Washington State auto insurance rates are a crucial aspect of driving in the Evergreen State. Factors such as your driving history, vehicle type, location, and coverage levels all play a role in determining your premiums. Understanding these factors and how they impact your rates is essential for making informed decisions about your insurance coverage.

This guide delves into the intricacies of Washington State’s auto insurance market, providing valuable insights into key factors affecting rates, exploring relevant regulations, and offering strategies for securing affordable coverage.

Washington State Auto Insurance Market Overview

The Washington State auto insurance market is a significant contributor to the state’s economy and plays a crucial role in protecting drivers and their vehicles. It encompasses a wide range of insurance providers and policies, catering to the diverse needs of Washington residents.

Market Size and Growth

The Washington State auto insurance market is substantial and steadily growing. Factors such as increasing vehicle ownership, population growth, and rising insurance premiums contribute to this expansion. The market is characterized by a competitive landscape with numerous insurance companies vying for customers.

Key Influencing Factors

Several factors influence the dynamics of the Washington State auto insurance market, shaping the pricing and availability of policies.

Demographics

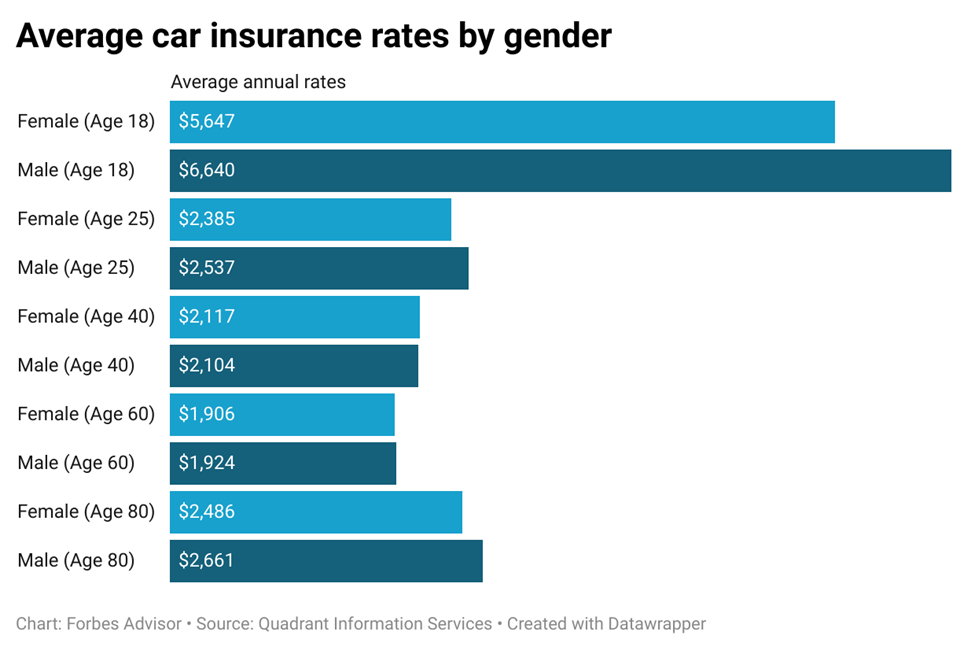

The state’s demographics play a significant role in insurance rates. Factors like age, gender, driving history, and location can impact premiums. For instance, younger drivers typically face higher rates due to their higher risk profiles.

Driving Habits

Driving habits are another key factor influencing auto insurance rates. Factors like driving history, mileage, and driving style are considered when determining premiums. Drivers with a history of accidents or violations often face higher rates.

Legislative Changes

Legislative changes in Washington State can impact the auto insurance market. For example, changes to insurance regulations, such as those related to minimum coverage requirements, can affect the cost and availability of policies.

