Washington State auto insurance rate increases have become a pressing issue for residents, prompting concerns about affordability and accessibility. Over the past few years, premiums have steadily climbed, impacting households across the state. This trend can be attributed to a confluence of factors, including increased claim severity, rising repair costs, and evolving state regulations. Understanding the dynamics at play is crucial for navigating this complex landscape.

This article delves into the intricate details of Washington State’s auto insurance market, examining the historical trends, influencing factors, and potential solutions. We will explore the impact of rising insurance costs on consumers and discuss strategies for managing premiums. By providing a comprehensive overview, this analysis aims to shed light on the challenges and opportunities associated with this critical issue.

Recent Trends in Washington State Auto Insurance Rates: Washington State Auto Insurance Rate Increases

Auto insurance rates in Washington State have been on the rise in recent years, reflecting a national trend. Understanding these fluctuations is crucial for drivers seeking affordable coverage.

Historical Overview of Auto Insurance Rate Changes in Washington State

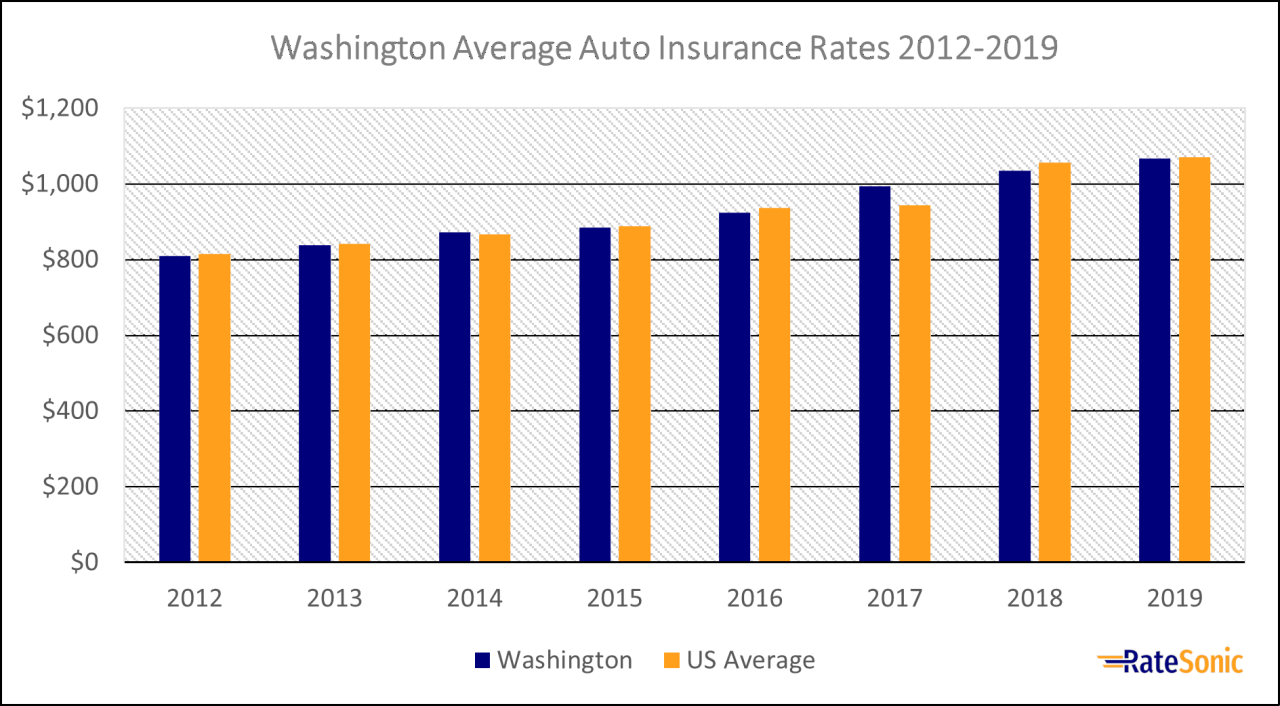

Examining the historical trends in auto insurance rates in Washington State over the past five years reveals a pattern of consistent increases.

