State of new jersey auto insurance – Navigating the world of New Jersey auto insurance can be a daunting task, but understanding the ins and outs is crucial for every driver. From mandatory coverage requirements to the nuances of the no-fault system, this comprehensive guide aims to equip you with the knowledge you need to make informed decisions about your insurance.

This guide will delve into the key aspects of New Jersey auto insurance, including the different types of coverage, factors influencing rates, and tips for finding the best policy. We’ll also explore the state’s unique regulations and provide valuable insights into navigating the insurance market.

Understanding New Jersey Auto Insurance

Navigating the world of auto insurance in New Jersey can seem daunting, but understanding the basics and available options empowers you to make informed decisions. This guide will provide a comprehensive overview of New Jersey auto insurance, helping you grasp the essential elements and factors that influence your premiums.

Mandatory Coverage Requirements

New Jersey mandates specific auto insurance coverage to ensure financial protection in case of accidents. These requirements are designed to safeguard both you and others involved in an accident.

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, property damage, and lost wages. In New Jersey, the minimum liability coverage required is 15/30/5, meaning $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $5,000 for property damage.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages, regardless of who caused the accident. New Jersey requires a minimum PIP coverage of $15,000.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses, lost wages, and property damage. New Jersey requires UM/UIM coverage to be equal to your liability coverage limits.

Types of Auto Insurance Coverage

Beyond the mandatory coverage, various optional insurance options can provide additional protection and peace of mind.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Rental Reimbursement Coverage: This coverage helps pay for a rental car if your vehicle is being repaired after an accident or covered event.

- Roadside Assistance Coverage: This coverage provides assistance in case of breakdowns, flat tires, or other roadside emergencies.

Factors Influencing Auto Insurance Rates

Numerous factors influence your auto insurance rates in New Jersey. Understanding these factors can help you make informed choices that may impact your premiums.

- Driving History: Your driving record, including accidents, violations, and DUI convictions, significantly impacts your rates.

- Vehicle Type: The type of vehicle you drive, its value, and safety features influence your insurance costs.

- Age and Gender: Younger drivers, particularly those under 25, typically pay higher premiums due to their higher risk profiles.

- Location: Your location, including the area’s accident rates and crime statistics, can influence your rates.

- Credit History: In New Jersey, insurance companies can use your credit history as a factor in determining your rates.

- Driving Habits: Factors such as your annual mileage and driving patterns, including commuting distance and time of day, can influence your premiums.

Navigating the New Jersey Auto Insurance Market: State Of New Jersey Auto Insurance

Choosing the right auto insurance policy in New Jersey can be a daunting task, given the diverse range of providers and policy options available. This section aims to guide you through the complexities of the New Jersey auto insurance market, equipping you with the knowledge and tools to make informed decisions.

Comparing Major Auto Insurance Providers

Understanding the strengths and weaknesses of major auto insurance providers in New Jersey can help you narrow down your search and find the best fit for your needs.

- State Farm: Known for its extensive network of agents, competitive rates, and strong customer service. However, they may not offer the most comprehensive coverage options.

