Cheap auto insurance State Farm is a popular choice for drivers seeking affordable coverage. State Farm, a well-established insurance provider, offers a wide range of auto insurance options tailored to diverse needs and budgets. Understanding the factors influencing State Farm’s pricing structure and exploring strategies to secure affordable rates are crucial for making informed decisions.

This article delves into the intricacies of cheap auto insurance from State Farm, analyzing its coverage options, pricing factors, and strategies for finding the best deals. We’ll explore how State Farm’s discounts and promotions can help you save money, and provide insights into their customer service and overall experience.

Understanding State Farm’s Auto Insurance Offerings

State Farm is a well-established and reputable insurance company with a long history in the auto insurance market. Founded in 1922, it has grown to become one of the largest and most trusted insurance providers in the United States. Its commitment to customer satisfaction and financial stability has earned it a strong reputation among consumers.

State Farm’s Auto Insurance Coverage Options

State Farm offers a comprehensive range of auto insurance coverage options designed to meet the diverse needs of its customers. These options include:

- Liability Coverage: This essential coverage protects you financially if you cause an accident that results in injuries or damage to another person’s property. It typically includes bodily injury liability and property damage liability coverage.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Medical Payments Coverage (MedPay): This coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault, in case of an accident.

- Personal Injury Protection (PIP): This coverage, available in some states, provides coverage for medical expenses, lost wages, and other expenses related to injuries sustained in an accident.

- Rental Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged or stolen and is being repaired or replaced.

State Farm’s Auto Insurance Pricing Structure

State Farm’s auto insurance premiums are determined by a variety of factors, including:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, plays a significant role in determining your premium. A clean driving record generally results in lower premiums.

- Vehicle Type: The make, model, year, and safety features of your vehicle influence your premium. More expensive or higher-performance vehicles typically have higher premiums.

- Location: Your location, including the state and zip code, affects your premium due to factors such as traffic density, crime rates, and weather conditions.

- Age and Gender: Younger and inexperienced drivers often have higher premiums due to their higher risk of accidents.

- Credit History: In some states, your credit history can be a factor in determining your auto insurance premium.

- Coverage Options: The type and amount of coverage you choose will affect your premium. More coverage generally results in higher premiums.

State Farm offers various discounts to help customers save on their auto insurance premiums. These discounts can include good driver discounts, safe driver discounts, multi-car discounts, and more.

Factors Affecting Cheap Auto Insurance Rates

Getting the most affordable auto insurance rates requires understanding the factors that influence premiums. Several key elements play a significant role in determining how much you pay for your car insurance.

Driving History

Your driving history is a primary factor in determining your auto insurance rates. Insurance companies consider your driving record, including accidents, traffic violations, and driving convictions.

- A clean driving record with no accidents or violations typically results in lower premiums.

- Accidents, especially those involving injuries or property damage, can significantly increase your rates.

- Traffic violations, such as speeding tickets or reckless driving, can also lead to higher premiums.

Vehicle Type, Cheap auto insurance state farm

The type of vehicle you drive significantly impacts your insurance rates. Insurance companies assess factors like the vehicle’s make, model, year, safety features, and value.

- Luxury or high-performance vehicles are generally more expensive to insure due to their higher repair costs and greater risk of theft.

- Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, often qualify for discounts.

- Older vehicles may have lower insurance premiums due to their lower value and potential for depreciation.

Location

Your location, including the state and zip code, influences your auto insurance rates. Insurance companies consider factors such as the density of population, traffic congestion, crime rates, and weather conditions.

- Urban areas with higher population density and traffic congestion tend to have higher insurance rates due to an increased risk of accidents.

- Areas with higher crime rates may also have higher insurance premiums due to a greater risk of theft or vandalism.

- Regions prone to natural disasters, such as hurricanes, earthquakes, or floods, may have higher insurance rates to account for potential damage.

Credit Score

Surprisingly, your credit score can also impact your auto insurance rates. Insurance companies use credit score as an indicator of financial responsibility.

- Individuals with good credit scores are often considered lower risk and may qualify for lower insurance premiums.

- A lower credit score may indicate a higher risk to insurance companies, leading to potentially higher premiums.

