Can I have insurance in two states? It’s a question that arises when individuals find themselves navigating the complexities of dual residency. While it may seem like a straightforward inquiry, the answer often depends on a variety of factors, including the specific type of insurance, state regulations, and individual circumstances. This article delves into the nuances of dual residency and insurance, exploring the potential benefits and drawbacks, and providing guidance on navigating this unique situation.

From understanding state-specific insurance requirements and regulations to analyzing the implications for different types of insurance, this comprehensive guide equips individuals with the knowledge needed to make informed decisions about their insurance coverage in a dual residency context.

Understanding Dual Residency and Insurance

Dual residency, in the context of insurance, refers to a situation where an individual is considered a resident of two different states simultaneously. This can happen for various reasons, such as owning property in both states, having a primary residence in one state and working in another, or spending significant time in both states.

While it may seem straightforward, dual residency can have significant implications for insurance coverage and premiums. Understanding the concept of dual residency and its impact on insurance is crucial for individuals who might find themselves in such a situation.

Benefits of Dual Residency in Insurance

Having insurance in two states can offer certain benefits, depending on the specific circumstances. For example:

* Access to broader coverage: In some cases, having insurance in two states can provide access to broader coverage options, potentially including benefits not available in one state alone.

* Lower premiums: If the insurance rates in one state are significantly lower than the other, having insurance in both states can help individuals secure lower premiums overall.

* Increased protection: Individuals with dual residency might be able to benefit from the protection of both state’s insurance regulations, offering greater peace of mind.

Drawbacks of Dual Residency in Insurance

While dual residency can have its advantages, it also comes with certain drawbacks:

* Increased complexity: Managing insurance policies in two states can be more complex, requiring individuals to keep track of multiple policies, premiums, and coverage details.

* Potential for conflicts: If the insurance policies in both states have conflicting terms or coverage limitations, it can lead to confusion and potential disputes in the event of a claim.

* Higher overall costs: Although lower premiums in one state might seem appealing, having insurance in two states can ultimately lead to higher overall costs due to the need to pay for two separate policies.

Situations Where Dual Residency is Relevant

Dual residency can be relevant in several situations:

* Individuals who own property in multiple states: Owning property in two states can make an individual eligible for insurance coverage in both states, particularly for property insurance.

* Individuals who work in a different state from their primary residence: Individuals who work in a state different from their primary residence may need to consider insurance options in both states, especially for health insurance and auto insurance.

* Individuals who spend significant time in both states: Spending a significant amount of time in both states can trigger residency requirements for insurance purposes, making it necessary to have coverage in both states.

Insurance Requirements and Regulations

Each state in the U.S. has its own unique set of insurance regulations, and these regulations can significantly impact your insurance coverage and costs. These laws govern how insurance companies operate, what types of coverage they must offer, and how they must handle claims. Understanding these regulations is crucial if you are considering dual residency, as it could impact your insurance needs and options.

State-Specific Insurance Regulations

State insurance regulations cover a wide range of aspects, including:

- Minimum Coverage Requirements: Every state mandates minimum liability insurance coverage for drivers, and these minimums can vary considerably. For instance, some states might require higher liability limits for bodily injury than others.

- Available Coverage Options: States differ in the types of insurance coverage they require or allow. Some states may mandate certain types of coverage, like personal injury protection (PIP), while others may not. States also have varying regulations for specialized coverage like flood insurance, earthquake insurance, or coverage for specific types of vehicles.

- Premium Calculation and Rate Setting: States have regulations governing how insurance companies can calculate premiums and set rates. These regulations might address factors like credit history, driving record, age, and geographic location.

- Claim Handling and Dispute Resolution: State laws dictate how insurance companies must handle claims, including timelines for processing, investigation, and payment. They also provide avenues for resolving disputes between policyholders and insurance companies.

Variations in Insurance Coverage

The impact of state-specific regulations is evident in the varying insurance coverage available across the country. For example:

- Auto Insurance: States like Florida and Pennsylvania require drivers to have personal injury protection (PIP) coverage, while other states, such as California, do not. These differences can affect the cost and coverage of your auto insurance policy.

