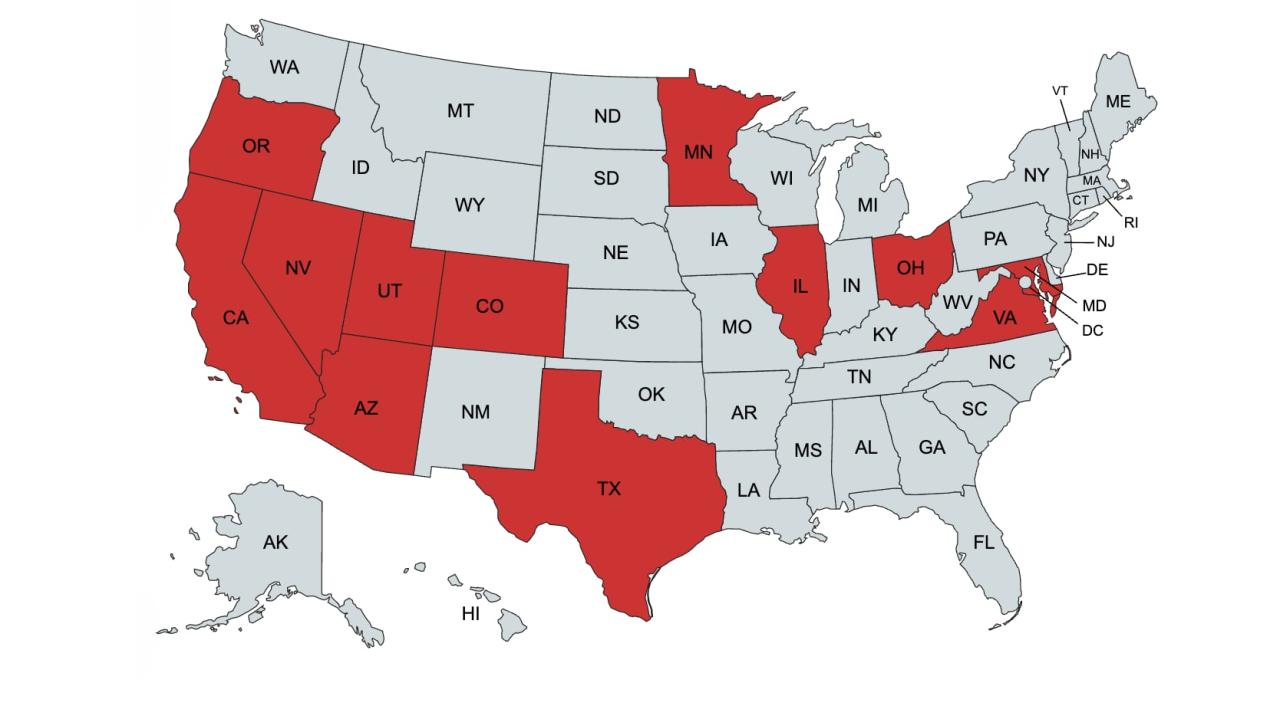

Tesla insurance available states – Tesla Insurance: Which States Offer Coverage? The electric vehicle revolution is in full swing, and Tesla, a pioneer in the industry, has taken its commitment to innovation a step further by offering its own insurance product. But not every Tesla owner has access to this unique insurance option. This article explores the current states where Tesla Insurance is available, the factors driving its expansion, and what the future holds for this disruptive insurance offering.

Tesla Insurance is designed to cater specifically to Tesla owners, leveraging the company’s extensive data on vehicle performance, safety features, and driver behavior to offer competitive premiums. This data-driven approach allows Tesla to provide customized rates based on individual driving habits, potentially resulting in significant savings for safe drivers. However, the availability of Tesla Insurance is limited to certain states, and its expansion is influenced by various factors, including regulatory approvals, market demand, and the company’s strategic goals.

Tesla Insurance Availability

Tesla Insurance is a relatively new entrant in the auto insurance market, offering coverage specifically tailored for Tesla vehicles. While its availability is expanding, it’s not yet accessible in every state.

