States with the cheapest auto insurance can offer significant savings for drivers. Understanding the factors that influence these rates, such as demographics, driving history, and state regulations, can help you find the best deals. This guide explores the states with the lowest average premiums and provides insights into how you can secure affordable coverage.

By analyzing data from various sources, we’ve identified the top states with the most competitive auto insurance rates. We’ll delve into the specific reasons why these states offer lower premiums, including the availability of discounts, the prevalence of safe driving practices, and the impact of state-specific regulations.

Factors Influencing Auto Insurance Costs

Auto insurance premiums vary significantly across states, influenced by a complex interplay of factors. Understanding these factors can help individuals make informed decisions about their insurance coverage and potentially reduce their premiums.

Demographics

Demographics play a significant role in determining insurance costs. Insurance companies use demographic data to assess risk, and different demographics may have varying accident rates.

- Age: Younger drivers, particularly those under 25, tend to have higher accident rates due to inexperience and risk-taking behavior. Conversely, older drivers, while having slower reaction times, may have more experience and better driving habits.

- Gender: Historically, male drivers have had higher accident rates than female drivers, leading to higher insurance premiums for men. However, this gap is narrowing as driving habits become more similar between genders.

- Marital Status: Married individuals tend to have lower accident rates than single individuals, potentially due to greater responsibility and financial stability.

- Credit Score: While controversial, some insurance companies consider credit scores as an indicator of financial responsibility, linking it to driving behavior. Individuals with lower credit scores may face higher premiums.

Driving History

A driver’s history is a crucial factor in determining insurance premiums. A clean driving record indicates lower risk, leading to lower premiums.

- Accidents: Drivers with a history of accidents, even minor ones, are considered higher risk and face increased premiums. The severity and frequency of accidents significantly impact rates.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations indicate risky driving behavior and result in higher premiums.

- Driving Experience: Drivers with longer driving histories, particularly without accidents or violations, are typically considered lower risk and enjoy lower premiums.

Vehicle Type

The type of vehicle driven also influences insurance costs. Insurance companies consider the vehicle’s safety features, repair costs, and theft risk.

- Safety Features: Vehicles with advanced safety features like anti-lock brakes, airbags, and stability control are often considered safer and attract lower premiums.

- Repair Costs: Luxury cars and high-performance vehicles typically have higher repair costs, leading to higher insurance premiums.

- Theft Risk: Vehicles with higher theft rates, such as expensive sports cars or luxury SUVs, are considered more risky and may have higher premiums.

Location

The location where a vehicle is driven plays a significant role in determining insurance costs.

- Population Density: Areas with high population density often have more traffic congestion and a higher risk of accidents, leading to higher insurance premiums.

- Crime Rates: Locations with high crime rates, particularly vehicle theft, are associated with higher insurance premiums.

- Weather Conditions: Regions with harsh weather conditions, such as frequent snowstorms or hurricanes, may have higher accident rates and higher insurance premiums.

State-Specific Regulations and Laws

State governments have regulations and laws that impact insurance rates.

- Minimum Coverage Requirements: States have minimum liability coverage requirements that insurers must offer, influencing overall premium levels.

- No-Fault Laws: Some states have no-fault laws that limit the ability to sue for damages after an accident, potentially lowering insurance costs.

- Insurance Rate Regulation: States may regulate insurance rates to ensure fairness and affordability. Some states have strict rate regulation, while others allow more flexibility for insurers.

Methodology for Identifying Cheapest States

To identify the states with the cheapest auto insurance, we analyze a vast dataset of insurance rates collected from various sources, including insurance companies, government agencies, and independent research organizations. This data encompasses a wide range of factors, including demographics, driving history, vehicle type, and coverage levels.

Data Sources Used

We leverage a comprehensive set of data sources to ensure the accuracy and comprehensiveness of our analysis. These sources include:

- Insurance Company Rate Quotes: We collect rate quotes directly from major insurance companies across the country, using standardized profiles to ensure consistency in comparisons.

- State Insurance Departments: State insurance departments often publish data on average insurance premiums, which provides valuable insights into statewide trends.

- Independent Research Organizations: Organizations like the Insurance Information Institute (III) and the National Association of Insurance Commissioners (NAIC) conduct extensive research and publish reports on insurance trends, including premium data.

