What state has the cheapest insurance – What state has the cheapest car insurance? This question is a common concern for many drivers, especially those seeking to minimize their monthly expenses. Car insurance costs can vary significantly across the United States, influenced by a complex interplay of factors, including population density, traffic volume, accident rates, and state regulations. Understanding these factors and how they impact insurance premiums can empower individuals to make informed decisions about their coverage and find the most affordable options.

In addition to state-specific factors, individual driving history and vehicle type also play a crucial role in determining insurance costs. A clean driving record with no accidents or violations can lead to lower premiums compared to drivers with a history of accidents or traffic tickets. Similarly, the type of vehicle you drive, such as a sedan, SUV, or truck, can influence your insurance rates. Insurance companies often consider safety features and other vehicle characteristics when calculating premiums, offering discounts for vehicles equipped with advanced safety technologies.

Factors Influencing Car Insurance Costs

Car insurance premiums vary significantly across different states, and several factors contribute to these variations. These factors encompass a wide range of aspects, including demographic characteristics, driving conditions, and state-specific regulations.

Impact of Demographic Factors

Demographic factors play a crucial role in shaping car insurance premiums. These factors reflect the characteristics of the population in a given state and their influence on driving habits and accident risks.

- Population Density: States with high population density often experience more traffic congestion and increased risk of accidents. This higher risk translates into higher insurance premiums for drivers in densely populated areas. For example, New York City, with its dense population and heavy traffic, has significantly higher car insurance rates compared to less populated areas.

- Age and Gender: Younger drivers, particularly those under 25, tend to have higher accident rates due to lack of experience and risk-taking behavior. Similarly, insurance companies may consider gender as a factor, as historical data has shown some differences in driving patterns between men and women. However, it’s important to note that insurance companies are increasingly moving away from gender-based pricing due to regulations and evolving societal views.

- Income Level: In some cases, insurance companies may consider income level as a factor in determining premiums. This is based on the assumption that individuals with higher incomes may be more likely to drive newer, more expensive vehicles, which could result in higher repair costs in case of accidents.

Influence of Driving Conditions

Driving conditions, including traffic volume and accident rates, significantly impact insurance costs. These factors reflect the overall risk associated with driving in a particular state.

- Traffic Volume: States with high traffic volume, such as California and Texas, tend to have higher accident rates due to increased congestion and potential for collisions. This increased risk is reflected in higher insurance premiums for drivers in these states.

- Accident Rates: States with higher accident rates, such as Florida and Louisiana, often have higher insurance premiums. These rates are influenced by factors such as road conditions, driving habits, and weather patterns.

Role of State Regulations and Insurance Laws

State regulations and insurance laws play a crucial role in shaping car insurance premiums. These laws govern how insurance companies operate and the factors they can consider when setting premiums.

- Minimum Coverage Requirements: Each state has its own minimum coverage requirements, which specify the minimum amount of insurance coverage drivers must carry. States with higher minimum coverage requirements tend to have higher average insurance premiums, as drivers are required to purchase more coverage.

- No-Fault Laws: Some states have no-fault laws, which dictate that drivers are responsible for their own injuries and damages, regardless of who is at fault in an accident. These laws can influence insurance premiums, as they may limit the amount of compensation available for injuries.

- Insurance Rate Regulation: Some states have regulations that limit the amount of profit insurance companies can make on car insurance. These regulations can affect premiums by limiting the amount insurance companies can charge for coverage.