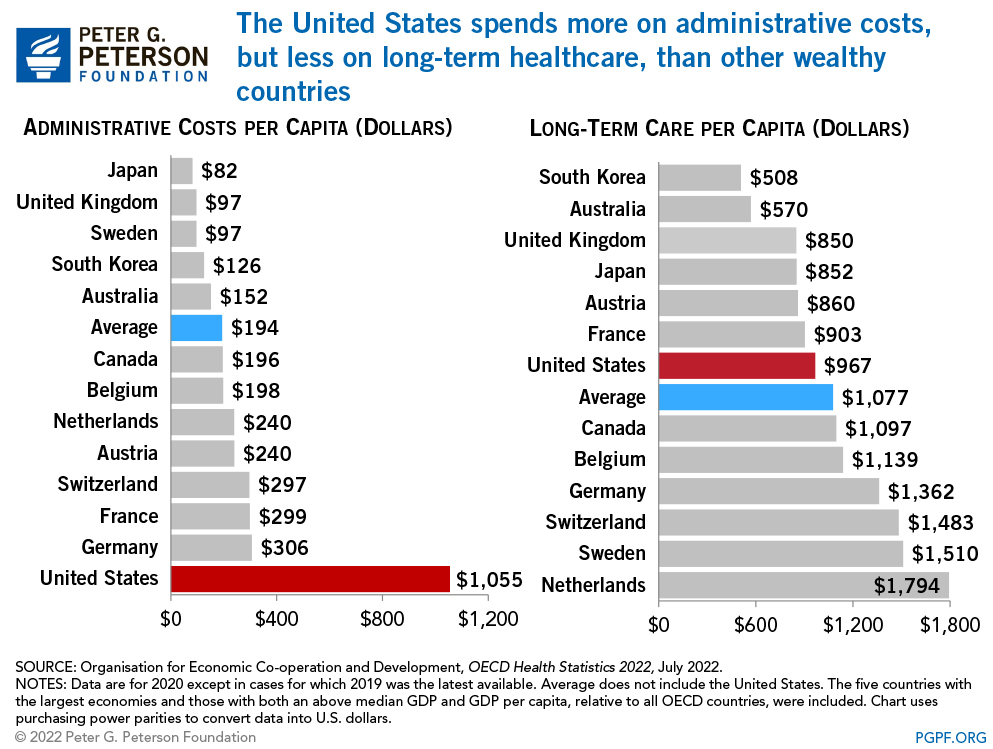

- Health Insurance: States have varying regulations regarding health insurance, such as the availability of individual health insurance plans and the affordability of coverage. Some states have implemented programs to expand access to affordable health insurance, while others have more limited options.

- Homeowners Insurance: The cost and availability of homeowners insurance can differ significantly between states. Factors like hurricane risk, earthquake risk, and the prevalence of natural disasters can influence premium costs and coverage options.

Impact of State Laws on Dual Residency Insurance

State insurance laws can significantly impact your insurance options and coverage if you have dual residency. For example:

If you maintain a primary residence in one state and a secondary residence in another, your insurance needs might be governed by the laws of both states. This can create complexities, especially if the insurance requirements differ significantly.

- Auto Insurance: If you primarily drive in one state but register your vehicle in another, you might need to comply with the insurance requirements of both states. This could mean maintaining separate auto insurance policies for each state, potentially leading to higher premiums.

- Homeowners Insurance: If you have a primary residence in one state and a secondary residence in another, you might need separate homeowners insurance policies for each property. The insurance regulations of each state could influence the coverage and costs of these policies.

Types of Insurance and Dual Residency

Dual residency can significantly impact your insurance coverage. Understanding how each type of insurance is affected is crucial for ensuring adequate protection in both states.

Health Insurance

Health insurance is one of the most critical types of insurance, and its implications for dual residents can be complex. The Affordable Care Act (ACA) mandates that most individuals must have health insurance. However, navigating the complexities of coverage across state lines can be challenging.

- State-Specific Coverage: Health insurance plans are typically regulated and offered at the state level. This means that the coverage, benefits, and costs of a plan may vary depending on the state where you reside.

- Open Enrollment Periods: Open enrollment periods for health insurance plans vary by state. If you are a dual resident, you may need to enroll in a plan during the open enrollment period for the state where you spend the majority of your time.

- Pre-Existing Conditions: States have different rules regarding coverage for pre-existing conditions. If you have a pre-existing condition, you may find that your coverage is more limited in one state than another.

- Out-of-State Coverage: Most health insurance plans offer some out-of-state coverage, but it may be limited. If you receive medical care in a state where you are not enrolled in a plan, you may face higher costs or have to file claims manually.

- Employer-Sponsored Coverage: If you receive health insurance through your employer, the coverage may be limited to the state where your employer is located. You may need to purchase additional coverage in the other state.

Auto Insurance

Auto insurance is another essential type of insurance that is subject to state regulations. Dual residents must be aware of the different requirements and regulations in each state.

- Minimum Coverage Requirements: Each state has minimum coverage requirements for auto insurance. You must meet the minimum requirements for each state where you drive.

- Liability Coverage: Liability coverage protects you from financial losses if you cause an accident. The minimum liability limits vary by state.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. The coverage limits vary by state.

