Cheaper car insurance than State Farm is definitely possible, and you don’t have to sacrifice coverage to save money. The car insurance market is competitive, and finding a better deal is often just a matter of knowing where to look and what to ask for.

This guide will explore the factors that influence car insurance costs, highlight alternative insurance providers, and provide actionable tips for lowering your premiums. We’ll also cover different types of coverage and help you make informed decisions about your insurance needs.

Understanding the Insurance Market

The car insurance market is a complex ecosystem driven by various factors that influence the cost of coverage. Understanding these factors is crucial for consumers seeking affordable insurance options.

Factors Influencing Car Insurance Costs

Several factors contribute to the cost of car insurance, and these factors are not always obvious to the average consumer. The insurance company uses these factors to assess risk and determine your premium.

- Driving Record: Your driving history, including accidents, traffic violations, and driving experience, significantly impacts your premium. Drivers with clean records and years of experience typically pay lower premiums.

- Vehicle Information: The make, model, year, and safety features of your vehicle influence your insurance costs. Newer, more expensive vehicles with advanced safety features tend to have higher premiums due to the higher cost of repairs and replacement.

- Location: Where you live influences your insurance costs due to factors like traffic density, crime rates, and weather conditions. Urban areas with high traffic and crime rates often have higher insurance premiums.

- Coverage Options: The level of coverage you choose, including liability, collision, and comprehensive coverage, impacts your premium. Higher coverage levels generally mean higher premiums.

- Credit Score: In many states, insurance companies use your credit score as a factor in determining your premium. This is based on the assumption that individuals with good credit scores are more responsible and less likely to file claims.

Coverage Options Offered by Insurance Companies

Insurance companies offer various coverage options to meet the diverse needs of their customers.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident and cause injury or damage to others. It covers medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage protects you if your vehicle is damaged in an accident, regardless of who is at fault. It covers repairs or replacement of your vehicle, minus your deductible.

- Comprehensive Coverage: This coverage protects you from damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. It covers repairs or replacement of your vehicle, minus your deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It covers your medical expenses, lost wages, and property damage.

Pricing Models and Discounts Offered by State Farm and Other Insurers

State Farm and other major insurers use different pricing models and offer various discounts to attract customers.

- State Farm: State Farm uses a proprietary pricing model that considers factors like your driving record, vehicle information, and location. They offer discounts for safe driving, good student, multi-car, and bundling insurance policies.

- Other Insurers: Other major insurers like Geico, Progressive, and Allstate also use various pricing models and offer a range of discounts. These discounts can include safe driver, good student, multi-car, bundling, and loyalty discounts. Some insurers also offer discounts for using telematics devices that track your driving habits.

Finding Cheaper Alternatives to State Farm

You’ve decided to explore car insurance options beyond State Farm, seeking more competitive rates and potentially better coverage. This is a smart move, as the insurance market is diverse, offering a range of choices to suit different needs and budgets.

Top Insurance Companies with Competitive Rates

Several insurance companies are known for offering competitive rates. It’s crucial to compare quotes from multiple providers to find the best deal for your specific circumstances.

- Geico: Known for its humorous advertising, Geico consistently ranks among the most affordable insurers. They offer a wide range of coverage options and have a user-friendly online platform for managing policies.

- Progressive: Progressive is another popular choice, particularly for its “Name Your Price” tool that allows you to set your desired premium and see which coverage options fit within your budget.

- USAA: While USAA primarily serves military personnel and their families, it often offers highly competitive rates and excellent customer service.

- Liberty Mutual: Liberty Mutual provides a variety of discounts and coverage options, making it a strong contender for those seeking comprehensive protection.

- Nationwide: Nationwide is known for its strong financial stability and offers a range of discounts and coverage options, including specialized programs for young drivers and seniors.

Obtaining Personalized Quotes from Multiple Insurers

To find the best car insurance deal, it’s essential to gather personalized quotes from several insurers. This ensures you’re comparing apples to apples and can identify the most competitive rates for your specific needs.

- Use online comparison tools: Websites like Policygenius, The Zebra, and Insurance.com allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves time and effort while providing a comprehensive overview of available options.

- Contact insurers directly: Reach out to insurance companies directly via phone, email, or their websites to obtain quotes. This allows you to discuss specific coverage needs and ask questions about their policies.