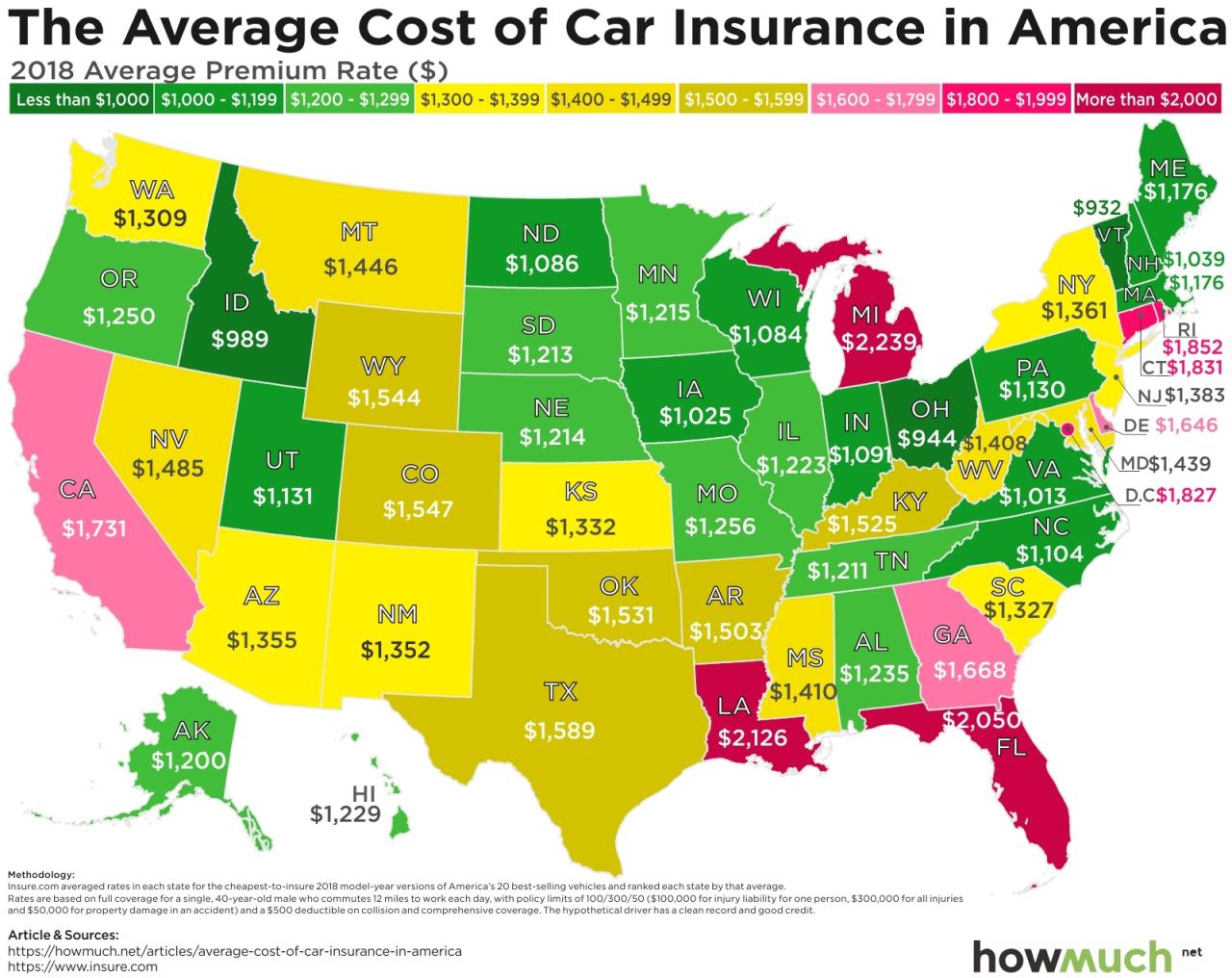

State-Specific Insurance Cost Comparisons

Understanding the average car insurance premiums in different states can provide valuable insights into the factors influencing insurance costs. By analyzing these premiums, we can identify the states with the cheapest insurance and gain a better understanding of the reasons behind these cost variations.

State-Specific Insurance Cost Comparisons

The table below presents the average annual car insurance premiums for full coverage and liability-only coverage in different states, based on data from the National Association of Insurance Commissioners (NAIC). This data can be useful in understanding the cost variations between states and identifying potential causes for these differences.

| State | Average Full Coverage Premium | Average Liability-Only Premium |

|---|---|---|

| Idaho | $1,288 | $492 |

| Maine | $1,305 | $508 |

| Utah | $1,327 | $515 |

| Vermont | $1,342 | $521 |

| Wyoming | $1,356 | $526 |

| Iowa | $1,368 | $532 |

| North Dakota | $1,379 | $537 |

| South Dakota | $1,391 | $543 |

| Montana | $1,403 | $548 |

| New Hampshire | $1,415 | $554 |

The states with the cheapest insurance generally have lower population densities, lower accident rates, and less severe weather conditions. For instance, Idaho, Maine, and Utah, which have the lowest average premiums, are all rural states with relatively low accident rates and moderate weather conditions. In contrast, states with higher population densities, such as California and New York, tend to have higher premiums due to increased traffic congestion and higher accident rates.

Impact of Driving History and Vehicle Type

Your driving history and the type of vehicle you drive significantly impact your car insurance premiums. Insurance companies assess your risk based on these factors, and those deemed higher risk will pay more.

Impact of Driving History

A clean driving record is the most significant factor in determining your car insurance premiums. If you have a history of accidents or traffic violations, your insurance rates will be higher. The severity of the accidents and violations will also affect the cost.

