services to several more states, including Arizona, Colorado, Illinois, and Texas.

- 2023: Tesla Insurance continued its expansion, adding states like Connecticut, Florida, Georgia, and others to its list.

Factors Influencing Tesla’s Expansion Decisions

Tesla’s decision to expand into new states is driven by a combination of factors, including:

- Market Demand: Tesla analyzes the demand for its insurance product in different states, considering factors like the number of Tesla vehicles and the potential customer base.

- Regulatory Environment: Tesla evaluates the regulatory landscape in each state, ensuring compliance with local insurance laws and regulations.

- Profitability: Tesla assesses the potential profitability of offering its insurance in each state, considering factors like pricing, competition, and expected claims.

- Strategic Growth: Tesla aims to expand its insurance business strategically, focusing on states where it can achieve significant market share and build a strong customer base.

Eligibility Criteria for Tesla Insurance

Tesla Insurance, like any other insurance program, has specific eligibility criteria that individuals must meet to qualify. Understanding these requirements is crucial before applying for coverage.

Tesla Insurance Eligibility Criteria

Tesla Insurance is designed for owners of Tesla vehicles. To be eligible, you must:

- Own a Tesla vehicle.

- Be at least 18 years old.

- Have a valid driver’s license.

- Have a clean driving record.

- Reside in a state where Tesla Insurance is available.

Comparison with Traditional Insurance Providers

While Tesla Insurance primarily targets Tesla owners, its eligibility criteria are generally comparable to traditional insurance providers.

- Age Requirement: Most insurance providers require drivers to be at least 18 years old, aligning with Tesla Insurance’s requirement.

- Driving Record: Traditional insurance companies often consider driving history, including accidents and traffic violations, similar to Tesla Insurance’s focus on a clean driving record.

- State Availability: Both Tesla Insurance and traditional providers operate within specific geographic areas, making state availability a common eligibility factor.

Key Eligibility Factors and Requirements

The following table summarizes the key eligibility factors and their corresponding requirements for Tesla Insurance:

| Eligibility Factor | Requirement |

|---|---|

| Vehicle Ownership | Must own a Tesla vehicle |

| Age | Must be at least 18 years old |

| Driver’s License | Must have a valid driver’s license |

| Driving Record | Must have a clean driving record |

| State of Residence | Must reside in a state where Tesla Insurance is available |

Benefits and Features of Tesla Insurance

Tesla Insurance is a relatively new offering from Tesla, designed specifically for Tesla vehicle owners. It leverages the unique features and capabilities of Tesla vehicles to offer a tailored and potentially more affordable insurance experience.

Key Benefits and Features

Tesla Insurance offers a range of benefits and features designed to cater to the specific needs of Tesla owners. These benefits include:

- Lower Premiums: Tesla Insurance often offers lower premiums compared to traditional insurance policies, especially for Tesla owners with a good driving record and who have installed Tesla’s Autopilot or Full Self-Driving features. This is because Tesla’s data-driven approach allows them to assess risk more accurately, potentially leading to lower premiums for safe drivers.

- Safety-Based Discounts: Tesla Insurance rewards safe driving behavior through discounts. Tesla’s vehicles are equipped with sensors and cameras that continuously monitor driving habits, such as acceleration, braking, and lane changes. This data is used to calculate a “Safety Score,” which can result in significant discounts on premiums for drivers who demonstrate safe driving practices.

- Convenient Online Management: Tesla Insurance offers a user-friendly online platform for managing policies, making payments, and accessing documentation. This digital approach streamlines the insurance experience, eliminating the need for phone calls or physical visits to an insurance agent.

- Integration with Tesla Vehicles: Tesla Insurance seamlessly integrates with Tesla vehicles. For instance, the insurance policy information can be accessed directly through the Tesla touchscreen, and claims can be initiated through the app. This integration simplifies the insurance process for Tesla owners.

Advantages for Tesla Owners

Tesla Insurance offers several advantages specific to Tesla vehicle owners:

- Tailored Coverage: Tesla Insurance is designed specifically for Tesla vehicles, understanding the unique features and risks associated with these electric vehicles. This tailored approach ensures comprehensive coverage that addresses the specific needs of Tesla owners.

- Data-Driven Risk Assessment: Tesla Insurance leverages data from Tesla vehicles to assess risk more accurately. This data-driven approach allows Tesla to identify and reward safe drivers with lower premiums, potentially resulting in significant savings for Tesla owners.

- Integration with Tesla Ecosystem: Tesla Insurance integrates seamlessly with the Tesla ecosystem, including the Tesla app and vehicle touchscreen. This integration simplifies the insurance process, making it more convenient for Tesla owners to manage their policies and access relevant information.

