Washington State cheap car insurance is a priority for many drivers, especially with the state’s unique insurance landscape. Finding affordable coverage requires understanding the factors that influence premiums and exploring strategies for securing discounts. This guide provides an overview of Washington state’s car insurance requirements, cost-determining factors, and tips for saving money on your premiums.

Navigating the world of car insurance in Washington state can be overwhelming. Factors like driving history, vehicle type, and even your credit score can significantly impact your premiums. However, with a little research and smart planning, you can find affordable coverage that meets your needs.

Understanding Washington State Car Insurance Landscape

Navigating the world of car insurance in Washington can seem complex, but understanding the key factors influencing your rates and the state’s requirements can help you make informed decisions.

Factors Influencing Car Insurance Rates

Various factors contribute to your car insurance premiums in Washington. These include:

- Driving History: Your driving record, including accidents, violations, and DUI convictions, significantly impacts your rates. A clean record generally translates to lower premiums.

- Age and Gender: Younger and inexperienced drivers are statistically more likely to be involved in accidents, leading to higher premiums. Similarly, certain gender demographics may experience different rate structures.

- Vehicle Type and Value: The make, model, year, and value of your vehicle play a role in determining your insurance costs. Expensive or high-performance vehicles typically have higher insurance premiums due to their repair costs and potential for higher claims.

- Location: Where you live in Washington impacts your rates. Areas with higher crime rates or traffic congestion tend to have higher insurance premiums due to increased risk of accidents and theft.

- Credit History: In Washington, insurance companies can use your credit history to assess your risk. Individuals with good credit scores often receive lower premiums. This practice is subject to certain regulations and can vary depending on the insurance provider.

- Coverage Levels: The amount of coverage you choose, such as liability limits, comprehensive, and collision coverage, directly influences your premium. Higher coverage levels generally result in higher premiums.

- Discounts: Many insurance companies offer discounts for various factors, including safe driving records, good student status, multi-car policies, and safety features in your vehicle. Taking advantage of these discounts can significantly reduce your premiums.

Mandatory Insurance Coverage Requirements

Washington state requires all drivers to carry the following minimum liability insurance coverage:

- Liability Coverage: This protects you financially if you cause an accident that injures someone or damages their property. The minimum requirements are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. Washington requires a minimum of $25,000 per person and $50,000 per accident for bodily injury and $10,000 for property damage.

Types of Car Insurance

In addition to the mandatory coverage, various other car insurance options are available in Washington. These include:

- Collision Coverage: This covers repairs or replacement of your vehicle if you are involved in an accident, regardless of fault. It is typically optional but can be crucial for newer or more expensive vehicles.

- Comprehensive Coverage: This covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It is generally optional but can be helpful in protecting your investment.

- Medical Payments Coverage (Med Pay): This covers medical expenses for you and your passengers, regardless of fault, in the event of an accident. It is optional and can be a valuable addition to your policy, especially if your health insurance has high deductibles or co-pays.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages regardless of fault. While not mandatory in Washington, it can provide essential protection in case of an accident.

- Rental Reimbursement: This coverage reimburses you for rental car expenses if your vehicle is damaged and needs repairs.

- Roadside Assistance: This coverage provides assistance for situations like flat tires, dead batteries, or lockouts. It can be a valuable addition to your policy, especially if you frequently drive long distances.

Factors Affecting Car Insurance Costs

In Washington state, several factors contribute to the cost of car insurance premiums. Understanding these factors can help you make informed decisions about your insurance needs and potentially save money.

Driving History

Your driving history is a significant factor in determining your car insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or even DUI convictions will significantly increase your rates. Insurance companies use your driving history to assess your risk of future accidents, and those with a history of risky behavior are considered higher risk.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Higher-performance cars, luxury vehicles, and newer models tend to have higher insurance costs due to their greater repair expenses and potential for higher theft rates. Conversely, older, less expensive vehicles typically have lower insurance premiums.

Location

The location where you live and drive also plays a role in your insurance rates. Areas with higher crime rates or more traffic congestion may have higher insurance premiums. Insurance companies consider the frequency and severity of accidents in different regions to assess the risk associated with insuring drivers in those areas.

Credit Score

Your credit score can also impact your car insurance premiums. Insurance companies have found a correlation between credit score and driving behavior. Individuals with lower credit scores may be considered higher risk and may be charged higher premiums.

Age

Your age is another factor that insurance companies consider. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Therefore, they may face higher premiums. As drivers age and gain experience, their premiums tend to decrease.

Finding Affordable Car Insurance Options

Finding the right car insurance policy in Washington state doesn’t have to be a daunting task. With a bit of research and comparison, you can find a policy that meets your needs and fits your budget.

