Cheapest home insurance in Washington State: Finding affordable home insurance in Washington State is essential for protecting your biggest investment. With diverse factors influencing premiums, navigating the insurance market can be challenging. This guide explores the key considerations, strategies for finding the best rates, and tips for saving on your home insurance.

From understanding mandatory coverage requirements to exploring the impact of location and home features on premiums, we delve into the factors that shape home insurance costs. We’ll also provide practical advice on comparing quotes, utilizing online tools, and choosing reputable insurance providers in Washington State.

Understanding Home Insurance in Washington State

Home insurance is crucial for protecting your biggest investment. It safeguards your home and belongings against various risks, offering peace of mind in case of unforeseen events. In Washington State, understanding the nuances of home insurance is essential to ensure you have adequate coverage.

Mandatory Coverage Requirements

Washington State doesn’t mandate specific coverage amounts for home insurance. However, most mortgage lenders require borrowers to have insurance that covers at least the outstanding loan amount. This ensures the lender’s investment is protected in case of damage or loss. Additionally, homeowners should consider the replacement cost of their home and belongings to determine the appropriate coverage amount.

Factors Influencing Home Insurance Premiums

Several factors influence home insurance premiums in Washington State. These include:

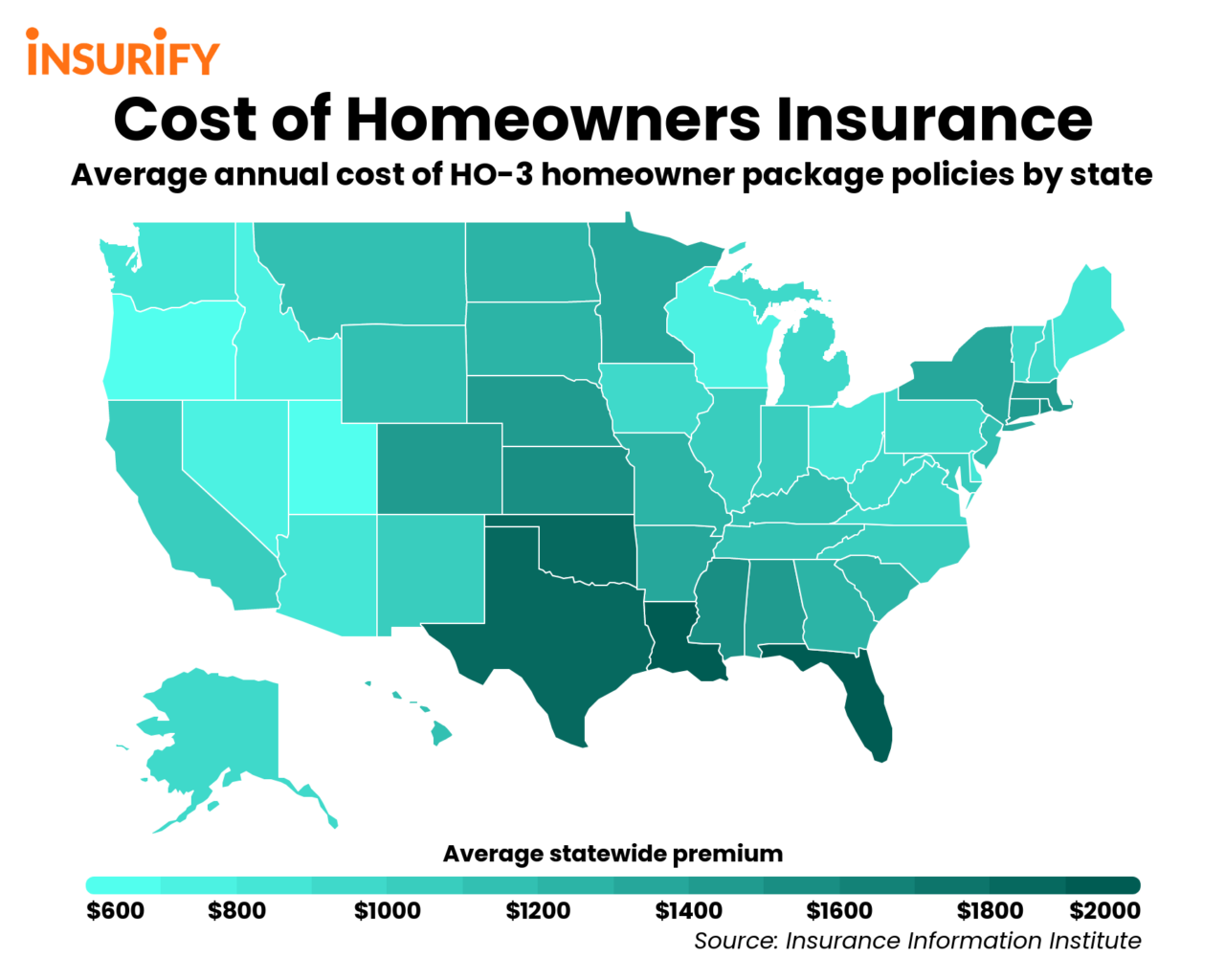

- Location: Homes located in areas prone to natural disasters, such as earthquakes or wildfires, generally have higher premiums. The risk of damage or loss is higher in such regions, leading to increased insurance costs.

- Home Value: The value of your home is a significant factor in determining your premium. Higher-valued homes typically require more coverage, resulting in higher premiums.

- Construction Type: Homes built with fire-resistant materials, such as brick or concrete, may qualify for lower premiums compared to those built with wood.

- Age of Home: Older homes may have outdated wiring or plumbing, increasing the risk of damage or loss. This can lead to higher premiums.

- Credit Score: Your credit score can impact your insurance premiums. Individuals with good credit scores may qualify for lower premiums, as they are perceived as less risky by insurers.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, as you are assuming more financial responsibility for smaller claims.

- Coverage Options: The type and amount of coverage you choose will also affect your premiums. Additional coverage options, such as flood insurance or earthquake insurance, can increase your overall premium.

Types of Home Insurance Policies

