Are there any states that don’t require car insurance? The answer might surprise you. While most states mandate car insurance to protect drivers and victims of accidents, a few states take a different approach. These states, often with a focus on individual liberty, rely on financial responsibility laws instead of mandatory insurance. This choice, however, comes with potential risks and consequences for both drivers and those they might encounter on the road.

This article explores the complexities of driving without mandatory car insurance, delving into the reasons behind this approach, the potential risks involved, and the alternative options available to drivers in these states. We’ll also examine the impact of uninsured motorists on road safety and the financial burden they can impose on others.

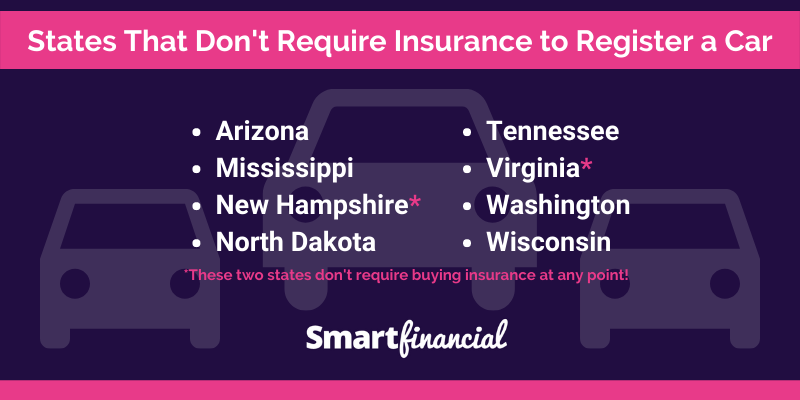

States with No Mandatory Car Insurance

While most states in the U.S. require drivers to carry car insurance, there are a few exceptions. These states have chosen not to mandate car insurance for various reasons, including concerns about government overreach and the belief that individuals should be free to make their own decisions about risk.

Reasons for Not Requiring Car Insurance

The states that do not require car insurance generally believe that individuals should be responsible for their own decisions and that government intervention in this area is unnecessary. They argue that requiring car insurance can lead to higher insurance premiums and that individuals who choose not to carry insurance are likely to be more careful drivers.

Risks and Consequences of Driving Without Insurance

Despite the arguments in favor of not requiring car insurance, there are significant risks and consequences associated with driving without insurance.

- Financial Ruin: In the event of an accident, drivers without insurance are personally liable for all damages, including medical bills, property damage, and legal fees. This can lead to financial ruin, especially if the accident results in serious injuries or death.

- Legal Penalties: Driving without insurance is illegal in most states, and drivers who are caught may face fines, license suspension, or even jail time.

- Limited Access to Healthcare: In the event of an accident, drivers without insurance may have limited access to healthcare, especially if they need expensive treatments or long-term care.

- Difficulty in Obtaining Future Insurance: Drivers who have been caught driving without insurance may find it difficult to obtain car insurance in the future, as insurance companies may view them as high-risk.

Financial Responsibility Laws

Financial responsibility laws are designed to ensure that drivers are held accountable for the financial consequences of their actions on the road. These laws require drivers to prove their ability to cover the costs of potential accidents, such as medical bills, property damage, and lost wages.

Financial responsibility laws are crucial for protecting accident victims and promoting road safety. They deter reckless driving by ensuring that drivers are financially responsible for the harm they cause.

Financial Responsibility Laws in States That Require Car Insurance

In states that mandate car insurance, financial responsibility laws typically require drivers to maintain a minimum level of insurance coverage. These laws specify the minimum amounts of liability coverage, which protects others from the driver’s negligence, and uninsured motorist coverage, which protects the driver in case they are involved in an accident with an uninsured driver.

- Minimum Coverage Requirements: States set minimum liability coverage limits, such as $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage. These minimum limits are intended to ensure that victims of accidents have access to funds to cover their losses.

- Financial Responsibility Proof: Drivers must provide proof of insurance to the state, often through a certificate of insurance or an electronic verification system. This proof is typically required during vehicle registration or at the time of a traffic stop.

- Penalties for Non-Compliance: States impose penalties on drivers who fail to maintain the required insurance coverage. These penalties can include fines, license suspension, or even vehicle impoundment.