Major Insurance Providers

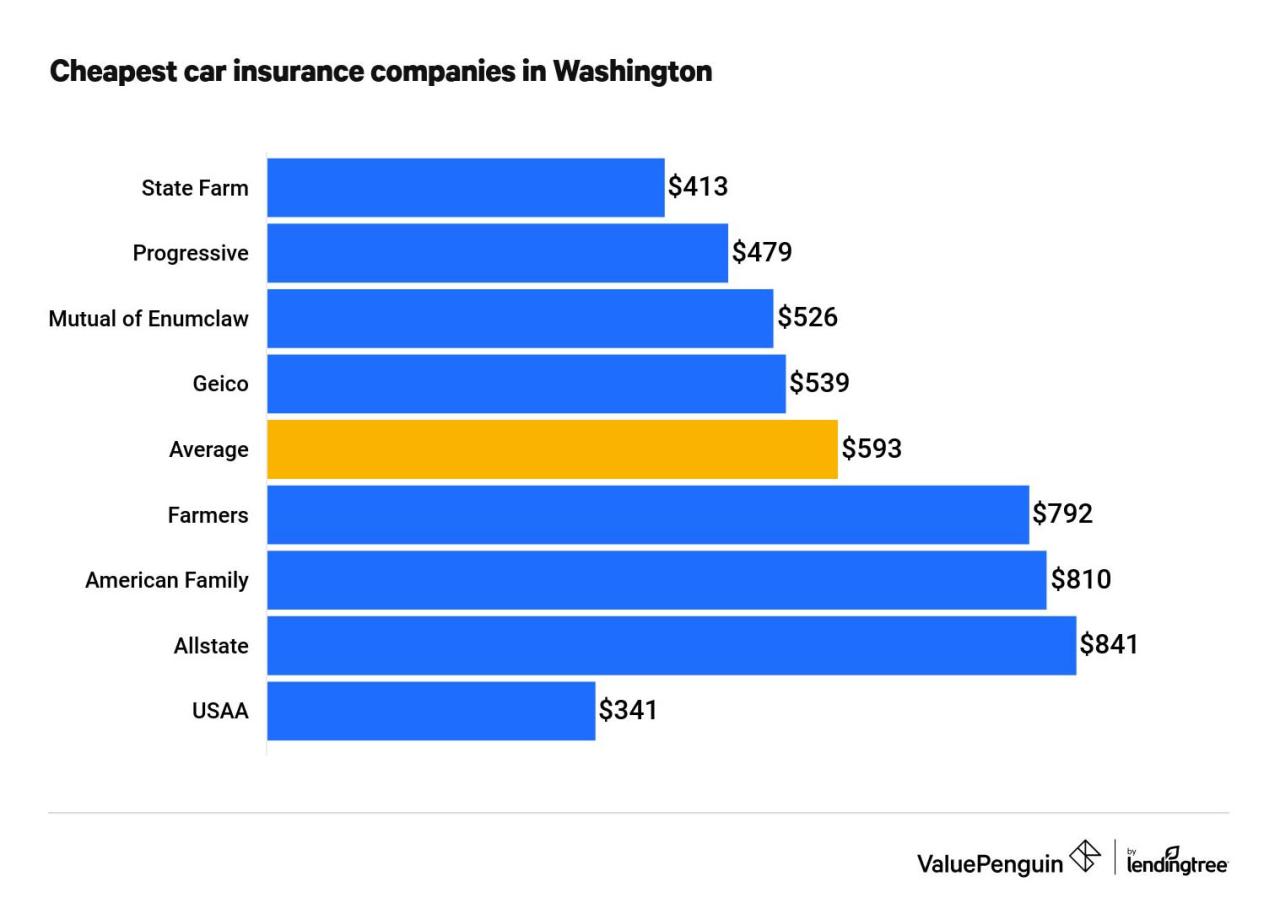

The Washington State auto insurance market is home to a diverse range of insurance providers, including:

- State Farm

- Geico

- Progressive

- Allstate

- Farmers Insurance

- Liberty Mutual

- USAA

- Nationwide

- American Family Insurance

These companies compete for customers by offering a variety of insurance products and services, including comprehensive coverage, collision coverage, liability coverage, and uninsured/underinsured motorist coverage. They also offer discounts for safe driving, good credit, and multiple policies.

Factors Affecting Auto Insurance Rates in Washington State

Numerous factors contribute to the cost of auto insurance in Washington State. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Driving History

Your driving history plays a significant role in determining your auto insurance rates. Insurance companies consider your past driving record, including accidents and traffic violations, to assess your risk as a driver.

- Accidents: A recent accident, even if it was not your fault, can significantly increase your premiums. The severity of the accident, such as the number of vehicles involved or the amount of damage, also influences the rate increase. For example, a minor fender bender might result in a smaller increase than a serious accident with injuries.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, or driving under the influence (DUI), are considered indicators of risky driving behavior. These violations can lead to substantial premium increases. The severity of the violation and the number of violations you have accumulated will impact the rate increase.

- Driving Record Clean-Up: You can improve your driving record by taking defensive driving courses or traffic school, which can help reduce points on your license and lower your insurance premiums.

Vehicle Type, Age, and Value

The type, age, and value of your vehicle are crucial factors in determining your insurance rates.

