What states does Tesla offer insurance? This question has become increasingly relevant as Tesla expands its insurance offerings beyond its own vehicles. Tesla Insurance, designed to be a more affordable and personalized option for Tesla owners, is now available in select states, promising a unique approach to car insurance. But what makes Tesla Insurance stand out from traditional providers? And how does its coverage compare? This guide delves into the details of Tesla Insurance, exploring its availability, features, and the benefits it offers to policyholders.

Tesla Insurance, a relatively new entrant in the insurance market, is attracting attention with its innovative approach to pricing and its focus on Tesla vehicle owners. The company leverages its extensive data on Tesla vehicles, including driving patterns and safety features, to offer tailored insurance premiums. This personalized approach aims to reward safe driving and provide competitive rates for Tesla owners.

Tesla Insurance Availability

Tesla Insurance, offered by Tesla Insurance Services, Inc., is a relatively new entrant in the auto insurance market. It’s designed to provide comprehensive coverage for Tesla vehicles, leveraging data and technology for a personalized and potentially more affordable experience.

States Where Tesla Insurance is Available

Tesla Insurance is currently available in a limited number of states. The specific states where Tesla Insurance is offered can vary depending on the time of year. As of today, Tesla Insurance is available in the following states:

- Arizona

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- Wisconsin

Determining Tesla Insurance Availability

To determine if Tesla Insurance is available in your state, you can visit the Tesla Insurance website. You can also check the availability directly through the Tesla app.

Expansion Plans

Tesla has expressed its intention to expand Tesla Insurance to more states in the future. However, specific timelines for expansion are not publicly available. The company is likely to consider factors such as regulatory approvals, market demand, and the availability of necessary infrastructure before expanding into new regions.

Eligibility Criteria for Tesla Insurance: What States Does Tesla Offer Insurance

Tesla Insurance, like most insurance providers, has certain eligibility criteria that individuals must meet to qualify for coverage. These requirements ensure that the insurer can assess risk accurately and determine the appropriate premium for each policyholder.

Eligibility Requirements

Tesla Insurance, like most insurance providers, has specific eligibility requirements that individuals must meet to qualify for coverage. These requirements ensure that the insurer can accurately assess risk and determine the appropriate premium for each policyholder.

- Age: Tesla Insurance typically requires drivers to be at least 18 years old. However, specific age requirements may vary depending on the state and the driver’s driving history.

- Driving History: A clean driving record is essential for obtaining insurance, and Tesla Insurance is no exception. Drivers with a history of accidents, violations, or suspensions may face higher premiums or even be denied coverage.

- Vehicle Ownership: Tesla Insurance is specifically designed for Tesla vehicles. Therefore, you must own a Tesla model to be eligible for coverage. This exclusivity is a key factor that distinguishes Tesla Insurance from other providers.

- State of Residence: Tesla Insurance is currently available in a limited number of states. Eligibility is determined based on the state where you reside and where your Tesla is registered.

- Credit Score: Like many insurance providers, Tesla Insurance may consider your credit score as a factor in determining your premium. A higher credit score generally translates to lower premiums, as it suggests a lower risk profile.

Comparison with Other Insurance Providers, What states does tesla offer insurance

Tesla Insurance offers a unique approach to insurance compared to traditional providers. While the core eligibility criteria are similar, some key differences exist:

- Vehicle Specificity: Tesla Insurance is exclusively for Tesla vehicles, unlike most other insurance providers that offer coverage for a wide range of car makes and models.

- Data-Driven Approach: Tesla Insurance leverages data from your Tesla’s onboard sensors and systems to assess your driving behavior. This data-driven approach can lead to more personalized premiums based on your actual driving habits, potentially resulting in lower premiums for safe drivers.

- Safety Features: Tesla vehicles are equipped with advanced safety features, which can influence your insurance premiums. These features, such as Autopilot and Full Self-Driving, may lead to lower premiums due to their potential to reduce accidents.