Financial Responsibility Laws in States That Do Not Require Car Insurance

States that do not mandate car insurance typically rely on a system of financial responsibility laws that require drivers to prove their ability to pay for damages they cause in an accident. These laws typically require drivers to post a bond, deposit cash, or provide other forms of financial security.

- Financial Responsibility Proof: Drivers who are involved in an accident must provide proof of financial responsibility to the state. This proof can take the form of a surety bond, a cash deposit, or a certificate of self-insurance.

- Penalties for Non-Compliance: Drivers who fail to provide proof of financial responsibility after an accident may face penalties such as license suspension, vehicle impoundment, or even jail time.

Impact of Financial Responsibility Laws on Road Safety and Accident Victims

Financial responsibility laws have a significant impact on road safety and accident victims. They deter reckless driving by ensuring that drivers are financially accountable for the harm they cause. They also protect accident victims by providing them with a means to recover financial compensation for their injuries and losses.

- Deterring Reckless Driving: The financial consequences of driving without insurance or financial responsibility can be significant, which can deter drivers from engaging in risky behavior. This can lead to a reduction in the number of accidents and injuries on the road.

- Protecting Accident Victims: Financial responsibility laws provide accident victims with a mechanism to recover compensation for their losses. By requiring drivers to maintain insurance or provide proof of financial responsibility, these laws ensure that victims have access to funds to cover medical expenses, lost wages, and property damage.

Consequences of Driving Without Insurance

Driving without car insurance in states that require it can lead to serious consequences, both financial and legal. Not only can you face hefty fines and penalties, but you could also lose your driving privileges and even have your vehicle impounded. It’s crucial to understand the potential repercussions of driving without insurance to ensure you’re always protected on the road.

Fines and Penalties

Driving without insurance in states that require it is a serious offense. You can expect to face significant financial penalties, including:

- Fines: The amount of the fine varies by state, but it can range from a few hundred dollars to thousands of dollars. In some states, the fine may be doubled if you’re caught driving without insurance more than once.

- Court Costs: You may also have to pay court costs, which can add to the overall expense.

- Surcharges: In some states, you may be required to pay a surcharge on your insurance premiums for a certain period of time after you get insurance.

License Suspension or Revocation

Driving without insurance can result in the suspension or revocation of your driver’s license. The length of the suspension or revocation will depend on the severity of the offense and the state’s laws.

Impoundment of the Vehicle

In some states, your vehicle may be impounded if you’re caught driving without insurance. This means that your vehicle will be towed and stored at a facility, and you’ll have to pay fees to get it back.

Difficulty Registering the Vehicle

Most states require proof of insurance before you can register your vehicle. If you don’t have insurance, you’ll likely have difficulty registering your vehicle, and you may not be able to drive it legally.

Higher Insurance Premiums in the Future

Even if you eventually get insurance, your premiums may be higher than they would have been if you had insurance from the start. This is because insurance companies consider drivers who have been caught driving without insurance to be higher risk.

Real-Life Examples

- Case 1: In California, a driver was caught driving without insurance and fined $1,000. They also had their license suspended for six months and their vehicle impounded. The driver had to pay an additional $500 to get their vehicle released from the impound lot.

- Case 2: In Florida, a driver was caught driving without insurance for the second time. They were fined $2,000 and their license was revoked for one year. The driver also had to pay a surcharge on their insurance premiums for the next three years.

Alternatives to Traditional Car Insurance

While traditional car insurance is the most common way to protect yourself financially in case of an accident, individuals living in states without mandatory insurance may have alternative options to consider. These alternatives may offer a way to manage risk and financial responsibility without the traditional insurance premiums.

Self-Insurance

Self-insurance involves setting aside a sum of money to cover potential costs associated with accidents or damages. This option assumes you have a strong financial foundation and can afford to cover significant expenses out of pocket.

- Pros:

- Potential for lower costs, as you are not paying premiums to an insurance company.

- Greater control over your finances and how you manage risk.

- Cons:

- Significant financial risk, as you are responsible for all costs in the event of an accident.

- Requires a substantial financial reserve to cover potential expenses.

- May not be suitable for individuals with limited financial resources.

Joining a Carpool or Ride-Sharing Program, Are there any states that don’t require car insurance

Participating in a carpool or ride-sharing program can reduce your driving frequency, potentially lowering your risk of accidents and the need for insurance. These programs can also provide shared liability coverage for participants.

- Pros:

- Reduced driving exposure, potentially lowering your risk of accidents.

