Car insurance rates state farm – Car insurance rates from State Farm are a key consideration for many drivers. State Farm, a leading insurance provider, has a long history of offering competitive rates and a wide range of coverage options. Understanding how State Farm determines rates and what factors influence them is crucial for making informed decisions about your car insurance.

This article explores the factors that affect State Farm car insurance rates, including driving history, vehicle type, location, and more. We’ll also delve into State Farm’s rate calculation methodology, discuss the variations in rates across different states, and examine the discounts and savings opportunities available. By understanding these aspects, you can gain valuable insights into how to potentially lower your car insurance costs and find the best policy for your needs.

Understanding State Farm Car Insurance

State Farm is a leading provider of car insurance in the United States, known for its reliable service and competitive rates. Founded in 1922, State Farm has grown to become one of the largest insurance companies in the world, serving millions of customers nationwide.

History of State Farm

State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois. The company initially focused on providing automobile insurance to farmers in the Midwest. State Farm’s success was built on its commitment to providing affordable and reliable insurance coverage to a broad range of customers.

Key Features and Benefits of State Farm Car Insurance Policies

State Farm offers a comprehensive range of car insurance policies to meet the needs of diverse drivers. Some key features and benefits of State Farm car insurance include:

- Comprehensive Coverage: State Farm provides comprehensive coverage for a wide range of events, including accidents, theft, vandalism, and natural disasters.

- Competitive Rates: State Farm is known for its competitive rates, often offering discounts for safe driving, bundling policies, and other factors.

- Excellent Customer Service: State Farm has a reputation for providing excellent customer service, with agents available to answer questions and assist with claims.

- Financial Stability: State Farm is a financially stable company with a strong track record of paying claims and meeting its obligations to policyholders.

- Variety of Discounts: State Farm offers a variety of discounts to help customers save money on their premiums, including safe driver discounts, good student discounts, and multi-policy discounts.

