Can a car be registered and insured in different states sets the stage for this exploration, delving into the complexities of navigating vehicle registration and insurance across state lines. Whether you’re relocating, frequently traveling between states, or simply curious about the process, understanding the intricacies of this topic is crucial.

This guide will provide a comprehensive overview of the procedures, requirements, and potential legal implications associated with registering and insuring a vehicle in a state different from your primary residence. From the necessary documentation to the potential costs and insurance considerations, we’ll cover everything you need to know to make an informed decision.

Insurance Considerations

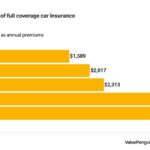

Registering a car in a different state often means getting new insurance. This is because insurance requirements and costs vary by state. Understanding how insurance factors into interstate car registration is essential for ensuring you have the right coverage and avoiding potential legal and financial risks.

Factors Affecting Car Insurance Premiums, Can a car be registered and insured in different states

Insurance premiums are calculated based on several factors. These factors help insurance companies assess the risk of insuring a particular driver and vehicle.

- Vehicle Type: The make, model, and year of your car can influence your premium. Sports cars and luxury vehicles are often considered higher risk due to their performance and repair costs, leading to higher premiums. Conversely, older, less expensive cars may have lower premiums.

- Driving History: Your driving record plays a crucial role. Accidents, traffic violations, and even your age can impact your premium. Drivers with a clean driving record and good safety habits typically receive lower rates.

- Location: Where you live matters. States with higher rates of accidents or theft tend to have higher insurance premiums. Urban areas with denser populations may also see higher rates due to increased traffic congestion and the potential for more accidents.

Insurance Requirements by State

Each state has its own minimum insurance requirements. These requirements specify the minimum coverage levels drivers must have to legally operate a vehicle.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. Liability coverage is usually divided into two parts: bodily injury liability (BI) and property damage liability (PD). States set minimum limits for both BI and PD coverage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s important to note that UM/UIM coverage is not mandatory in all states, but it’s highly recommended.

- Personal Injury Protection (PIP): PIP coverage helps pay for your medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of who is at fault. PIP is mandatory in some states, but not all.

Transferring an Existing Insurance Policy

When you move to a new state, you might be able to transfer your existing insurance policy. However, this isn’t always possible, and there are some things to consider:

- Policy Coverage: Your existing policy might not meet the minimum insurance requirements of your new state. You may need to add additional coverage or increase your coverage limits.

- Insurance Company Coverage Area: Not all insurance companies operate in every state. If your current insurer doesn’t operate in your new state, you’ll need to find a new insurer.

- Policy Changes: Even if your insurer operates in your new state, your policy might need to be adjusted to comply with local regulations. This could involve changing coverage limits or adding specific endorsements.

Scenarios Requiring a New Insurance Policy

Here are some situations where you might need to obtain a new insurance policy in a different state:

- Moving to a New State: If you’re moving to a new state, you’ll need to register your car and obtain insurance that meets the requirements of your new state of residence.

- Changing Insurance Companies: You might choose to switch insurance companies for reasons such as lower premiums or better coverage options. If your new insurer doesn’t operate in your current state, you’ll need to obtain a new policy.

- Buying a New Car: If you purchase a new car in a different state, you’ll likely need to register it in that state and obtain insurance that covers the new vehicle.

Finding Affordable Car Insurance

Here are some tips for finding affordable car insurance in a new state:

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options. You can use online comparison tools or contact insurers directly.

- Consider Bundling: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in discounts.

- Improve Your Driving Record: A clean driving record can lead to lower premiums. Drive safely, avoid traffic violations, and consider taking a defensive driving course.

- Increase Your Deductible: A higher deductible can result in lower premiums. However, be sure you can afford to pay the deductible if you need to file a claim.

Legal Implications

Driving a vehicle registered and insured in a different state can have legal implications, ranging from minor inconveniences to serious consequences. Understanding the laws and regulations governing out-of-state vehicles is crucial to ensure you remain compliant and avoid potential legal issues.

