States with the lowest car insurance rates offer drivers a chance to save money on their premiums. These states often have factors that contribute to lower average rates, such as lower accident rates, less dense populations, and strong competition among insurance companies. By understanding the factors that influence car insurance rates, drivers can make informed decisions and potentially find more affordable coverage.

This article explores the top states with the lowest car insurance rates, examining the specific factors that contribute to their affordability. We’ll also discuss how drivers can save money on their premiums by taking advantage of discounts, comparing quotes, and understanding their state’s specific insurance requirements.

Factors Influencing Car Insurance Rates

Car insurance premiums are not uniform across the United States. Various factors play a significant role in determining how much individuals pay for car insurance. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Factors Affecting Car Insurance Rates, States with the lowest car insurance rates

Several factors influence car insurance rates, and these can vary from state to state. These factors include:

- Driving History: Your driving record is a major factor in determining your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions can significantly increase your insurance costs.

- Age and Gender: Younger drivers, especially those under 25, often face higher insurance rates due to their statistically higher risk of accidents. Similarly, gender can also play a role, with men generally paying higher premiums than women.

- Vehicle Type: The type of car you drive has a significant impact on your insurance rates. Luxury cars, sports cars, and high-performance vehicles are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents.

- Location: The state and even the specific location where you live can influence your car insurance rates. Areas with higher crime rates, more traffic congestion, or a higher frequency of accidents tend to have higher insurance premiums.

- Credit Score: In many states, insurance companies use your credit score as a factor in determining your insurance rates. Individuals with good credit scores often qualify for lower premiums, while those with poor credit scores may face higher rates.

- Coverage Levels: The amount of coverage you choose can also affect your premiums. Higher coverage limits, such as comprehensive and collision coverage, will typically result in higher premiums.

State Regulations and Insurance Laws

State regulations and insurance laws play a crucial role in shaping car insurance rates. Different states have different minimum coverage requirements, which can impact the overall cost of insurance. For instance, states with higher minimum coverage requirements may have higher average insurance premiums compared to states with lower requirements.

- No-Fault Laws: Some states have “no-fault” insurance laws, which require drivers to file claims with their own insurance company regardless of who is at fault in an accident. These laws can influence insurance rates, as they may lead to higher claim frequencies and potentially higher premiums.

- Tort Laws: Other states operate under “tort” laws, which allow drivers to sue the at-fault party in an accident. These laws can lead to higher litigation costs and potentially higher insurance premiums.

- Insurance Rate Regulation: Some states have strict regulations on how insurance companies can set rates, while others allow for more flexibility. These regulations can impact the overall competitiveness of the insurance market and ultimately influence insurance rates.

States with the Lowest Car Insurance Rates

Finding affordable car insurance is a priority for many drivers. While rates vary based on individual factors, some states consistently offer lower average premiums than others. This section explores the top five states with the lowest average car insurance rates, highlighting the factors contributing to their affordability.

