Washington State Minimum Liability Insurance is a crucial aspect of responsible driving, ensuring financial protection in the event of an accident. This insurance requirement safeguards both drivers and their assets, covering potential damages and injuries that might arise from an accident caused by the insured driver.

Understanding the minimum liability coverage is essential for all drivers in Washington State. This article will delve into the intricacies of this insurance, explaining the types of coverage, factors affecting costs, and tips for finding affordable options. We’ll also explore the importance of evaluating individual needs and considering additional coverage beyond the minimum requirements.

Understanding Washington State Minimum Liability Insurance

Driving a car comes with inherent risks, and accidents can happen. Washington State requires all drivers to have minimum liability insurance to protect themselves and others from the financial consequences of these accidents. This insurance helps cover costs like medical bills, property damage, and lost wages.

Legal Requirements for Car Owners in Washington State

Washington State law mandates that all car owners must have liability insurance to cover potential damages resulting from an accident. This insurance is crucial for protecting yourself and others from significant financial burdens in case of an accident.

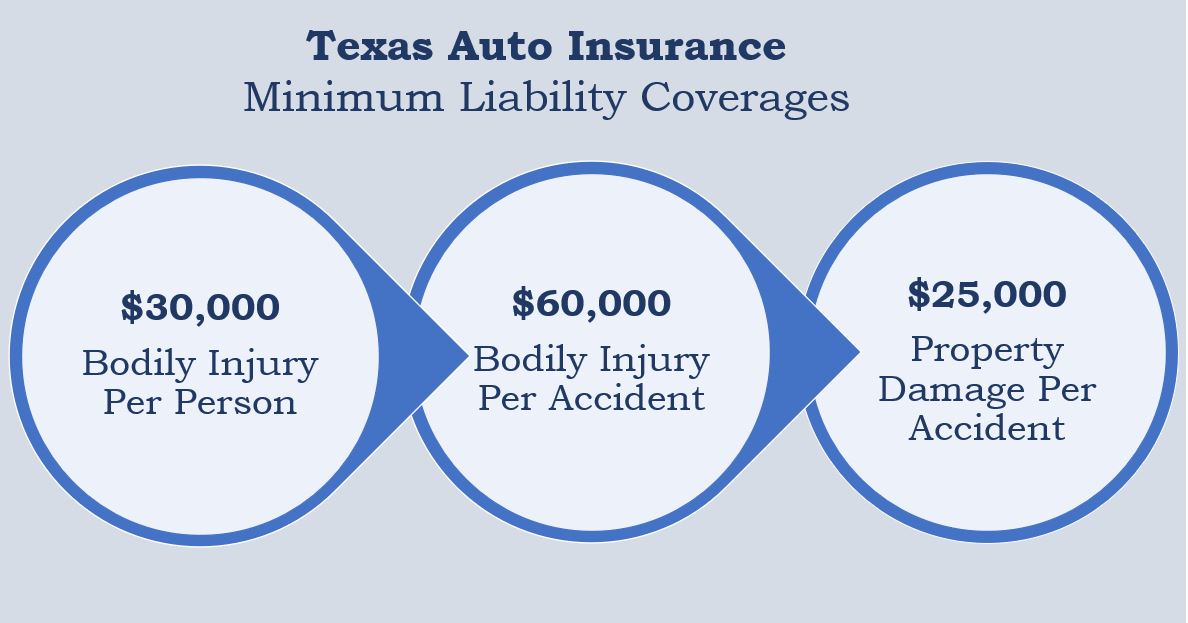

- Minimum Liability Coverage: The minimum liability insurance requirements in Washington State are as follows:

- Bodily Injury Liability: $25,000 per person/$50,000 per accident. This coverage helps pay for medical expenses, lost wages, and other damages incurred by the injured party.

- Property Damage Liability: $10,000 per accident. This coverage helps pay for repairs or replacement costs for damaged property, such as another vehicle or a building.

- Proof of Insurance: Drivers must carry proof of insurance in their vehicle at all times. This proof can be in the form of an insurance card or a digital copy on a smartphone.

Consequences of Driving Without Minimum Liability Insurance

Driving without minimum liability insurance in Washington State can lead to serious consequences. The state takes this requirement seriously and enforces it through penalties and legal actions.

- Fines: Drivers caught driving without insurance face fines ranging from $430 to $1,282. The specific fine amount may vary depending on the circumstances.

- License Suspension: Driving without insurance can lead to the suspension of your driver’s license. This suspension can make it difficult or impossible to drive legally.

- Vehicle Impoundment: In some cases, your vehicle may be impounded if you are caught driving without insurance. You will need to pay fees to have your vehicle released.

- Financial Responsibility: If you cause an accident without insurance, you are personally responsible for all damages and injuries. This can lead to significant financial burdens and legal issues.

Types of Coverage Included in Minimum Liability Insurance

Washington State’s minimum liability insurance includes several types of coverage that protect drivers and their assets in case of an accident. These coverages provide financial protection for the policyholder and the other party involved in an accident.

Bodily Injury Liability Coverage

Bodily injury liability coverage protects you financially if you cause injury to another person in an accident. This coverage pays for medical expenses, lost wages, and pain and suffering. The minimum limits for bodily injury liability coverage in Washington State are:

- $25,000 per person: This is the maximum amount the insurance company will pay for injuries to one person in an accident.

- $50,000 per accident: This is the maximum amount the insurance company will pay for injuries to all people involved in an accident.

