State Farm MN Insurance is a prominent provider of insurance products and services in the state, boasting a long history of serving Minnesotan residents. From its humble beginnings, State Farm has grown to become a household name, offering a wide range of insurance options, including auto, home, life, and health insurance. With a strong commitment to customer satisfaction and community involvement, State Farm has earned a reputation for reliability and trust in Minnesota.

State Farm’s presence in Minnesota is characterized by its extensive network of local agents who provide personalized insurance advice and support to customers. The company’s dedication to its agents and their role in building strong customer relationships is evident in its commitment to training and development programs.

State Farm in Minnesota

State Farm, a leading insurance provider in the United States, has a long and established presence in Minnesota. The company’s commitment to serving Minnesotan communities has shaped its growth and solidified its position as a trusted insurance partner.

History of State Farm in Minnesota

State Farm’s journey in Minnesota began in 1922 when the company expanded its operations beyond its Illinois roots. The company’s initial focus was on providing auto insurance, a crucial need in a state known for its vast network of roads and its embrace of automobile transportation. State Farm’s dedication to customer service and competitive pricing quickly resonated with Minnesotans, leading to rapid growth in the state.

Key Milestones and Achievements of State Farm in Minnesota, State farm mn insurance

State Farm’s success in Minnesota is marked by several key milestones and achievements:

- Expansion of Services: Over the years, State Farm expanded its offerings in Minnesota to include a comprehensive range of insurance products, including home, life, health, and business insurance. This diversification solidified its position as a one-stop shop for insurance needs, catering to a wider segment of the Minnesotan population.

- Community Involvement: State Farm has a long-standing commitment to community engagement in Minnesota. The company actively supports local organizations, sponsors events, and participates in initiatives aimed at improving the lives of Minnesotans. This dedication to community welfare has fostered strong relationships and earned the company widespread goodwill.

- Technological Advancements: State Farm has embraced technological advancements to enhance customer experience and streamline operations. This includes implementing online platforms for policy management, claims reporting, and customer service. These advancements have made it easier for Minnesotans to interact with State Farm and manage their insurance needs.

Role of State Farm in the Minnesota Insurance Market

State Farm plays a significant role in the Minnesota insurance market. The company is one of the largest insurance providers in the state, offering a wide range of products and services to individuals and businesses. Its strong brand recognition, competitive pricing, and commitment to customer service have made it a preferred choice for many Minnesotans.

State Farm’s presence in Minnesota also contributes to the state’s economic well-being. The company employs a significant number of Minnesotans and supports local businesses through its operations and community involvement. Its contributions to the state’s economy and its dedication to serving Minnesotans have solidified its position as a valued member of the community.

Insurance Products and Services

State Farm offers a comprehensive range of insurance products and services to meet the diverse needs of Minnesotan residents. From protecting your car and home to safeguarding your financial future, State Farm provides tailored solutions for individuals, families, and businesses.

Auto Insurance

State Farm’s auto insurance policies offer comprehensive coverage options to protect you and your vehicle. These policies include:

- Liability coverage: This covers damages to other vehicles or property caused by an accident for which you are at fault.

- Collision coverage: This covers damage to your vehicle resulting from an accident, regardless of who is at fault.

- Comprehensive coverage: This covers damage to your vehicle caused by events other than an accident, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Personal injury protection (PIP): This covers medical expenses, lost wages, and other related costs if you are injured in an accident.

State Farm also offers various discounts to help you save on your auto insurance premiums, including safe driving discounts, good student discounts, and multi-policy discounts.

Home Insurance

State Farm’s home insurance policies provide comprehensive protection for your home and belongings against various risks, including:

- Fire and lightning damage

- Windstorm and hail damage

- Theft and vandalism

- Natural disasters such as earthquakes and floods (depending on location and coverage options)

State Farm offers various customization options for your home insurance policy, including coverage for personal property, liability protection, and additional living expenses if your home becomes uninhabitable due to a covered event.

Life Insurance

State Farm offers a variety of life insurance products to help you protect your loved ones financially in the event of your passing. These products include:

- Term life insurance: This provides coverage for a specific period, typically 10 to 30 years. It is generally more affordable than permanent life insurance but does not build cash value.