Home insurance policies in Washington State generally fall into two main categories:

- HO-3 (Special Form): This is the most comprehensive type of homeowner’s insurance policy. It provides coverage for all perils except those specifically excluded in the policy. This policy offers broad protection for your home and belongings.

- HO-8 (Modified Coverage): This policy is designed for older homes, often with historical significance. It provides coverage for named perils, such as fire, wind, and hail. The coverage is more limited compared to the HO-3 policy.

Factors Affecting Home Insurance Costs

Several factors influence the cost of home insurance in Washington State. Understanding these factors can help you make informed decisions and potentially save money on your premiums.

Location and Risk Factors

Your home’s location plays a significant role in determining your insurance costs. Insurance companies assess the risk of natural disasters and other perils in different areas.

- Earthquake Risk: Washington State is prone to earthquakes, especially in the Puget Sound region. Homes located in high-risk zones will have higher premiums due to the increased likelihood of earthquake damage.

- Wildfire Risk: Certain areas of Washington State, particularly in Eastern Washington, are susceptible to wildfires. Homes situated in these areas will likely face higher premiums due to the increased risk of fire damage.

- Flood Risk: Coastal areas and areas near rivers and lakes are more prone to flooding. Homes in these locations may have higher insurance premiums due to the increased risk of flood damage.

Home Features and Value

The features and value of your home directly impact your insurance costs.

- Construction Materials: Homes built with fire-resistant materials like brick or stone tend to have lower insurance premiums than homes constructed with wood.

- Roof Age and Condition: A newer roof in good condition is generally considered a lower risk by insurance companies, resulting in lower premiums. Older roofs may require higher premiums due to the increased risk of damage or failure.

- Security Systems: Homes equipped with security systems, such as alarms and surveillance cameras, are often considered lower risk by insurance companies. These features can lead to lower premiums due to the reduced likelihood of theft or vandalism.

- Home Value: The higher the value of your home, the more it will cost to insure. Insurance premiums are typically calculated based on the replacement cost of your home, which is the amount it would cost to rebuild it in the event of a total loss.

Other Factors

Beyond location and home features, several other factors can influence your home insurance costs.

- Your Credit Score: Insurance companies often use credit scores as an indicator of financial responsibility. Individuals with higher credit scores may qualify for lower premiums.