For example, if you cause an accident that injures three people, your insurance company will pay up to $25,000 per person for a total of $75,000, even though the per-accident limit is $50,000.

Property Damage Liability Coverage

Property damage liability coverage protects you financially if you damage someone else’s property in an accident. This coverage pays for repairs or replacement of the damaged property, such as a vehicle, building, or fence. The minimum limit for property damage liability coverage in Washington State is:

- $10,000 per accident: This is the maximum amount the insurance company will pay for damage to property in an accident.

For example, if you cause an accident that damages another person’s car, your insurance company will pay up to $10,000 for repairs or replacement.

Factors Affecting Insurance Costs

Several factors contribute to the cost of minimum liability insurance in Washington State. Insurance companies use a complex system to calculate premiums based on risk assessment. Understanding these factors can help you make informed decisions about your insurance needs and potentially save money.

Driving History

Your driving history significantly impacts your insurance premiums. A clean driving record with no accidents or violations will result in lower premiums. Conversely, having a history of accidents, traffic violations, or even DUI convictions will increase your insurance costs. Insurance companies consider your driving history a strong indicator of your risk as a driver.

Age

Your age also plays a role in determining your insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for young drivers due to their higher risk profile. As you gain more driving experience and reach a certain age, your premiums may decrease.

Vehicle Type

The type of vehicle you drive also affects your insurance costs. Vehicles with higher performance capabilities, luxury features, or a history of theft or accidents are generally considered more expensive to insure. Sports cars, trucks, and SUVs often have higher insurance premiums compared to smaller, less expensive vehicles.

Finding Affordable Minimum Liability Insurance: Washington State Minimum Liability Insurance

Finding affordable minimum liability insurance in Washington State can be a challenge, but with some research and planning, you can find a policy that fits your budget.

Reputable Insurance Providers in Washington State

It is important to choose a reputable insurance provider that offers competitive rates and excellent customer service. Here are some of the most reputable insurance providers in Washington State:

- State Farm

- Geico

- Progressive

- Farmers Insurance

- USAA

Comparing Quotes from Multiple Insurers, Washington state minimum liability insurance

Comparing quotes from multiple insurers is crucial to finding the best deal on minimum liability insurance. This process can be time-consuming, but it’s worth it to ensure you’re getting the most affordable coverage.

- Use online comparison tools: Websites like Insurance.com, The Zebra, and Policygenius allow you to compare quotes from multiple insurers simultaneously.

- Contact insurers directly: You can also contact insurers directly to get quotes. This allows you to ask specific questions and discuss your individual needs.

- Consider discounts: Many insurers offer discounts for safe driving records, good credit scores, and bundling multiple insurance policies. Be sure to ask about any available discounts when you’re getting quotes.

Remember, the lowest price isn’t always the best deal. Make sure you’re comparing apples to apples when comparing quotes, and that the coverage offered by each insurer meets your needs.

Additional Considerations

While Washington state’s minimum liability insurance requirements offer a basic level of protection, it’s essential to understand their limitations and explore the potential need for additional coverage. The right insurance coverage can safeguard your financial well-being and protect you from unexpected costs in the event of an accident.

Understanding the Limitations of Minimum Liability Insurance

Minimum liability insurance provides the bare minimum coverage mandated by the state, often insufficient to cover all potential costs associated with an accident. For instance, if you’re involved in an accident that results in significant injuries or property damage exceeding the policy limits, you could be held personally liable for the remaining costs.

The Need for Additional Coverage

To address these limitations, consider expanding your coverage beyond the minimum requirements. Here are some additional types of coverage you might want to explore:

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage to cover your losses.

- Collision Coverage: This coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. It can help you avoid out-of-pocket expenses for repairs.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by events other than accidents, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, up to the policy limit.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other expenses for you and your passengers, regardless of fault, up to the policy limit.

Choosing the Right Insurance Coverage

Determining the right insurance coverage depends on your individual needs and circumstances. Here are some factors to consider:

- Your driving record: A clean driving record may qualify you for lower premiums. However, if you have a history of accidents or traffic violations, you may need to pay higher premiums.

- The value of your vehicle: If you have a newer or more expensive vehicle, you may want to consider higher coverage limits for collision and comprehensive coverage.

- Your financial situation: If you can afford it, increasing your coverage limits can provide greater financial protection in the event of an accident.

- Your lifestyle: If you frequently drive in high-traffic areas or drive long distances, you may want to consider additional coverage to protect yourself from potential risks.

Wrap-Up

By understanding the nuances of Washington State Minimum Liability Insurance, drivers can ensure they are adequately protected on the road. While the minimum coverage provides a basic level of protection, evaluating individual needs and exploring additional coverage options can provide greater peace of mind. Remember, responsible driving and proper insurance are essential for a safe and secure driving experience in Washington State.

Key Questions Answered

What happens if I don’t have minimum liability insurance in Washington State?

Driving without minimum liability insurance is illegal in Washington State. You could face fines, license suspension, and even vehicle impoundment.

Can I choose my own insurance provider for minimum liability coverage?

Yes, you can choose your own insurance provider. It’s advisable to compare quotes from multiple insurers to find the most affordable option that meets your needs.

What are some factors that affect the cost of minimum liability insurance?

Factors that influence the cost include your driving history, age, vehicle type, and the coverage limits you choose.

What are some tips for finding affordable minimum liability insurance?

Compare quotes from multiple insurers, consider bundling your insurance policies, and explore discounts offered by insurance providers.