- Vehicle Type: Sports cars and luxury vehicles are generally considered higher risk due to their performance and value, resulting in higher premiums. Conversely, less expensive and less powerful vehicles often have lower insurance rates.

- Vehicle Age: Newer vehicles are typically more expensive to repair, which translates to higher insurance costs. Older vehicles, while potentially less expensive to repair, may have higher risk of breakdowns or safety concerns, potentially leading to higher premiums.

- Vehicle Value: The value of your vehicle plays a significant role in determining your insurance rates. Higher-value vehicles, like luxury cars or expensive trucks, generally have higher premiums due to the higher cost of replacement or repair in case of an accident.

Location

Your location, specifically whether you live in an urban or rural area, can influence your insurance rates.

- Urban Areas: Urban areas typically have higher traffic density, increasing the likelihood of accidents. This higher risk can result in higher insurance premiums.

- Rural Areas: Rural areas often have lower traffic density and fewer accidents, potentially leading to lower insurance premiums. However, factors like longer distances to emergency services or increased wildlife encounters could impact rates.

Coverage Levels

The level of coverage you choose for your auto insurance also significantly affects your premiums.

- Liability Coverage: Liability coverage protects you financially if you cause an accident. Higher liability limits, which provide greater financial protection, will generally result in higher premiums.

- Collision Coverage: Collision coverage pays for repairs to your vehicle if you are involved in an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damages from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

Credit Score and Other Personal Factors

In Washington State, insurance companies are allowed to use credit scores as a factor in determining insurance rates.

- Credit Score: A higher credit score generally indicates a lower risk to the insurance company, potentially leading to lower premiums. Conversely, a lower credit score can result in higher premiums.

- Other Personal Factors: Other personal factors, such as age, gender, marital status, and occupation, can also influence your insurance rates.

Understanding Washington State Insurance Regulations

Navigating the complexities of auto insurance in Washington State can be simplified by understanding the state’s regulations. These regulations are designed to protect both consumers and insurers, ensuring fair and transparent practices.

Mandatory Coverage Requirements

Washington State mandates certain minimum auto insurance coverages to protect drivers and their property. These requirements ensure that individuals are financially responsible in case of accidents.

- Liability Coverage: This covers damages to other people and their property if you cause an accident. The minimum requirements are $25,000 for injury or death to one person, $50,000 for injury or death to multiple people, and $10,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: This protects you and your passengers if you are involved in an accident with a driver who doesn’t have adequate insurance. The minimum coverage is the same as liability coverage, but it’s advisable to have higher limits.

- Damages to Your Own Vehicle: This covers damages to your own vehicle in an accident. There are two options:

- Collision Coverage: This covers damages to your vehicle regardless of fault, including accidents with another vehicle or objects.

- Comprehensive Coverage: This covers damages to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

Role of the Washington State Office of the Insurance Commissioner

The Washington State Office of the Insurance Commissioner (OIC) plays a crucial role in regulating the auto insurance industry. It aims to ensure that insurers operate fairly and responsibly, protecting consumers’ rights and interests. The OIC’s responsibilities include:

- Licensing and Monitoring Insurers: The OIC licenses and monitors insurance companies operating in Washington State, ensuring they meet the state’s financial stability requirements.

- Enforcing Consumer Protection Laws: The OIC investigates and resolves consumer complaints related to auto insurance practices. It also educates consumers about their rights and responsibilities.

- Setting Rates: The OIC has the authority to review and approve insurance rate filings, ensuring they are fair and reasonable.

Key Consumer Protection Laws and Regulations

Washington State has several consumer protection laws and regulations in place to safeguard individuals’ rights in the auto insurance market. These laws aim to prevent unfair practices and ensure transparency.

- Fair Credit Reporting Act: This law protects consumers’ credit information and ensures insurers use it responsibly when determining rates.

- Washington Consumer Protection Act: This law prohibits unfair and deceptive business practices, including those related to auto insurance.

- Right to Cancel Policy: Consumers have the right to cancel their auto insurance policy within 30 days of purchase and receive a full refund if they are dissatisfied with the policy.

- Right to Dispute Claims: Consumers have the right to dispute insurance claims if they believe they were unfairly denied or underpaid.

Strategies for Saving on Auto Insurance in Washington State

Finding affordable auto insurance in Washington State is essential for responsible drivers. By understanding the factors that influence premiums and implementing smart strategies, you can significantly reduce your insurance costs.

Finding Affordable Auto Insurance Quotes

Comparing quotes from multiple insurance providers is crucial for securing the best rates. Several online platforms and tools allow you to enter your information once and receive quotes from various insurers.