- Shop around regularly: Insurance rates can fluctuate based on factors like driving history, location, and vehicle type. It’s advisable to review your insurance policies annually and compare rates from other providers to ensure you’re getting the best deal.

Key Features and Benefits Offered by Alternative Insurance Providers

Beyond price, consider the features and benefits offered by different insurers. These can significantly impact your overall experience and satisfaction with your policy.

- Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your vehicle, multiple policy bundling, and even completing defensive driving courses.

- Coverage options: Ensure the insurer provides the coverage options you need, such as collision, comprehensive, liability, and uninsured/underinsured motorist coverage. Some insurers offer specialized coverage, such as rental car reimbursement or roadside assistance.

- Customer service: Look for insurers with a strong reputation for customer service. Consider factors like ease of contacting agents, responsiveness to claims, and overall customer satisfaction ratings.

- Digital tools and resources: Many insurers offer convenient online platforms for managing policies, paying premiums, and filing claims. Some even provide mobile apps for quick access to policy information and support.

Factors Affecting Car Insurance Rates

Car insurance premiums are influenced by a variety of factors, each contributing to the overall cost of coverage. Understanding these factors can help you make informed decisions to potentially lower your insurance rates.

Driving History

Your driving history is a significant factor in determining your car insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower rates. Insurance companies consider your driving history a strong indicator of your risk as a driver.

- Accidents: Accidents, even those that weren’t your fault, can significantly increase your insurance premiums. This is because accidents are statistically linked to an increased likelihood of future claims.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations can also raise your insurance premiums. These violations indicate a higher risk of future accidents.

- Driving Record: Maintaining a clean driving record is essential for keeping your insurance premiums low. Consider defensive driving courses to improve your driving skills and reduce the risk of accidents.

Age

Your age is another factor that insurance companies consider.

- Young Drivers: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk is reflected in higher insurance premiums for younger drivers.

- Mature Drivers: Older drivers, typically over 65, may also see higher premiums due to factors such as declining eyesight and slower reaction times. However, some insurance companies offer discounts for mature drivers with clean driving records.

- Experience: As you gain experience and a clean driving record, your insurance premiums may decrease.

Location

Your location plays a crucial role in determining your car insurance rates.

- Population Density: Areas with high population density tend to have more traffic congestion, leading to a higher risk of accidents. This can result in higher insurance premiums.

- Crime Rates: Areas with high crime rates may also see higher insurance premiums due to the increased risk of car theft or vandalism.

- Weather Conditions: Regions with severe weather conditions, such as hurricanes or heavy snow, can also influence insurance rates.

Vehicle Type, Make, and Model

The type, make, and model of your car can have a significant impact on your insurance premiums.

- Vehicle Value: Cars with higher market values are generally more expensive to insure. This is because the cost of repairs or replacement is higher for these vehicles.

- Safety Features: Cars with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts on insurance premiums.

- Repair Costs: Certain car models may have higher repair costs due to the use of specialized parts or complex repair procedures. This can result in higher insurance premiums.

- Theft Risk: Some car models are more prone to theft than others. This increased risk can lead to higher insurance premiums.

Credit Score

Your credit score can surprisingly influence your car insurance rates.

- Credit Score as a Risk Indicator: Insurance companies use your credit score as an indicator of your financial responsibility. A good credit score suggests you are more likely to pay your insurance premiums on time, making you a lower risk for the insurer.

- State Regulations: The use of credit score in determining insurance rates varies by state. Some states prohibit this practice, while others allow it.

- Impact on Premiums: A lower credit score can lead to higher insurance premiums. If you have a poor credit score, consider improving it to potentially lower your insurance rates.

Driving Habits

Your driving habits, even outside of your driving record, can also impact your insurance premiums.

- Telematics Devices: Some insurance companies offer discounts for using telematics devices that track your driving habits, such as speed, braking, and mileage.

- Driving Habits Data: The data collected from these devices can help insurance companies assess your risk as a driver and offer lower premiums if you exhibit safe driving habits.

- Data Privacy: It’s important to understand the privacy implications of using telematics devices before opting into such programs.

Tips for Lowering Car Insurance Premiums

Finding affordable car insurance doesn’t have to be a stressful endeavor. By implementing a few strategies, you can significantly reduce your premiums and keep more money in your pocket.

Improve Your Driving Habits

Your driving record is a major factor in determining your insurance rates. By adopting safer driving practices, you can reduce your risk and potentially lower your premiums.