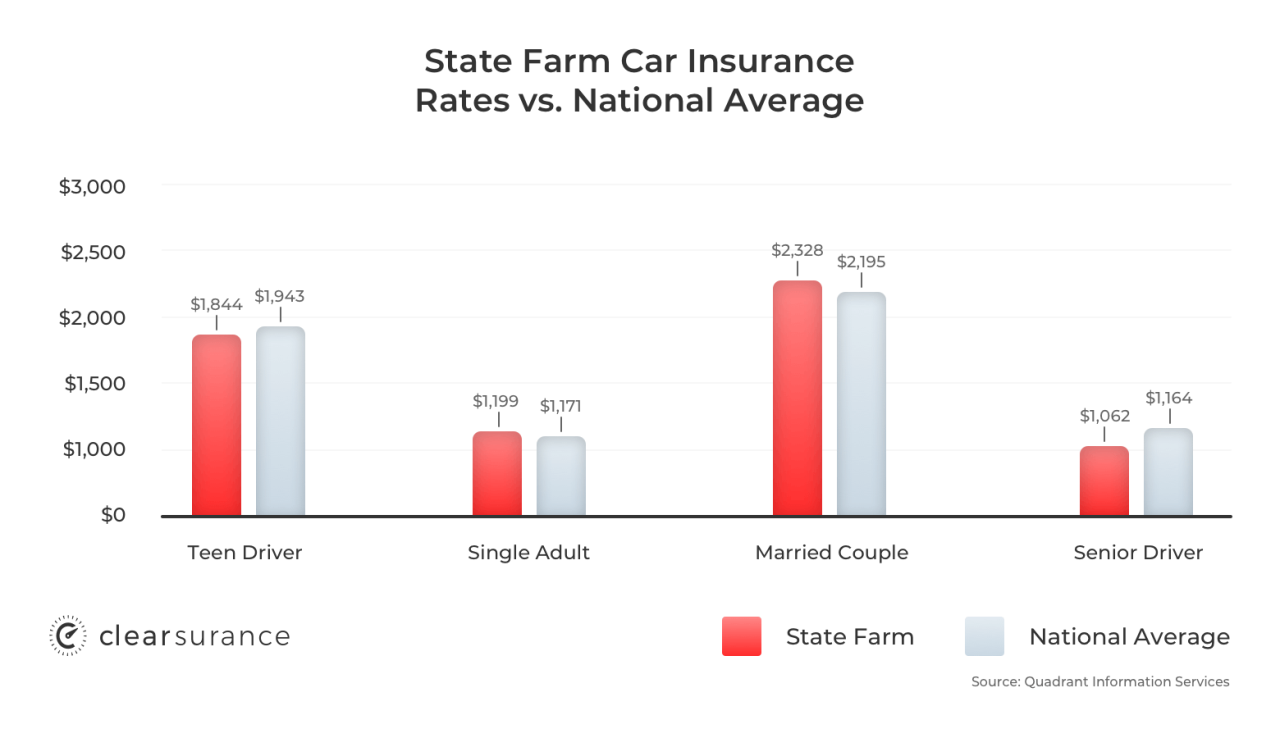

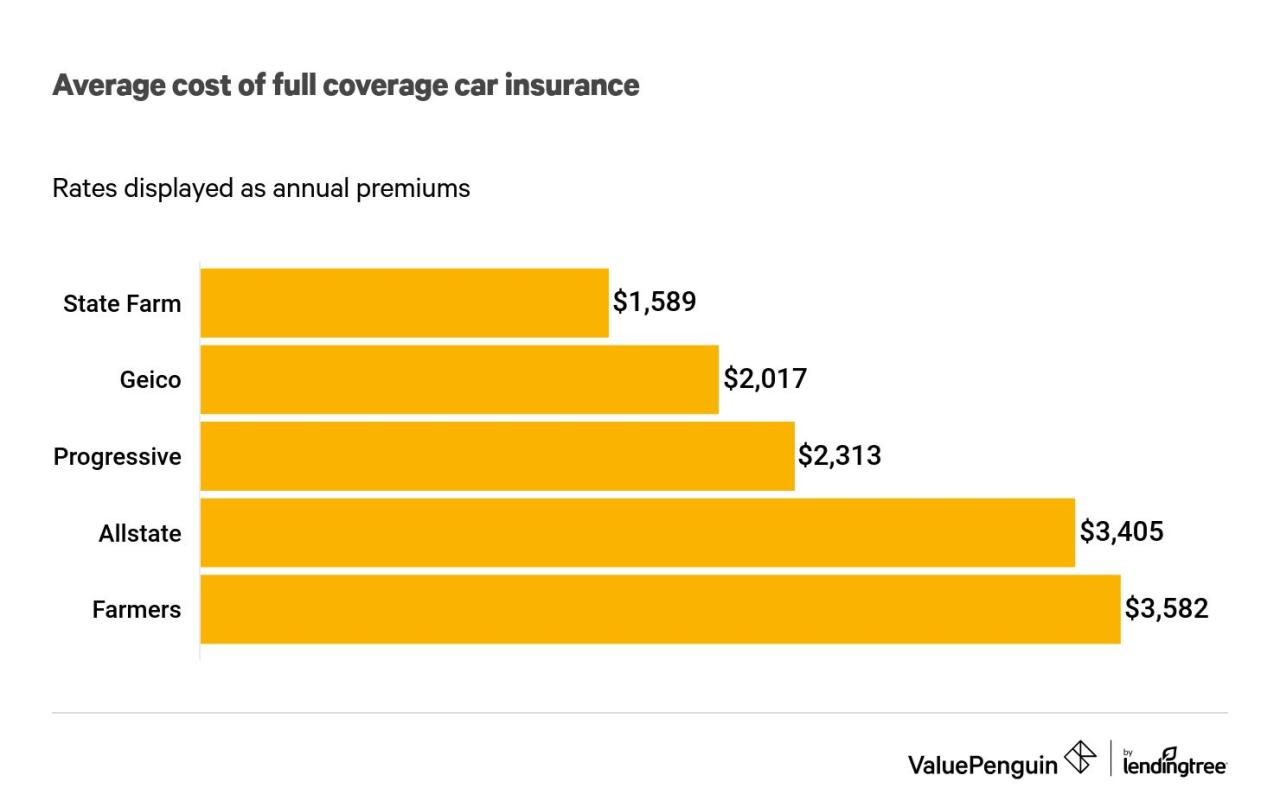

Comparison with Other Car Insurance Providers

State Farm competes with other major car insurance providers, such as Geico, Progressive, and Allstate. While each company offers its own unique features and benefits, State Farm is generally considered a strong option for drivers seeking a balance of affordability, coverage, and customer service.

Factors Influencing Car Insurance Rates

Car insurance rates are influenced by various factors, some within your control and others outside your control. Understanding these factors is crucial for making informed decisions that can help you secure the best possible rates for your needs. State Farm considers these factors when calculating your premium.