Unique Factors Influencing Eligibility

In addition to the general eligibility requirements, certain unique factors can affect your eligibility for Tesla Insurance:

- Vehicle Model: Tesla Insurance may offer different coverage options or premium rates depending on the specific Tesla model you own. Factors such as the vehicle’s age, performance, and safety features can influence your eligibility.

- Driving History: Tesla Insurance may consider your driving history in detail, going beyond simple accidents and violations. Factors like speeding tickets, parking violations, and even your driving style as assessed by the vehicle’s sensors can influence your premium.

Key Features and Benefits of Tesla Insurance

Tesla Insurance is a relatively new entrant in the insurance market, but it has quickly gained popularity for its unique features and benefits tailored specifically for Tesla owners. This insurance program leverages Tesla’s advanced technology and data insights to offer competitive rates and a seamless user experience.

Key Features of Tesla Insurance

Tesla Insurance offers several unique features that differentiate it from traditional insurance providers. These features are designed to provide Tesla owners with a more personalized and convenient insurance experience.

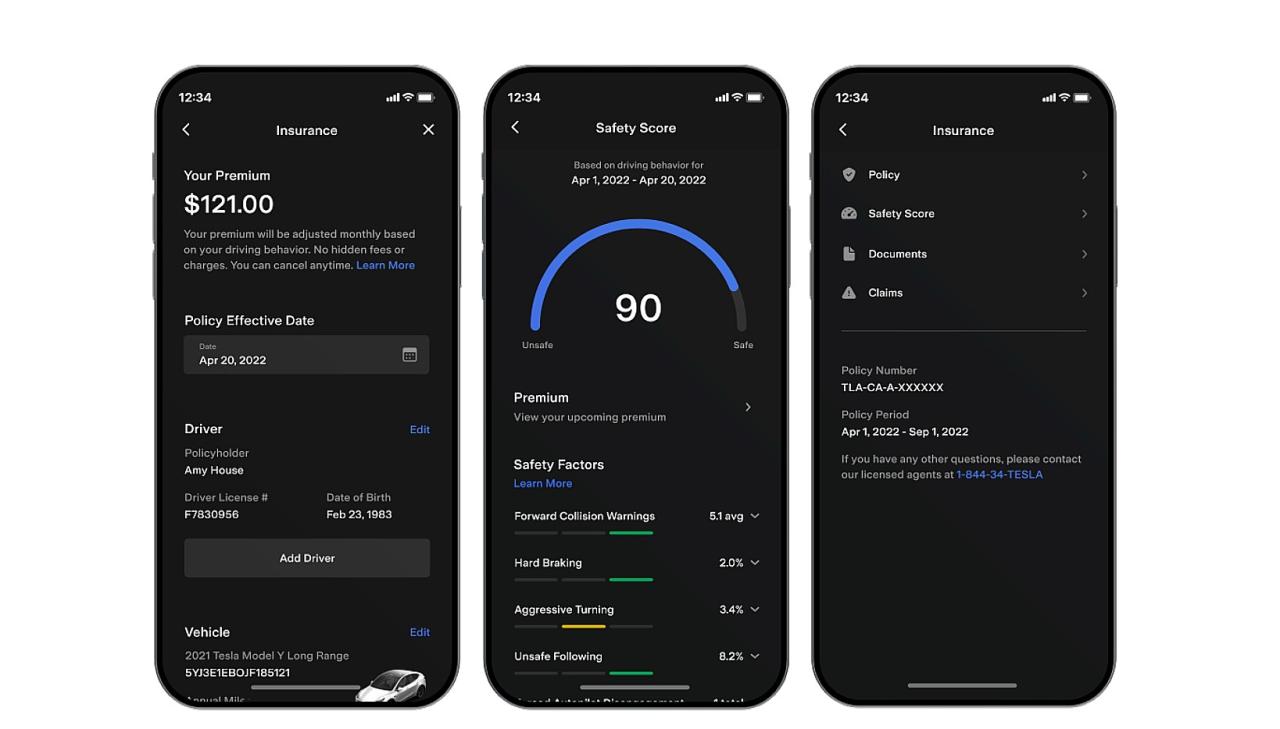

- Safety Score-Based Pricing: Tesla Insurance utilizes a proprietary safety score system to assess individual driving behavior. This score is based on factors such as acceleration, braking, cornering, and adherence to traffic laws. Drivers with a higher safety score can potentially qualify for lower premiums. This approach rewards safe driving and incentivizes responsible behavior on the road.