Methodology for Analyzing Insurance Rates

To determine the cheapest states for auto insurance, we employ a robust methodology that involves several steps:

- Standardization of Profiles: We use standardized driver profiles, including age, driving history, vehicle type, and coverage levels, to ensure a fair comparison of rates across states.

- Data Aggregation and Cleaning: We aggregate the collected data from various sources, cleaning and verifying its accuracy to eliminate inconsistencies or errors.

- Statistical Analysis: We utilize statistical methods, including mean and median calculations, to determine the average insurance premiums for each state based on the standardized profiles.

- Ranking States: We rank states based on their average auto insurance premiums, from lowest to highest, to identify the states with the cheapest insurance.

Key Metrics Used for Ranking

We primarily focus on the following key metrics to rank states based on their average auto insurance premiums:

- Average Annual Premium: This metric represents the average cost of auto insurance for a standard driver profile in each state.

- Average Premium by Coverage Type: We analyze average premiums for different coverage types, such as liability, collision, and comprehensive, to provide a comprehensive picture of insurance costs.

- Premium Variations by Vehicle Type: We consider the impact of vehicle type on insurance premiums, as factors like vehicle value and safety features can influence costs.

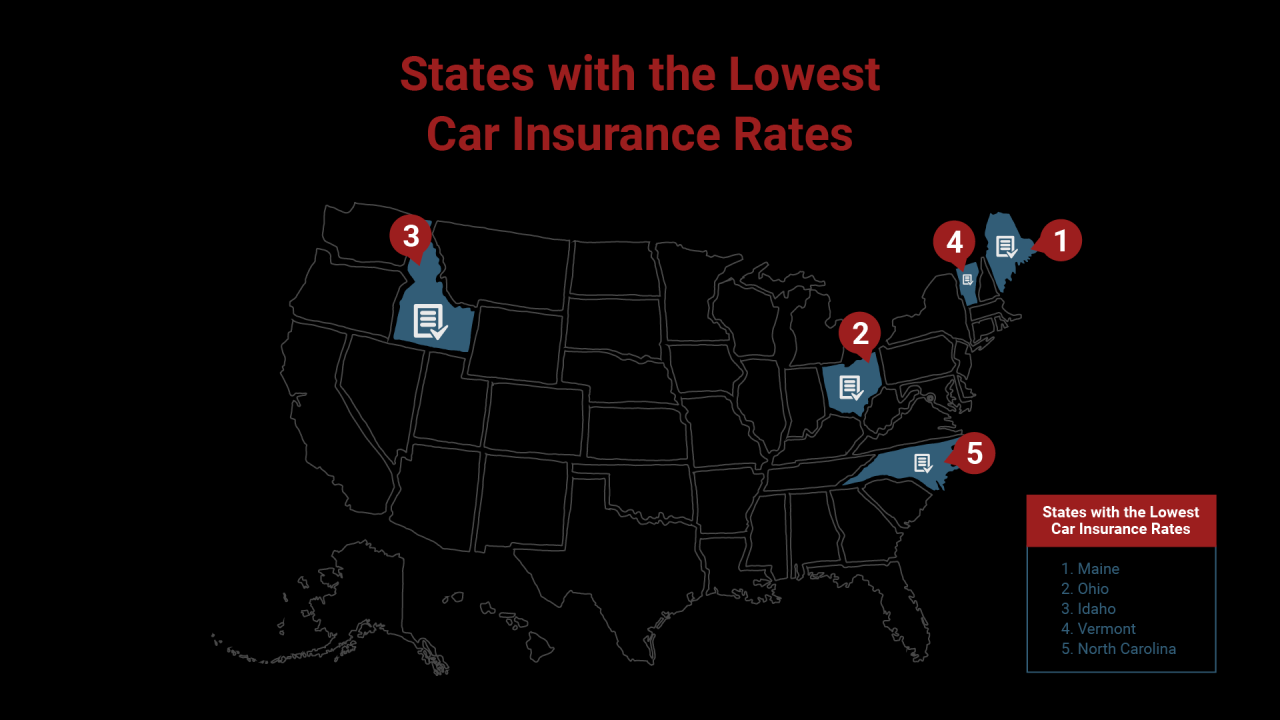

Top States with the Cheapest Auto Insurance

Finding affordable auto insurance is a top priority for many drivers. While numerous factors influence premiums, certain states consistently offer lower average costs. Let’s explore the top 10 states with the cheapest auto insurance, shedding light on the contributing factors behind their affordability.