- In 2018, the average annual premium for car insurance in Washington State was $1,420, according to the Insurance Information Institute (III).

- By 2019, this figure rose to $1,510, representing a 6.3% increase.

- In 2020, the average premium further climbed to $1,600, marking an additional 5.9% increase.

- The year 2021 saw a more significant jump, with the average premium reaching $1,750, representing an 8.7% increase.

- In 2022, the average annual premium for car insurance in Washington State reached $1,900, signifying a further 8.5% increase.

These figures highlight the consistent upward trend in auto insurance rates in Washington State over the past five years.

Factors Contributing to Recent Increases in Auto Insurance Rates

Several factors contribute to the recent increases in auto insurance rates in Washington State.

- Rising Costs of Vehicle Repairs: The cost of repairing vehicles has increased significantly in recent years, driven by factors such as advanced safety features and the use of more expensive materials. This increased repair cost directly impacts insurance premiums, as insurers must account for these expenses when setting rates.

- Increased Frequency and Severity of Accidents: The number of accidents, particularly those involving serious injuries, has been on the rise in Washington State. This trend can be attributed to various factors, including distracted driving, aggressive driving, and an increase in the number of vehicles on the road. As insurers face higher claims payouts due to more accidents, they often pass these costs on to policyholders through rate increases.

- Higher Cost of Living: The rising cost of living in Washington State, including increased costs for housing, healthcare, and fuel, directly impacts insurance premiums. Insurers must account for these increased expenses when setting rates, which can contribute to higher premiums for policyholders.

- Increased Regulatory Costs: State and federal regulations related to auto insurance are constantly evolving, often leading to increased compliance costs for insurers. These costs are ultimately passed on to policyholders through higher premiums.

- Inflation: Inflation plays a significant role in driving up the cost of goods and services, including auto insurance. As inflation rises, insurers face increased costs for everything from administrative expenses to claims payouts, leading to higher premiums for policyholders.

Impact of Rate Increases on Washington State Residents

The recent increases in auto insurance rates have a significant impact on Washington State residents.

- Increased Financial Burden: Higher auto insurance premiums represent an increased financial burden for drivers, particularly for those on fixed incomes or with limited financial resources. This burden can make it challenging to afford other essential expenses, such as housing, healthcare, and food.

- Limited Access to Affordable Coverage: The rising cost of auto insurance can make it difficult for some drivers to find affordable coverage, particularly for those with a history of accidents or violations. This can lead to a situation where individuals are forced to drive without insurance, which carries significant legal and financial risks.

- Impact on Driving Habits: Some drivers may be forced to reduce their driving due to the increased cost of insurance. This can have a ripple effect on the economy, as people may be less likely to commute to work or participate in leisure activities that involve driving.

Factors Influencing Auto Insurance Rates

Several factors contribute to the cost of auto insurance in Washington State, and understanding these factors can help policyholders make informed decisions about their coverage and potentially reduce their premiums.

Driving History

Your driving history is a significant factor in determining your auto insurance rates. A clean driving record with no accidents or violations generally leads to lower premiums. Conversely, a history of accidents, traffic violations, or driving under the influence (DUI) can significantly increase your rates. Insurance companies consider this history as a measure of your risk as a driver. For example, a driver with multiple speeding tickets might be seen as a higher risk than a driver with a clean record, resulting in higher premiums.

Vehicle Type

The type of vehicle you drive also plays a role in your insurance rates. Some vehicles are considered more expensive to repair or replace than others, making them riskier for insurance companies. For instance, luxury cars, high-performance vehicles, and newer models tend to have higher insurance premiums due to their higher repair costs and potential for greater damage in an accident. Conversely, older and less expensive vehicles typically have lower insurance rates.

Location

Your location can also influence your auto insurance rates. Insurance companies consider factors like the density of population, crime rates, and the frequency of accidents in a particular area. Areas with higher traffic congestion, higher crime rates, or more frequent accidents tend to have higher insurance premiums. Conversely, areas with lower traffic, lower crime rates, and fewer accidents may have lower premiums.