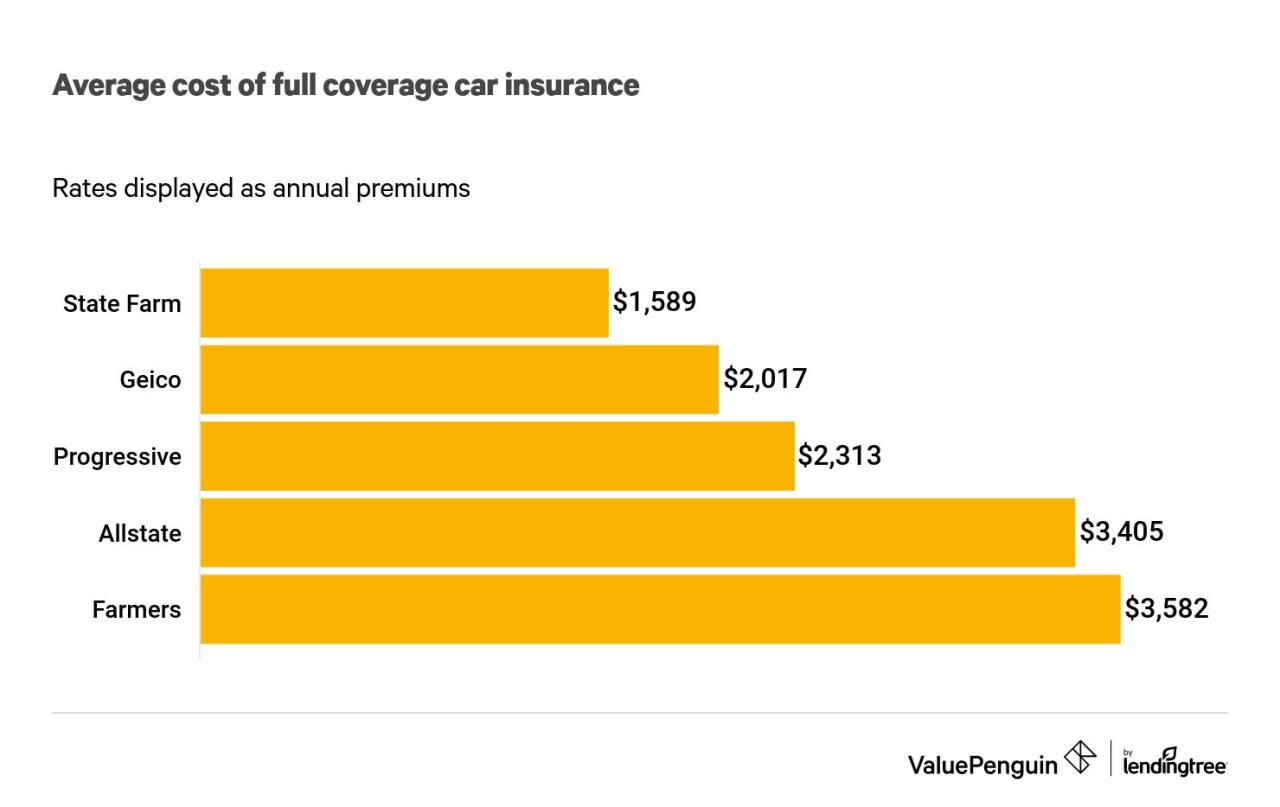

State Farm Rates Compared to Other Providers

State Farm is a major insurance provider, and its rates can vary depending on your individual circumstances. To find the most competitive rates, it’s essential to compare quotes from multiple insurance companies.

- Online insurance comparison websites can help you quickly compare rates from different providers, including State Farm.

- Consider factors like coverage options, customer service, and financial stability when evaluating different insurance companies.

Discounts and Promotions

State Farm offers various discounts and promotions to help customers save on their auto insurance premiums.

- Good Driver Discount: This discount is typically offered to drivers with a clean driving record, rewarding safe driving habits.

- Safe Driver Discount: Similar to the good driver discount, this reward drivers who maintain a safe driving record.

- Multi-Policy Discount: State Farm offers discounts for bundling multiple insurance policies, such as auto, home, or renters insurance.

- Anti-theft Device Discount: This discount is available to drivers who install anti-theft devices on their vehicles, reducing the risk of theft.