- Remote Monitoring and Diagnostics: Tesla Insurance leverages the vehicle’s built-in sensors and data connectivity to monitor driving patterns and vehicle health. This allows for proactive risk assessment and potential early detection of issues that could lead to accidents. This data-driven approach can contribute to more accurate risk assessments and potentially lower premiums.

- Over-the-Air Updates: Tesla Insurance policies can be updated over the air, ensuring that coverage remains current and relevant to the latest vehicle features and technology. This eliminates the need for manual paperwork or visits to an insurance agent for updates. This approach provides a seamless and efficient way to manage insurance coverage, reflecting the digital nature of the Tesla brand.

Benefits of Tesla Insurance

Tesla Insurance aims to provide a more personalized and cost-effective insurance solution for Tesla owners. This is achieved through several key benefits:

- Competitive Premiums: Tesla Insurance often offers competitive premiums compared to traditional insurance providers, particularly for drivers with a good safety record. This is due to the company’s data-driven approach and its ability to assess risk more accurately based on individual driving behavior.

- Seamless Integration with Tesla Ecosystem: Tesla Insurance is seamlessly integrated with the Tesla ecosystem, allowing for easy management of policies and claims through the Tesla app. This streamlined process eliminates the need for multiple platforms or interactions with different providers.

- Enhanced Customer Service: Tesla Insurance prioritizes customer satisfaction and offers dedicated customer service channels for Tesla owners. This ensures a personalized and responsive experience, addressing any concerns or inquiries promptly.

Comparison to Other Insurance Providers

While Tesla Insurance offers unique features and benefits, it’s essential to compare it to other insurance providers to determine the best fit for individual needs.

| Feature | Tesla Insurance | Traditional Insurance |

|---|---|---|

| Pricing | Based on safety score and driving data | Based on factors like age, location, driving history, and vehicle type |

| Features | Remote monitoring, over-the-air updates, seamless integration with Tesla ecosystem | May offer various add-ons like roadside assistance, rental car coverage, and accident forgiveness |

| Customer Service | Dedicated customer service channels for Tesla owners | May vary depending on the provider |

While Tesla Insurance offers a unique value proposition for Tesla owners, traditional insurance providers may offer more competitive rates or a broader range of coverage options for certain individuals.

Pricing and Cost Factors

Tesla Insurance premiums are calculated based on a comprehensive assessment of various factors, including the driver’s profile, the vehicle itself, and the location. These factors are weighed to determine the likelihood of an insurance claim, and the potential cost of that claim.

Factors Influencing Tesla Insurance Premiums

Tesla Insurance premiums are influenced by a range of factors, which can be broadly categorized into driver-related, vehicle-related, and location-related factors.

- Driver-Related Factors: These include factors like age, driving history, and credit score. Younger drivers with limited driving experience or a history of accidents may face higher premiums. Drivers with good credit scores are often considered less risky and may qualify for lower premiums.

- Vehicle-Related Factors: The make, model, and year of the vehicle play a significant role in determining premiums. Tesla vehicles, with their advanced safety features and technology, may be eligible for lower premiums compared to other vehicles. However, the specific model and its safety ratings will influence the premium. For example, a Model S Plaid with its high performance and potential for higher repair costs may have a higher premium than a Model 3.

- Location-Related Factors: The geographic location where the vehicle is insured also influences premiums. Areas with higher rates of accidents or theft may have higher insurance premiums. The density of traffic and the prevalence of weather-related hazards can also contribute to premium variations.