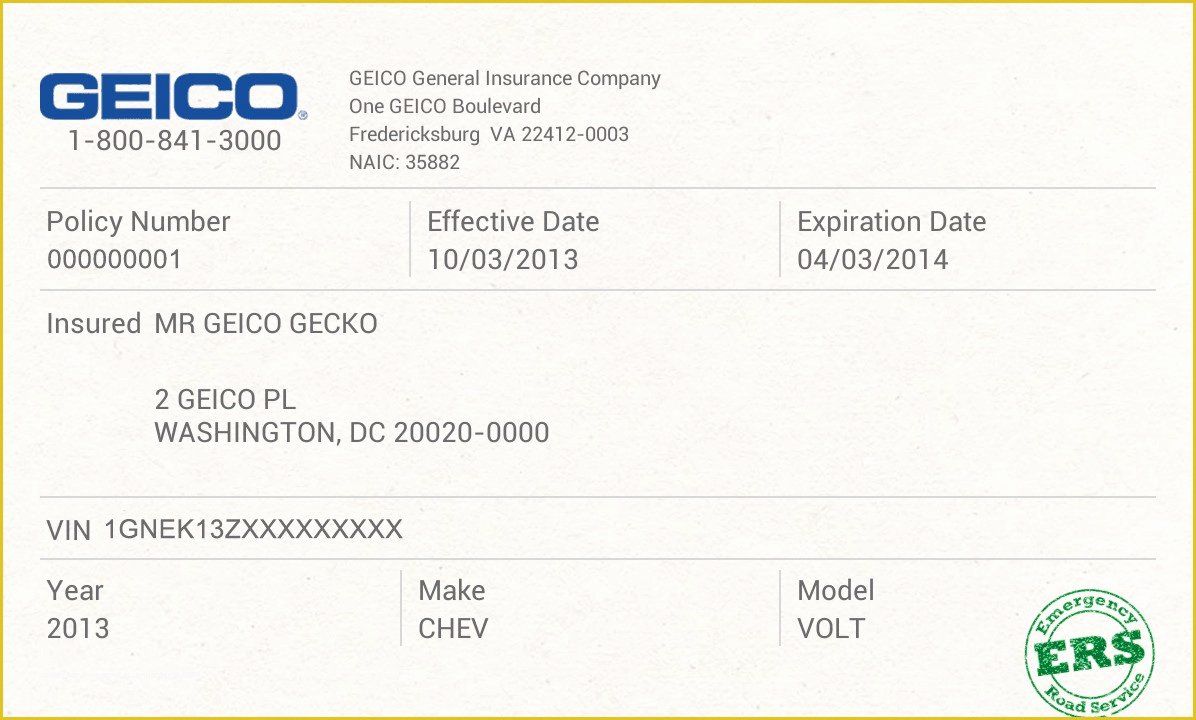

- Geico: Offers competitive rates and a user-friendly online experience. However, their customer service can sometimes be less responsive compared to other providers.

- Progressive: Offers a wide range of coverage options and discounts, including their well-known “Name Your Price” tool. However, their rates can vary significantly depending on your driving history and other factors.

- Allstate: Provides a comprehensive range of insurance products, including auto, home, and life insurance. They also offer a strong customer service reputation. However, their rates may be higher compared to some other providers.

- New Jersey Manufacturers Insurance Company (NJM): A regional provider with a strong reputation for customer service and competitive rates in New Jersey. They may offer more personalized attention compared to larger national providers.

Obtaining Quotes from Different Insurance Providers

The process of obtaining quotes from different insurance providers in New Jersey is relatively straightforward and can be done through various methods:

- Online Platforms: Many insurance providers offer online quote tools that allow you to quickly compare rates based on your specific needs. Popular platforms include:

- Insurance.com: A comprehensive website that compares quotes from multiple insurance providers.

- The Zebra: Offers a user-friendly interface for comparing quotes from various providers.

- Policygenius: Provides a personalized approach to finding the best insurance options.

- In-Person Consultations: You can also schedule in-person consultations with insurance agents from different providers. This allows you to discuss your needs in detail and receive personalized recommendations.

- Phone Calls: Many insurance providers offer phone-based quote services. You can contact them directly to receive a quote over the phone.

Understanding and Comparing Insurance Policies

When comparing insurance policies, it’s crucial to understand the key terms and coverage details:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property.

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries caused to others.

- Property Damage Liability: Covers repairs or replacement costs for damage to other people’s vehicles or property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

- Deductible: The amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums.

- Premium: The amount you pay for your insurance policy. Premiums are calculated based on various factors, including your driving history, age, location, and vehicle type.

Key Considerations for New Jersey Drivers

Navigating the New Jersey auto insurance landscape can be a complex process, but understanding key considerations can significantly impact your premiums and overall driving experience. By making informed decisions and implementing effective strategies, you can potentially save money and ensure you have the right coverage to protect yourself and your vehicle.

Shopping Around for Rates

One of the most effective ways to reduce your auto insurance premiums is to shop around and compare quotes from multiple insurance companies. New Jersey’s competitive insurance market offers a wide range of options, with varying rates and coverage packages. By obtaining quotes from several insurers, you can identify the best value for your needs and potentially save hundreds of dollars annually.

Maintaining a Good Driving Record

Your driving history plays a crucial role in determining your auto insurance premiums. A clean driving record with no accidents or violations will generally result in lower rates. Conversely, incidents like speeding tickets, accidents, or driving under the influence can significantly increase your premiums.

- Avoid traffic violations and accidents, as these incidents can lead to increased insurance premiums.