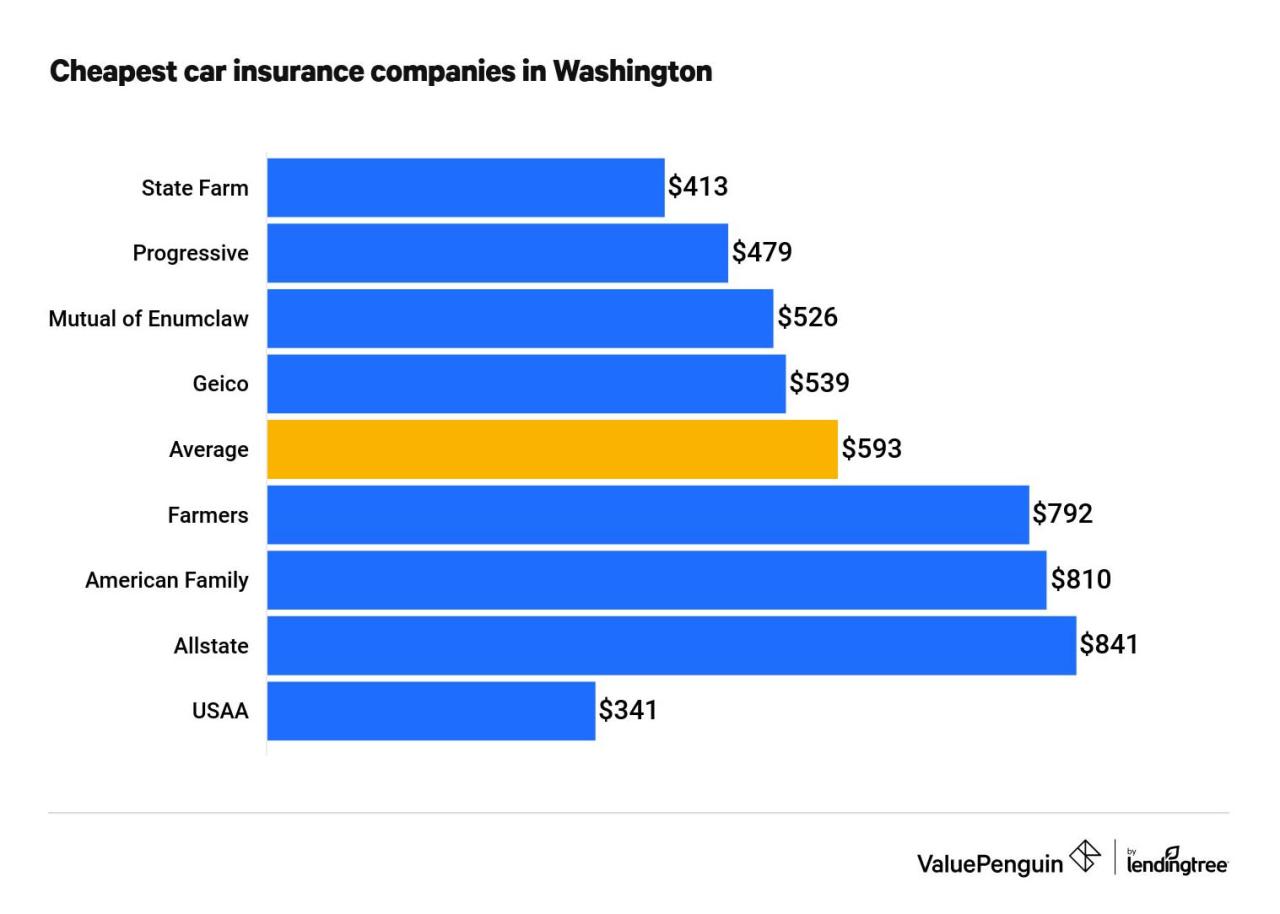

Comparing Car Insurance Providers

Understanding the key features and average rates of major car insurance providers in Washington state can help you make an informed decision. Here’s a table comparing some popular options:

| Provider | Key Features | Average Rate |

|—|—|—|

| GEICO | Nationwide coverage, 24/7 customer service, mobile app | $1,200 per year |

| State Farm | Comprehensive coverage options, discounts for good driving records, strong customer satisfaction | $1,300 per year |

| Progressive | Customizable coverage, online quoting, discounts for bundling policies | $1,100 per year |

| Liberty Mutual | Strong financial stability, various discounts, customer-friendly website | $1,400 per year |

| USAA | Exclusive for military members and their families, excellent customer service, competitive rates | $1,000 per year |

Note: These average rates are estimates and can vary based on individual factors like driving history, age, vehicle type, and coverage options.

Strategies for Getting Car Insurance Discounts

Several strategies can help you lower your car insurance premiums in Washington state:

* Maintain a good driving record: Avoiding accidents and traffic violations can significantly reduce your insurance costs.