- Your Claims History: A history of filing insurance claims can lead to higher premiums. Insurance companies may perceive you as a higher risk if you have filed numerous claims in the past.

- Your Deductible: The deductible is the amount you agree to pay out of pocket in the event of a claim. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums.

- Insurance Coverage: The type and amount of coverage you choose can significantly impact your premiums. For example, comprehensive coverage, which protects against a wider range of perils, typically costs more than basic coverage.

Finding the Cheapest Home Insurance

Finding the most affordable home insurance in Washington State involves careful comparison and consideration of various factors. You can achieve this by following a structured approach, utilizing online tools, and engaging with insurance brokers.

Comparing Home Insurance Quotes, Cheapest home insurance in washington state

Comparing quotes from different insurance providers is essential to finding the best price. Here’s a step-by-step guide:

- Gather Your Information: Before contacting insurers, gather all necessary information, including your property details, coverage preferences, and any relevant discounts you may qualify for.

- Contact Multiple Providers: Reach out to at least three to five different insurance companies. You can do this through their websites, phone calls, or by visiting their offices.

- Provide Accurate Information: When requesting quotes, ensure you provide accurate information about your property, including its age, size, location, and any safety features. Accurate information helps ensure you receive an accurate quote.

- Compare Quotes Carefully: Once you receive quotes from different providers, compare them carefully, paying attention to coverage details, deductibles, and premium amounts. Consider the overall value of each policy, not just the lowest premium.

- Ask Questions: Don’t hesitate to ask questions if anything is unclear or if you have specific concerns. Understanding the details of each policy is crucial for making an informed decision.

Benefits of Using Online Comparison Tools

Online comparison tools can streamline the process of finding the cheapest home insurance. They offer several advantages:

- Convenience: Online tools allow you to compare quotes from multiple insurers without leaving your home.

- Speed: The process is generally faster than contacting each insurer individually.

- Transparency: You can easily compare quotes side-by-side, making it easier to identify the best deals.

- Objectivity: Online tools present information impartially, without any bias towards specific insurers.

Benefits of Using Insurance Brokers

Insurance brokers can provide valuable assistance in finding the cheapest home insurance. Here are some benefits of working with a broker:

- Expertise: Brokers have extensive knowledge of the insurance market and can help you navigate the complexities of home insurance.

- Personalized Service: Brokers can tailor their services to your specific needs and preferences.

- Access to Multiple Insurers: Brokers have relationships with numerous insurance companies, giving you access to a wider range of options.

- Negotiation: Brokers can negotiate on your behalf to secure better rates and coverage.