- Accidents: Insurance companies typically raise premiums after an accident, even if you weren’t at fault. The higher the severity of the accident, the more your premiums will increase.

- Traffic Violations: Speeding tickets, reckless driving, and DUI offenses can lead to substantial premium increases. Some states have a “points” system where violations accrue points on your driving record, further impacting your rates.

Impact of Vehicle Type

The type of vehicle you drive also plays a crucial role in determining your insurance costs. Generally, luxury vehicles, sports cars, and trucks are more expensive to insure than sedans. This is due to factors like:

- Repair Costs: Luxury and high-performance vehicles have more expensive parts and repairs, leading to higher insurance costs.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts, potentially lowering your insurance premiums.

- Theft Risk: Some vehicle models are more prone to theft, leading to higher insurance premiums.

Vehicle Safety Features and Driver Characteristics

Insurance companies offer discounts for certain vehicle safety features and driver characteristics, such as:

- Anti-theft Devices: Installing an alarm system or GPS tracking device can lower your insurance premiums.

- Good Student Discount: Many insurance companies offer discounts to students with good grades.

- Safe Driver Discounts: Insurance companies often offer discounts for drivers who have completed defensive driving courses.

Cost Differences for Different Vehicle Models

The cost of insurance for different vehicle models can vary significantly across states. For example, a 2023 Honda Civic might be cheaper to insure in one state than in another due to factors like:

- State Laws: Different states have varying insurance laws, which can impact the cost of insurance.

- Accident Rates: States with higher accident rates may have higher insurance premiums.

- Theft Rates: States with higher theft rates may have higher insurance premiums for certain vehicle models.