- Maintain a safe driving record by adhering to traffic laws and practicing defensive driving techniques.

- Consider enrolling in a defensive driving course to enhance your driving skills and potentially earn discounts on your insurance premiums.

Impact of Vehicle Safety Features, State of new jersey auto insurance

Modern vehicles are equipped with advanced safety features that can significantly reduce the risk of accidents and injuries. Insurance companies recognize the value of these technologies and often offer lower premiums for vehicles with features like anti-lock brakes, electronic stability control, and airbags.

- Newer vehicles generally come equipped with more advanced safety features, which can lead to lower insurance premiums.

- Features like anti-lock brakes, electronic stability control, and airbags can significantly reduce the risk of accidents and injuries, leading to lower insurance premiums.

- When purchasing a new or used vehicle, consider the impact of safety features on insurance rates and factor them into your decision-making process.

Understanding New Jersey’s Unique Regulations

New Jersey’s auto insurance landscape is shaped by a unique set of regulations designed to ensure fair compensation for drivers involved in accidents. This system, known as a no-fault insurance system, focuses on providing prompt and efficient coverage for medical expenses and lost wages, regardless of who is at fault for the accident.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is a mandatory coverage in New Jersey that provides benefits for medical expenses, lost wages, and other related expenses resulting from an auto accident, regardless of fault. PIP coverage is designed to help injured individuals recover from their injuries and return to their normal lives.

Key Features of PIP Coverage:

- Medical Expenses: PIP covers reasonable and necessary medical expenses incurred as a result of an accident, including doctor’s visits, hospital stays, physical therapy, and prescription medications.

- Lost Wages: PIP provides compensation for lost wages if you are unable to work due to your injuries. The amount of coverage varies based on your policy and your income.

- Other Expenses: PIP can also cover other expenses related to your injuries, such as home health care, transportation, and funeral expenses.

- Coverage Limits: New Jersey law requires a minimum PIP coverage limit of $15,000 per person. However, you can choose higher coverage limits, depending on your needs and budget.

Filing Claims in New Jersey

In New Jersey, the process for filing an auto insurance claim is straightforward and regulated by the New Jersey Department of Banking and Insurance (DOBI). The DOBI plays a crucial role in ensuring that insurance companies comply with state regulations and provide fair and timely claims processing.

Steps to File a Claim:

- Contact Your Insurance Company: As soon as possible after an accident, contact your insurance company and report the incident. Be sure to provide all necessary details, including the date, time, location, and other involved parties.

- File a Claim: Your insurance company will provide you with a claim form to complete. Fill out the form accurately and provide all requested information.

- Submit Medical Records: If you have sustained injuries, you will need to submit medical records from your treating physician to support your claim.

- Negotiate Settlement: Once your claim is reviewed, your insurance company will make an offer for settlement. You have the right to negotiate the settlement amount or to file an appeal if you disagree with the offer.

Consumer Resources and Advocacy Groups

The New Jersey Department of Banking and Insurance (DOBI) offers a variety of consumer resources and assistance programs to help drivers understand their auto insurance rights and navigate the claims process.

Available Resources:

- DOBI Website: The DOBI website provides comprehensive information about auto insurance regulations, consumer rights, and available resources. You can find information about filing claims, resolving disputes, and understanding your policy.

- Consumer Hotline: The DOBI operates a consumer hotline that you can call to get assistance with auto insurance issues. You can speak with a representative who can answer your questions and provide guidance.

- Consumer Education Programs: The DOBI offers various consumer education programs and workshops to help drivers understand their insurance rights and responsibilities.

Conclusive Thoughts

As you embark on your journey through the New Jersey auto insurance landscape, remember that being informed is your best defense. By understanding your options, comparing rates, and advocating for your needs, you can secure the coverage that provides peace of mind and financial protection on the road.

Top FAQs

How often should I review my auto insurance policy?

It’s recommended to review your auto insurance policy at least annually, or even more frequently if you experience significant life changes like a new car, a change in driving habits, or a move to a different location.

What are the penalties for driving without insurance in New Jersey?

Driving without insurance in New Jersey is illegal and can result in fines, license suspension, and even vehicle impoundment. It’s crucial to maintain continuous coverage.

Can I get a discount on my auto insurance if I have a good driving record?

Yes, many insurance providers offer discounts for drivers with clean driving records. Maintaining a safe driving history can significantly reduce your premiums.