States that allow digital insurance cards are leading the way in embracing technology within the insurance industry. This shift is driven by consumer demand for convenience and efficiency, along with the increasing adoption of digital solutions across various sectors. Digital insurance cards offer a modern alternative to traditional paper cards, providing a secure and accessible way to access vital insurance information.

This article delves into the legal landscape surrounding digital insurance cards, exploring the different approaches taken by various states. It examines the types of insurance covered by digital cards, the leading providers in the market, and the impact of digital insurance cards on consumer adoption and the insurance industry as a whole.

State Laws and Regulations

The legal landscape surrounding digital insurance cards is evolving rapidly across the United States. While some states have explicitly embraced this technology, others are still navigating its implications. This section explores the legal framework in different states, identifying specific laws and regulations that govern the use of digital insurance cards.

State Laws and Regulations Governing Digital Insurance Cards

The use of digital insurance cards is governed by a combination of state laws and regulations. These laws typically address issues such as:

- Validity and Legality: Some states have explicitly legalized the use of digital insurance cards, recognizing them as valid proof of insurance. Others may have regulations that implicitly permit their use, while some may have no specific laws addressing them.

- Acceptance by Law Enforcement: Some states require law enforcement officers to accept digital insurance cards as valid proof of insurance, while others leave it to the discretion of individual officers.

- Data Security and Privacy: State laws may address the security and privacy of personal information stored on digital insurance cards, ensuring compliance with data protection regulations.

- Format and Content Requirements: Some states may specify the format and content of digital insurance cards, ensuring they contain all necessary information.

Examples of State Approaches to Digital Insurance Cards

Here are some examples of how different states have approached the use of digital insurance cards:

- California: California has explicitly legalized the use of digital insurance cards. The California Department of Insurance (CDI) has issued guidance stating that digital insurance cards are valid proof of insurance, as long as they meet certain requirements.

- Texas: Texas has no specific laws or regulations governing the use of digital insurance cards. However, the Texas Department of Insurance (TDI) has stated that it considers digital insurance cards to be valid proof of insurance as long as they contain all the required information.

- New York: New York has no specific laws or regulations governing the use of digital insurance cards. However, the New York State Department of Financial Services (DFS) has issued guidance stating that digital insurance cards may be acceptable as proof of insurance, but only if they are “easily verifiable” and meet certain requirements.

Comparison of State Approaches

States have adopted different approaches regarding the acceptance of digital insurance cards, ranging from explicit legalization to a more cautious approach:

- Explicit Legalization: Some states, like California, have explicitly legalized the use of digital insurance cards, recognizing them as valid proof of insurance.

- Implicit Acceptance: Other states, like Texas, have no specific laws or regulations governing the use of digital insurance cards, but their insurance departments have issued statements indicating their acceptance.

- Cautious Approach: Some states, like New York, have no specific laws or regulations governing the use of digital insurance cards and have taken a more cautious approach, requiring that they be “easily verifiable” and meet certain requirements.

Types of Insurance Covered

Digital insurance cards are becoming increasingly popular as a convenient and efficient way to manage insurance information. These cards can be used to access various types of insurance policies, offering a streamlined experience for policyholders.

Digital insurance cards are typically used for a wide range of insurance types, including health, auto, and home insurance. They provide a secure and readily accessible method for individuals to manage their insurance information, replacing traditional paper cards.

Health Insurance

Digital health insurance cards offer several benefits for policyholders, including:

* Easy access: Policyholders can easily access their health insurance information through their smartphones or other devices, eliminating the need to carry physical cards.

* Secure storage: Digital cards are stored securely on the user’s device or in a cloud-based system, reducing the risk of loss or theft.

* Real-time updates: Changes to coverage or plan details are reflected immediately on digital cards, ensuring accurate information.

However, there are some limitations to consider:

* Limited acceptance: While digital health cards are gaining acceptance, not all healthcare providers may be equipped to scan or accept them.

* Technical issues: Technical glitches or network connectivity problems can hinder access to digital cards.