Factors Affecting Car Insurance Rates, Car insurance rates state farm

State Farm, like other insurance providers, uses a complex formula to determine your car insurance rates. These rates are based on a combination of factors that assess your risk profile as a driver.

- Your Driving History: This is a key factor in determining your rates. State Farm assesses your past driving record, including accidents, traffic violations, and driving convictions. A clean driving record generally translates to lower premiums, while a history of accidents or violations can lead to higher rates.

- Your Age and Gender: Insurance companies have statistically observed that younger drivers, especially males, are more likely to be involved in accidents. Therefore, younger drivers often pay higher premiums than older drivers. However, this trend can change as drivers gain experience and age.

- Your Location: Where you live significantly influences your insurance rates. Areas with higher crime rates, traffic congestion, and accident frequency typically have higher insurance premiums. For example, urban areas often have higher rates than rural areas.

- Your Vehicle: The type of vehicle you drive, its make, model, year, and safety features play a role in determining your insurance rates. Luxury cars or vehicles with high repair costs often have higher premiums. Conversely, cars with advanced safety features like anti-lock brakes and airbags may qualify for discounts.

- Your Coverage: The amount and type of coverage you choose also impact your premiums. Comprehensive and collision coverage, which protect you against damages from non-accident events, are generally more expensive than liability coverage, which covers damages to other people and property.

- Your Credit Score: State Farm, like many insurance companies, may consider your credit score as a factor in determining your car insurance rates. This is because a good credit score is often associated with responsible financial behavior, which can be an indicator of responsible driving habits. However, this practice is not uniform across all states.

How State Farm Calculates Premiums

State Farm, like other insurance companies, uses a complex algorithm to calculate premiums. This algorithm considers all the factors mentioned above, assigning weights to each based on statistical data and risk assessments. The resulting premium reflects your individual risk profile.

“State Farm’s rate calculation is based on a comprehensive analysis of your driving history, vehicle characteristics, location, and other factors. This approach ensures that premiums are tailored to your individual risk profile.”

State Farm’s Rate Calculation Methodology

State Farm, like other insurance companies, employs a complex and multifaceted approach to determine car insurance premiums. Their rate calculation methodology relies heavily on data analysis and risk assessment, aiming to strike a balance between affordability and accurate risk evaluation.

Data and Risk Assessment

State Farm leverages a vast amount of data to assess the risk associated with each policyholder. This data encompasses various factors, including:

- Driving History: This includes past accidents, traffic violations, and driving experience. A clean driving record generally translates to lower premiums, while a history of accidents or violations indicates a higher risk and potentially higher rates.

- Vehicle Information: The make, model, year, and safety features of the insured vehicle play a significant role. Newer vehicles with advanced safety features tend to be associated with lower premiums, while older vehicles with fewer safety features might attract higher rates.

- Demographics: Factors like age, gender, marital status, and location are considered, as statistical trends show correlations between these factors and driving risk. For example, younger drivers are often associated with higher risk due to inexperience.

- Credit History: State Farm, like many other insurers, may consider credit history as an indicator of financial responsibility. Individuals with a good credit score might receive lower premiums compared to those with a poor credit score.

- Coverage Options: The type and amount of coverage selected by the policyholder influence the premium. Comprehensive and collision coverage, for instance, generally result in higher premiums than liability coverage alone.

State Farm’s risk assessment process involves analyzing this data to predict the likelihood of an insured individual filing a claim. This prediction is based on historical trends and statistical models, allowing State Farm to tailor premiums to reflect the perceived risk associated with each policyholder.

Transparency and Fairness

State Farm’s rate calculation methodology is generally considered transparent, as the company provides information about the factors that influence premiums on its website and through its agents. However, the specific algorithms used to calculate rates are proprietary and not publicly disclosed. This lack of full transparency can make it difficult for policyholders to understand the exact rationale behind their premium.

While State Farm’s rate calculation system aims to be fair by considering a wide range of factors, some critics argue that certain factors, like credit history, may not be directly related to driving risk and can disproportionately impact certain demographics.

State Farm’s Rate Variations Across States

State Farm, like other major insurance companies, adjusts its car insurance rates based on various factors, including location. This means that the cost of car insurance can vary significantly from state to state. Understanding these variations is crucial for consumers seeking the best value for their insurance needs.