Claims Frequency and Severity

The frequency and severity of claims in a particular region also affect insurance rates. If there are a high number of accidents or significant claims in a specific area, insurance companies may adjust premiums to reflect the increased risk. This is because insurance companies need to collect enough premiums to cover their costs, including claims payouts.

Inflation and Rising Repair Costs

Inflation and rising repair costs have a direct impact on auto insurance premiums. As the cost of parts, labor, and other expenses related to vehicle repair increases, insurance companies need to adjust their premiums to cover these rising costs. This ensures that they can pay out claims and maintain their financial stability. For example, the rising cost of electronic components in modern vehicles can lead to higher repair costs, which in turn may result in higher insurance premiums.

State Regulations and Insurance Practices

Washington State’s auto insurance market is subject to a comprehensive regulatory framework designed to protect consumers and ensure fair competition among insurers. This framework influences insurance rates and the overall cost of auto insurance for drivers in the state.

Impact of State Laws and Regulations on Insurance Rates

State laws and regulations play a significant role in determining auto insurance rates. Washington State has enacted several laws and regulations that directly impact insurance costs, including:

- Minimum Coverage Requirements: Washington State mandates specific minimum coverage levels for all drivers, including liability, uninsured/underinsured motorist coverage, and personal injury protection. These requirements ensure that drivers have adequate financial protection in case of accidents. This can lead to higher premiums as insurers must cover these mandated coverages.

- Rate Regulation: Washington State regulates auto insurance rates to prevent excessive pricing and ensure fairness. The state’s Office of the Insurance Commissioner (OIC) reviews and approves rate filings by insurers, ensuring that rates are actuarially sound and reflect the actual cost of providing coverage. This regulatory oversight can help stabilize rates and prevent excessive increases.

- Restrictions on Rate Factors: Washington State restricts the use of certain factors in determining insurance rates. For example, insurers cannot consider an individual’s credit score or occupation when setting rates. This helps prevent discrimination and ensures that rates are based on factors related to driving risk. However, limiting rate factors can potentially increase rates for certain drivers as insurers may not be able to accurately assess their risk.

Consumer Perspectives and Options

The rise in auto insurance rates in Washington State presents significant challenges for residents, impacting their budgets and financial planning. While insurance is essential for protecting against financial losses in case of accidents, the escalating costs are a growing concern for many.

Strategies for Managing Insurance Premiums

Consumers can employ various strategies to manage their auto insurance premiums effectively. These strategies can help minimize the financial burden associated with rising rates and ensure adequate coverage.

- Shop Around for Competitive Rates: Comparing quotes from multiple insurance providers can help identify the most affordable options that meet individual needs. Online comparison websites and independent insurance brokers can facilitate this process.

- Maintain a Good Driving Record: A clean driving record is crucial for securing lower premiums. Avoiding traffic violations, accidents, and DUI offenses demonstrates responsible driving habits and can lead to significant discounts.

- Increase Deductibles: Raising deductibles, the amount paid out-of-pocket before insurance coverage kicks in, can lower premiums. However, it’s essential to ensure the chosen deductible aligns with financial capabilities in case of an accident.

- Consider Bundling Policies: Combining multiple insurance policies, such as auto and homeowners, with the same provider can often result in discounts. This strategy can be particularly beneficial for individuals with multiple insurance needs.

- Explore Discounts: Many insurance companies offer discounts for various factors, such as good student status, safe driving courses, anti-theft devices, and multiple car coverage. It’s worth investigating all potential discounts to maximize savings.

- Review Coverage Needs: Regularly assessing insurance coverage needs is essential. Unnecessary coverage can lead to higher premiums. For instance, if a car is older and has lower value, comprehensive and collision coverage may not be necessary.

Impact on Different Demographic Groups

The impact of insurance rate increases varies across different demographic groups, with certain populations facing greater financial strain.