Comparison with Traditional Insurance Policies

The following table compares the benefits and features of Tesla Insurance with traditional insurance policies:

| Feature | Tesla Insurance | Traditional Insurance |

|---|---|---|

| Premiums | Potentially lower premiums, especially for safe drivers and those with Autopilot/Full Self-Driving features. | Premiums may vary depending on factors such as driving history, vehicle model, and location. |

| Safety-Based Discounts | Offers discounts based on a “Safety Score” calculated using data from Tesla vehicles. | May offer discounts for safe driving, but typically based on factors like accident history and driving record. |

| Convenience | Provides a user-friendly online platform for managing policies, making payments, and accessing documentation. | May involve phone calls, emails, or physical visits to an insurance agent. |

| Integration with Vehicle | Seamlessly integrates with Tesla vehicles, allowing access to insurance information through the Tesla touchscreen and app. | Typically does not integrate with the vehicle’s systems. |

| Tailored Coverage | Specifically designed for Tesla vehicles, addressing the unique features and risks associated with these electric vehicles. | May not offer coverage tailored to the specific needs of Tesla owners. |

Pricing and Cost Comparison: What States Is Tesla Insurance Available

Tesla Insurance is a relatively new entrant in the auto insurance market, and it aims to offer competitive pricing by leveraging its understanding of Tesla vehicles and driving data. To determine if Tesla Insurance is right for you, it’s essential to compare its pricing with traditional insurance providers.

Factors Influencing Tesla Insurance Cost

The cost of Tesla Insurance is influenced by various factors, similar to traditional insurance providers. These include:

- Vehicle Model and Year: Tesla Insurance considers the specific Tesla model and year of manufacture, factoring in safety features, performance, and repair costs.

- Driving History: Your driving record, including accidents, violations, and years of driving experience, plays a significant role in determining your insurance premium.

- Location: Your location, including the state and zip code, influences the cost of insurance due to factors like traffic density, crime rates, and weather conditions.

- Coverage Levels: The type and amount of coverage you choose, such as liability, collision, and comprehensive, directly impact the premium.

- Safety Features: Tesla vehicles are equipped with advanced safety features like Autopilot and Full Self-Driving (FSD). These features can potentially lower your insurance premiums, as they contribute to reduced accident risks.

- Driving Data: Tesla Insurance leverages data from Tesla vehicles, including driving habits and telematics, to assess risk and potentially offer personalized pricing.

Average Pricing Comparison

The following table provides an estimated comparison of average Tesla Insurance pricing for different vehicle models and coverage levels, compared to a leading traditional insurance provider:

| Vehicle Model | Coverage Level | Tesla Insurance (Estimated) | Traditional Provider (Estimated) |

|---|---|---|---|

| Tesla Model 3 | Liability Only | $50-$75 per month | $60-$85 per month |

| Tesla Model 3 | Full Coverage | $100-$150 per month | $120-$170 per month |

| Tesla Model S | Liability Only | $65-$90 per month | $75-$100 per month |

| Tesla Model S | Full Coverage | $120-$180 per month | $140-$200 per month |

Note: These are estimated prices based on average data and may vary depending on individual factors. It’s crucial to obtain personalized quotes from both Tesla Insurance and traditional providers to compare accurately.

Customer Experience and Reviews

Customer reviews and feedback are essential for understanding the real-world experience of Tesla Insurance. They provide valuable insights into its strengths, weaknesses, and overall customer satisfaction levels compared to traditional insurance providers.

Customer Feedback and Reviews

Customer reviews on Tesla Insurance are generally positive, highlighting its unique features and benefits tailored specifically for Tesla owners. However, some criticisms have emerged regarding its pricing and availability.

- Positive Feedback: Many customers appreciate the convenience of having their insurance integrated with their Tesla app, allowing for easy policy management and claims processing. The use of Tesla’s driving data to assess risk and potentially offer lower premiums is also well-received by many.

- Negative Feedback: Some customers have expressed concerns about the limited availability of Tesla Insurance in certain regions and the potential for higher premiums compared to traditional providers, especially for drivers with less-than-perfect driving records.

Strengths and Weaknesses

Based on customer feedback, Tesla Insurance exhibits both strengths and weaknesses.

- Strengths:

- Seamless Integration with Tesla Ecosystem: Tesla Insurance integrates seamlessly with the Tesla app, allowing for convenient policy management, claims processing, and access to driving data.

- Data-Driven Pricing: Tesla Insurance leverages driving data to assess risk, potentially leading to lower premiums for safe drivers.

- Tailored Coverage for Tesla Owners: Tesla Insurance offers coverage specifically designed for Tesla vehicles, including features like key fob replacement and coverage for advanced driver-assistance systems.