- Permanent life insurance: This provides lifelong coverage and builds cash value that you can borrow against or withdraw. It is generally more expensive than term life insurance but offers greater flexibility and potential for long-term financial growth.

- Universal life insurance: This offers flexible premiums and death benefits, allowing you to adjust your coverage and premiums as your needs change.

- Variable life insurance: This allows you to invest your premiums in a variety of sub-accounts, offering the potential for higher returns but also greater risk.

State Farm’s life insurance agents can help you determine the right type and amount of coverage to meet your specific needs and budget.

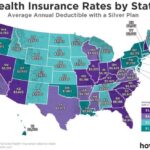

Health Insurance

State Farm offers health insurance plans through the Affordable Care Act (ACA) Marketplace. These plans provide coverage for a wide range of medical expenses, including:

- Preventive care

- Hospitalization

- Prescription drugs

- Mental health and substance abuse treatment

State Farm’s health insurance plans are designed to provide affordable and comprehensive coverage to individuals and families in Minnesota.

Services

State Farm provides a range of services to make your insurance experience seamless and convenient. These services include:

- Claims processing: State Farm has a dedicated claims team available 24/7 to assist you with reporting and managing claims. They work diligently to ensure a prompt and fair resolution for all claims.

- Customer support: State Farm offers various ways to contact their customer service representatives, including phone, email, and online chat. They are available to answer your questions, provide assistance with your policy, and resolve any issues you may have.

- Financial planning: State Farm offers financial planning services to help you manage your finances and achieve your financial goals. These services can include retirement planning, college savings, and estate planning.

State Farm’s commitment to providing exceptional customer service and support is evident in its dedication to helping you navigate the complexities of insurance and financial planning.

Customer Experience and Reviews

State Farm is one of the largest insurance providers in the United States, and its presence in Minnesota is significant. To understand the customer experience with State Farm in Minnesota, it’s crucial to analyze customer reviews and feedback. This analysis helps identify the strengths and weaknesses of State Farm’s customer service and claims handling, ultimately comparing it to other insurance providers in the state.

Customer Reviews and Feedback

Customer reviews and feedback provide valuable insights into the customer experience with State Farm in Minnesota. Reviews are available on various platforms, including Google, Yelp, and Trustpilot, and often reflect customer experiences with specific aspects of State Farm’s services, such as customer service, claims handling, and policy features.

Financial Performance and Reputation: State Farm Mn Insurance

State Farm is a major player in the insurance industry, with a strong presence in Minnesota. Its financial performance and reputation play a significant role in its success.

Financial Performance

State Farm’s financial performance in Minnesota is impressive. The company consistently ranks among the top insurance providers in the state based on revenue, profits, and market share. State Farm’s strong financial position is attributed to its diverse product portfolio, efficient operations, and a loyal customer base.

Reputation

State Farm enjoys a positive reputation in Minnesota. The company is known for its reliable service, fair claims handling, and strong community involvement. State Farm’s brand image is associated with trustworthiness, stability, and customer satisfaction.

Comparison with Other Providers

When compared to other insurance providers in Minnesota, State Farm generally performs well in terms of both financial performance and reputation. The company’s strong brand recognition and customer loyalty give it a competitive edge. However, other providers may offer more competitive pricing or specialized products in certain areas.

Agents and Local Presence

State Farm’s presence in Minnesota is anchored by a robust network of local agents, acting as crucial intermediaries between the insurance company and its policyholders. These agents play a pivotal role in providing personalized insurance solutions, fostering strong customer relationships, and ensuring seamless access to State Farm’s services.

Agent Network in Minnesota

State Farm boasts a widespread network of agents across Minnesota, ensuring accessibility and convenience for residents seeking insurance solutions. This extensive network allows customers to connect with agents in their local communities, facilitating face-to-face interactions and personalized service. The company’s commitment to maintaining a strong agent presence ensures that customers have readily available support and guidance throughout their insurance journey.

Role of Local Agents

Local State Farm agents act as trusted advisors, guiding customers through the complexities of insurance and helping them find the right coverage to meet their specific needs. They play a multifaceted role in the customer experience:

- Personalized Consultation: Agents conduct thorough assessments of individual needs and circumstances, tailoring insurance plans to ensure comprehensive coverage. They provide personalized recommendations and explain policy details in a clear and understandable manner.