- Online Comparison Websites: Websites like [name of website], [name of website], and [name of website] offer convenient quote comparisons from multiple insurers.

- Insurance Agents: Local insurance agents can provide personalized advice and assist you in finding suitable policies from various companies.

- Direct Insurers: Companies like [name of company] and [name of company] sell policies directly to consumers, often offering competitive rates.

Benefits of Bundling Insurance Policies

Combining multiple insurance policies, such as home, renters, and auto insurance, with the same provider can often lead to significant discounts.

- Bundling Discount: Insurers typically offer a discount for bundling policies, as they see you as a more valuable customer.

- Convenience: Managing all your insurance policies with a single provider simplifies administration and communication.

- Potential for Lower Premiums: The combined coverage can result in lower overall premiums compared to purchasing individual policies from different providers.

Savings Associated with Safety Features and Driver Training Courses, Washington state auto insurance rates

Investing in safety features and driver training can demonstrate your commitment to safe driving and potentially earn you discounts.

- Safety Features: Vehicles equipped with anti-theft devices, airbags, anti-lock brakes, and other safety features often qualify for discounts.

- Driver Training Courses: Completing defensive driving or other approved driver training courses can lower premiums by demonstrating your commitment to safe driving practices.

Negotiating Lower Premiums with Insurance Providers

- Review Your Policy Regularly: Ensure your coverage meets your current needs and that you are not paying for unnecessary features. Consider adjusting your deductible to potentially reduce your premium.

- Shop Around Periodically: Even if you are satisfied with your current insurer, it’s beneficial to compare quotes every few years to ensure you are getting the best rate.

- Ask About Discounts: Inquire about any available discounts, such as good driver, multi-car, or student discounts, and ensure you are receiving all applicable reductions.

- Negotiate with Your Insurer: If you have a good driving record and have been a loyal customer, you may be able to negotiate a lower premium with your insurer.

Comparing Auto Insurance Providers in Washington State

Choosing the right auto insurance provider can significantly impact your overall cost and coverage. With numerous options available in Washington State, comparing providers based on various factors is crucial to finding the best fit for your needs.

Comparing Auto Insurance Providers

A comprehensive comparison of auto insurance providers in Washington State should consider factors like coverage options, pricing, customer service, and online reviews. Here’s a table outlining key aspects of some major providers:

| Provider | Coverage Options | Pricing | Customer Service | Online Reviews | Website |

|---|---|---|---|---|---|

| State Farm | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, rental car coverage | Competitive rates, discounts available | Generally positive, extensive agent network | 4.5 stars on average across major review sites | [Link to State Farm website] |

| Geico | Similar coverage options to State Farm | Often known for competitive pricing, discounts for good driving records and bundling | Mixed reviews, some complaints about customer service wait times | 4 stars on average across major review sites | [Link to Geico website] |

| Progressive | Wide range of coverage options, including optional add-ons like roadside assistance | Competitive pricing, discounts for safe driving and bundling | Mixed reviews, some complaints about claims processing | 4 stars on average across major review sites | [Link to Progressive website] |

| USAA | Comprehensive coverage options, known for military-focused services | Highly competitive rates for military members and families | Excellent customer service, strong reputation for claims handling | 4.8 stars on average across major review sites | [Link to USAA website] |

| Liberty Mutual | Comprehensive coverage options, including accident forgiveness and new car replacement | Competitive pricing, discounts for good driving records and bundling | Generally positive reviews, known for strong customer service | 4.5 stars on average across major review sites | [Link to Liberty Mutual website] |

It’s important to note that these are just a few of the many insurance providers available in Washington State. The best provider for you will depend on your individual needs and circumstances. You should always compare quotes from multiple providers before making a decision.

Final Summary: Washington State Auto Insurance Rates

Navigating the world of Washington State auto insurance can be complex, but with careful planning and informed choices, you can find coverage that meets your needs and budget. By understanding the factors that influence rates, exploring available options, and leveraging strategies for saving, you can confidently navigate the insurance landscape and ensure peace of mind on the road.

FAQ Overview

What are the minimum auto insurance requirements in Washington State?

Washington State requires all drivers to carry liability insurance, which covers damages to other people and property in an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I get a free auto insurance quote in Washington State?

Many insurance providers offer free online quotes. You can also contact insurance agents directly to request a quote. Be sure to provide accurate information about your vehicle, driving history, and desired coverage levels.

What is the role of the Washington State Office of the Insurance Commissioner?

The Washington State Office of the Insurance Commissioner regulates the insurance industry in the state. They ensure that insurance companies comply with state laws and protect consumers’ rights.