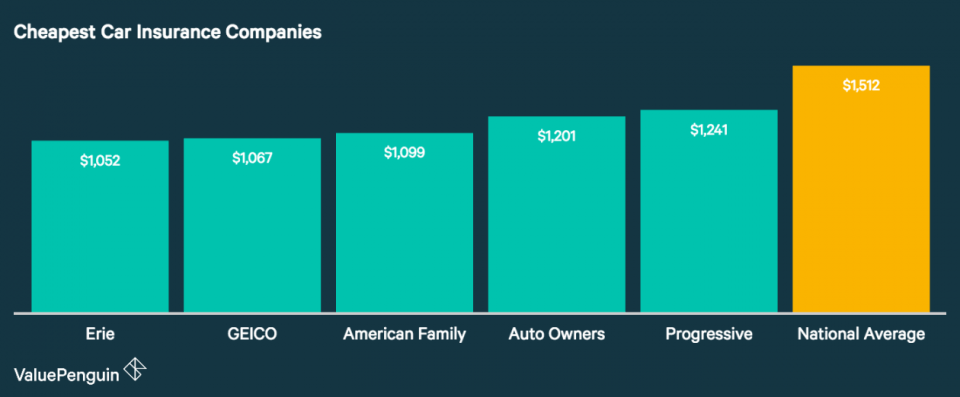

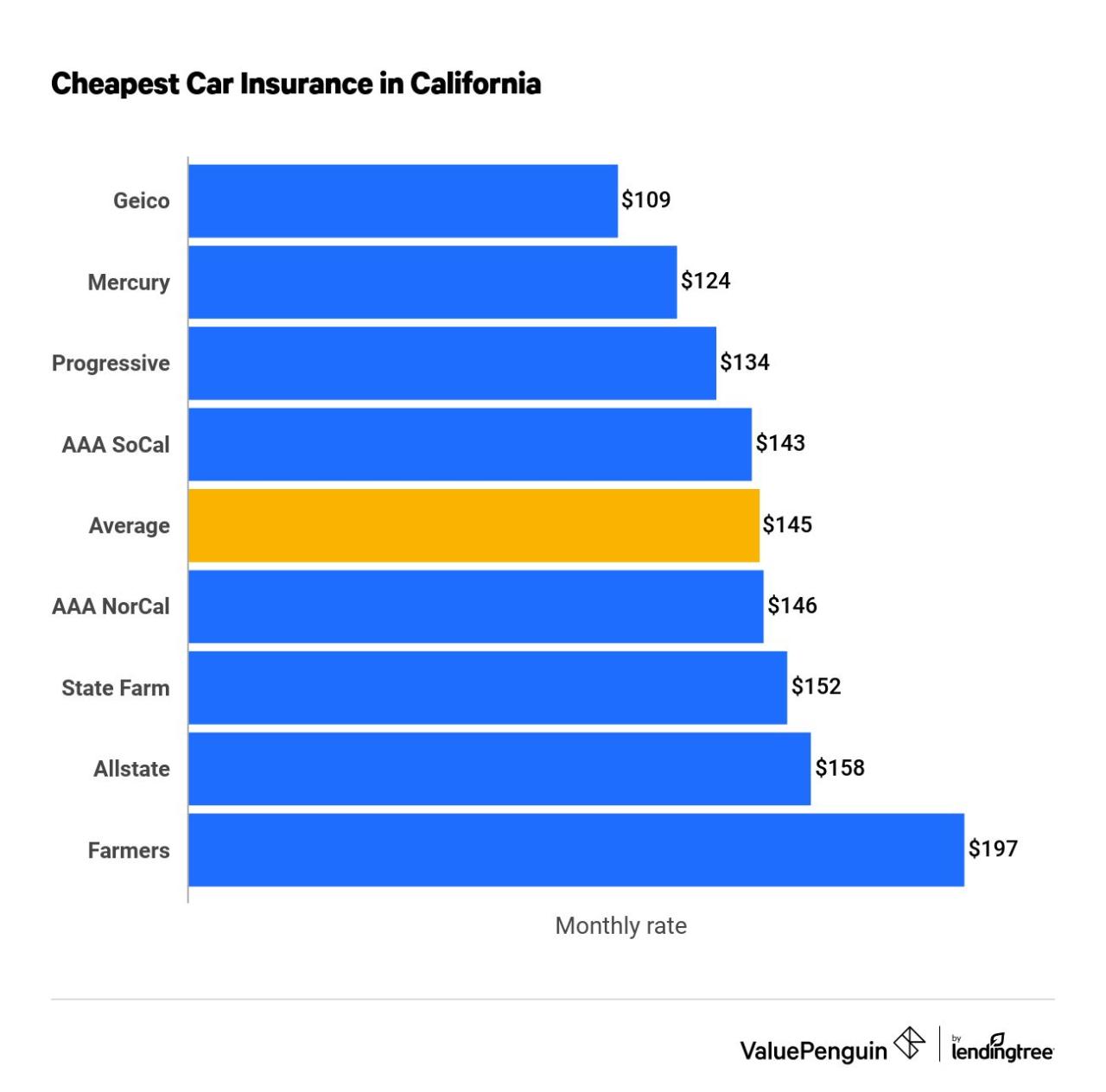

Exploring State-Specific Insurance Provider Options

Understanding the car insurance landscape in your state is crucial to finding the best coverage at the most affordable price. Knowing the major providers and their offerings can help you make an informed decision that aligns with your individual needs and budget.

Major Car Insurance Providers in Each State

Each state has a unique mix of insurance providers, with some companies having a strong national presence while others are more regional. It’s important to research the companies operating in your state and their market share.

- National Insurance Companies: These companies have a broad reach across the United States, often offering standardized coverage options and discounts. Examples include State Farm, Geico, Progressive, and Allstate.

- Regional Insurance Companies: These companies focus on specific geographic areas, sometimes offering more tailored coverage and competitive pricing for local drivers. Examples include Farmers Insurance, USAA, and Erie Insurance.

- Local Insurance Companies: These companies operate within a smaller region or city, often providing personalized service and community support. They may offer competitive rates for local drivers, but their coverage options might be more limited.

Comparing Coverage Options, Discounts, and Customer Service

Once you’ve identified the major providers in your state, it’s essential to compare their coverage options, discounts, and customer service offerings.

- Coverage Options: Compare the different types of coverage offered, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Make sure the coverage options align with your individual needs and risk tolerance.

- Discounts: Explore the various discounts available, such as safe driving, good student, multi-car, and bundling discounts. These discounts can significantly reduce your premium.

- Customer Service: Consider factors like ease of contact, responsiveness, and claim handling processes. Read online reviews and customer testimonials to get a sense of the company’s customer service reputation.

Local vs. National Insurance Companies

Choosing between a local and a national insurance company involves weighing the potential benefits and drawbacks of each option.

- Local Insurance Companies:

- Benefits: Personalized service, community support, potentially competitive rates for local drivers.

- Drawbacks: Limited coverage options, smaller claims handling network, potential lack of nationwide recognition.

- National Insurance Companies:

- Benefits: Extensive coverage options, standardized discounts, large claims handling network, nationwide recognition.

- Drawbacks: Less personalized service, potential higher premiums, standardized approach may not always cater to specific needs.

