What states allow electronic proof of insurance? This question has become increasingly relevant as the insurance industry embraces digitalization. Many drivers are opting for convenient and accessible electronic proof, ditching the traditional paper insurance cards. This shift reflects a growing trend towards digital solutions in various aspects of our lives, and the insurance sector is no exception.

The legal landscape surrounding electronic proof of insurance is evolving, with different states adopting their own regulations. Understanding the specific requirements and accepted forms of electronic proof in each state is crucial for drivers to avoid potential legal issues and ensure they are compliant with the law.

Electronic Proof of Insurance: A Modern Approach

The traditional paper-based insurance cards are gradually being replaced by electronic proof of insurance (e-proof), a digital format that offers convenience and efficiency. This shift is driven by the increasing adoption of technology in various aspects of life, including insurance.

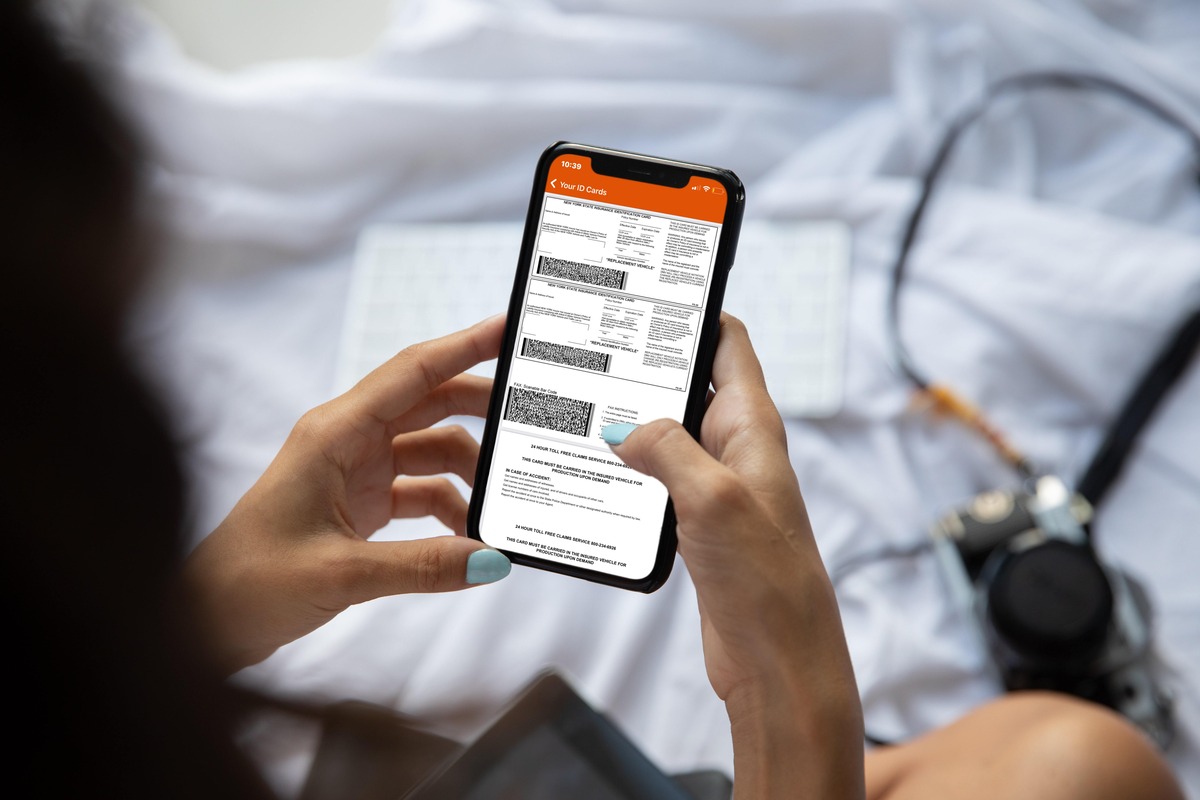

Electronic proof of insurance is a digital representation of your insurance policy, typically accessible through a mobile app or online portal. It provides a convenient and readily available proof of coverage, eliminating the need to carry physical cards.

The Benefits of Electronic Proof of Insurance

Electronic proof of insurance offers numerous advantages for both policyholders and insurance companies:

- Convenience: Policyholders can easily access their e-proof on their smartphones, eliminating the need to carry physical cards.

- Accessibility: E-proof is readily available anytime and anywhere, allowing for quick and easy verification of coverage.

- Security: Electronic proof of insurance can be secured with passwords and other authentication methods, reducing the risk of fraud and theft.

- Efficiency: Insurance companies can process claims and verify coverage more efficiently using digital records.