States Where Tesla Insurance is Offered

Tesla Insurance is currently available in the following states:

- Arizona

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- Wisconsin

Factors Influencing Tesla Insurance Expansion

Tesla’s decision to expand into specific states is driven by a combination of factors, including:

- Market Size and Tesla Vehicle Concentration: Tesla focuses on states with a significant number of Tesla vehicles and a large potential customer base.

- Regulatory Environment: Tesla seeks states with favorable regulatory environments that support innovative insurance products.

- Competition: Tesla assesses the competitive landscape in each state, considering existing insurance providers and their offerings.

- Operational Efficiency: Tesla evaluates the logistical and operational feasibility of expanding its insurance services to a new state.

Tesla Insurance Expansion Plans

Tesla has been actively expanding its insurance footprint, aiming to reach more states in the coming years. While specific timelines are not publicly disclosed, Tesla’s commitment to providing its customers with comprehensive insurance solutions suggests continued expansion efforts.

Coverage Options and Features

Tesla Insurance offers a comprehensive suite of coverage options designed to protect your Tesla vehicle and provide peace of mind. It provides similar coverage to traditional insurance providers but with unique features tailored specifically for Tesla owners.

Coverage Options

Tesla Insurance offers a range of coverage options, similar to traditional insurance providers, including:

- Liability Coverage: This covers damages to other people’s property or injuries caused by an accident you are responsible for.

- Collision Coverage: This covers damages to your Tesla vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: This covers damages to your Tesla vehicle caused by non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers in case of an accident.

Comparison to Traditional Insurance Providers, Tesla insurance available states

Tesla Insurance offers similar coverage options to traditional insurance providers, but it also boasts several unique features that cater to Tesla owners:

- Safety Score Discounts: Tesla Insurance uses a safety score system that considers your driving habits, such as braking, acceleration, and lane keeping, to offer discounts. The better your safety score, the lower your insurance premium. This encourages safe driving practices and rewards responsible drivers.

- Tesla-Specific Features: Tesla Insurance takes into account the unique features of Tesla vehicles, such as Autopilot and Full Self-Driving, when determining premiums. This ensures that your insurance reflects the advanced safety technology of your Tesla.

- Direct-to-Consumer Model: Tesla Insurance operates through a direct-to-consumer model, eliminating the need for intermediaries like agents or brokers. This can result in lower premiums and a more streamlined insurance experience.

Unique Features of Tesla Insurance

Tesla Insurance offers several unique features designed to enhance your insurance experience:

- Tesla App Integration: Tesla Insurance seamlessly integrates with the Tesla app, allowing you to manage your policy, file claims, and access important information directly from your smartphone.

- 24/7 Customer Support: Tesla Insurance provides 24/7 customer support through various channels, including phone, email, and online chat, ensuring you can get help whenever you need it.

- Personalized Coverage Options: Tesla Insurance allows you to customize your coverage options based on your specific needs and preferences, ensuring you only pay for the coverage you require.

Pricing and Cost Factors

Tesla Insurance premiums are determined by a variety of factors, including your driving history, location, vehicle model, and coverage options. It’s crucial to understand these factors to get the best possible rate.

Tesla Insurance Pricing Compared to Other Providers

Tesla Insurance premiums are often competitive compared to traditional insurance providers, particularly for Tesla owners. This is due to Tesla’s advanced safety features and access to driving data.

- Tesla’s Safety Features: Tesla vehicles are equipped with advanced safety features such as Autopilot and Full Self-Driving Capability, which can reduce the risk of accidents. These features are often factored into Tesla Insurance pricing, resulting in lower premiums for Tesla owners.

- Driving Data: Tesla has access to a vast amount of driving data collected from its vehicles, which can be used to assess individual driving habits and risks. This data allows Tesla Insurance to offer more personalized and accurate pricing.

Factors Influencing Tesla Insurance Premiums

Several factors contribute to the calculation of Tesla Insurance premiums. Understanding these factors can help you make informed decisions to potentially lower your costs.

- Driving History: Your driving history is a significant factor in determining your insurance premiums. A clean driving record with no accidents or violations typically leads to lower premiums.

- Location: The location where you reside can influence your insurance premiums. Areas with higher accident rates or crime rates tend to have higher premiums.