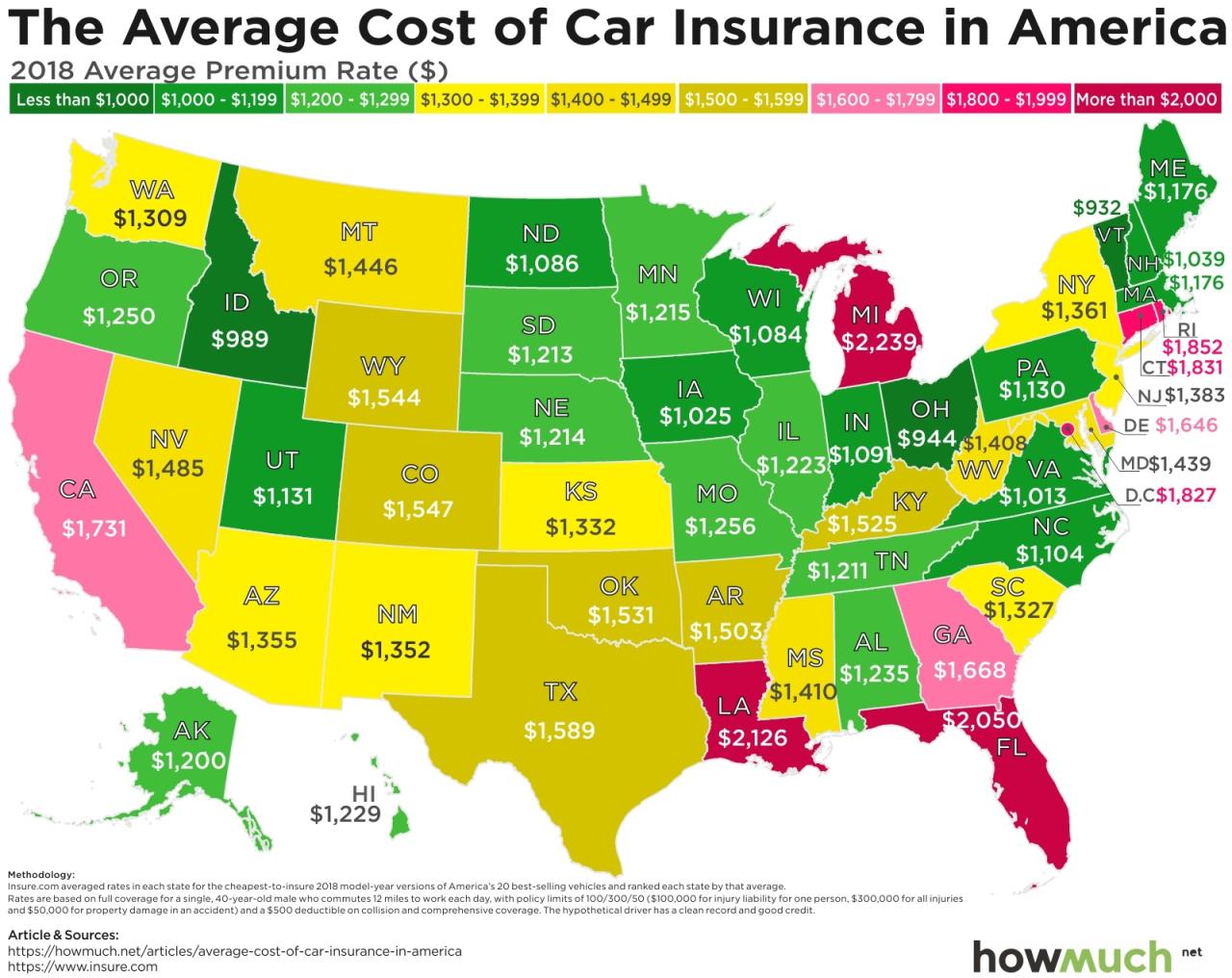

States with the Lowest Average Car Insurance Rates

The following table presents the top five states with the lowest average car insurance rates, according to recent data from the National Association of Insurance Commissioners (NAIC):

| State | Average Annual Premium |

|---|---|

| Maine | $1,020 |

| Idaho | $1,050 |

| Vermont | $1,070 |

| Iowa | $1,100 |

| North Dakota | $1,120 |

Factors Contributing to Lower Car Insurance Rates

Several factors contribute to lower car insurance rates in these states. These include:

- Lower Accident Rates: States with lower accident rates generally have lower car insurance premiums. This is because insurance companies pay out fewer claims in these areas. For example, Maine, Idaho, and Vermont have consistently ranked among states with lower-than-average accident rates, according to the National Highway Traffic Safety Administration (NHTSA).

- Lower Population Density: States with lower population densities often have fewer traffic congestion and accidents. This translates to lower insurance premiums for drivers in these areas. For instance, Idaho, Vermont, and North Dakota are relatively sparsely populated compared to other states.

- Competitive Insurance Market: States with a competitive insurance market tend to have lower rates. When several insurance companies operate in an area, they compete for customers by offering more affordable premiums. This competitive environment helps to keep rates in check.

- Favorable State Laws: Some states have laws that benefit drivers by limiting the amount of damages insurance companies can pay out in certain situations. This can help to reduce insurance premiums. For example, Maine has a law that limits the amount of non-economic damages that can be awarded in a personal injury case.

- Lower Average Vehicle Values: States with lower average vehicle values may have lower car insurance rates. This is because the cost of replacing or repairing a vehicle is typically lower in these areas. For instance, Idaho and North Dakota have lower average vehicle values compared to other states.

Reasons for Lower Rates in Specific States

States with lower car insurance rates often share certain characteristics that contribute to their affordability. These factors influence the risk profile of drivers, ultimately impacting the cost of insurance.

Driving Environment and Demographics

The driving environment and demographics of a state significantly impact car insurance rates. States with lower population density, fewer traffic congestion issues, and lower accident rates tend to have lower insurance premiums. For example, rural states with sparsely populated areas often have lower accident rates due to less traffic volume and longer distances between cities.

Traffic Density and Accident Rates

High traffic density in urban areas can lead to increased accidents, resulting in higher insurance costs. States with lower traffic congestion tend to have fewer accidents, contributing to lower insurance rates. For instance, states like Wyoming and Montana have low population density and relatively low accident rates, which translates to lower insurance premiums.

Population Distribution

The distribution of population in a state can also influence insurance rates. States with a more even distribution of population, with fewer concentrated urban areas, may have lower accident rates and, therefore, lower insurance premiums.

Insurance Company Competition and Market Dynamics

Competition among insurance companies is another key factor in determining car insurance rates. When there is a lot of competition, companies often offer lower rates to attract customers. Conversely, states with fewer insurance companies may have higher rates due to limited competition.

Cost-Saving Strategies for Drivers

Saving money on car insurance is a priority for most drivers. Fortunately, there are several strategies you can implement to lower your premiums. By taking proactive steps and exploring available options, you can significantly reduce your insurance costs without compromising coverage.

Strategies for Lowering Premiums

There are several effective strategies you can employ to reduce your car insurance premiums. These strategies involve making smart choices about your driving habits, vehicle, and insurance policy.