Auto Insurance

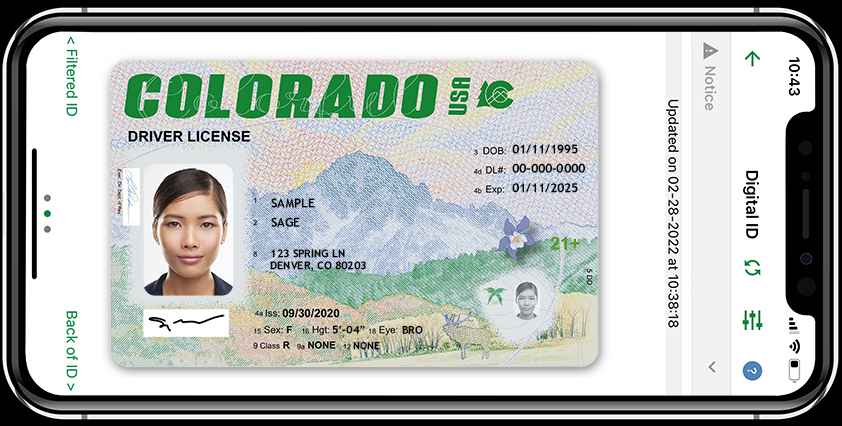

Digital auto insurance cards provide a convenient way to carry proof of insurance, particularly during traffic stops.

* Digital cards are readily available: Policyholders can access their digital auto insurance cards anytime and anywhere through their smartphones or other devices.

* Instant verification: Law enforcement officers can quickly verify insurance information through digital cards, streamlining traffic stops.

However, there are potential limitations:

* Battery life: Digital cards rely on device batteries, which may drain during extended trips or emergencies.

* Network availability: Access to digital cards may be restricted in areas with poor network coverage.

Home Insurance

Digital home insurance cards provide policyholders with convenient access to essential coverage information, such as policy details and contact information for claims.

* Easy access to policy information: Policyholders can quickly review their home insurance policy details through digital cards.

* Convenient contact information: Digital cards provide immediate access to the insurance company’s contact information, facilitating prompt communication in case of emergencies.

However, digital home insurance cards may have limitations:

* Limited functionality: Digital home insurance cards may not provide access to all policy details, requiring policyholders to refer to their physical policy documents for comprehensive information.

* Security concerns: Data breaches or unauthorized access to digital cards could compromise sensitive personal information.

Digital Insurance Card Providers

Digital insurance card providers offer a range of solutions for managing and accessing insurance information electronically. These platforms streamline the process of verifying coverage and accessing essential details, offering convenience and efficiency for both individuals and healthcare providers.

Major Providers of Digital Insurance Card Solutions

The digital insurance card market is evolving rapidly, with several prominent players offering innovative solutions.

- Apple Wallet: Apple’s digital wallet allows users to store their insurance cards securely and conveniently. It integrates seamlessly with iOS devices, enabling quick access to essential information.

- Google Pay: Google’s digital wallet offers similar functionality to Apple Wallet, allowing users to store their insurance cards digitally and access them easily through their Android devices.

- Samsung Pay: Samsung Pay provides a platform for storing and accessing digital insurance cards on Samsung devices. It integrates with various insurance providers and offers a user-friendly interface.

- Healthvana: Healthvana focuses on providing digital health records and insurance card solutions for healthcare providers and patients. Its platform enables secure storage and sharing of health information.

- DocuSign: DocuSign, a leader in electronic signature technology, also offers digital insurance card solutions. Its platform allows users to store and access their insurance cards electronically and securely.

Features and Functionalities of Digital Insurance Card Platforms

Digital insurance card platforms offer a variety of features and functionalities to enhance convenience and efficiency:

- Secure Storage: Platforms prioritize data security, employing encryption and other measures to protect sensitive information.

- Easy Access: Users can quickly access their digital insurance cards through their mobile devices or web browsers.

- Real-Time Updates: Platforms can automatically update insurance card information, ensuring users have the most current details.

- Sharing Capabilities: Users can easily share their digital insurance cards with healthcare providers, facilitating seamless verification of coverage.

- Personalized Experience: Platforms often offer customization options, allowing users to personalize their digital insurance cards with relevant information.