- Shared liability coverage through the program.

- Potential for cost savings on fuel and parking.

- Cons:

- Limited control over driving schedules and routes.

- Potential for inconvenience or delays.

- May not be suitable for all individuals, depending on their lifestyle and commuting needs.

Obtaining Liability Coverage Through Other Means

Some individuals may be able to obtain liability coverage through other sources, such as homeowners insurance or umbrella policies. This coverage may not be as comprehensive as traditional car insurance, but it can provide some protection against financial liability in case of an accident.

- Pros:

- Potential for lower costs than traditional car insurance.

- Can provide some financial protection in case of an accident.

- Cons:

- May not cover all types of accidents or damages.

- May have lower coverage limits than traditional car insurance.

- Requires careful review of policy terms and conditions.

Impact on Uninsured Motorists

The absence of mandatory car insurance in certain states poses a significant risk to road safety and can have severe consequences for both accident victims and the overall financial stability of the healthcare system. Uninsured motorists, by their very nature, operate without the financial protection that insurance provides, leaving a trail of potential financial and physical burdens in their wake.

Financial Burden on Other Drivers and the Healthcare System

The financial burden of uninsured drivers falls disproportionately on other motorists and the healthcare system. When an uninsured driver causes an accident, the injured party is left to navigate the complex and often expensive process of seeking compensation for their losses. This can include medical bills, lost wages, property damage, and other expenses. In many cases, accident victims are forced to pursue legal action against the uninsured driver, which can be a lengthy and costly endeavor.

Furthermore, the healthcare system bears the brunt of the financial strain associated with uninsured drivers. When uninsured individuals are involved in accidents, they are often unable to afford necessary medical treatment, leading to unpaid bills that ultimately burden hospitals and taxpayers. This financial strain can lead to reduced access to healthcare services for all, including those who are insured.

The Role of Insurance Companies: Are There Any States That Don’t Require Car Insurance

Insurance companies play a crucial role in promoting safe driving practices and reducing the number of uninsured motorists. By offering incentives and penalties, they influence driver behavior and contribute to a safer driving environment.

Strategies to Encourage Insurance

Insurance companies use a variety of strategies to encourage drivers to obtain insurance. These strategies include:

- Offering discounts for safe driving: Insurance companies often provide discounts for drivers who maintain a clean driving record, complete defensive driving courses, or install safety features in their vehicles. This incentivizes drivers to prioritize safe driving practices and reduces the likelihood of accidents and claims.

- Raising premiums for high-risk drivers: Drivers with a history of accidents, traffic violations, or DUI convictions are typically charged higher premiums. This discourages risky driving behavior and encourages drivers to improve their driving records to reduce their insurance costs.

- Implementing usage-based insurance programs: These programs track driving habits through telematics devices or smartphone apps. Drivers who demonstrate safe driving behaviors, such as avoiding speeding or hard braking, are rewarded with lower premiums. This encourages drivers to adopt safer driving habits and reduces the likelihood of accidents.

- Partnering with state governments: Insurance companies collaborate with state governments to promote the importance of car insurance and enforce compliance with financial responsibility laws. They may participate in public awareness campaigns, provide educational resources, and support law enforcement efforts to identify and penalize uninsured drivers.

Wrap-Up

Navigating the world of car insurance, especially in states without mandatory coverage, requires careful consideration. Understanding the potential risks and consequences, exploring alternative options, and taking responsibility for your actions on the road are crucial steps in ensuring a safe and secure driving experience. While the absence of mandatory insurance may seem appealing to some, it’s important to remember that the consequences of driving without coverage can be significant, affecting not only yourself but also others on the road.

FAQs

What happens if I get into an accident without car insurance in a state that doesn’t require it?

Even in states without mandatory insurance, you are still legally responsible for any damages or injuries caused by an accident. You could be held liable for significant financial losses, including medical bills, property repairs, and legal fees.

Can I drive without car insurance in a state that requires it?

No, driving without car insurance in a state that requires it is illegal and can result in serious consequences, including fines, license suspension, and even vehicle impoundment.

What are the benefits of having car insurance?

Car insurance offers financial protection in case of accidents, covering damages to your vehicle, injuries to yourself or others, and legal expenses. It also helps to mitigate the financial burden of accidents and ensures you can afford to repair your vehicle or cover medical bills.