- Avoid Distracted Driving: Minimize distractions while driving, such as using your phone, eating, or adjusting the radio. Focus on the road and anticipate potential hazards.

- Maintain a Safe Speed: Adhering to speed limits reduces the risk of accidents. Furthermore, exceeding the speed limit often results in higher fines and points on your license, leading to increased insurance premiums.

- Defensive Driving: Take a defensive driving course to learn techniques for avoiding accidents and improving your overall driving skills. Many insurance companies offer discounts for completing these courses.

Explore Discounts and Bundling Options

Insurance companies offer a variety of discounts to incentivize safe driving and loyalty. Take advantage of these options to lower your premiums.

- Good Student Discount: If you or your child maintain a high GPA, you may qualify for a good student discount. This is typically offered to students under the age of 25.

- Safe Driver Discount: Maintaining a clean driving record with no accidents or violations can earn you a safe driver discount. Insurance companies often reward drivers with a history of responsible driving.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, can result in significant savings. This strategy demonstrates your loyalty to the insurance company and reduces their administrative costs.

Negotiate with Your Insurance Company

Don’t be afraid to negotiate your insurance premiums. Insurance companies are often willing to work with customers to find solutions that meet their needs.

- Shop Around: Get quotes from multiple insurance companies to compare rates and find the best deal. Use online comparison tools or contact insurance brokers to streamline the process.

- Review Your Policy: Examine your current policy and identify any unnecessary coverage or features. Consider reducing coverage if you have a high deductible or if your car is older and less valuable.

- Ask for a Lower Rate: If you’ve been a loyal customer with a clean driving record, consider asking your insurance company for a lower rate. Explain your situation and highlight your positive driving history. You can also point out any discounts you might be eligible for but haven’t yet claimed.

Other Tips for Lowering Car Insurance Premiums, Cheaper car insurance than state farm

- Increase Your Deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can result in lower premiums. Consider increasing your deductible if you’re comfortable with a higher out-of-pocket expense.

- Choose a Safe Car: Some car models are inherently safer than others. Insurance companies often offer lower rates for vehicles with safety features such as anti-lock brakes, airbags, and stability control.

- Park Your Car Safely: Storing your car in a garage can reduce the risk of theft or damage, potentially leading to lower premiums. Some insurance companies offer discounts for garage parking.

Understanding Coverage Options

Car insurance offers different types of coverage, each designed to protect you and your vehicle in various situations. Understanding these options is crucial to making informed decisions that align with your needs and budget.