- Maintain a Safe Driving Record: A clean driving record is a significant factor in determining your insurance rates. Avoiding traffic violations, accidents, and driving under the influence will keep your premiums lower.

- Improve Your Credit Score: In many states, insurance companies consider your credit score when setting rates. A higher credit score generally leads to lower premiums.

- Choose a Safe Vehicle: Certain vehicle models are considered safer than others. Selecting a car with advanced safety features and a good safety rating can lower your insurance costs.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can result in lower premiums.

- Bundle Your Policies: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Shop Around for Quotes: Regularly compare quotes from different insurance companies to ensure you’re getting the best rates. Use online comparison tools or contact insurance agents directly.

Comparing Insurance Quotes

Finding the best car insurance deal involves a systematic approach to comparing quotes. Here’s a step-by-step guide to help you navigate the process effectively:

- Gather Your Information: Before starting your search, collect all the necessary information, including your driving history, vehicle details, and desired coverage levels.

- Use Online Comparison Tools: Several online platforms allow you to compare quotes from multiple insurance companies simultaneously. These tools are convenient and can save you time.

- Contact Insurance Agents: Reach out to insurance agents directly to discuss your needs and get personalized quotes. This approach allows you to ask questions and get tailored advice.

- Review Quotes Carefully: Compare quotes from different companies side by side, paying attention to coverage details, deductibles, and premium amounts.

- Consider Discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, and multi-car discounts.

- Read Policy Documents: Before finalizing your choice, carefully read the policy documents to understand the coverage details, exclusions, and limitations.

Discounts and Benefits

Insurance companies offer a wide range of discounts and benefits to attract and retain customers. Here are some common examples:

- Safe Driver Discounts: Drivers with clean driving records often qualify for discounts.

- Good Student Discounts: Students with good grades may be eligible for lower premiums.

- Multi-Car Discounts: Insuring multiple vehicles with the same company can lead to significant savings.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle can reduce your insurance costs.

- Telematics Programs: Some insurers offer programs that track your driving habits and reward safe driving with lower premiums.

Understanding State-Specific Insurance Requirements

It’s crucial to understand the specific insurance requirements in each state, as they can vary significantly. Knowing these requirements is essential to avoid legal issues and ensure you have the necessary coverage in case of an accident.

State-Specific Insurance Requirements

The following table summarizes the mandatory insurance coverage requirements in some states with the lowest car insurance rates:

| State | Minimum Liability Coverage | Minimum Uninsured Motorist Coverage | Minimum Personal Injury Protection (PIP) |

|---|---|---|---|

| Maine | $50,000 per person/$100,000 per accident | $50,000 per person/$100,000 per accident | $0 |

| Idaho | $25,000 per person/$50,000 per accident | $25,000 per person/$50,000 per accident | $0 |

| North Dakota | $25,000 per person/$50,000 per accident | $25,000 per person/$50,000 per accident | $0 |

| Wyoming | $25,000 per person/$50,000 per accident | $25,000 per person/$50,000 per accident | $0 |

Importance of Understanding State Regulations

Understanding state-specific insurance regulations is essential to avoid legal issues and financial burdens. Driving without adequate insurance coverage can result in serious consequences, including:

* Fines and Penalties: Driving without the minimum required insurance coverage can lead to hefty fines and penalties, potentially impacting your driving privileges.

* License Suspension: Failure to maintain adequate insurance coverage can result in the suspension of your driver’s license.

* Legal Liability: In the event of an accident, driving without adequate insurance coverage leaves you personally liable for any damages or injuries caused, potentially leading to significant financial losses and even legal action.

* Difficulty in Registering Your Vehicle: Many states require proof of insurance to register your vehicle, and driving without it can make it difficult or impossible to register your vehicle.

* Higher Insurance Premiums: If you’re caught driving without insurance, your future insurance premiums are likely to be significantly higher.

It’s important to note that these are just some of the potential consequences of driving without adequate insurance coverage. The specific consequences can vary depending on the state and the circumstances of the situation.

Ending Remarks: States With The Lowest Car Insurance Rates

Ultimately, finding affordable car insurance involves a combination of understanding state-specific regulations, taking advantage of discounts, and comparing quotes from multiple insurance companies. By taking these steps, drivers can ensure they have the coverage they need without breaking the bank. So, whether you’re looking to relocate to a state with lower insurance rates or simply seeking ways to save on your current policy, the information provided in this article can be a valuable resource for your journey toward more affordable car insurance.

Helpful Answers

What are the top 5 states with the lowest car insurance rates?

The top 5 states with the lowest average car insurance rates typically include Maine, Idaho, North Dakota, Vermont, and Iowa. However, specific rates can vary based on individual factors such as driving history, vehicle type, and coverage levels.

How can I compare car insurance quotes?

Many online insurance comparison websites allow you to enter your information and receive quotes from multiple insurers simultaneously. This helps you easily compare rates and find the best deal for your needs.

What are some common car insurance discounts?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining auto and home insurance. You can often find more specific discounts offered by individual insurance companies.