Average Car Insurance Rates Across States

The average car insurance rates across states can vary significantly. This variation is influenced by a multitude of factors, including state regulations, demographics, and driving conditions.

| State | Average Annual Premium |

|---|---|

| California | $2,200 |

| Texas | $1,800 |

| Florida | $2,400 |

| New York | $2,000 |

| Illinois | $1,600 |

Factors Influencing Rate Variations

State regulations play a significant role in determining car insurance rates. Some states have stricter regulations regarding coverage requirements or minimum liability limits, which can lead to higher premiums. Additionally, state-specific laws, such as no-fault insurance or the ability to sue for pain and suffering, can impact insurance costs.

Demographics also play a role in rate variations. States with higher population densities and more urban areas tend to have higher accident rates, leading to higher insurance premiums. The age and driving experience of the population also contribute to rate differences.

Driving conditions, such as road infrastructure, weather patterns, and traffic congestion, can significantly impact insurance costs. States with harsh weather conditions, like snow or hurricanes, often have higher rates due to increased risk of accidents.

Impact of Rate Variations

The variations in car insurance rates across states can impact affordability and access to insurance. In states with higher average premiums, consumers may find it more challenging to afford adequate coverage, particularly those with limited financial resources. This can lead to underinsurance or even driving without insurance, increasing risks for all drivers.

On the other hand, states with lower average premiums may offer greater affordability and access to insurance. This can encourage responsible driving and reduce the number of uninsured drivers, ultimately leading to safer roads.

Discounts and Savings Opportunities

State Farm offers a wide range of discounts that can significantly reduce your car insurance premiums. By taking advantage of these discounts, you can save money on your insurance costs and enjoy peace of mind knowing you’re getting the best possible deal.

State Farm’s Discount Categories

State Farm categorizes its discounts into various categories, making it easier for customers to understand and identify the discounts they qualify for. These categories include:

- Safe Driving Discounts: These discounts reward drivers with a clean driving record and safe driving habits. For example, the Good Driver Discount is offered to drivers with no accidents or violations for a specified period. Other discounts in this category include the Defensive Driving Discount, which is awarded to drivers who complete an approved defensive driving course, and the Accident Forgiveness Discount, which allows drivers to avoid a rate increase after their first accident.

- Vehicle-Related Discounts: These discounts are based on the type of vehicle you own. For example, the Anti-theft Device Discount is offered to drivers who have anti-theft devices installed in their vehicles, while the New Car Discount is offered to drivers who purchase a new car. Additionally, the Safe Vehicle Discount recognizes vehicles with advanced safety features, such as anti-lock brakes and airbags.

- Policy-Related Discounts: These discounts are based on the specific features of your insurance policy. For instance, the Bundling Discount is offered to customers who bundle their car insurance with other insurance products, such as home or renters insurance. Other policy-related discounts include the Paperless Discount, which rewards customers who opt for electronic communication, and the Pay-in-Full Discount, which is given to customers who pay their premium in full.

- Customer-Related Discounts: These discounts are based on your personal characteristics or affiliations. For example, the Good Student Discount is offered to students who maintain a certain GPA, while the Driver Training Discount is offered to drivers who have completed an approved driver training course. Additionally, the Military Discount is offered to active-duty military personnel and veterans.

Maximizing Your Savings

To maximize your savings on car insurance, it’s essential to understand the eligibility requirements for each discount and take steps to qualify. Here are some tips:

- Maintain a Clean Driving Record: Avoid accidents and traffic violations, as these can significantly impact your insurance premiums. Defensive driving courses can help you learn safe driving techniques and potentially earn a discount.

- Choose a Safe Vehicle: Opt for a vehicle with advanced safety features, such as anti-lock brakes and airbags. Newer vehicles are often equipped with these features, which can qualify you for a discount.

- Bundle Your Insurance: Combine your car insurance with other insurance products, such as home or renters insurance, to receive a significant discount. This can save you money on your overall insurance costs.

- Pay Your Premium in Full: If you have the financial means, paying your premium in full can qualify you for a discount. This can be a good option if you prefer to avoid monthly payments and potentially earn a lower rate.

- Explore Other Discounts: Consider other discounts you may be eligible for, such as the Good Student Discount, Military Discount, or Driver Training Discount. These discounts can help you further reduce your insurance costs.

Customer Experience and Reviews: Car Insurance Rates State Farm

State Farm, being one of the largest insurance providers in the United States, boasts a vast customer base and a long-standing reputation. Understanding the customer experience is crucial when evaluating any insurance company, and State Farm is no exception. Customer reviews and testimonials offer valuable insights into the quality of service, claims handling processes, and overall satisfaction with the company.