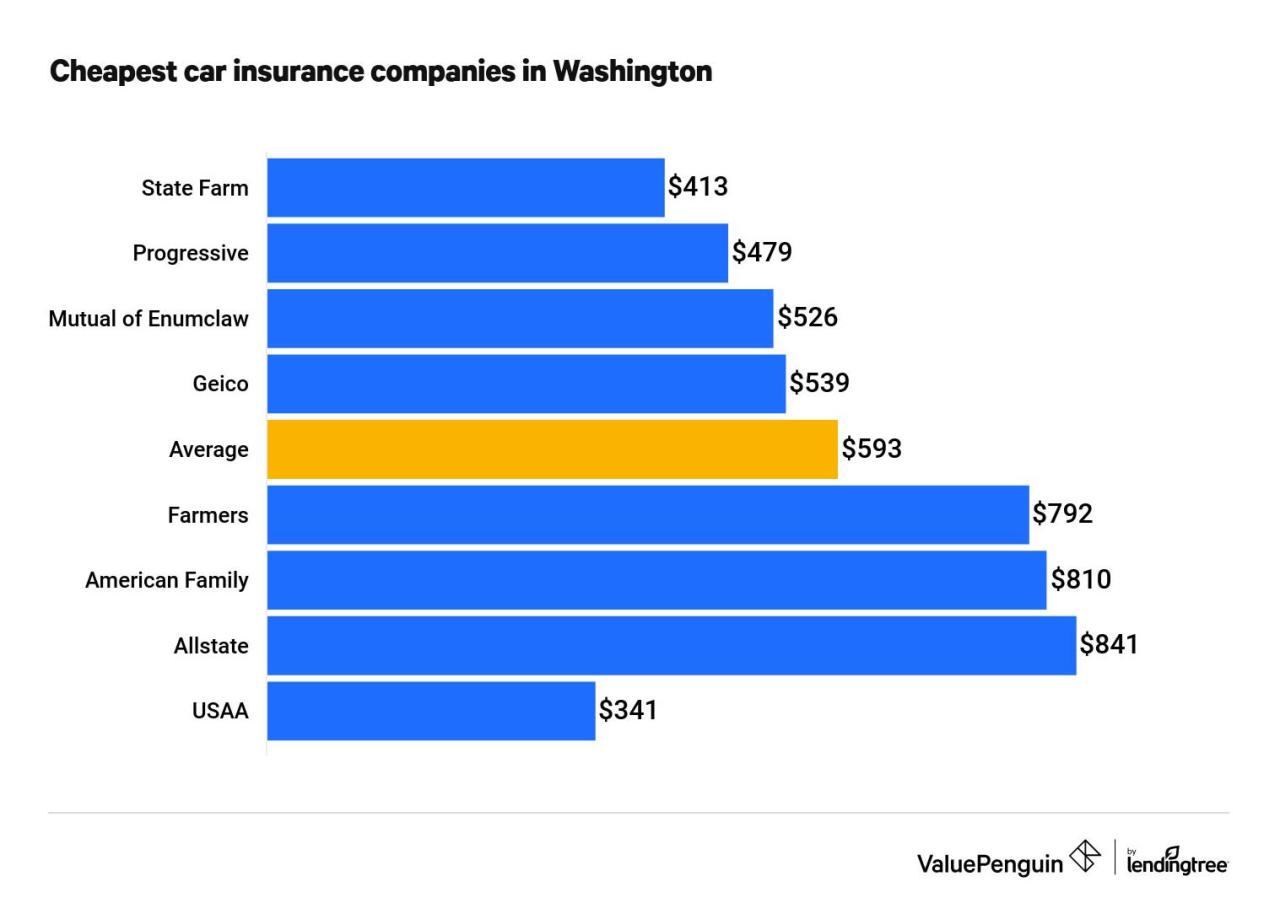

Reputable Home Insurance Companies in Washington State

Here’s a table listing some reputable home insurance companies operating in Washington State:

| Company Name | Website |

|---|---|

| State Farm | statefarm.com |

| Farmers Insurance | farmers.com |

| Allstate | allstate.com |

| Liberty Mutual | libertymutual.com |

| USAA | usaa.com |

Tips for Saving on Home Insurance

Finding the cheapest home insurance in Washington State is only part of the equation. You can save even more by taking steps to lower your premiums. There are a number of things you can do to reduce your home insurance costs. These range from simple actions like updating your security system to more involved projects like making energy-efficient upgrades.

Improve Your Home’s Safety and Security

Taking steps to improve your home’s safety and security can lead to significant savings on your home insurance premiums. Insurance companies view these actions as reducing the risk of damage or theft, making your home a less risky investment for them.

- Install a Security System: A professionally installed security system with monitoring can significantly lower your premiums. Insurance companies recognize the deterrent effect of a monitored system and the increased chance of recovering stolen items.

- Upgrade Locks and Doors: Solid core doors with high-quality deadbolt locks are more difficult to break into. Consider replacing old, weak locks with modern, high-security locks.

- Install Smoke Detectors and Carbon Monoxide Detectors: These devices are crucial for safety and can significantly reduce your premiums. Insurance companies recognize the importance of fire and carbon monoxide safety.

- Maintain Your Roof: A well-maintained roof protects your home from water damage and other weather-related issues. Regular inspections and repairs can prevent costly claims.

- Trim Trees and Shrubs: Overgrown trees and shrubs can obstruct views and provide hiding places for intruders. Regular trimming keeps your property well-maintained and safer.

Bundle Home and Auto Insurance

Bundling your home and auto insurance policies with the same company can often result in substantial savings. Insurance companies offer discounts for multiple policyholders, recognizing the increased loyalty and business volume.

- Reduced Premiums: Bundling policies typically leads to lower premiums compared to purchasing individual policies. The discount varies by insurer and policy type.

