Cheapest car insurance in the United States is a hot topic for many drivers. Finding the best deal can be a daunting task, but understanding the factors that influence car insurance costs is crucial. From your driving history to the type of vehicle you own, several elements play a role in determining your premiums.

This guide delves into the intricacies of car insurance in the United States, exploring different coverage options, strategies for finding the cheapest rates, and tips for saving money. We’ll break down the complexities of insurance policies, helping you navigate the process of securing the best protection at an affordable price.

Factors Influencing Car Insurance Costs

Car insurance premiums are determined by a complex interplay of factors that assess your risk as a driver. Insurance companies use these factors to calculate the likelihood of you filing a claim, and subsequently, the cost of covering that claim.

Demographics

Demographics play a significant role in determining your car insurance premiums.

- Age: Younger drivers, particularly those under 25, tend to have higher premiums due to their inexperience and higher risk of accidents. As drivers gain experience and age, their premiums generally decrease.

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, directly impacts your premiums. A clean driving history translates to lower premiums, while a history of accidents or violations will likely result in higher premiums.

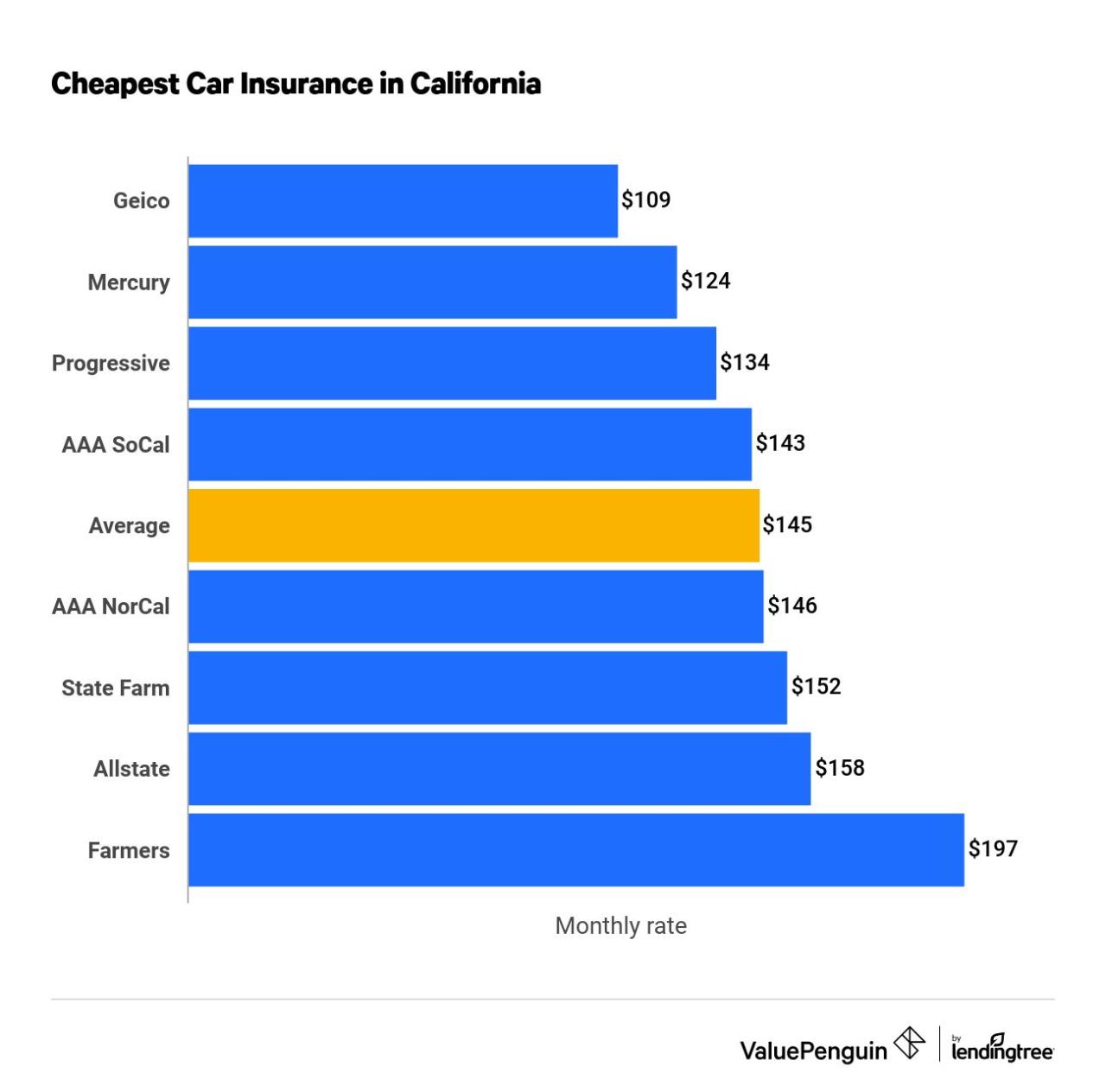

- Location: Where you live influences your insurance costs. Areas with high traffic density, crime rates, and accident rates often have higher premiums. This is because insurance companies assess the likelihood of accidents and the cost of claims in different regions.