- Vehicle Model: The model of your Tesla vehicle also affects your insurance premiums. Higher-performance models or those with more expensive parts may have higher premiums.

- Coverage Options: The type and amount of coverage you choose can significantly impact your premiums. Comprehensive and collision coverage offer more protection but also come with higher premiums.

Impact of Tesla’s Safety Features and Driving Data on Premiums

Tesla’s advanced safety features and driving data play a crucial role in influencing insurance premiums.

- Safety Features: Features like Autopilot and Full Self-Driving Capability can reduce the risk of accidents, potentially leading to lower premiums. For example, Tesla’s Autopilot system has been shown to significantly reduce the likelihood of rear-end collisions.

- Driving Data: Tesla’s access to driving data allows them to assess individual driving habits and risks. This data can help them identify drivers with safer driving patterns and potentially offer them lower premiums.

Eligibility and Application Process

Tesla Insurance is designed to provide comprehensive coverage for Tesla owners. To be eligible for Tesla Insurance, you must meet certain criteria and follow the application process.

Eligibility Requirements

Tesla Insurance eligibility is determined by factors such as your driving history, vehicle information, and location. Here are the key requirements:

- Must be a Tesla Owner: Tesla Insurance is exclusively available to owners of Tesla vehicles.

- Valid Driver’s License: You must have a valid driver’s license in the state where you reside and plan to insure your Tesla.

- Good Driving Record: Tesla Insurance generally requires a good driving history, with minimal or no accidents or traffic violations.

- Residency in Eligible States: Tesla Insurance is currently available in a limited number of states. You must reside in one of these states to be eligible.

Application Process

Applying for Tesla Insurance is a straightforward process. You can apply online or through the Tesla mobile app. Here are the steps involved:

- Create an Account: If you don’t already have a Tesla account, you’ll need to create one.

- Provide Vehicle Information: You’ll need to provide information about your Tesla, including the VIN (Vehicle Identification Number), year, make, and model.

- Enter Personal Information: You’ll need to provide personal information, such as your name, address, date of birth, and driver’s license number.

- Provide Driving History: You’ll need to provide information about your driving history, including any accidents or traffic violations.

- Select Coverage Options: You’ll need to choose the coverage options that best suit your needs, such as liability, collision, and comprehensive coverage.

- Receive a Quote: Once you’ve submitted your application, Tesla will provide you with a personalized quote for your insurance.

- Review and Accept: You can review the quote and, if you’re satisfied, accept it to finalize your Tesla Insurance policy.

Customer Experience

Tesla Insurance aims to provide a seamless and convenient experience for its customers. Here are some key aspects of the customer experience:

- Online and Mobile App Access: You can manage your Tesla Insurance policy online or through the Tesla mobile app, making it easy to access your policy information, make payments, and file claims.

- Personalized Quotes: Tesla Insurance uses advanced algorithms to generate personalized quotes based on your individual driving history, vehicle information, and location.

- Dedicated Customer Support: Tesla Insurance offers dedicated customer support to assist you with any questions or concerns you may have.

- Safety Features Integration: Tesla Insurance may offer discounts or incentives for Tesla owners who utilize their vehicle’s advanced safety features, such as Autopilot and Full Self-Driving.

Customer Reviews and Feedback: Tesla Insurance Available States

Tesla Insurance has garnered a mix of positive and negative reviews from customers. Some praise its competitive pricing and seamless integration with Tesla vehicles, while others express concerns about limited coverage options and customer service challenges.

Customer Satisfaction and Key Strengths

Customer reviews highlight several strengths of Tesla Insurance. These include:

- Competitive Pricing: Many customers appreciate the competitive pricing of Tesla Insurance, often finding it cheaper than traditional insurers, especially for Tesla owners.

- Seamless Integration with Tesla Vehicles: Tesla Insurance leverages data from Tesla vehicles, such as driving history and safety features, to offer personalized pricing and coverage. This integration is a key advantage for Tesla owners.

- Convenient Online Platform: Tesla Insurance offers a user-friendly online platform for managing policies, making payments, and filing claims, which customers find convenient.