Security Measures Implemented by Digital Insurance Card Providers

Digital insurance card providers prioritize security to safeguard sensitive information. They implement various measures to protect data from unauthorized access:

- Encryption: Platforms encrypt data during transmission and storage, ensuring confidentiality and integrity.

- Multi-Factor Authentication: Many platforms require users to verify their identity through multiple factors, enhancing account security.

- Data Access Controls: Platforms implement strict access controls, limiting access to authorized personnel and preventing unauthorized data disclosure.

- Regular Security Audits: Providers conduct regular security audits to identify and address potential vulnerabilities.

- Compliance with Industry Standards: Platforms comply with relevant industry standards, such as HIPAA for healthcare information, to ensure data protection.

Successful Digital Insurance Card Implementations

Several states have successfully implemented digital insurance card initiatives, demonstrating the benefits of this technology:

- California: California has implemented a digital insurance card program that allows residents to store their insurance information in their digital wallets. This initiative has simplified access to coverage information for individuals and healthcare providers.

- New York: New York has also adopted a digital insurance card program, allowing residents to use their smartphones to access their insurance cards. This program has contributed to greater convenience and efficiency in healthcare settings.

- Arizona: Arizona has implemented a digital insurance card program that enables residents to store and access their insurance information electronically. This initiative has facilitated easier verification of coverage and reduced the need for physical cards.

Consumer Adoption and Use

While the legal framework for digital insurance cards is being established, the rate of consumer adoption is crucial for their widespread success. Understanding the factors that influence consumer acceptance and addressing the challenges and opportunities associated with promoting digital insurance cards is essential.

Factors Influencing Consumer Acceptance

Consumer acceptance of digital insurance cards is influenced by a variety of factors. These factors can be categorized as follows:

- Convenience and Accessibility: Digital insurance cards offer convenience and accessibility by eliminating the need for physical cards. They can be easily accessed on smartphones or other devices, making it easier for individuals to present their insurance information when needed.

- Security and Privacy Concerns: Consumers are often concerned about the security and privacy of their personal information when using digital platforms. Assurances about data encryption, secure storage, and robust authentication protocols are essential to build trust and address these concerns.

- Trust and Familiarity: Consumers are more likely to adopt digital insurance cards if they trust the issuing entity and are familiar with the technology. Building trust through clear communication, transparent practices, and user-friendly interfaces is crucial.

- Awareness and Education: Consumers need to be aware of the availability and benefits of digital insurance cards. Educational campaigns and outreach efforts can play a significant role in increasing awareness and promoting adoption.

Challenges and Opportunities in Promoting Adoption, States that allow digital insurance cards

Promoting digital insurance card adoption presents both challenges and opportunities.

- Overcoming Resistance to Change: Some consumers may be resistant to adopting new technologies, especially those who are comfortable with traditional methods. Educating consumers about the benefits and ease of use of digital insurance cards can help overcome this resistance.

- Addressing Security Concerns: Addressing security concerns through robust security measures and clear communication is crucial for building consumer trust. Implementing multi-factor authentication, data encryption, and regular security audits can enhance security and alleviate concerns.

- Leveraging Technological Advancements: Integrating digital insurance cards with other technologies, such as mobile wallets and wearables, can enhance convenience and accessibility. This integration can also provide opportunities for personalized experiences and value-added services.

- Collaboration and Partnerships: Collaboration between insurance companies, technology providers, and healthcare providers can facilitate the adoption of digital insurance cards. Joint initiatives, shared resources, and standardized practices can streamline the process and create a more cohesive ecosystem.

Pros and Cons of Digital Insurance Cards

The following table Artikels the pros and cons of using digital insurance cards from a consumer perspective:

| Pros | Cons |

|---|---|

| Convenience and accessibility | Potential for technical difficulties |

| Reduced risk of loss or damage | Security and privacy concerns |

| Environmental sustainability | Requirement for a smartphone or other device |

| Potential for personalized features | Limited acceptance in certain settings |

Industry Impact and Future Trends

The advent of digital insurance cards has significantly impacted the insurance industry, driving innovation and transforming how insurance is accessed and managed. The trend toward digitalization is poised to continue, with several future trends shaping the landscape of insurance card usage. This section delves into the impact of digital insurance cards on the industry, explores emerging trends, and identifies potential challenges and opportunities.