- Defensive Driving Course Discount: Completing a defensive driving course can qualify you for a discount, demonstrating your commitment to safe driving practices.

Strategies for Finding Affordable State Farm Auto Insurance

Finding affordable auto insurance with State Farm requires a strategic approach. You can leverage various tools and strategies to get the best possible rate.

Obtaining a Quote from State Farm

To get a quote from State Farm, follow these steps:

- Visit the State Farm website: Navigate to the State Farm website and locate the “Get a Quote” section. This is usually found on the homepage or in the “Auto Insurance” section.

- Provide basic information: You’ll be asked to enter information about yourself, your vehicle, and your driving history. This includes your name, address, date of birth, driving license details, vehicle make and model, and any past accidents or violations.

- Choose coverage options: State Farm offers various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Select the coverage levels that meet your needs and budget.

- Get your quote: After entering your information and selecting coverage options, State Farm will generate a personalized quote. You can then review the quote details, including the premium amount, coverage limits, and deductibles.

Comparing Quotes from Different Insurance Companies

Comparing quotes from multiple insurance companies is crucial to ensure you’re getting the best possible rate. This process involves:

- Using online comparison tools: Websites like Insurance.com, NerdWallet, and Policygenius allow you to compare quotes from multiple insurers simultaneously. These tools simplify the process and help you find the most competitive rates.

- Contacting insurance companies directly: You can also contact insurance companies directly to request quotes. This allows you to ask specific questions about coverage options and discounts.

- Reviewing quote details carefully: Once you have quotes from multiple companies, carefully compare the coverage details, premium amounts, and deductibles. Consider factors like the company’s financial stability, customer service reputation, and claim handling process.

The Importance of Shopping Around and Negotiating

Shopping around and negotiating with insurance providers are essential to secure the best possible rate. This involves:

- Contacting multiple insurance companies: Don’t limit yourself to just a few companies. Contact as many insurers as possible to get a broad range of quotes.

- Negotiating discounts: Ask about available discounts, such as good driver, multi-car, and safety features discounts. State Farm offers a wide range of discounts that can significantly reduce your premium.

- Reviewing your policy periodically: It’s advisable to review your policy at least annually to ensure you’re still getting the best rate. You may be eligible for additional discounts or need to adjust your coverage levels based on changes in your circumstances.

Tips for Lowering Your Auto Insurance Costs with State Farm

Finding affordable auto insurance is a priority for many drivers, and State Farm offers a variety of ways to reduce your premiums. By implementing a few smart strategies, you can significantly lower your monthly payments and enjoy the peace of mind that comes with comprehensive coverage.

Maintain a Good Driving Record

A clean driving record is essential for obtaining lower insurance rates. State Farm, like most insurers, rewards safe drivers with discounted premiums. Every traffic violation, accident, or DUI can lead to a significant increase in your insurance costs. By avoiding risky behaviors behind the wheel and adhering to traffic laws, you can significantly reduce your insurance premiums.

Analyzing State Farm’s Customer Experience

State Farm, a leading insurance provider, strives to deliver a positive customer experience. Their commitment to customer satisfaction is evident in their various service channels and their dedication to resolving issues promptly and efficiently.

Customer Service Channels

State Farm provides multiple avenues for customers to access their services.

- Online Platforms: State Farm offers a comprehensive online platform where customers can manage their policies, file claims, make payments, and access other services. The platform is user-friendly and provides a convenient way to interact with State Farm anytime, anywhere.

- Phone Support: State Farm provides 24/7 phone support for customers seeking assistance with their insurance needs. Their agents are available to answer questions, provide guidance, and help with various tasks, such as filing claims or making policy changes.

- Physical Locations: State Farm has a vast network of physical locations across the United States. Customers can visit these locations to speak with an agent in person, discuss their insurance needs, or file claims.

Ease of Filing Claims

State Farm aims to make the claims process as straightforward as possible.

- Online Claim Filing: Customers can file claims online through State Farm’s website or mobile app. This process is typically quick and convenient, allowing customers to submit their claims from the comfort of their homes.

- 24/7 Claims Support: State Farm provides 24/7 claims support through their phone lines, allowing customers to report accidents or incidents at any time.