- No-Fault Coverage: Some states have no-fault insurance laws, which require you to file claims with your own insurer regardless of who caused the accident. Other states have traditional fault-based systems.

- Rates: Auto insurance rates are influenced by factors such as your driving record, age, and the type of vehicle you drive. Rates can vary significantly between states.

Homeowners Insurance

Homeowners insurance protects your home and belongings from damage or loss. Dual residents must consider the implications of having coverage in two states.

- Coverage Limits: Homeowners insurance policies typically have coverage limits for different types of losses. These limits may vary by state.

- Peril Coverage: The types of perils covered by homeowners insurance policies can vary by state. Some policies may cover natural disasters, such as earthquakes or floods, while others may not.

- Valuation Methods: States use different methods to value your home for insurance purposes. This can affect the amount of coverage you receive.

- Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Deductibles can vary by state.

- Insurance Premiums: Homeowners insurance premiums are influenced by factors such as the value of your home, the location, and the type of coverage you choose. Premiums can vary significantly between states.

Life Insurance

Life insurance provides financial protection for your beneficiaries in the event of your death. While life insurance policies are not typically regulated at the state level, dual residency can have implications for coverage.

- State of Residence: Your state of residence may influence the types of life insurance policies available to you. Some states may have specific regulations or restrictions.

- Beneficiary Designation: It is important to ensure that your beneficiary designations are up-to-date and reflect your current residency status. This is especially important if you have beneficiaries in different states.

- Tax Implications: The tax implications of life insurance proceeds can vary by state. It is important to consult with a tax advisor to understand the tax implications of your life insurance policy.

Choosing the Right Insurance Coverage

Navigating insurance with dual residency can be complex. You need to ensure you have adequate coverage in both states while avoiding unnecessary duplication. This section will guide you through the process of selecting the right insurance policies for your unique situation.

Factors to Consider When Choosing Insurance

Choosing the right insurance policies involves considering several factors. Understanding these aspects is crucial to making informed decisions.

- Your individual needs and circumstances: Assess your personal requirements based on your age, health, assets, and lifestyle. Consider your risk tolerance and the level of protection you need.

- State-specific requirements: Each state has its own insurance regulations, including minimum coverage requirements. Ensure your policies comply with both states’ regulations.

- Coverage limitations: Be aware of any limitations in your insurance policies, such as coverage exclusions, deductibles, and co-pays. Understand how these factors may affect your claims.

- Cost and affordability: Compare insurance premiums and coverage options from different providers to find the most affordable plan that meets your needs.

Comparing and Evaluating Insurance Plans

Comparing insurance plans is essential to find the best value for your money. Here’s a breakdown of key areas to focus on:

- Coverage: Compare the types of coverage offered by each plan, such as medical, liability, property, and life insurance. Consider the scope and limits of each coverage area.

- Premiums: Compare the cost of premiums for each plan, considering factors such as deductibles, co-pays, and coverage limits.

- Customer service: Evaluate the reputation and customer service of each insurance provider. Look for companies with a track record of responsiveness and helpfulness.

- Claims process: Research the claims process for each provider, including the timeliness and ease of filing claims and receiving payouts.

Managing Insurance with Dual Residency

Living in two states can complicate your insurance needs. You may need to juggle policies from both states, ensuring you have the right coverage for your unique situation. This section will provide a step-by-step guide to help you manage your insurance effectively with dual residency.

Notifying Insurance Companies of Residency Changes

It is crucial to inform your insurance companies about any changes in your residency status. Failure to do so could lead to coverage gaps or even policy cancellation. Here’s how to approach this:

- Review Your Policies: Carefully read your insurance policies to understand the requirements for notifying your insurance companies about a change in residency. Most policies Artikel specific timelines for reporting such changes.

- Contact Your Providers: Once you’ve reviewed your policies, contact your insurance providers to inform them of your dual residency status. Be prepared to provide documentation, such as a driver’s license, utility bills, or tax returns, to verify your residency in both states.

- Update Your Contact Information: Ensure your insurance companies have your current contact information, including your mailing address, phone number, and email address, in both states. This will ensure you receive important communications related to your policies.

Maintaining Clear Communication with Insurance Providers

Open and consistent communication with your insurance providers is essential for managing your insurance effectively with dual residency. Here are some tips:

- Keep Detailed Records: Maintain a log of all communication with your insurance companies, including dates, times, and the content of conversations. This will help you track your interactions and resolve any discrepancies.

- Request Confirmation: After notifying your insurance companies about your dual residency, request written confirmation of the changes. This will provide you with a record of their acknowledgment and ensure your coverage is updated accordingly.

- Ask Questions: Don’t hesitate to ask your insurance providers any questions you may have regarding your coverage, policies, or procedures. It’s better to be clear and informed than to assume or miss important details.