- Environmental Sustainability: By eliminating the need for paper cards, e-proof reduces paper waste and promotes sustainability.

The Legal Framework for Electronic Proof of Insurance

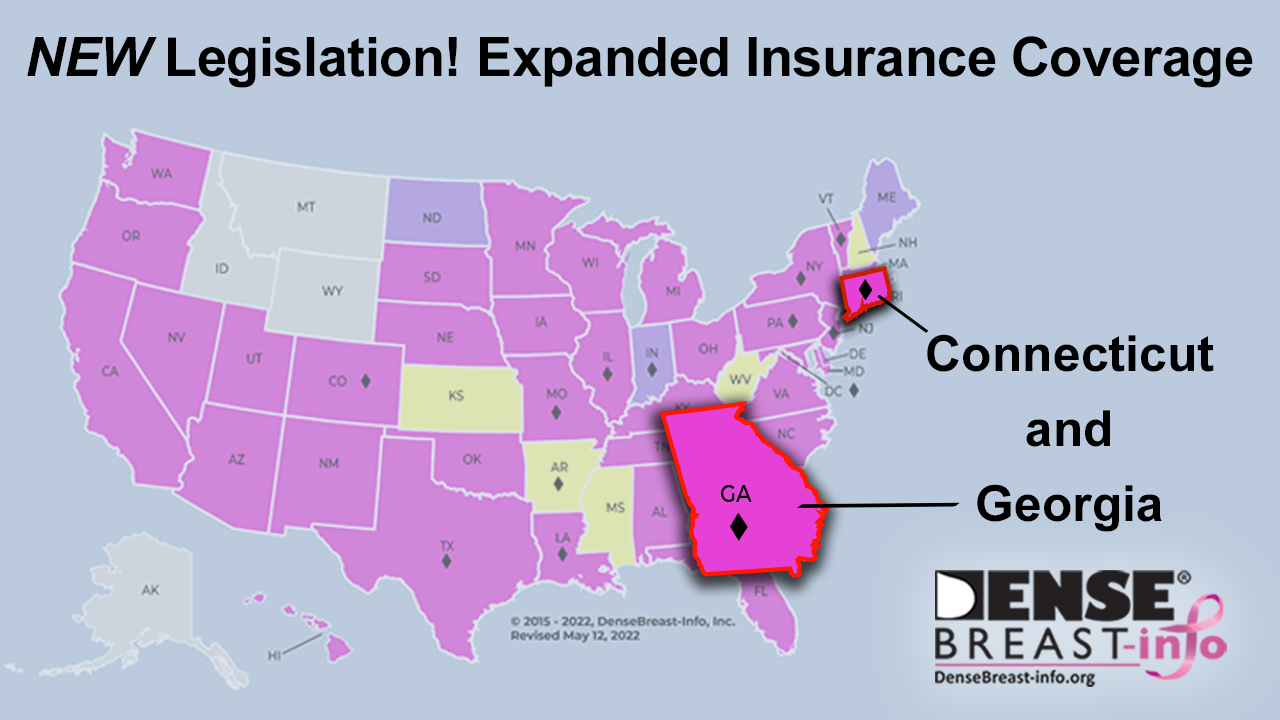

The legal framework for electronic proof of insurance in the US is evolving. Several states have adopted legislation recognizing the validity of e-proof, while others are still considering similar laws.

The legal framework for e-proof varies from state to state, but generally requires the following:

- Electronic Signatures: Electronic signatures must be legally recognized and verifiable.

- Data Security: The e-proof system must meet certain security standards to protect sensitive information.

- Accessibility: Policyholders must have easy access to their e-proof.

Benefits of Electronic Proof of Insurance

Electronic proof of insurance offers a modern and convenient alternative to traditional paper insurance cards, providing numerous advantages for drivers and law enforcement alike.

Convenience and Accessibility

Electronic proof of insurance significantly enhances convenience and accessibility for drivers. Instead of carrying a physical card that can be easily misplaced or damaged, drivers can store their insurance information digitally on their smartphones or other devices. This eliminates the need to worry about carrying a physical card and ensures that proof of insurance is readily available whenever needed.

Reduced Risk of Lost or Damaged Cards

The risk of losing or damaging a paper insurance card is a common concern for drivers. Electronic proof eliminates this risk entirely. Drivers can access their insurance information anytime, anywhere, as long as they have their device. This ensures that they are always prepared to provide proof of insurance, regardless of the circumstances.

Streamlined Interactions with Law Enforcement

Electronic proof of insurance can streamline interactions between drivers and law enforcement officers. Officers can quickly and easily verify insurance information through electronic databases or by scanning QR codes on drivers’ devices. This eliminates the need for drivers to dig through their wallets or glove compartments for their insurance cards, saving time and reducing potential delays.