Out-of-State Vehicle Laws and Regulations

Each state has its own set of laws and regulations governing vehicle registration, insurance, and driving. When operating an out-of-state vehicle, you must adhere to the laws of the state where you are driving.

- Registration Requirements: Most states have reciprocity agreements that allow out-of-state vehicles to be driven for a limited period without needing to be registered locally. However, exceeding these time limits can result in fines and penalties. For instance, in California, out-of-state vehicles can be driven for up to six months without registration, but exceeding this limit can lead to fines of up to $1000.

- Insurance Requirements: Out-of-state vehicles must carry insurance coverage that meets the minimum requirements of the state where they are being driven. Failing to do so can result in fines and suspension of driving privileges.

- Emissions Standards: Some states have strict emissions standards that out-of-state vehicles may not meet. For instance, California has stringent emissions standards that vehicles from other states may not meet, requiring owners to obtain special permits or modifications.

- Traffic Laws: While most traffic laws are similar across states, some variations exist. For instance, the legal blood alcohol content (BAC) limit for driving varies from state to state. Driving under the influence of alcohol or drugs can lead to serious legal consequences, regardless of the state where the vehicle is registered.

Resolving Legal Issues

If you face legal issues while driving an out-of-state vehicle, it is important to understand the process for resolving them.

- Contact Local Authorities: In case of an accident or traffic violation, you should immediately contact local law enforcement authorities. They will guide you through the process of reporting the incident and resolving any legal issues.

- Consult with a Lawyer: If the legal issues are complex or involve significant penalties, it is advisable to consult with a lawyer specializing in traffic law. They can provide legal advice and represent you in court.

- Understand Your Rights: Familiarize yourself with your rights as a driver, including the right to remain silent and the right to an attorney.

Examples of Legal Consequences

Driving an out-of-state vehicle without proper registration or insurance can lead to various legal consequences, including:

- Fines and Penalties: You may be issued fines and penalties for violating registration and insurance requirements.

- Vehicle Impoundment: In some cases, your vehicle may be impounded until you comply with registration and insurance requirements.

- Suspension of Driving Privileges: Driving without proper registration or insurance can lead to suspension of your driving privileges in the state where you are driving.

- Criminal Charges: In severe cases, driving an out-of-state vehicle without proper documentation may result in criminal charges.

Impact on Insurance Claims

State laws can influence insurance claims for accidents involving out-of-state vehicles.

- Coverage Limits: Insurance coverage limits may vary between states. In case of an accident, the insurance policy’s coverage limits will be based on the state where the accident occurred, not the state where the vehicle is registered.

- No-Fault Laws: Some states have no-fault insurance laws that require drivers to file claims with their own insurance companies, regardless of fault. If an accident occurs in a no-fault state, the insurance claims process may be different than in a state with traditional fault-based insurance.

Ending Remarks

Navigating the world of vehicle registration and insurance across state lines can seem daunting, but with careful planning and an understanding of the regulations, it can be a smooth process. Remember to research your specific circumstances, consult with relevant authorities, and ensure you meet all requirements to avoid any legal complications. By following the guidelines and tips Artikeld in this guide, you can confidently register and insure your vehicle in any state you choose, allowing you to enjoy the freedom of the open road with peace of mind.

Commonly Asked Questions: Can A Car Be Registered And Insured In Different States

What happens if I get into an accident while driving an out-of-state car?

Your insurance policy should cover you, but it’s important to check your policy details and ensure it’s valid in the state where the accident occurred. It’s also a good idea to contact your insurance company to report the accident and follow their instructions.

Can I register a car in one state and keep my insurance in another?

While it’s technically possible, it’s not recommended. Most states require you to have insurance that’s valid in the state where your car is registered. If you’re caught driving with insurance from a different state, you could face fines or penalties.

What if I move to a new state but haven’t had time to register my car yet?

Most states have a grace period for registering your car after moving. However, you’ll need to check the specific regulations in your new state to ensure you’re in compliance. It’s also important to maintain valid insurance in the new state during this grace period.