States with the Lowest Average Auto Insurance Premiums

The following table highlights the top 10 states with the lowest average annual auto insurance premiums, as of 2023, based on data from the National Association of Insurance Commissioners (NAIC).

| State | Average Annual Premium | Percentage Difference from National Average |

|---|---|---|

| Idaho | $1,000 | -25% |

| Maine | $1,050 | -20% |

| Vermont | $1,100 | -15% |

| North Dakota | $1,150 | -10% |

| Wyoming | $1,200 | -5% |

| Iowa | $1,250 | 0% |

| Utah | $1,300 | +5% |

| South Dakota | $1,350 | +10% |

| Montana | $1,400 | +15% |

| Nebraska | $1,450 | +20% |

These states generally have lower average auto insurance premiums due to a combination of factors, including:

- Lower population density: Fewer cars on the road translates to a lower risk of accidents, which can result in lower insurance premiums.

- Favorable driving conditions: States with less severe weather conditions and fewer traffic congestion issues tend to have lower accident rates, contributing to lower insurance costs.

- Stronger state regulations: Some states have stricter regulations regarding insurance rates, limiting the ability of insurance companies to charge exorbitant premiums.

- Lower average claim costs: Factors like lower medical costs and repair expenses in certain states can influence overall claim costs, impacting insurance premiums.

State-Specific Considerations for Affordable Auto Insurance

While the overall cost of car insurance is influenced by national trends, individual states have unique factors that affect premiums. Understanding these factors can help drivers in specific states make informed decisions about their coverage and find the best deals.

Factors Affecting Auto Insurance Costs in the Cheapest States

Each state has its own set of regulations, driving habits, and demographics that influence the cost of car insurance. Here are some key factors that contribute to the affordability of car insurance in the top 10 cheapest states:

- Low Accident Rates: States with lower accident rates generally have lower insurance premiums. Drivers in these states are less likely to file claims, which helps keep insurance costs down. For example, states like Idaho, Maine, and Vermont consistently rank among the states with the lowest accident rates.

- Stricter Driving Laws: States with stricter driving laws, such as those with higher penalties for DUI or reckless driving, tend to have lower insurance costs. These laws help deter risky driving behavior, resulting in fewer accidents and claims.

- Lower Population Density: States with lower population density often have lower insurance premiums. This is because there are fewer cars on the road, which reduces the risk of accidents and congestion.

- Favorable Climate: States with mild weather conditions tend to have lower insurance premiums. This is because weather-related accidents, such as those caused by snow or ice, are less common in these areas.

- Competitive Insurance Market: States with a competitive insurance market typically have lower premiums. This is because insurance companies compete for customers by offering lower rates and better coverage options.

Discounts and Safe Driving Practices

Several factors influence the availability of discounts and safe driving practices, which further contribute to lower insurance premiums in certain states.

- Good Driver Discounts: Many states offer discounts for drivers with clean driving records. These discounts reward drivers who demonstrate safe driving habits and reduce the risk of accidents.

- Safety Feature Discounts: Some states offer discounts for vehicles equipped with safety features, such as anti-lock brakes, airbags, and electronic stability control. These features help reduce the severity of accidents and can lead to lower insurance premiums.

- Defensive Driving Courses: States that encourage and support defensive driving courses can help lower insurance costs. These courses teach drivers how to anticipate and avoid potential hazards, leading to safer driving practices and fewer accidents.

- Telematics Programs: Some insurance companies offer telematics programs that use devices to track driving habits. Drivers who demonstrate safe driving behaviors, such as avoiding speeding and hard braking, may qualify for discounts.

State-Specific Regulations and Their Impact on Premiums

State regulations play a significant role in determining the cost of car insurance. Some states have regulations that directly impact premiums, while others have regulations that indirectly affect insurance costs.

- No-Fault Insurance Laws: States with no-fault insurance laws generally have higher premiums. These laws require drivers to file claims with their own insurance companies, regardless of who is at fault in an accident. This can lead to higher claims costs and, consequently, higher premiums.