Vehicle Type, Model, and Safety Features

The type of vehicle you drive significantly impacts your insurance premiums.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and potential for higher speeds and accidents.

- Vehicle Model: Certain car models have a history of higher accident rates or repair costs, which can lead to higher premiums. Insurance companies often track accident statistics and repair costs for different car models to assess their risk.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, often qualify for lower premiums. These features reduce the severity of accidents and can decrease the likelihood of claims.

Driving Habits and Usage

Your driving habits and how you use your vehicle also affect your insurance costs.

- Mileage: Drivers who commute long distances or frequently use their vehicles for work tend to have higher premiums. Increased mileage means a higher risk of accidents.

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, directly impacts your premiums. A clean driving history translates to lower premiums, while a history of accidents or violations will likely result in higher premiums.

- Parking Location: If you park your car in a high-crime area or on the street, you may face higher premiums due to the increased risk of theft or vandalism.

Types of Car Insurance Coverage

Car insurance is a necessity for most car owners, and understanding the different types of coverage available is crucial for making informed decisions about your policy. Choosing the right coverage can help protect you financially in the event of an accident or other covered event.

Types of Car Insurance Coverage

Here’s a breakdown of the most common types of car insurance coverage:

- Liability Coverage: This is the most basic type of car insurance and is required in all states. Liability coverage protects you financially if you cause an accident that results in injuries or damage to another person’s property. It covers the costs of:

- Bodily injury liability: Covers medical expenses, lost wages, and other damages resulting from injuries you cause to others.

- Property damage liability: Covers damage to another person’s vehicle or property, such as a fence or building.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of fault. If you have a loan or lease on your car, the lender may require you to have collision coverage.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as:

- Theft

- Vandalism

- Fire

- Hail

- Flooding

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re injured in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages regardless of who was at fault in an accident. It’s available in some states.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of fault, if you’re injured in an accident. It’s often included in liability coverage, but you can purchase it separately.

Minimum Coverage Requirements by State

Each state has its own minimum requirements for car insurance coverage. These requirements are designed to ensure that drivers have at least some financial protection in case they cause an accident. Failing to meet these minimum requirements can result in fines, license suspension, or even jail time.

- Liability Coverage: Most states require a minimum amount of liability coverage, which varies by state. For example, in California, the minimum liability coverage requirements are $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $5,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: Many states require a minimum amount of uninsured/underinsured motorist coverage, which varies by state.

Benefits and Drawbacks of Coverage Options

Choosing the right car insurance coverage involves weighing the benefits and drawbacks of each option.

- Liability Coverage: This is a necessity for all drivers, but the minimum requirements may not be sufficient to cover all your potential liabilities in an accident.

Consider increasing your liability limits if you have significant assets or a high-risk driving record.

- Collision Coverage: This coverage is beneficial if you have a newer vehicle or a loan or lease on your car. However, it’s often expensive, and it may not be worthwhile if your vehicle is older or has a low value.

If your vehicle is older and you have a low deductible, it may be more cost-effective to self-insure for collision damage.

- Comprehensive Coverage: This coverage is particularly important if you live in an area prone to natural disasters or if your vehicle is expensive to replace. However, it’s not always necessary if your vehicle is older or has a low value.

Consider your risk factors and the value of your vehicle when deciding whether comprehensive coverage is necessary.

- Uninsured/Underinsured Motorist Coverage: This coverage is crucial because it protects you from financial hardship if you’re involved in an accident with an uninsured or underinsured driver.

It’s often advisable to have coverage limits that are equal to or greater than your liability limits.

- PIP: If available in your state, PIP coverage can provide peace of mind, knowing that your medical expenses and lost wages will be covered after an accident, regardless of fault.

However, PIP coverage can be expensive, and it may not be necessary if you have other health insurance.

- Medical Payments Coverage: This coverage can be a valuable supplement to your health insurance, especially if you have a high deductible.

However, it’s important to understand that it only covers medical expenses, not other damages.

Choosing the Right Coverage

The best way to choose the right car insurance coverage is to consider your individual needs and circumstances. Here are some factors to consider:

- Your driving record: A clean driving record will generally result in lower premiums. If you have a history of accidents or traffic violations, you may need to pay higher premiums.

- The value of your vehicle: The more expensive your vehicle is, the more it will cost to insure.