Types of Car Insurance Coverage

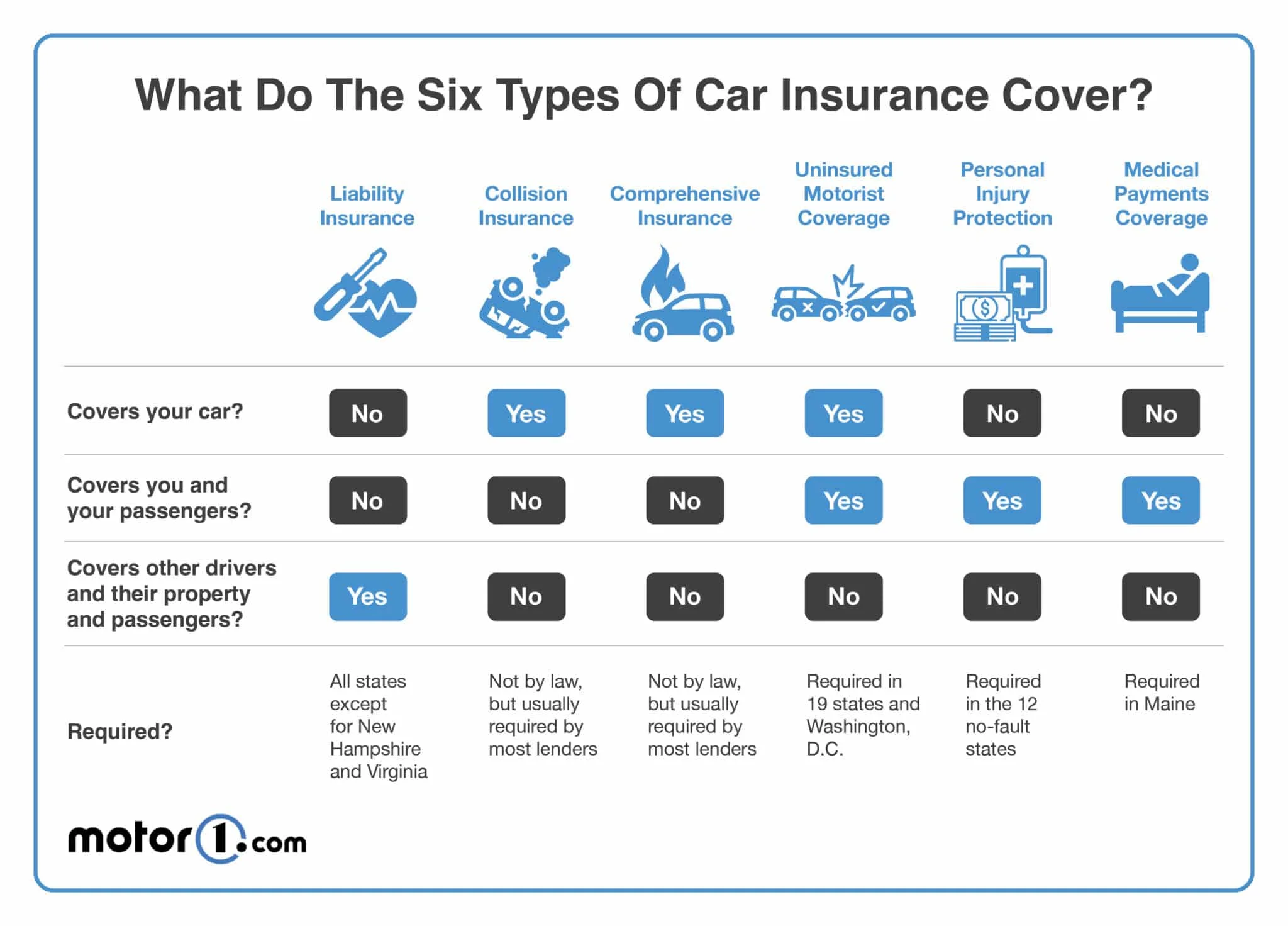

Car insurance policies typically include several types of coverage, each addressing specific risks.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other party’s medical expenses, lost wages, and property damage. Liability coverage is usually divided into two parts:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other related costs for injuries caused to others.

- Property Damage Liability: Covers the cost of repairs or replacement for damaged property, such as another vehicle or a building.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from non-collision events, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It is often required in some states.

Determining Adequate Coverage

The amount of coverage you need depends on several factors, including:

- Your financial situation: If you have a lot of assets to protect, you may want to consider higher liability limits.

- Your driving habits: If you frequently drive in high-traffic areas or have a history of accidents, you may need more coverage.

- The value of your vehicle: If you have a newer or more expensive vehicle, you may want to consider higher collision and comprehensive coverage limits.

- State laws: Each state has minimum liability coverage requirements, which you must meet.

Evaluating Coverage Options

When evaluating coverage options, consider the following:

- Compare quotes from multiple insurers: This will help you find the best rates for the coverage you need.

- Read the policy carefully: Make sure you understand the coverage limits, deductibles, and exclusions.

- Ask questions: Don’t hesitate to ask your insurance agent for clarification on any aspects of the policy you don’t understand.

- Consider your individual needs: Choose coverage options that align with your specific circumstances and risk tolerance.

Outcome Summary

By understanding the factors that affect car insurance rates and exploring alternative insurance providers, you can significantly reduce your premiums without compromising on coverage. Remember to shop around, compare quotes, and leverage the tips we’ve shared to secure the best possible deal. You might be surprised at the savings you can achieve!

FAQ Corner: Cheaper Car Insurance Than State Farm

How often should I compare car insurance quotes?

It’s a good idea to compare quotes at least once a year, and even more often if you’ve had a significant life change, such as a new job, a move, or a change in your driving record.

What are some common discounts offered by insurance companies?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, multi-policy discounts, and discounts for safety features on your car.

Can I bundle my car insurance with other types of insurance?

Yes, many insurance companies offer discounts for bundling your car insurance with other types of insurance, such as homeowners insurance or renters insurance.

How can I improve my driving record and get lower insurance rates?

You can improve your driving record by avoiding accidents, traffic violations, and speeding tickets. Consider taking a defensive driving course to learn safe driving techniques.