Impact on the Insurance Industry

Digital insurance cards have ushered in a new era of convenience and efficiency for both insurers and policyholders. Here are some key impacts:

- Enhanced Customer Experience: Digital insurance cards offer a seamless and user-friendly experience, enabling policyholders to access their insurance information anytime, anywhere. This eliminates the need for physical cards, reducing the risk of loss or damage.

- Cost Reduction: Insurers can significantly reduce costs associated with printing, mailing, and managing physical cards. This frees up resources for other critical operations and investments.

- Improved Security: Digital insurance cards can incorporate advanced security features, such as encryption and multi-factor authentication, making them more secure than physical cards. This helps prevent fraud and identity theft.

- Real-Time Updates: Digital cards can be updated instantly, reflecting changes in policy details, coverage, or expiration dates. This eliminates the need for manual updates and ensures that policyholders have access to the latest information.

- Data Analytics and Insights: Digital insurance cards provide insurers with valuable data insights into customer behavior, preferences, and usage patterns. This information can be leveraged to personalize services, develop targeted marketing campaigns, and improve risk assessment models.

Future Trends

The future of digital insurance cards is bright, with several trends driving their adoption and evolution.

- Integration with Wearable Devices: Digital insurance cards are expected to be integrated with wearable devices, such as smartwatches and fitness trackers, providing users with instant access to their insurance information and enabling automated claims processing.

- Blockchain Technology: Blockchain technology can enhance the security and transparency of digital insurance cards by providing a tamper-proof record of transactions and policy details.

- Artificial Intelligence (AI): AI-powered chatbots and virtual assistants can streamline customer interactions, providing instant support and guidance related to insurance cards and policies.

- Personalized Insurance: Digital insurance cards can be used to personalize insurance offerings based on individual risk profiles, usage patterns, and lifestyle choices.

- Expansion of Coverage: Digital insurance cards are expected to expand beyond traditional insurance products to cover a wider range of services, such as travel insurance, health insurance, and home insurance.

Challenges and Opportunities

While the adoption of digital insurance cards presents numerous opportunities, there are also challenges that need to be addressed.

- Data Privacy and Security: Ensuring the security and privacy of sensitive insurance data is paramount. Robust security measures and compliance with data protection regulations are essential.

- Accessibility and Inclusivity: Digital insurance cards should be accessible to all policyholders, regardless of their technological proficiency or access to digital devices.

- Interoperability: Ensuring interoperability between different digital insurance card providers and platforms is crucial for seamless user experience.

- Regulatory Framework: Clear regulatory frameworks and standards are needed to govern the issuance, use, and security of digital insurance cards.

- Consumer Education and Awareness: Educating consumers about the benefits and features of digital insurance cards is essential for widespread adoption.

Hypothetical Scenario

Imagine a future where digital insurance cards are seamlessly integrated into a user’s smartphone. Upon entering a car rental agency, the user’s phone automatically detects the rental agreement and provides the necessary insurance details to the agency, completing the process in seconds. This scenario highlights the potential of digital insurance cards to simplify and automate complex processes, creating a frictionless experience for consumers.

Last Word: States That Allow Digital Insurance Cards

The adoption of digital insurance cards is transforming the way consumers interact with the insurance industry. As technology continues to advance, we can expect to see further innovation in this space, with the potential for even more convenient and secure digital solutions. The future of insurance is undoubtedly digital, and states that allow digital insurance cards are at the forefront of this exciting evolution.

Question & Answer Hub

What are the benefits of using a digital insurance card?

Digital insurance cards offer several benefits, including convenience, accessibility, and security. They are readily available on your smartphone or tablet, eliminating the need to carry physical cards. They are also more secure, as they can be protected with passwords and other security measures.

How do I obtain a digital insurance card?

The process for obtaining a digital insurance card varies depending on your insurance provider. Some providers offer digital cards directly through their mobile apps, while others may require you to download a separate app or access the card through their website.

Are digital insurance cards accepted everywhere?

While digital insurance cards are becoming increasingly accepted, it’s essential to check with healthcare providers, law enforcement agencies, and other organizations to confirm their acceptance. Some states may have specific requirements for the use of digital insurance cards.