Customer Concerns and Weaknesses

Despite its strengths, Tesla Insurance faces some criticisms from customers. These include:

- Limited Coverage Options: Some customers find the coverage options offered by Tesla Insurance to be limited compared to traditional insurers.

- Customer Service Challenges: Some customers have reported challenges with customer service, including long wait times and difficulties resolving claims.

- Lack of Transparency: Some customers feel that Tesla Insurance lacks transparency regarding pricing and coverage details, making it difficult to compare options.

Addressing Customer Concerns and Service Improvements

Tesla Insurance is actively working to address customer concerns and improve its services. They are expanding their coverage options, enhancing their customer service channels, and increasing transparency in their pricing and coverage information.

Tesla Insurance and the Future of Automotive Insurance

Tesla Insurance, launched in 2019, has the potential to significantly disrupt the traditional automotive insurance industry. By leveraging its extensive data on driver behavior and vehicle performance, Tesla offers a unique approach to insurance pricing and risk assessment.

Tesla Insurance’s Technological Innovations

Tesla Insurance leverages technology to transform the insurance landscape in several ways:

- Data-Driven Pricing: Tesla utilizes data from its vehicles’ sensors, cameras, and software to assess individual driver behavior and risk. This allows for more accurate and personalized pricing, rewarding safe drivers with lower premiums.

- Real-Time Risk Assessment: Tesla’s system can continuously monitor driving patterns and adjust premiums based on real-time risk factors. This dynamic approach to pricing reflects the evolving nature of driving behavior.

- Automated Claims Processing: Tesla’s insurance platform is designed to streamline the claims process, leveraging technology for faster and more efficient claim handling. This reduces the time and effort required for policyholders to resolve claims.

Impact on the Automotive Insurance Industry

Tesla Insurance’s innovative approach is expected to have a profound impact on the automotive insurance industry:

- Increased Competition: Tesla’s entry into the insurance market has intensified competition, pushing traditional insurers to innovate and offer more competitive products and services.

- Shift Towards Data-Driven Pricing: Tesla’s success with data-driven pricing is likely to encourage other insurers to adopt similar approaches, leading to a more personalized and equitable pricing model.

- Rise of Telematics: Tesla’s use of telematics data to assess risk is expected to drive the adoption of telematics-based insurance solutions across the industry.

Future of Automotive Insurance in the Context of Autonomous Vehicles and Connected Cars

The advent of autonomous vehicles and connected cars is poised to further revolutionize the automotive insurance landscape:

- Reduced Risk: Autonomous vehicles are expected to significantly reduce accidents due to human error, potentially leading to lower insurance premiums.

- New Risk Factors: The introduction of new technologies like autonomous driving will bring about new risk factors that insurers will need to address, such as cyberattacks and software vulnerabilities.

- Data-Driven Insurance Models: Connected cars generate vast amounts of data that can be used to develop sophisticated insurance models, providing a deeper understanding of driving behavior and risk.

“The future of insurance is data-driven. Insurers that embrace technology and leverage data to personalize their products and services will be best positioned to succeed in the evolving automotive landscape.” – Industry Expert

Closure

Tesla Insurance is undoubtedly a game-changer in the automotive insurance industry. Its innovative approach, leveraging data and technology, offers a glimpse into the future of insurance, where personalized pricing and driver-centric solutions are the norm. As Tesla continues to expand its insurance footprint, we can expect to see further advancements in coverage options, pricing models, and overall customer experience. The company’s commitment to disrupting the traditional insurance landscape has the potential to reshape how we think about protecting our vehicles and ourselves on the road.

Quick FAQs

What are the advantages of Tesla Insurance?

Tesla Insurance offers several advantages, including potentially lower premiums for safe drivers, tailored coverage options specific to Tesla vehicles, and access to Tesla’s extensive network of service centers.

How does Tesla Insurance use data to determine premiums?

Tesla Insurance leverages data from Tesla vehicles, such as driving habits, safety features, and vehicle performance, to assess risk and determine premiums. This data-driven approach allows for more accurate and personalized pricing.

Is Tesla Insurance available in all states?

No, Tesla Insurance is currently available in a limited number of states. The company is expanding its availability gradually.