- Your financial situation: If you have a high net worth, you may want to consider increasing your liability limits. If you’re on a tight budget, you may need to prioritize coverage that’s essential for your financial protection.

- Your location: Car insurance rates can vary significantly depending on your location. Urban areas tend to have higher rates due to factors like higher population density and traffic congestion.

- Your age: Younger drivers generally pay higher premiums due to their higher risk of accidents.

- Your driving habits: Drivers who commute long distances or drive frequently may pay higher premiums than those who drive less.

- Your car’s safety features: Vehicles with advanced safety features, such as anti-lock brakes and airbags, may qualify for lower premiums.

Finding the Cheapest Car Insurance

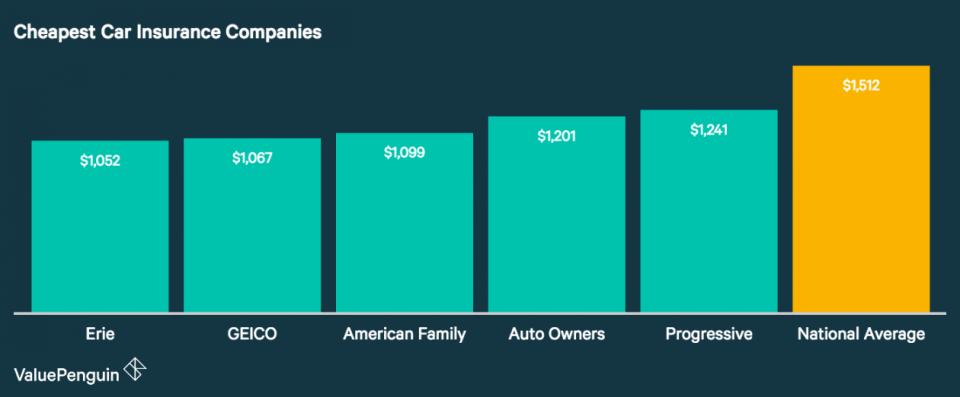

Finding the cheapest car insurance requires careful comparison and research. By understanding the factors influencing car insurance costs, you can make informed decisions to secure the most affordable coverage. This section will guide you through the process of comparing quotes, identifying key websites and tools, understanding policy details, and negotiating rates.

Comparing Car Insurance Quotes, Cheapest car insurance in the united states

Comparing car insurance quotes from multiple providers is crucial to finding the best deal. This involves obtaining quotes from different insurance companies and then comparing their prices, coverage options, and other factors.

- Gather Personal Information: Prepare essential information, such as your driving history, vehicle details, and contact information, as insurance companies will require it to generate accurate quotes.

- Use Online Comparison Tools: Numerous websites specialize in comparing car insurance quotes from various providers. These platforms allow you to enter your information once and receive multiple quotes instantly, saving you time and effort.

- Contact Insurance Companies Directly: While online comparison tools are convenient, contacting insurance companies directly can provide more personalized quotes and allow you to ask specific questions about their policies.

- Compare Quotes Carefully: Once you have gathered quotes from different providers, compare them side-by-side. Pay attention to the coverage offered, deductibles, premiums, and any additional fees or discounts.

Key Websites and Tools

Several websites and tools can assist you in obtaining car insurance quotes and finding the best deals.

- Insurance Comparison Websites: These websites, such as Insurance.com, NerdWallet, and Bankrate, allow you to compare quotes from multiple insurance providers simultaneously.

- Insurance Company Websites: Most major insurance companies have websites where you can request quotes and compare their coverage options.

- Mobile Apps: Many insurance companies offer mobile apps that allow you to manage your policy, get quotes, and even file claims.

Understanding Policy Details

Once you have received quotes from different insurance companies, it is essential to understand the details of each policy. This involves carefully reading the policy documents and understanding the following aspects:

- Coverage Limits: Coverage limits define the maximum amount your insurance company will pay for specific types of claims. Ensure the coverage limits are sufficient for your needs.

- Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums.

- Exclusions: Policy exclusions specify events or situations that are not covered by your insurance. Understanding these exclusions is crucial to avoid surprises during a claim.

Negotiating Insurance Rates

While insurance companies have set rates, there are ways to negotiate your premiums and potentially secure a better deal.

- Shop Around Regularly: Regularly comparing quotes from different providers can help you find better rates, as insurance premiums can fluctuate.

- Bundle Policies: Combining multiple insurance policies, such as auto and home insurance, with the same company can often lead to discounts.

- Improve Your Driving Record: Maintaining a clean driving record with no accidents or violations can significantly reduce your premiums.

- Ask About Discounts: Many insurance companies offer discounts for factors like good student status, safe driving courses, and installing safety features in your car.

Saving Money on Car Insurance

Lowering your car insurance premiums can be a significant way to save money, especially in the long run. Here are some practical strategies and factors to consider when looking to reduce your costs.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners, renters, or life insurance, can often lead to substantial discounts. This is because insurance companies often offer a lower overall premium when you purchase multiple policies from them.