- Low-Income Households: Individuals and families with limited financial resources may struggle to afford rising insurance premiums, potentially impacting their ability to maintain adequate coverage and face financial hardship in case of accidents.

- Young Drivers: Newly licensed drivers typically have higher insurance premiums due to their lack of driving experience and higher risk profile. Rising rates can further exacerbate this cost burden, making car ownership less affordable.

- Minority Groups: Studies have shown that certain minority groups often pay higher insurance premiums compared to their white counterparts. This disparity can be attributed to various factors, including location, socioeconomic status, and access to insurance.

Potential Solutions and Future Outlook

Addressing the issue of rising auto insurance rates in Washington State requires a multifaceted approach, encompassing both government policy adjustments and industry-driven practices. This section explores potential solutions and examines the future trends in auto insurance rates within the state.

Government Policy and Industry Practices, Washington state auto insurance rate increases

Government policies and industry practices play a significant role in shaping auto insurance rates. Effective measures can help mitigate rate increases and ensure a more equitable and affordable insurance market.

- Strengthening Consumer Protections: Implementing stricter regulations to prevent unfair pricing practices and ensure transparency in rate calculations can empower consumers. For instance, requiring insurers to provide detailed explanations for rate increases and making it easier for consumers to compare quotes from different providers can foster a more competitive market.

- Promoting Safety and Reducing Claims: Government initiatives to improve road safety, such as enhanced driver education programs and stricter enforcement of traffic laws, can contribute to a reduction in accidents and claims. This, in turn, can lower insurance costs for everyone.

- Supporting Affordable Insurance Options: Government programs that provide financial assistance or subsidies to low-income drivers can help ensure access to affordable auto insurance. This can address the issue of insurance affordability for vulnerable populations and reduce the burden on the overall insurance market.

- Encouraging Innovation in Insurance Technology: Supporting the development and adoption of innovative technologies, such as telematics, can lead to more accurate risk assessments and potentially lower premiums for safe drivers. Telematics devices can track driving behavior and provide valuable data to insurers, allowing them to reward safe driving habits.

Future Trends in Auto Insurance Rates

Predicting future trends in auto insurance rates requires considering various factors, including economic conditions, technological advancements, and evolving consumer behavior.

- Inflation and Economic Volatility: Rising inflation and economic uncertainty can impact the cost of vehicle repairs and medical care, potentially leading to higher insurance premiums.

- Technological Advancements: The emergence of autonomous vehicles and advanced driver assistance systems (ADAS) could significantly influence future insurance rates. While autonomous vehicles have the potential to reduce accidents and lower premiums, the transition to this technology will likely involve a period of adjustment and new risk considerations.

- Changing Consumer Preferences: Factors such as increased urban living and reliance on ride-sharing services could impact driving patterns and insurance demand. These shifts may influence future rate adjustments.

Concluding Remarks

Navigating the complexities of Washington State’s auto insurance market requires a multifaceted approach. By understanding the factors contributing to rate increases, consumers can make informed decisions regarding their insurance coverage and explore strategies to mitigate costs. While challenges persist, the future holds opportunities for innovation and collaboration between policymakers, insurance companies, and consumers to ensure a sustainable and affordable auto insurance landscape in Washington State.

Clarifying Questions

What are the main reasons for the recent increase in auto insurance rates in Washington State?

The recent increase in auto insurance rates in Washington State can be attributed to a combination of factors, including rising repair costs due to inflation and the use of more advanced vehicle technology, increased claim severity due to more accidents and higher medical costs, and changes in state regulations that affect insurance premiums.

How can I reduce my auto insurance premiums in Washington State?

There are several ways to reduce your auto insurance premiums in Washington State, such as maintaining a good driving record, choosing a higher deductible, bundling your insurance policies, taking a defensive driving course, and comparing quotes from different insurance providers.

Are there any state programs or initiatives designed to help Washington residents with rising auto insurance costs?

Washington State offers various programs and initiatives to help residents with rising auto insurance costs. These programs include low-cost insurance options for low-income individuals, discounts for good drivers, and assistance with resolving insurance disputes.