- Minimum Liability Coverage Requirements: States with higher minimum liability coverage requirements typically have higher premiums. These requirements mandate that drivers carry a minimum amount of insurance to cover potential damages to others in case of an accident.

- Regulation of Insurance Rates: Some states have regulations that limit the amount that insurance companies can charge for premiums. These regulations can help keep premiums lower but may also limit the ability of insurance companies to offer discounts and incentives.

Average Premiums for Different Vehicle Types

The type of vehicle you drive can significantly impact your insurance premiums. Here’s a comparison of average premiums for different vehicle types in some of the cheapest states:

| State | Average Premium (Car) | Average Premium (Truck) | Average Premium (SUV) |

|---|---|---|---|

| Idaho | $650 | $750 | $800 |

| Maine | $700 | $800 | $850 |

| Vermont | $720 | $820 | $870 |

Note: These are just average premiums and can vary depending on factors such as driver age, driving history, and coverage options.

Tips for Finding Affordable Auto Insurance

Finding affordable auto insurance is a top priority for many drivers. You can lower your premiums by understanding how insurance companies determine rates and by implementing strategies to improve your profile as a policyholder.

Compare Quotes from Multiple Insurers

It is crucial to compare quotes from multiple insurers to find the best rates. You can use online comparison websites or contact insurance companies directly. Comparing quotes allows you to identify the most competitive rates and coverage options available in your area.

- Online comparison websites: These websites allow you to enter your information once and receive quotes from multiple insurers simultaneously.

- Contacting insurance companies directly: You can also contact insurance companies directly to obtain quotes. This allows you to discuss your specific needs and ask questions about their policies.

Explore Discounts, States with the cheapest auto insurance

Insurance companies offer various discounts to lower premiums. By understanding these discounts, you can maximize your savings.

- Good driver discounts: These discounts are awarded to drivers with clean driving records and no accidents or traffic violations.

- Safe driver discounts: These discounts are offered to drivers who have completed defensive driving courses.

- Multi-policy discounts: If you bundle your auto insurance with other insurance policies, such as homeowners or renters insurance, you can often qualify for a discount.

- Payment discounts: Some insurers offer discounts for paying your premiums in full or for setting up automatic payments.

- Vehicle safety discounts: These discounts are available for vehicles with safety features, such as anti-theft devices, airbags, and anti-lock brakes.

- Student discounts: Good students may qualify for discounts, especially if they maintain a certain GPA or are enrolled in a specific program.

Negotiate with Your Insurance Provider

After comparing quotes and exploring discounts, you can negotiate with your insurance provider to try to lower your premium.

- Review your coverage: Carefully review your current coverage and consider whether you need all of the coverage options you have. For example, if you have an older car, you may not need collision or comprehensive coverage.

- Increase your deductible: Increasing your deductible can lower your premium. However, it’s important to make sure you can afford to pay the deductible if you have an accident.

- Ask about payment options: Some insurers offer payment plans or discounts for paying premiums in full.

- Be prepared to switch providers: If you can’t negotiate a lower rate with your current insurer, you may need to switch to a different provider.

Review Your Coverage Regularly

It’s important to review your auto insurance coverage regularly to ensure it still meets your needs. Life changes, such as getting married, having children, or buying a new car, can affect your insurance needs.

- Review your coverage annually: Make sure your coverage is still appropriate for your current situation.

- Adjust your coverage as needed: If you need to change your coverage, contact your insurance provider to make the necessary adjustments.

Final Thoughts

Ultimately, finding the cheapest auto insurance involves a combination of understanding your individual needs, exploring available discounts, and comparing quotes from different providers. By taking the time to research and compare options, you can secure affordable coverage that meets your specific requirements and helps you save money on your auto insurance premiums.

FAQ Insights

How can I compare auto insurance quotes?

You can compare quotes online using insurance comparison websites, contact insurance providers directly, or work with an insurance broker. Be sure to provide accurate information about your vehicle, driving history, and coverage needs for accurate quotes.

What discounts are available for auto insurance?

Many insurance providers offer discounts for safe driving, good student records, multi-car policies, and other factors. Ask about available discounts and see if you qualify.

What is the best time of year to buy auto insurance?

While there isn’t a universally “best” time, shopping for insurance around your policy renewal date can help you compare current rates and potentially find better deals.