Comparison with Other Insurance Providers, What states does tesla offer insurance

Tesla Insurance often offers competitive pricing compared to traditional insurance providers, particularly for Tesla owners. This is due to the company’s deep understanding of Tesla vehicles and their safety features. However, it’s important to compare quotes from multiple insurance providers to ensure you’re getting the best value for your needs.

“Tesla Insurance leverages its unique insights into Tesla vehicles to offer competitive pricing for owners, often undercutting traditional insurers.”

Customer Experience and Reviews

Tesla Insurance has garnered a mixed bag of reviews from customers, with some praising its competitive pricing and seamless integration with Tesla vehicles, while others have raised concerns about its claims process and customer service.

Pricing and Value

Customer reviews often highlight the competitive pricing of Tesla Insurance, particularly for Tesla owners. Many customers find the insurance premiums to be lower than traditional insurance providers, especially when factoring in the safety features and technology of Tesla vehicles. However, some customers have reported that the pricing can vary significantly depending on factors such as location, driving history, and vehicle model.

Claims Process

The claims process is another area where customer experiences vary. Some customers have reported a smooth and efficient claims process, with quick responses and hassle-free settlements. However, others have encountered delays, communication issues, and difficulties in navigating the claims process. Some customers have also expressed concerns about the limited network of repair shops available for Tesla vehicles, which could potentially lead to longer repair times.

Customer Service

Customer service is a crucial aspect of any insurance provider, and Tesla Insurance has received mixed feedback in this area. Some customers have praised the responsiveness and helpfulness of Tesla Insurance representatives, while others have reported difficulty in getting through to customer service and receiving timely assistance.

Comparison to Traditional Insurance Providers

Tesla Insurance is a relatively new player in the insurance market, and it offers a unique approach to auto insurance compared to traditional insurance providers. This section delves into the key differences between Tesla Insurance and traditional insurance providers, highlighting the pros and cons of each.

Features and Benefits

Tesla Insurance offers several features and benefits that distinguish it from traditional insurance providers.

- Safety Score-Based Pricing: Tesla Insurance uses a driver’s safety score, which is calculated based on their driving habits, to determine their insurance premium. This system rewards safe drivers with lower premiums, which can be a significant advantage compared to traditional providers that rely primarily on factors like age, driving history, and vehicle type.

- Tesla-Specific Coverage: Tesla Insurance offers coverage specifically tailored for Tesla vehicles, including coverage for Autopilot and Full Self-Driving features. This can be a valuable benefit for Tesla owners who want to ensure their vehicle is fully protected.

- Direct-to-Consumer Model: Tesla Insurance operates a direct-to-consumer model, meaning customers can purchase and manage their policies online without needing to interact with an agent. This streamlined process can be more convenient for tech-savvy customers who prefer to handle their insurance matters digitally.

- Integrated Experience: Tesla Insurance is seamlessly integrated with the Tesla app, allowing customers to manage their policies, track their safety score, and file claims directly through the app. This integrated experience can be a significant advantage for Tesla owners who are already familiar with the Tesla app.

Pricing and Cost Factors

The pricing of Tesla Insurance can vary depending on factors like the driver’s safety score, the Tesla model, and the location. However, Tesla Insurance generally aims to offer competitive pricing, especially for safe drivers.

- Lower Premiums for Safe Drivers: Tesla Insurance’s safety score-based pricing model can result in lower premiums for safe drivers compared to traditional insurance providers. This can be a significant advantage for drivers who have a good driving record.

- Higher Premiums for Riskier Drivers: Conversely, drivers with a less-than-perfect driving history may find that Tesla Insurance premiums are higher than those offered by traditional providers. This is because Tesla Insurance heavily emphasizes safe driving and rewards those who demonstrate safe driving habits.

- Variable Pricing: Tesla Insurance uses dynamic pricing, which means premiums can fluctuate based on factors like driving conditions and the driver’s safety score. This can be advantageous for drivers who consistently drive safely and avoid risky behaviors, as their premiums may decrease over time. However, it can also be a disadvantage for drivers who are less careful or experience unexpected events that negatively impact their safety score.