- Claims Support: During challenging times, agents provide compassionate and efficient support during the claims process. They assist customers in navigating the complexities of filing claims, ensuring smooth and timely resolution.

- Community Engagement: State Farm agents actively engage with their local communities, fostering strong relationships and participating in community events. This dedication to local involvement enhances the company’s reputation and strengthens its connection with residents.

- Accessibility and Convenience: The widespread presence of agents across Minnesota ensures convenient access to insurance services, enabling customers to meet with agents in person, schedule appointments, or contact them for assistance through various channels.

Accessibility of Agents in Different Regions

State Farm’s agent network extends across all regions of Minnesota, ensuring that residents in both urban and rural areas have access to personalized insurance services. The company’s commitment to maintaining a strong presence in both metropolitan centers and smaller communities demonstrates its dedication to serving the diverse needs of Minnesota residents.

Community Involvement and Social Responsibility

State Farm is deeply committed to giving back to the communities it serves, and Minnesota is no exception. The company actively engages in a variety of initiatives aimed at improving the lives of Minnesotans.

State Farm’s Support for Local Organizations and Charities

State Farm’s commitment to social responsibility is evident in its generous support of numerous local organizations and charities in Minnesota. These contributions are designed to address critical needs in the community and create a positive impact on the lives of residents.

- The United Way: State Farm is a long-standing supporter of the United Way, a non-profit organization dedicated to improving the lives of people in local communities. Through its partnership with the United Way, State Farm contributes financially and through employee volunteerism to support various programs addressing issues such as poverty, education, and healthcare.

- The American Red Cross: State Farm also partners with the American Red Cross to provide disaster relief and preparedness services. This collaboration helps to ensure that Minnesotans have access to essential resources during times of crisis.

- Local Schools and Youth Organizations: State Farm recognizes the importance of education and youth development. The company provides financial support to local schools and youth organizations, promoting academic achievement and fostering healthy communities.

Impact of State Farm’s Community Engagement on Minnesotans

State Farm’s community engagement initiatives have a tangible impact on the lives of Minnesotans. By supporting local organizations and charities, the company helps to address critical needs, promote positive change, and enhance the overall well-being of the community.

- Addressing Social Issues: State Farm’s support for organizations like the United Way and the American Red Cross helps to address pressing social issues such as poverty, homelessness, and disaster relief, contributing to a more equitable and resilient society.

- Empowering Youth: By investing in education and youth development programs, State Farm empowers young Minnesotans to reach their full potential and become productive members of society.

- Strengthening Communities: State Farm’s commitment to community engagement fosters a sense of unity and shared responsibility, strengthening the fabric of Minnesota communities.

Ultimate Conclusion

State Farm MN Insurance stands as a reliable and trusted partner for Minnesotans seeking comprehensive insurance solutions. With its diverse product offerings, exceptional customer service, and strong community ties, State Farm has established itself as a leader in the Minnesota insurance market. Whether you’re looking for auto insurance, home insurance, or financial planning services, State Farm provides the resources and expertise to meet your individual needs. Their commitment to innovation and customer satisfaction ensures that State Farm continues to adapt to the evolving insurance landscape, offering peace of mind to its policyholders in Minnesota.

Quick FAQs

What types of insurance does State Farm offer in Minnesota?

State Farm offers a wide range of insurance products in Minnesota, including auto, home, life, health, renters, business, and more.

How do I find a State Farm agent in Minnesota?

You can find a State Farm agent in Minnesota by visiting the State Farm website or using their online agent locator tool.

What are the benefits of choosing State Farm in Minnesota?

State Farm offers a variety of benefits, including competitive rates, personalized service, 24/7 customer support, and a strong reputation for customer satisfaction.

How do I file a claim with State Farm in Minnesota?

You can file a claim with State Farm in Minnesota online, over the phone, or through your local agent.

What are the different types of discounts available with State Farm in Minnesota?

State Farm offers a variety of discounts, including good driver discounts, safe driver discounts, multi-policy discounts, and more.