For example, if you have a homeowners policy and a car insurance policy with the same company, you may receive a discount of 10% or more on both premiums.

Discounts Based on Driving History, Safety Features, and Other Factors

Many insurance companies offer discounts based on your driving history, the safety features of your vehicle, and other factors.

- Good Driving Record: Maintaining a clean driving record with no accidents or traffic violations can significantly reduce your premiums.

- Defensive Driving Courses: Completing a defensive driving course can also demonstrate your commitment to safe driving and lead to discounts.

- Safety Features: Vehicles equipped with safety features such as anti-theft devices, airbags, and anti-lock brakes are often considered safer and can qualify for discounts.

- Good Credit Score: Some insurance companies use your credit score as a factor in determining your premium. A good credit score may lead to lower rates.

- Vehicle Use: If you drive your car less frequently, such as for commuting or short trips, you may qualify for a discount.

- Loyalty: Staying with the same insurance company for an extended period can also lead to loyalty discounts.

Maintaining a Good Driving Record

Maintaining a good driving record is crucial for obtaining lower car insurance premiums.

- Avoid Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can significantly increase your insurance premiums.

- Drive Safely: Always drive defensively and follow all traffic laws to avoid accidents.

- Maintain Your Vehicle: Regular vehicle maintenance, such as oil changes and tire rotations, can help prevent breakdowns and accidents.

Understanding Car Insurance Policies: Cheapest Car Insurance In The United States

Car insurance policies are legal contracts that Artikel the terms and conditions of coverage between you and your insurance company. Understanding the key terms and conditions of your policy is crucial for making informed decisions about your coverage and navigating the claims process effectively.

Common Terms and Conditions

It’s important to understand the common terms and conditions found in car insurance policies. These terms define the scope of coverage, the responsibilities of both the insured and the insurer, and the procedures for filing claims.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums.

- Premium: The amount you pay periodically for your insurance coverage. Premiums are typically calculated based on factors such as your driving history, vehicle type, and location.

- Coverage Limits: The maximum amount your insurer will pay for covered losses. Coverage limits are typically specified for different types of coverage, such as liability, collision, and comprehensive.

- Exclusions: Certain events or situations that are not covered by your insurance policy. Common exclusions include intentional acts, wear and tear, and damage caused by acts of war.

- Limitations: Restrictions on the scope of coverage. For example, your policy may limit the amount of coverage for rental car reimbursement or towing services.

Filing a Claim

The process of filing a claim involves notifying your insurer about an accident or other covered event, providing necessary documentation, and cooperating with the claims adjuster.

- Report the Accident: Contact your insurer immediately after an accident, providing details about the incident, including date, time, location, and parties involved.

- Provide Documentation: Your insurer will likely require you to provide documentation, such as a police report, photos of the damage, and medical records, to support your claim.

- Cooperate with the Claims Adjuster: The claims adjuster will investigate the accident and determine the extent of the damage and the amount of coverage. You will need to cooperate with the adjuster by providing information and allowing them to inspect your vehicle.

- Vehicle Repair or Replacement: If your vehicle is damaged, your insurer will either repair it or replace it, depending on the extent of the damage and the terms of your policy.

Exceeding Coverage Limits

If the cost of repairs or replacement exceeds your coverage limits, you may be responsible for the remaining amount. For example, if your liability coverage limit is $100,000 and you are involved in an accident that results in $150,000 in damages, you will be responsible for the remaining $50,000.

Understanding Exclusions and Limitations

It is crucial to carefully review your policy to understand the exclusions and limitations that apply to your coverage. These provisions can significantly impact the scope of your coverage and the amount of compensation you receive in the event of a claim.

Final Wrap-Up

Ultimately, securing the cheapest car insurance in the United States involves a combination of informed decision-making and proactive strategies. By understanding the factors that affect premiums, comparing quotes from multiple providers, and taking advantage of available discounts, you can find the best value for your insurance needs. Remember, choosing the right coverage and understanding the terms of your policy are crucial steps in ensuring you’re adequately protected on the road.

Questions and Answers

What are the minimum car insurance requirements in my state?

Minimum car insurance requirements vary by state. It’s essential to check your state’s regulations to ensure you meet the legal minimums.

How can I bundle my car insurance with other policies?

Bundling your car insurance with other policies, such as home or renters insurance, can often lead to significant discounts.

What are some common discounts available on car insurance?

Common discounts include good driver discounts, safe vehicle discounts, and multi-car discounts.

What is the difference between collision and comprehensive coverage?

Collision coverage protects against damage to your vehicle in an accident, while comprehensive coverage covers damage from non-collision events like theft or natural disasters.