Customer Experience and Reviews

Customer reviews of Tesla Insurance are mixed. While some customers praise the ease of use, the competitive pricing, and the integrated experience, others have expressed concerns about the lack of personalized service and the limited availability of coverage options.

- Positive Reviews: Many customers appreciate the convenience and efficiency of Tesla Insurance’s online platform and the ease of managing their policies through the Tesla app. They also value the competitive pricing, especially for safe drivers, and the coverage specifically tailored for Tesla vehicles.

- Negative Reviews: Some customers have expressed frustration with the lack of personalized service and the limited availability of coverage options. They also note that the pricing can be higher than traditional providers for drivers with less-than-perfect driving histories.

Future of Tesla Insurance

Tesla Insurance, being a relatively new entrant in the insurance market, has the potential to disrupt the traditional insurance model with its data-driven approach and focus on Tesla vehicle owners.

Potential Future Developments and Innovations

Tesla Insurance is well-positioned to leverage its access to real-time data from Tesla vehicles to enhance its offerings. This data can be used to create more personalized and accurate risk assessments, leading to potentially lower premiums for safe drivers. Furthermore, Tesla can incorporate features like:

- Predictive Maintenance: By analyzing vehicle data, Tesla Insurance could offer proactive maintenance recommendations, potentially reducing the likelihood of accidents caused by mechanical failures.

- Usage-Based Insurance: Tesla Insurance could further refine its usage-based insurance model, offering discounts for drivers who exhibit safe driving habits, such as maintaining consistent speed limits or avoiding harsh braking.

- Automated Claims Processing: Leveraging AI and machine learning, Tesla Insurance could streamline claims processing, enabling faster and more efficient payouts for policyholders.

Impact of Emerging Technologies on the Insurance Industry

The insurance industry is on the cusp of significant transformation due to the advent of technologies such as:

- Artificial Intelligence (AI): AI can revolutionize risk assessment, claims processing, and fraud detection, enabling insurers to offer more personalized and efficient services.

- Internet of Things (IoT): Connected devices and sensors in vehicles, homes, and other areas can provide insurers with real-time data on risk factors, leading to more accurate pricing and risk management.

- Blockchain: Blockchain technology can enhance transparency and security in the insurance industry, enabling faster and more efficient claims processing and reducing the risk of fraud.

Long-Term Vision and Goals for Tesla Insurance

Tesla Insurance’s long-term vision is to become a leading provider of innovative and customer-centric insurance solutions. Their goals include:

- Expanding Product Offerings: Tesla Insurance aims to expand its product portfolio to cover a wider range of insurance needs, such as homeowners and renters insurance.

- Global Expansion: Tesla Insurance plans to expand its operations into new markets, offering its unique insurance solutions to Tesla owners worldwide.

- Enhanced Customer Experience: Tesla Insurance aims to provide a seamless and intuitive customer experience through its digital platform, offering personalized services and transparent communication.

Conclusive Thoughts

Tesla Insurance is still a relatively new player in the insurance market, but its unique approach to pricing and its focus on Tesla vehicle owners is attracting attention. As Tesla continues to expand its insurance offerings, it’s worth exploring the potential benefits and comparing them to traditional insurance providers. Whether you’re a Tesla owner or considering a Tesla in the future, understanding the ins and outs of Tesla Insurance can help you make informed decisions about your insurance needs.

Frequently Asked Questions

What are the main benefits of Tesla Insurance?

Tesla Insurance offers several benefits, including potentially lower premiums for safe drivers, access to Tesla’s extensive data on vehicle safety and performance, and personalized coverage tailored to Tesla owners.

Can I get Tesla Insurance if I don’t own a Tesla?

Currently, Tesla Insurance is primarily designed for Tesla owners. However, Tesla might expand its offerings to include other vehicle types in the future.

How do I file a claim with Tesla Insurance?

The claims process for Tesla Insurance is similar to other insurance providers. You can typically file a claim online, over the phone, or through a mobile app.