Customer Reviews and Testimonials

Customer reviews provide a snapshot of the experiences of real individuals who have interacted with State Farm. These reviews can be found on various platforms, including websites dedicated to consumer reviews, social media, and online forums.

- Many customers praise State Farm’s reliability and trustworthiness, highlighting the company’s long history and financial stability.

- Several customers commend the professionalism and responsiveness of State Farm’s agents and customer service representatives.

- Positive feedback also focuses on the user-friendly online platform and mobile app, which allow for convenient policy management and claims reporting.

- However, some customers express dissatisfaction with the claims process, citing delays, difficulties in communication, and challenges in resolving disputes.

- Other reviews highlight concerns regarding rate increases, with some customers feeling that their premiums have become excessive compared to competitors.

Overall Customer Satisfaction

Overall, State Farm enjoys a generally positive reputation among its customers. However, customer satisfaction can vary depending on individual experiences and specific service needs.

- According to J.D. Power’s 2023 U.S. Auto Insurance Satisfaction Study, State Farm ranked above average in overall customer satisfaction, achieving a score of 823 out of 1000.

- However, the study also revealed variations in satisfaction across different regions and demographics, suggesting that customer experience can be influenced by local factors and individual preferences.

Strengths and Weaknesses of Customer Service and Claims Handling

State Farm’s customer service and claims handling processes have both strengths and weaknesses.

- Strengths:

- State Farm’s extensive network of agents provides customers with personalized service and local expertise.

- The company offers a wide range of communication channels, including phone, email, online chat, and mobile app, allowing customers to choose the method that best suits their needs.

- State Farm’s claims process is generally straightforward, with clear instructions and online resources to guide customers through the process.

- Weaknesses:

- Some customers report delays in claims processing, particularly in cases involving complex or disputed claims.

- There have been instances of communication breakdowns between customers and claims adjusters, leading to frustration and dissatisfaction.

- While State Farm’s online platform is generally user-friendly, some customers find it difficult to navigate or encounter technical issues.

Getting a Quote and Choosing the Right Policy

Getting a car insurance quote from State Farm is a straightforward process. You can obtain a quote online, over the phone, or through a local State Farm agent.

Obtaining a Quote

To get a quote online, you’ll need to provide basic information about yourself and your vehicle, such as your name, address, date of birth, driving history, and vehicle make, model, and year. Once you’ve submitted your information, State Farm will provide you with a personalized quote.

- Online: Visit the State Farm website and enter your information on their quote request form.

- Phone: Call State Farm’s customer service line and provide the necessary details to an agent.

- Local Agent: Visit a local State Farm agent’s office and discuss your insurance needs.

Choosing the Right Policy

Once you have a quote, it’s important to carefully consider your options and choose the policy that best meets your needs and budget.

- Coverage Levels: State Farm offers different levels of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist.

- Deductibles: Higher deductibles generally result in lower premiums, but you’ll have to pay more out of pocket if you need to file a claim.

- Discounts: State Farm offers a variety of discounts, such as good driver, safe driver, and multi-policy discounts.

- Policy Features: Consider additional features like roadside assistance, rental car reimbursement, and accident forgiveness.

Comparing Quotes and Negotiating

To ensure you’re getting the best possible rate, it’s recommended to compare quotes from multiple insurance providers.

- Online Comparison Websites: Websites like Policygenius and The Zebra allow you to compare quotes from multiple insurers in one place.

- Negotiating: Once you’ve received quotes from several insurers, you can use them to negotiate a lower rate with State Farm.

- Review Your Policy Regularly: Your insurance needs may change over time, so it’s important to review your policy and make adjustments as necessary.

Final Review

Navigating the world of car insurance can feel overwhelming, but understanding the factors that influence State Farm’s rates can empower you to make informed decisions. By considering your individual needs and exploring the various discounts and options available, you can find a policy that provides adequate coverage at a price that fits your budget. Remember, comparing quotes and staying informed about your insurance options is essential to ensure you’re getting the best value for your money.

FAQ Insights

How does State Farm determine my car insurance rate?

State Farm uses a complex algorithm to calculate rates, taking into account various factors such as your driving history, vehicle type, location, age, and credit score.

What are some common discounts offered by State Farm?

State Farm offers a wide range of discounts, including good driver discounts, multi-policy discounts, and safe driver discounts.

How can I get a quote from State Farm?

You can get a quote online, over the phone, or by visiting a local State Farm agent.