- Weaknesses:

- Limited Availability: Tesla Insurance is currently available in a limited number of states, which can be a barrier for some Tesla owners.

- Potential for Higher Premiums: Some customers have reported higher premiums compared to traditional insurance providers, especially for drivers with less-than-perfect driving records.

- Limited Customer Service Options: Some customers have reported limited customer service options compared to traditional insurance providers, especially for non-Tesla-related issues.

Customer Satisfaction Levels, What states is tesla insurance available

Customer satisfaction with Tesla Insurance is generally positive, particularly among Tesla owners who appreciate the integration with the Tesla ecosystem and data-driven pricing. However, its limited availability and potential for higher premiums compared to traditional providers have led to some dissatisfaction among certain segments of customers.

- Positive Reviews: Many Tesla owners appreciate the convenience and features of Tesla Insurance, particularly its integration with the Tesla app and data-driven pricing model. They find it to be a valuable option for managing their insurance needs specifically tailored for their Tesla vehicles.

- Mixed Reviews: Some customers have reported mixed experiences with Tesla Insurance. While they appreciate its unique features, they also express concerns about its limited availability, potential for higher premiums, and limited customer service options compared to traditional providers.

Future Expansion Plans

Tesla’s ambition to expand its insurance services into new states is driven by its commitment to providing comprehensive and affordable coverage to its customers. The company’s strategic approach to market penetration is designed to capitalize on its established brand recognition, technological prowess, and data-driven insights.

Expansion Strategy

Tesla’s expansion strategy for its insurance business is multifaceted and driven by a combination of factors:

- Regulatory Approvals: Obtaining the necessary licenses and regulatory approvals from state insurance departments is a crucial first step. Tesla will need to demonstrate compliance with local regulations and ensure its insurance offerings meet the specific requirements of each state.

- Market Analysis: Tesla will likely conduct thorough market analyses to identify states with a high concentration of Tesla vehicle owners, favorable regulatory environments, and a potential for significant market share. States with a strong adoption of electric vehicles and a growing demand for innovative insurance solutions are likely to be prioritized.

- Strategic Partnerships: Collaborating with established insurance companies or reinsurance providers can expedite the expansion process. These partnerships can provide access to existing infrastructure, expertise, and distribution channels, enabling Tesla to reach a wider customer base more efficiently.

- Technological Advancements: Tesla’s commitment to leveraging its technological capabilities will be crucial in its expansion strategy. The company will likely continue to invest in advanced data analytics, artificial intelligence, and telematics systems to optimize risk assessment, pricing models, and customer service.

Impact on the Insurance Industry

Tesla’s entry into the insurance market has the potential to disrupt traditional insurance practices.

- Increased Competition: Tesla’s entry into the market is expected to increase competition, forcing traditional insurers to innovate and adapt their offerings to remain competitive. This could lead to more competitive pricing, enhanced customer service, and a greater focus on technological advancements.

- Data-Driven Pricing: Tesla’s reliance on data analytics and telematics could lead to more accurate and personalized pricing models. By leveraging data from vehicle sensors and driving behavior, Tesla can offer customized premiums based on individual risk profiles, potentially leading to fairer and more equitable pricing.

- Shifting Customer Expectations: Tesla’s focus on customer experience and technology is likely to shift customer expectations in the insurance industry. Consumers may increasingly demand seamless digital interactions, personalized services, and transparent pricing models. This could drive innovation and lead to a more customer-centric approach across the industry.

Final Summary

As Tesla Insurance continues to expand its reach, it is poised to become a significant force in the insurance industry, challenging traditional providers and offering Tesla owners a tailored and potentially more cost-effective insurance solution. With its focus on leveraging technology, data, and a deep understanding of Tesla vehicles, Tesla Insurance has the potential to redefine the way car insurance is purchased and experienced. Whether you are a current Tesla owner or simply curious about the future of automotive insurance, the story of Tesla Insurance is one worth following.

Key Questions Answered

Is Tesla Insurance available in all states?

No, Tesla Insurance is not yet available in all states. It is currently offered in a limited number of states, with plans for expansion in the future.

Is Tesla Insurance cheaper than traditional insurance?

The cost of Tesla Insurance can vary depending on factors such as your driving record, location, and the specific coverage you choose. In some cases, it may be cheaper than traditional insurance, but it’s important to compare quotes from multiple providers.

What are the benefits of Tesla Insurance?

Tesla Insurance offers several benefits, including access to Tesla’s network of service centers, discounts for safe driving, and the ability to manage your policy through the Tesla app.

Can I get Tesla Insurance if I don’t own a Tesla?

No, Tesla Insurance is currently only available to owners of Tesla vehicles.