- Dedicated Claim Adjusters: Once a claim is filed, State Farm assigns a dedicated claim adjuster to handle the process. The adjuster will work with the customer to gather information, assess damages, and determine the appropriate compensation.

Customer Testimonials and Reviews

Customer feedback is crucial for understanding the overall customer experience.

“I’ve been with State Farm for over 10 years and have always been impressed with their customer service. They’re always helpful and responsive, and I’ve never had any issues filing claims.” – John Smith, a satisfied State Farm customer.

While customer reviews can vary, State Farm consistently receives positive feedback for its customer service and claims handling processes. Many customers appreciate the company’s responsiveness, helpfulness, and commitment to resolving issues efficiently.

Considerations for Choosing State Farm Auto Insurance: Cheap Auto Insurance State Farm

Choosing the right auto insurance provider is a crucial decision, and State Farm is a well-established and reputable option. Before committing to State Farm, it’s essential to weigh the pros and cons and consider if their offerings align with your specific needs and preferences.

Comparing Pros and Cons

To help you make an informed decision, here’s a comparison of the advantages and disadvantages of choosing State Farm for your auto insurance:

| Pros | Cons |

|---|---|

| Wide availability across the United States | May not offer the most competitive rates in all areas |

| Strong reputation for customer service | Some customers have reported issues with claims processing |

| Wide range of coverage options | May have stricter underwriting guidelines than other insurers |

| Discount programs for safe driving and other factors | May not be the best option for drivers with a poor driving history |

Factors to Consider

Several factors should be considered when deciding if State Farm is the right fit for your auto insurance needs:

- Your driving history: State Farm’s rates can be influenced by your driving record, including accidents, violations, and years of driving experience. If you have a clean driving record, State Farm may be a good option. However, if you have a history of accidents or violations, you may find more competitive rates with other insurers.

- Your location: State Farm’s rates can vary significantly by location, so it’s important to compare quotes from multiple insurers in your area. State Farm may offer competitive rates in some regions but not others.

- Your vehicle: The type, age, and value of your vehicle can affect your insurance rates. State Farm’s rates for certain vehicle models or types may be higher or lower than other insurers.

- Your coverage needs: State Farm offers a wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It’s important to choose the coverage that best meets your needs and budget.

- Your budget: State Farm’s rates can vary depending on your coverage options and discounts. It’s essential to compare quotes from multiple insurers and find a policy that fits your budget.

Benefits and Drawbacks

State Farm’s auto insurance policies offer several benefits, including:

- Strong financial stability: State Farm is a financially sound company with a long history of paying claims. This can provide peace of mind knowing that your insurance will be there when you need it.

- Extensive network of agents: State Farm has a vast network of agents across the country, making it easy to find an agent near you. This can be beneficial for personalized service and assistance with your policy.

- Variety of discounts: State Farm offers a wide range of discounts for safe driving, bundling policies, and other factors. These discounts can help you save money on your premium.

However, it’s important to be aware of some potential drawbacks:

- Potentially higher rates: State Farm’s rates may not always be the most competitive, especially in certain areas or for drivers with a poor driving history.

- Customer service inconsistencies: While State Farm generally has a good reputation for customer service, some customers have reported issues with claims processing or other aspects of their experience.

- Stricter underwriting guidelines: State Farm may have stricter underwriting guidelines than other insurers, which could lead to higher premiums or a denial of coverage for some drivers.

Summary

Securing cheap auto insurance with State Farm involves a multifaceted approach. By understanding the factors that influence pricing, utilizing available discounts, and comparing quotes from different insurers, you can find a policy that meets your needs and budget. State Farm’s reputation for customer service and its comprehensive coverage options make it a compelling choice for many drivers. Ultimately, the key to finding the best deal lies in thorough research, careful consideration, and effective negotiation.

Key Questions Answered

How can I get a quote from State Farm?

You can obtain a quote online, over the phone, or by visiting a local State Farm agent. The process typically involves providing information about your vehicle, driving history, and desired coverage levels.

What are some common discounts offered by State Farm?

State Farm offers a variety of discounts, including good driver discounts, safe driver discounts, multi-policy discounts, and discounts for safety features like anti-theft devices.

Is State Farm’s customer service good?

State Farm generally receives positive reviews for its customer service. They offer multiple channels for support, including online platforms, phone support, and physical locations.