For example, in many states, officers can now use mobile devices to scan QR codes on drivers’ phones, instantly verifying insurance information. This eliminates the need for drivers to search for their paper insurance cards and speeds up traffic stops.

Challenges and Considerations

While electronic proof of insurance offers numerous benefits, it’s crucial to acknowledge potential challenges and considerations associated with its implementation and adoption. These challenges range from security concerns to the need for widespread adoption and technical infrastructure.

Security Concerns and Data Privacy

Data security and privacy are paramount when dealing with sensitive information like insurance details. Electronic proof of insurance requires robust security measures to protect against unauthorized access, data breaches, and misuse.

- Data Encryption: Implementing strong encryption protocols is essential to safeguard sensitive information during transmission and storage. This ensures that only authorized individuals can access the data.

- Authentication and Authorization: Secure authentication methods are crucial to verify the identity of users accessing electronic proof of insurance. Multi-factor authentication can enhance security by requiring multiple forms of verification.

- Data Integrity: Measures to ensure data integrity are essential to prevent tampering or modification of insurance information. Digital signatures and blockchain technology can help maintain data integrity.

- Privacy Policies and Compliance: Clear and comprehensive privacy policies should be established to inform users about data collection, use, and sharing practices. Compliance with relevant data privacy regulations, such as GDPR and CCPA, is crucial.

Future Trends and Developments

The adoption of electronic proof of insurance (e-proof) is steadily gaining momentum, and the future holds exciting possibilities for further advancements and integration. As technology continues to evolve, we can expect to see e-proof play an increasingly vital role in the insurance landscape, leading to greater efficiency, security, and convenience for all stakeholders.

The Future of e-Proof: A Look Ahead

The widespread adoption and standardization of e-proof are likely to continue, driven by the numerous benefits it offers. As more states embrace e-proof, it will become the norm, leading to greater acceptance and usage across the industry. This standardization will also simplify compliance and ensure consistency in how e-proof is presented and verified.

Technology’s Role in Shaping the Future, What states allow electronic proof of insurance

Technology will play a crucial role in shaping the future of insurance documentation. The development of advanced technologies like blockchain and artificial intelligence (AI) will further enhance the security and efficiency of e-proof systems. Blockchain technology, with its decentralized and tamper-proof nature, can be used to create a secure and transparent ledger for e-proof records, enhancing trust and accountability. AI can automate various tasks, such as verifying insurance information and detecting fraud, further streamlining the process.

Advancements in Electronic Proof

Integration with Connected Vehicles

The integration of e-proof with connected vehicles is a promising development. Connected vehicles equipped with telematics systems can automatically transmit insurance information to law enforcement or emergency responders in case of an accident. This seamless integration can expedite the claims process and reduce the need for manual verification.

Blockchain Technology

Blockchain technology can revolutionize the way insurance policies are stored and verified. By creating a secure and transparent ledger, blockchain can ensure the authenticity and immutability of e-proof records. This eliminates the risk of tampering or fraud, enhancing trust and accountability.

“Blockchain technology offers a secure and transparent way to manage insurance policies, eliminating the need for intermediaries and reducing the risk of fraud.”

AI-Powered Verification

AI algorithms can be used to automate the verification process, ensuring the authenticity and validity of e-proof. AI can analyze various data points, such as vehicle registration information and insurance policy details, to detect inconsistencies and potential fraud. This automation can significantly reduce the time and effort required for verification, leading to faster processing times and reduced costs.

“AI can significantly improve the efficiency and accuracy of e-proof verification, freeing up human resources for more complex tasks.”

Final Summary

As technology continues to advance, we can expect further developments in electronic proof of insurance. The integration of connected vehicles and blockchain technology could revolutionize the way insurance information is stored and shared. The future of insurance documentation is likely to be increasingly digital, offering greater convenience, security, and efficiency for both drivers and insurance providers.

Questions and Answers: What States Allow Electronic Proof Of Insurance

Is electronic proof of insurance accepted everywhere in the US?

No, not all states allow electronic proof of insurance. You should check the specific requirements in your state.

What if my phone battery dies and I can’t show my electronic proof?

It’s always a good idea to have a printed copy of your insurance card as a backup, especially in states that don’t explicitly allow electronic proof.

Is electronic proof of insurance as secure as a paper card?

Electronic proof can be just as secure as a paper card, but it’s important to use reputable insurance apps and websites and protect your personal information.

How can I find out what the requirements are in my state?

You can visit your state’s Department of Motor Vehicles (DMV) website or contact your insurance company directly for the most up-to-date information.