Potential Challenges and Solutions

Managing insurance with dual residency can present unique challenges. It’s crucial to understand these potential hurdles and develop strategies to mitigate them effectively. This section explores common challenges and offers solutions to ensure smooth insurance management in a dual-residency context.

Navigating Coverage Gaps

Coverage gaps can arise when insurance policies don’t fully align with your dual residency situation. For instance, your primary state’s health insurance might not cover medical expenses incurred in your secondary state.

- Assess Coverage: Thoroughly review your existing insurance policies to understand their geographical limitations. Check if they extend coverage to your secondary state, especially for critical needs like health, auto, and home insurance.

- Consider Supplemental Coverage: Explore supplemental insurance options that bridge coverage gaps. For example, travel insurance can provide medical coverage while traveling to your secondary state.

- Seek Expert Advice: Consult with insurance brokers or agents specialized in dual residency situations. They can assess your specific needs and recommend tailored insurance solutions.

Maintaining Compliance with Regulations

Each state has its own insurance regulations, and dual residency can create complexities. You must ensure compliance with both states’ requirements.

- Research State Regulations: Familiarize yourself with the insurance regulations of both your primary and secondary states. Understand requirements related to minimum coverage, policy types, and reporting obligations.

- Maintain Accurate Records: Keep detailed records of your insurance policies, including coverage details, renewal dates, and payment confirmations. This documentation will be crucial for demonstrating compliance.

- Consult Legal Professionals: For complex situations, consider seeking advice from legal professionals familiar with insurance regulations in both states. They can guide you on navigating the legal framework and ensure compliance.

Addressing Claims and Disputes, Can i have insurance in two states

Filing claims and resolving disputes can be more challenging with dual residency. It’s important to understand the claims procedures and potential jurisdictional issues.

- Understand Claim Procedures: Familiarize yourself with the claims processes of your insurance providers in both states. Note any specific requirements or deadlines for filing claims.

- Maintain Communication: Keep open communication with your insurance providers, clearly explaining your dual residency situation and any relevant details. This proactive approach can prevent misunderstandings during claims processing.

- Seek Legal Guidance: If you encounter difficulties with claims processing or face disputes, consider seeking legal advice from attorneys specializing in insurance law. They can guide you through the process and protect your rights.

Managing Costs and Premiums

Dual residency can impact insurance costs. It’s essential to manage premiums effectively and explore strategies to minimize expenses.

- Compare Premiums: Research insurance providers in both states and compare their premiums for comparable coverage. This allows you to find the most cost-effective options.

- Bundle Policies: Consider bundling your insurance policies (auto, home, and health) with the same provider. Many insurers offer discounts for bundling multiple policies.

- Explore Discounts: Inquire about potential discounts offered by insurers based on factors like good driving records, safety features, or membership in certain organizations.

Ensuring Continuous Coverage

Maintaining continuous insurance coverage is crucial, especially with dual residency. Gaps in coverage can leave you vulnerable in case of accidents or emergencies.

- Plan Renewal Dates: Carefully track the renewal dates of your insurance policies in both states. Ensure smooth transitions by renewing policies before they expire.

- Communicate Address Changes: Promptly notify your insurance providers of any changes in your address, especially if you’re moving between states. This ensures that your policies remain active and reflect your current location.

- Maintain Proof of Coverage: Always keep copies of your insurance cards and policy documents readily available, especially when traveling between states. This documentation can be crucial in case of emergencies.

Final Summary

Managing insurance with dual residency can present its own set of challenges, but with careful planning and communication, it’s possible to navigate these complexities and ensure adequate coverage. By understanding the relevant factors, seeking professional advice when necessary, and proactively managing insurance policies, individuals can effectively address the unique demands of dual residency and secure the protection they need.

Quick FAQs: Can I Have Insurance In Two States

What are the potential benefits of having insurance in two states?

Having insurance in two states can provide broader coverage, potentially offering greater peace of mind and protection in various situations. For instance, if you have a car accident in a state where you’re not a resident but have insurance there, you’ll be covered.

What are the potential drawbacks of having insurance in two states?

Potential drawbacks include higher premiums, administrative complexities, and potential conflicts between insurance policies. It’s crucial to carefully weigh the benefits and drawbacks before deciding to have insurance in multiple states.

How do I notify my insurance company about a change in residency?

Contact your insurance company immediately and provide them with the necessary documentation, such as a change of address form or proof of residency in the new state.

Can I choose different insurance providers for different states?

Yes, you can choose different insurance providers for different states, but you’ll need to ensure that your coverage meets your needs in each state. It’s advisable to consult with an insurance broker to explore the best options.