* Bundle your policies: Combining your car insurance with other policies like homeowners or renters insurance can often lead to significant discounts.

* Take a defensive driving course: Completing a certified defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount.

* Install safety features: Having safety features like anti-theft devices, airbags, and anti-lock brakes can make your vehicle safer and qualify you for discounts.

* Pay your premiums on time: Consistent and timely payments can often lead to lower rates or discounts.

* Consider higher deductibles: Choosing a higher deductible can lower your monthly premiums, but you’ll be responsible for paying more out of pocket in case of an accident.

* Shop around and compare quotes: Regularly comparing quotes from different insurance providers can help you find the best rates.

Tips for Negotiating Car Insurance Rates

Negotiating your car insurance rates can help you save money. Here are some tips:

* Be polite and respectful: A positive and courteous approach can go a long way in getting the best rates.

* Be prepared to discuss your driving record and other factors: Having your driving history and other relevant information readily available can help you make a strong case.

* Ask about available discounts: Inquire about any discounts you may qualify for based on your situation, such as good student discounts, safe driver discounts, or multi-car discounts.

* Don’t be afraid to negotiate: If you feel the rate is too high, politely ask for a lower price or a better deal.

* Consider switching providers: If you’re not satisfied with your current provider, shopping around and comparing quotes from other insurers can often lead to significant savings.

Tips for Saving on Car Insurance: Washington State Cheap Car Insurance

Saving money on car insurance in Washington State is possible with some strategic planning. Here are some tips to help you lower your premiums without compromising coverage.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners, renters, or life insurance, can significantly reduce your overall premiums. Insurance companies often offer discounts for bundling multiple policies together. This strategy allows you to save money by consolidating your insurance needs with a single provider. For example, if you bundle your car insurance with your homeowners insurance, you might receive a 10-15% discount on your premiums.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premiums. This is because a higher deductible means you are taking on more financial responsibility, which reduces the risk for the insurance company. However, make sure you can afford the higher deductible if you need to file a claim. For instance, increasing your deductible from $500 to $1000 could result in a 15-20% reduction in your monthly premium.

Maintaining a Good Driving Record, Washington state cheap car insurance

A clean driving record is crucial for keeping your car insurance premiums low. Avoid traffic violations, accidents, and DUI charges. Insurance companies reward safe drivers with lower premiums. By maintaining a good driving record, you demonstrate to insurers that you are a responsible driver, reducing their risk and leading to lower premiums.

Resources for Car Insurance Information

Navigating the world of car insurance can feel overwhelming, but there are numerous resources available to help you find the information you need. These resources can provide valuable insights into understanding your coverage options, comparing prices, and making informed decisions about your car insurance.

Washington State Office of the Insurance Commissioner

The Washington State Office of the Insurance Commissioner (OIC) is a crucial resource for anyone seeking information about car insurance in the state. The OIC plays a vital role in protecting consumers and ensuring a fair and competitive insurance market.

The OIC’s website offers a wealth of information on car insurance, including:

- Consumer guides: The OIC provides comprehensive guides that explain different types of car insurance, coverage options, and factors that affect your premiums.

- Complaints and dispute resolution: If you have a dispute with your insurance company, the OIC can assist you in resolving the issue.

- Licensing and regulation: The OIC licenses and regulates insurance companies operating in Washington state, ensuring they comply with state laws and regulations.

- Market analysis: The OIC monitors the insurance market and provides data and reports on trends and consumer issues.

Benefits of Consulting with an Insurance Broker

Consulting with an insurance broker can be beneficial for finding affordable car insurance options. Insurance brokers act as intermediaries between you and insurance companies, helping you compare quotes and find the best coverage for your needs.

Here are some key advantages of working with a broker:

- Access to multiple insurers: Brokers have relationships with various insurance companies, allowing you to compare quotes from a wider range of providers.

- Personalized advice: Brokers can assess your individual needs and recommend coverage options that best suit your situation.

- Negotiation and advocacy: Brokers can negotiate with insurers on your behalf, potentially securing lower premiums or better coverage terms.

- Claims assistance: Brokers can assist you with filing claims and navigating the claims process.

Last Point

Securing cheap car insurance in Washington state requires a proactive approach. By understanding the factors that influence premiums, exploring available discounts, and shopping around for the best rates, you can find affordable coverage that protects you and your vehicle. Remember to review your policy regularly and consider bundling insurance options to maximize your savings.

Quick FAQs

What are the minimum car insurance requirements in Washington state?

Washington state requires all drivers to carry liability insurance, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I get car insurance discounts in Washington state?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling insurance policies.

What are the best car insurance providers in Washington state?

The best provider for you depends on your individual needs and preferences. It’s recommended to compare quotes from multiple insurers to find the most affordable and comprehensive coverage.