State-Specific Insurance Provider Comparisons

Here’s a table summarizing the key features and pricing of different insurance providers in a few states.

| State | Provider | Coverage Options | Discounts | Average Annual Premium |

|---|---|---|---|---|

| California | State Farm | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Safe Driver, Good Student, Multi-Car, Bundling | $2,000 |

| California | Geico | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Safe Driver, Good Student, Multi-Car, Bundling | $1,800 |

| Texas | Progressive | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Safe Driver, Good Student, Multi-Car, Bundling | $1,600 |

| Texas | Farmers Insurance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Safe Driver, Good Student, Multi-Car, Bundling | $1,700 |

Tips for Finding Affordable Insurance: What State Has The Cheapest Insurance

Finding the most affordable car insurance doesn’t have to be a daunting task. With a little research and some smart strategies, you can significantly reduce your premiums and ensure you’re getting the best value for your money. This section will explore practical tips and techniques to help you navigate the world of car insurance and secure the most favorable rates.

Comparing Quotes from Different Insurers, What state has the cheapest insurance

Obtaining quotes from multiple insurers is crucial to finding the most competitive rates. Different companies have varying pricing structures and may offer discounts tailored to your specific profile.

- Online Comparison Websites: Utilize online comparison websites, such as Policygenius, NerdWallet, and Insurance.com, to quickly gather quotes from numerous insurers. These platforms allow you to input your details once and receive multiple offers, simplifying the comparison process.

- Direct Contact with Insurers: Reach out directly to insurance companies you’re interested in. This allows you to discuss your specific needs and ask questions about their policies and discounts. It also gives you an opportunity to negotiate rates based on your unique circumstances.

- Local Agents: Consider working with local insurance agents who specialize in car insurance. They can provide personalized guidance and help you navigate the complexities of different policies and coverage options.

Negotiating Favorable Rates

Once you have multiple quotes, you can leverage this information to negotiate favorable rates.

- Highlight Positive Driving History: If you have a clean driving record with no accidents or violations, emphasize this to insurers. A good driving history is a significant factor in determining premiums, and highlighting it can increase your chances of securing lower rates.

- Bundle Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance, through the same insurer. Bundling often leads to discounts as insurers reward customers for consolidating their insurance needs.

- Explore Discounts: Research available discounts and inquire about their eligibility criteria. Common discounts include:

- Good Student Discount: This discount is available for students with good academic standing.

- Safe Driver Discount: Insurers often offer discounts for drivers with a history of safe driving, including those who have completed defensive driving courses.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or GPS tracking systems, can qualify you for a discount.

- Loyalty Discount: Long-term customers may be eligible for discounts for their continued business.

Understanding Coverage Options

Car insurance policies come with various coverage options, each with its own purpose and cost. Understanding these options is crucial to selecting the right policy for your needs.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s generally optional, but it’s often required by lenders if you have a financed vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. It’s also typically optional, but it’s often required by lenders if you have a financed vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It helps cover your medical expenses and vehicle damage.

Maintaining a Good Driving Record

A clean driving record is crucial for obtaining affordable car insurance.

- Avoid Traffic Violations: Driving safely and adhering to traffic laws can help you avoid tickets and maintain a good driving record.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices and may qualify you for discounts.

- Avoid Accidents: Every accident, regardless of fault, can negatively impact your insurance premiums.

Considering Safety Features in Vehicles

Vehicles equipped with advanced safety features often qualify for discounts.

- Anti-lock Braking System (ABS): ABS helps prevent wheel lock-up during braking, improving vehicle control and reducing the risk of accidents.

- Electronic Stability Control (ESC): ESC helps maintain vehicle stability during challenging maneuvers, reducing the risk of skidding or rollovers.

- Airbags: Airbags provide an additional layer of protection in the event of a collision, reducing the risk of serious injuries.

Summary

Finding the cheapest car insurance involves a multifaceted approach. By understanding the factors that influence premiums, comparing quotes from different insurers, and considering your individual needs and driving habits, you can find the most affordable coverage for your situation. It’s essential to prioritize comprehensive coverage while exploring discounts and negotiating favorable rates to minimize your insurance expenses. Remember, driving safely and maintaining a good driving record are crucial steps in keeping your premiums low and ensuring you have the right protection on the road.

Key Questions Answered

What are some common discounts offered by car insurance companies?

Many insurance companies offer discounts for good driving records, safety features, multiple car policies, and bundling insurance with other services like home or renters insurance.

How can I compare car insurance quotes from different companies?

You can use online comparison tools, contact insurance companies directly, or work with an insurance broker to gather quotes and compare coverage options.

What are some tips for negotiating lower car insurance rates?

Consider increasing your deductible, bundling insurance policies, and shopping around for quotes from multiple insurers. You can also try negotiating a lower rate by highlighting your good driving record and any relevant safety features in your vehicle.