- Convenience: Managing both your home and auto insurance with one provider simplifies your insurance needs. You have one point of contact for all your insurance needs, streamlining communication and claims processes.

- Potential for Additional Discounts: Some insurers offer additional discounts for bundling multiple policies, such as discounts for good driving records or multiple vehicles.

Understanding Coverage and Exclusions

Home insurance in Washington state provides financial protection against various perils that could damage your property or cause personal injury. Understanding the different types of coverage and exclusions is crucial to ensure you have adequate protection.

Types of Coverage

Home insurance policies in Washington typically include several types of coverage, each addressing specific risks:

- Dwelling Coverage: This protects your home’s structure, including attached structures like garages and porches, against perils like fire, windstorm, and vandalism. It covers the cost of repairs or rebuilding your home.

- Other Structures Coverage: This extends coverage to detached structures like sheds, fences, and swimming pools, protecting them against similar perils as dwelling coverage.

- Personal Property Coverage: This covers your belongings inside your home, such as furniture, electronics, clothing, and jewelry, against perils like theft, fire, and water damage. The coverage amount is typically a percentage of your dwelling coverage, often 50% to 70%.

- Loss of Use Coverage: This provides financial assistance if you are unable to live in your home due to a covered peril. It covers expenses like temporary housing, food, and other living costs.

- Personal Liability Coverage: This protects you from financial liability if someone is injured on your property or you are held responsible for damages caused to others. This coverage includes legal defense costs.

- Medical Payments Coverage: This provides medical expense coverage for guests injured on your property, regardless of fault. It covers medical bills and other related expenses.

Common Exclusions and Limitations

While home insurance policies offer extensive coverage, certain events and situations are typically excluded. It’s crucial to understand these limitations to avoid surprises:

- Earthquakes: Most standard home insurance policies do not cover earthquake damage. You’ll need to purchase separate earthquake insurance for this specific risk.

- Flooding: Similar to earthquakes, standard policies generally don’t cover flood damage. You need to purchase flood insurance separately, especially if you live in an area prone to flooding.

- Acts of War: War-related damage or destruction is typically excluded from home insurance policies.

- Neglect or Intentional Acts: If damage results from intentional actions or negligence, your claim might be denied.

- Certain Perils: Some policies may have specific exclusions for perils like mold, insect infestation, or damage caused by pets.

- Deductibles: You’ll have to pay a deductible, a predetermined amount, before your insurance company covers the remaining costs of a covered claim.

- Coverage Limits: There are often limits on the amount of coverage for specific types of property, such as jewelry or fine art. It’s essential to review these limits and consider additional coverage if necessary.

Choosing the Right Coverage Levels

The appropriate coverage levels depend on your individual needs and circumstances. Consider these factors when choosing coverage:

- Value of your home: The dwelling coverage should be sufficient to rebuild your home in case of a total loss. Consider the current market value and construction costs.

- Value of your belongings: Determine the value of your personal property and ensure you have enough coverage to replace them. Consider inventorying valuable items and obtaining additional coverage if needed.

- Liability risks: Evaluate your liability risks based on your lifestyle and activities. If you have a swimming pool, pets, or host frequent gatherings, you might need higher liability coverage.

- Financial situation: Consider your financial situation and how much you can afford to pay in premiums and deductibles. It’s essential to balance coverage levels with your budget.

Epilogue: Cheapest Home Insurance In Washington State

Securing the cheapest home insurance in Washington State requires a proactive approach. By understanding the factors that influence premiums, comparing quotes diligently, and implementing cost-saving strategies, you can find a policy that offers comprehensive coverage at a price that fits your budget. Remember, the right insurance policy provides peace of mind, knowing your home is protected against unforeseen events.

FAQ Summary

What are the minimum coverage requirements for home insurance in Washington State?

Washington State requires homeowners to carry a minimum amount of liability coverage to protect themselves from financial losses due to accidents or injuries on their property.

What are some common exclusions in home insurance policies?

Home insurance policies typically exclude coverage for certain events, such as earthquakes, floods, and acts of war. It’s essential to review the policy details to understand what is and isn’t covered.

How often should I review my home insurance policy?

It’s recommended to review your home insurance policy at least annually to ensure it still meets your needs and consider any changes in your home’s value, coverage requirements, or risk factors.